It can be easy to get carried away with geo-political risk and assume the worst. If you look at some of the serious world events over the last few years it is easy to see the huge, sad human impact. The bombing of Syria in 2017, the US withdrawal from Afghanistan, and the North Korean Missile crisis. The recent Russian and Ukrainian crisis has once again brought to the forefront the market reaction to these Geo-political events. Now human cost of these events are only too self evident. However, what may be surprising is that the market reaction to these events can be surprisingly mild.

Buy the geo-political risk dip

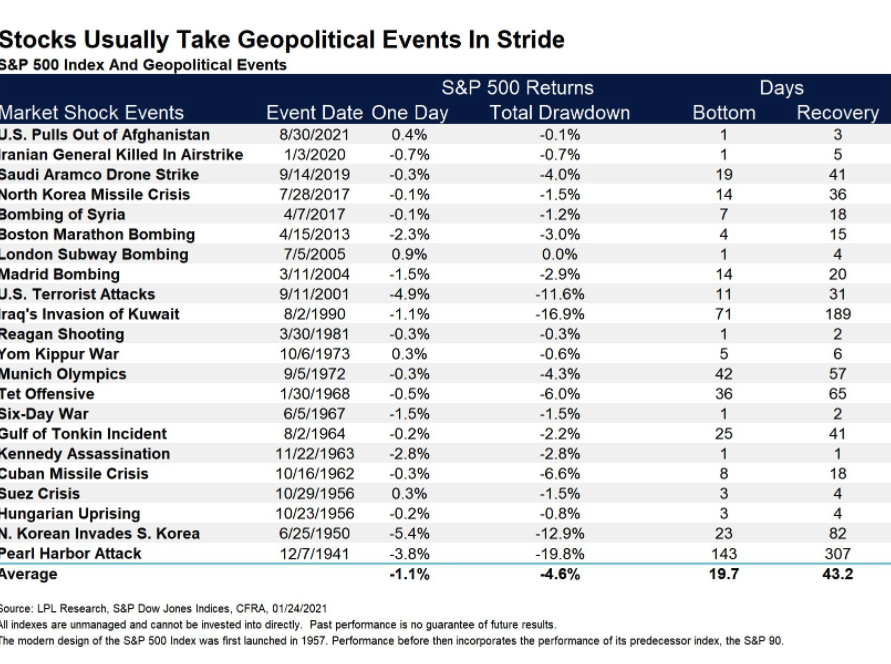

The general rule of thumb is that geo-political risk results in only a relatively short lived falls in stocks. If you look at the Cuban missile crisis of the 1960’s when the threat of a nuclear strike was only moments away the market reaction was pretty mild. The S&P500 bottomed after 8 days and recovered in 18 days! The US terrorist attacks of September 11, which shaped much of the US’s foreign policy in the years following, only saw a total drawdown of -11.6% and the recovery in stocks took only 31 days. The biggest impact was the Pearl Harbour attack which brought the US into the Second World War. That resulted in nearly a 20% fall of the S&P500. However, the bottom was formed in just 147 days. Look at some stats below taken from LPL Research.

So, what’s the geo-political risk trade?

Well, historically speaking it is to buy the dip on geo-political risk. So, if the current Russian/Ukraine crisis does escalate the dip will almost certainly be bought. As things stands Ukraine is not a part of Nato. That in one sense is a saving grace. Why? Because of something called ‘collective defense’ . NATO is committed to the principle that an attack against one or several of its members is considered as an attack against all. This principle is enshrined in Article 5 of the Washington Treaty. It has only been used once thus far, when the US was attacked on 9/11. As Ukraine is not a NATO member it does not automatically trigger the collective defence mandate. Trade along with me here each day to develop a deeper understanding of market moves.

Your article helped me a lot, is there any more related content? Thanks!

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.