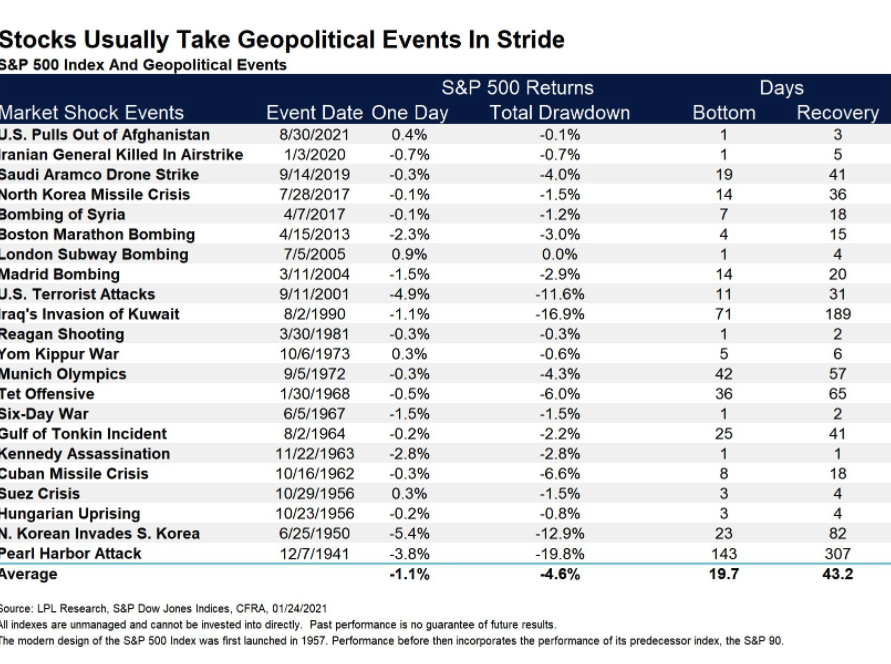

It can be easy to get carried away with geo-political risk and assume the worst. If you look at some of the serious world events over the last few years it is easy to see the huge, sad human impact. The bombing of Syria in 2017, the US withdrawal from Afghanistan, and the North Korean Missile crisis. The recent Russian and Ukrainian crisis has once again brought to the forefront the market reaction to these Geo-political events. Now human cost of these events are only too self evident. However, what may be surprising is that the market reaction to these events can be surprisingly mild.

Buy the geo-political risk dip

The general rule of thumb is that geo-political risk results in only a relatively short lived falls in stocks. If you look at the Cuban missile crisis of the 1960’s when the threat of a nuclear strike was only moments away the market reaction was pretty mild. The S&P500 bottomed after 8 days and recovered in 18 days! The US terrorist attacks of September 11, which shaped much of the US’s foreign policy in the years following, only saw a total drawdown of -11.6% and the recovery in stocks took only 31 days. The biggest impact was the Pearl Harbour attack which brought the US into the Second World War. That resulted in nearly a 20% fall of the S&P500. However, the bottom was formed in just 147 days. Look at some stats below taken from LPL Research.

So, what’s the geo-political risk trade?

Well, historically speaking it is to buy the dip on geo-political risk. So, if the current Russian/Ukraine crisis does escalate the dip will almost certainly be bought. As things stands Ukraine is not a part of Nato. That in one sense is a saving grace. Why? Because of something called ‘collective defense’ . NATO is committed to the principle that an attack against one or several of its members is considered as an attack against all. This principle is enshrined in Article 5 of the Washington Treaty. It has only been used once thus far, when the US was attacked on 9/11. As Ukraine is not a NATO member it does not automatically trigger the collective defence mandate. Trade along with me here each day to develop a deeper understanding of market moves.

Your article helped me a lot, is there any more related content? Thanks!

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

order amoxicillin pills – amoxicillin cheap purchase amoxicillin online cheap

order forcan pills – on this site fluconazole ca

escitalopram 10mg cost – escitapro.com lexapro oral

cenforce 100mg usa – cenforce rs cenforce 100mg for sale

when is the best time to take cialis – https://ciltadgn.com/# when does cialis go generic

cialis generic overnite – https://strongtadafl.com/# tadalafil review forum

viagra 50mg cost – buy viagra soho sildenafil 50 mg price at walmart

Good blog you be undergoing here.. It’s severely to find high calibre script like yours these days. I justifiably respect individuals like you! Take guardianship!! prednisone to buy online

More posts like this would make the blogosphere more useful. synthroid 50 mg para hombres

More posts like this would persuade the online play more useful. https://ursxdol.com/prednisone-5mg-tablets/

This is a keynote which is forthcoming to my verve… Diverse thanks! Faithfully where can I lay one’s hands on the phone details an eye to questions? order lopressor pill

I couldn’t resist commenting. Well written! cialis super active sans ordonnance pas cher

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

This is a theme which is near to my fundamentals… Myriad thanks! Faithfully where can I upon the acquaintance details an eye to questions? https://ondactone.com/simvastatin/

Thanks on putting this up. It’s okay done.

https://proisotrepl.com/product/baclofen/

The sagacity in this ruined is exceptional. http://ledyardmachine.com/forum/User-Vfeest

forxiga 10mg ca – https://janozin.com/# buy cheap generic dapagliflozin

orlistat cost – https://asacostat.com/# buy orlistat

This is a topic which is forthcoming to my callousness… Many thanks! Quite where can I notice the contact details an eye to questions? http://www.orlandogamers.org/forum/member.php?action=profile&uid=29923

Your article helped me a lot, is there any more related content? Thanks!

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

You can protect yourself and your dearest by being heedful when buying medicine online. Some pharmacy websites function legally and put forward convenience, privacy, rate savings and safeguards as a replacement for purchasing medicines. buy in TerbinaPharmacy https://terbinafines.com/product/levitra.html levitra

The depth in this tune is exceptional. online

This is the type of post I unearth helpful.

Your article helped me a lot, is there any more related content? Thanks!

Was wir herausgefunden haben, finden Sie mithilfe

unserer Casino Tesberichte heraus. Das Grand Casino Baden bietet eine breite Palette von klassischen Spielen, von Roulette bis hin zu Blackjack und Pokerturnieren,

die für jeden Adrenalinspiegel etwas bereithalten. Black Jack gibt

es an fünf Tischen, Baccara an zwei Tischen und an einem

Tisch kann Punto Banco gespielt werden. Im grossen Spiel kann an neun Tischen der Spielbank Roulette gespielt werden. Hier finden Sie alle Events im

Club Bernstein. Hier finden Sie alle Events im Überblick.

Sie entscheiden, ob Sie Poker, Bingo oder Roulette auf moderne Art spielen wollen. Hier spielen Sie komfortabel und

bequem mit Touchscreen-Bildschirm Roulette.

Auf Glücksspieler warten Roulette, Blackjack und Poker sowie natürlich spannende Spielautomaten und Jackpot Automaten. Wenn du

dich entscheidest, um echtes Geld zu spielen, stelle bitte sicher, dass du

nicht mehr spielst, als du es dir finanziell leisten kannst zu verlieren. Casinospieler erhalten präzise Informationen über sichere Online-Glücksspiele und Online-Casinos in der Schweiz.

Dank seiner Erfahrung und fundierten Kenntnisse in diesen Bereichen liefert er wertvolle Informationen für Casinospieler in der Schweiz.

References:

https://online-spielhallen.de/bitkingz-casino-cashback-holen-sie-sich-bares-geld-zuruck/

Die Welt der Online Casinos in Deutschland

bietet eine beeindruckende Vielfalt an Spielen,

innovativen Technologien und sicheren Spielumgebungen. Mit fortschreitender Technologie und sich

entwickelnden Vorschriften werden diese Plattformen weiterhin innovative

Spiele und verbesserte Spielerfahrungen anbieten. Sie bieten verschiedene Werkzeuge und Ressourcen, um sicherzustellen, dass das Spielverhalten gesund bleibt und

Spielsuchtprävention ernst genommen wird.

Mit einer großen Auswahl an Themen, Bonusfunktionen und

Jackpots bieten diese Spiele endlose Unterhaltung und die Chance auf große Gewinne.

Live Casino Spiele bieten eine einzigartige und immersive

Erfahrung in Online Casinos.

Es ist entscheidend, illegale Online Casinos zu

meiden, da diese oft durch verweigerte Gewinnauszahlungen und das

Fehlen einer staatlichen Glücksspiellizenz auffallen.

Die GGL führt eine Whitelist, die alle lizenzierten Online Casinos auflistet, die in Deutschland legal operieren. Die GGL gewährleistet, dass

alle lizenzierten Anbieter in Deutschland sicher und legal operieren und

ihre Angebote regelmäßig kontrolliert werden. Die Umsatzbedingungen sollten dabei fair und realistisch sein,

um den Spielern eine echte Chance auf Gewinne zu bieten.

References:

https://online-spielhallen.de/starda-casino-freispiele-ihr-schlussel-zu-unterhaltung-und-gewinnen/

NetBet Casino Gutschein

References:

https://online-spielhallen.de/frumzi-casino-bewertung-eine-tiefgehende-analyse-fur-deutsche-spieler/

The platform strives to process withdrawal requests quickly,

understanding that players want prompt access to their funds.

The minimum deposit amounts are reasonable, making the platform accessible to all

players. It’s a carefully structured welcome that rewards loyalty and

encourages players to explore the vast library of games.

The game selection is heavily skewed towards online pokies,

the heart of Australian gaming culture. Discover why

this premier online gaming hub is the top

choice for Australian players. SkyCrown Casino is a fully licensed online casino, which ensures that it

is legal and safe for Australian players.

The platform offers a flawless mobile experience through a fully optimized website.

Navigation is intuitive, with a clear menu that

allows players to effortlessly move between the game lobby, promotions, banking,

and support. On the cryptocurrency front, the platform’s extensive support makes it a top choice for modern players.

Regarding Skycrown Casino’s withdrawal and deposit methods, it couldn’t be any different.

It is worth remembering that Skycrown Casino bonuses have specific terms and conditions.

Therefore, we rely on an extremely capable team to think of the best way to

present our services to our players.

References:

https://blackcoin.co/best-casinos-in-singapore/

The Australian online casino industry may appear confusing

at first, but in reality the law is very simple to understand.

We will not recommend online casino sites unless they

pass all these checks. The 2011 Interactive Gambling Act clearly states

that casino sites are not allowed to accept

bets from Aussie players. Most online live casinos in Australia support a wide mix of payment methods, including cards,

e-wallets, and cryptocurrencies. The best online live casinos

structure their loyalty programmes so that higher VIP status unlocks progressively better rewards and benefits.

The best online casinos in Australia are internationally licensed sites that welcome

players based in Oz. At online casinos in Australia, you can try your luck at slots and poker games, which offer the opportunity to win a progressive jackpot.

The best Australian online casinos commit to responsible gaming practices to protect players

from harmful behaviour. Below, we list a few tips

to help you make the most out of playing at online casinos

Australia with real money. Therefore, online

casino operators can’t offer games of chance or skill to Australian residents or players abroad.

It offers over 6,000 real money games, trusted payment

options, along with a A$11,000 welcome bonus and a ton of promotions for loyal

players.

References:

https://blackcoin.co/ripper-casino-bonus-codes-november-2025/

Tham gia giải trí nhất định anh em không nên bỏ qua sảnh chơi cá cược thể thao. raja slot365 . com đưa tới cho cược thủ hàng trăm các tỷ lệ kèo siêu hấp dẫn trên khắp thế giới, tỷ lệ thưởng đa dạng. Với nhiều giải đấu lớn nhỏ được cập nhật liên tục mỗi ngày như Champions League, Euro, La Liga, Serie A, Premier League, World Cup,… TONY12-26

This article covers the top gambling sites, their

game offerings, bonuses, and security features to help

you make an informed choice. Free professional educational courses for

online casino employees aimed at industry best practices, improving player experience, and fair approach to gambling.

Also, there are websites that focus solely on Czech legal online

casinos, such as licencovanakasina.cz.

There’s no shortage of real money casino games at Aussie-facing sites.

You’ll notice straight away how much more offshore Australian casino sites offer when it comes

to games. The table below lets you quickly compare the top 10 Australian online casinos and their key features.

See our list below to find the best Australian online

casino real money sites.

I sound like a broken record by now, but the

best advice of all is to manage your bankroll and

set aside a precise amount of money for gambling that you feel comfortable losing.

Buying the bonus round in pokies. You won, mission accomplished, now it’s time to

withdraw. Literal money pits for the everyday player.

References:

https://blackcoin.co/king-billy-casino-login/

With the bright lights of Tokyo as our muse, we’ve created

a lively take on casual Japanese dining that packs a punch.

Reservations for groups of 1 to 11 guests can be made online.

Surrender your senses to Asian fine dining with a modern, tropical Queensland twist.

Like all casinos in Australia, entry to The Ville Casino is restricted to people aged 18 years and

over. Alternatively, Casino gaming rules can be found online.

Ask our friendly gaming team on the Casino main gaming floor and they’ll give you a hand.

Need a little refresher on some of your favourite games,

or trying your hand at something new? We can cater for

large groups and private events. Held on special occasions or during themed nights,

the event creates an exhilarating atmosphere where participants can win a variety of prizes,

such as up to $500 in free play credits, cash prizes up to $1,000,

or $50 dining credits. The “Ardo on Us” promotion is tailored to reward patrons who engage

in specified gaming activities on designated days.

For group bookings guests will select from one of our incredible

banquet options. Book a spot on the restaurant balcony or in Miss Songs’ exclusive private dining room for your group booking of

up to 20 people. The Palm House has a range of options for larger

group bookings to suit all occasions including al fresco dining and a private

dining room. Reservations for groups of 1 to 20 guests can be made online, with reservations available 3

months prior to the dining date.

References:

https://blackcoin.co/bizzo-casino-australia-review/

online casino usa paypal

References:

https://placifyconnect.com/employer/paypal-casinos-2025-best-casino-sites-that-accept-paypal/

online casinos that accept paypal

References:

https://slprofessionalcaregivers.lk/companies/best-online-casinos-that-accept-paypal-play-for-real-money-in-2025

online pokies paypal

References:

https://lavoroadesso.com/employer/exchange-paypal-usd-to-neteller-usd-%ef%bf%bd-where-is-the-best-exchange-rate/

australian online casinos that accept paypal

References:

pizzaepp.co.kr

mobile casino paypal

References:

https://vhembedirect.co.za/employer/best-australian-casino-sites-2025-aussie-online-casinos/

online casino australia paypal

References:

https://skinforum.co.in/employer/payidcasinoau-top-payid-casinos-guide-for-aussies/

casino online paypal

References:

https://www.securityprofinder.com/employer/paypal-casinos-2025-best-online-casinos-accepting-paypal/

At Ripper Casino, the online table games are a non stop thrill ride, every hand and roll a chance to hit it big! Whether you’ve got a question about your account, a game, or a bonus, reach out to [email protected] or visit our Customer Support page and submit the simple form with your details and the nature of the problem. Our vast selection of pokies, crash games, scratch cards, and casino games will keep you entertained for hours on end! We even give out weekly BitCoin, LiteCoin and NeoSurf bonuses for all you cryptocurrency enthusiasts! Plus you get grouse bonuses up to $7500 total by using welcome codes the first 4 times you make a deposit.

Our experts have distilled the essential steps to ensure an even smoother experience for you. Come and experience the thrill of Ripper Casino, knowing you’re in the safest hands.Remember, gamble responsibly. Our RNG software is regularly tested by independent auditors, ensuring truly random game outcomes. Playful reminders keep you mindful of playtime, and valuable resources are always available.

References:

https://blackcoin.co/ufo9-casino-your-place-to-play-your-way/

online casino for us players paypal

References:

https://interior01.netpro.co.kr:443/bbs/board.php?bo_table=free&wr_id=139

paypal casino uk

References:

https://classihub.in/author/brodiebrien/

Möglicherweise müssen Sie zusätzliche Nachweise erbringen, um wieder Zugang zu erhalten. Wenden Sie sich an den Kundendienst, um den Grund für die Sperrung zu erfahren und um Anweisungen zu erhalten, wie Sie Ihr Konto wieder freischalten oder aktivieren können. Geben Sie Ihre registrierte E-Mail-Adresse ein, und Sie erhalten einen Link zum Zurücksetzen des Passworts.

Daher kann man auch um echtes Geld spielen, wenn man die Anmeldung hinter sich gebracht hat. Man kann bei uns kostenlose Casino Spiele erleben, indem man die Probeversionen von Spielautomaten und ausgewählten Tischspielen testet. Live-Spiele werden in Online Casinos immer beliebter und man kann davon ausgehen, dass die Auswahl an Casinospielen und unterschiedlichen Setzlimits in Zukunft nur weiter zunehmen wird. Bei diesen Casinospielen hat man einen echten Dealer, der das Tischspiel leitet. Bei den Tischspielen kommen typische Glücksspiele vor, beispielsweise Roulette oder Blackjack. Es werden ähnliche Regeln verwendet, doch man kann alleine spielen und Videopoker sogar als kostenloses Casinospiel entdecken.

References:

https://s3.amazonaws.com/onlinegamblingcasino/casino%20ibiza.html

Verde Casino hat etwa 144 Live Spiele auf seiner Website, von denen Du gegen andere Spieler oder Live Croupiers spielen kannst. Neben den Verde Casino Bonus Optionen kannst Du spielen und die verschiedenen Aktionen genießen, die diese Online Casino Bonus Liste zu Deiner Verfügung hat. Die Freispiele, (free spins) die mit dem Willkommensbonus gespielt werden können, haben einen Mindestdrehwert von €0,20 und nach der Registrierung hast Du 4 Tage Zeit, den Bonus zu aktivieren. Zum Beispiel ist die Umsatzbedingungen des Willkommensbonus für den Bonus 30x, aber für die Freispiele ist 40x. Die Bonusbedingungen gelten für alle Arten von Bonusoptionen und vor dem Spielen und Genießen eines Bonus bei verde casino solltest Du zumindest einige davon durchlesen. Der erste Einzahlungsbonus ist ein Bonus von 120% bis zu €300 plus 50 Freispiele. Danach erwartet Dich das Verde Casino 50 Free Spin Angebot mit 50 Freispielen (free spins).

Für Sportwetter steht alternativ ein Willkommensbonus von bis zu 600 € zur Verfügung. Du erhältst Einstiegsboni, regelmäßige Reloads und saisonale Angebote. Du findest Slots, Crash‑Titel, Tischspiele und weitere Kategorien. Das Online‑Casino bietet dir über 3.000 Spiele von Top‑Studios.

References:

https://s3.amazonaws.com/onlinegamblingcasino/casino%20nina.html

Wie alle anderen Bonusangebote bringt auch ein 300% Casino Bonus viele Vorteile, aber ebenso einige Nachteile mit sich. Angenommen, der Faktor läge stattdessen bei 10%, so müsstest Du den zehnfachen Umsatz erspielen, um Dich für die Bonusauszahlung zu qualifizieren. Nicht alle Bonusangebote sind fair und seriös. Dieses Kriterium ist insbesondere für Spieler interessant, die bevorzugt mit hohen Einsätzen spielen.

Es gibt mehrere Möglichkeiten, wie Online-Casinos den Spielern ihre Willkommensboni anbieten. Viele Online-Casinos bieten sehr großzügige Willkommensboni und wollen damit neue Spieler begeistern. Schauen Sie sich zuerst das Willkommenspaket an, das bei Top Casinos angeboten wird. Ebenso sollte es kein maximales Limit für eine Gewinnauszahlung geben, wenn wir mit einem Bonus spielen. Bei einem Willkommensbonus oder einem Neukundenbonus sind in vielen Online Casinos auch zusätzliche Freispiele Bestandteil des Angebots. Ein Online Casino Anbieter verfügt aber ebenfalls über die Umsatzbedingungen, die an die Bonusangebote geknüpft sind.

References:

https://s3.amazonaws.com/new-casino/platincasino%20casino.html

References:

Anavar before and after women

References:

https://linkagogo.trade/story.php?title=anavar-erfahrungen-zyklus-%EF%B8%8F-anavar-frauen-steroid-2026

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Vaping 24 delivers concentrated, juicy flavors with smooth airflow, balanced sweetness, and satisfying clouds, providing a high-quality, convenient, and long-lasting disposable vape.

References:

Nj online casino

References:

https://lassiter-beebe-3.blogbright.net/contact-us-wd-40-australia

bodybuilders that don’t use steroids

References:

https://marvelvsdc.faith/wiki/Weider_Prime_Testosterone_Support_120_Capsules

what is winstrol used for

References:

https://historydb.date/wiki/Steroids_Fast_Facts

women on steroids before and after

References:

https://dokuwiki.stream/wiki/N1_Appetitzgler_Kapseln_forte_42_St_ab_1445

References:

Anavar men before and after

References:

https://lit-book.ru/user/valueping66/

References:

Before and after test cyp 500 week and anavar

References:

https://mensvault.men/story.php?title=4-week-anavar-before-and-after-transformations-results-and-considerations

References:

50mg anavar before and after

References:

http://gojourney.xsrv.jp/index.php?oysterquill5

References:

Anavar before and after 1 month reddit

References:

https://nerdgaming.science/wiki/Winstrol_Cycle_The_Ultimate_Guide

References:

Transformation anavar female before and after

References:

http://hikvisiondb.webcam/index.php?title=winklerdillard4335

steroid basic structure

References:

https://mensvault.men/story.php?title=hintergrund-kaelbermastmittel-als-doping

%random_anchor_text%

References:

https://lovebookmark.win/story.php?title=pfizer-genotropin-pen-for-sale-in-the-uk-buy-pfizer-genotropin-uk

what side effects can occur from taking anabolic steroids

References:

https://hedgedoc.info.uqam.ca/s/zTbo1QpH7

References:

Play slots for real money

References:

https://sportpoisktv.ru/author/witchprison6/

References:

Online roulette play roulette and receive $1500

References:

https://socialbookmarknew.win/story.php?title=jeux-de-casino-en-direct-avec-croupiers

References:

Ipad online

References:

https://alston-iqbal-2.federatedjournals.com/machine-c3-80-sous-dargent-r-c3-a9el-top-casinos-en-ligne-de-2026

References:

T slot nuts

References:

https://socialbookmarknew.win/story.php?title=beste-online-casino-zahlungsmethoden-januar-2026-in-deutschland

References:

Vegas casinos

References:

http://downarchive.org/user/salepigeon85/

References:

Ballys casino ac

References:

https://livebookmark.stream/story.php?title=live-dealer-casinos-2026-best-live-casino-games-online

References:

888 roulette

References:

https://lovebookmark.win/story.php?title=wifi-connexion-candy-seche-linge-communaute-sav-darty-5221979

References:

Capitol casino

References:

https://socialbookmark.stream/story.php?title=96-com-1-trusted-online-casino-sports-and-crypto-betting-site

References:

How do slot machines work

References:

https://stackoverflow.qastan.be/?qa=user/drakearm33

References:

Grand casino coushatta

References:

https://humanlove.stream/wiki/FakeshopFinder_Prfen_Sie_ob_ein_OnlineShop_seris_ist

References:

Online casino sverige

References:

https://bookmarkstore.download/story.php?title=candy96-casino-australia-pokies-bonus-deals-fast-withdrawals

%random_anchor_text%

References:

https://writeablog.net/bridgehedge47/abnehmtabletten-aus-der-apotheke-zur-erganzung-ihrer-diat

how to use steroids

References:

https://king-wifi.win/wiki/Gua_completa_para_comprar_testosterona_Beneficios_usos_y_recomendaciones_en_parafarmacia

geneza steroids for sale

References:

https://bookmarks4.men/story.php?title=appetithemmer-fuer-ein-abnehmen-ohne-hunger

bodybuilder health problems

References:

https://coolpot.stream/story.php?title=dianabol-20-mg-comprimidos-en-venta-en-espana-entrega-garantizada

how long does it take to get big on steroids

References:

https://scientific-programs.science/wiki/Monores_un_farmaco_sicuro_Come_funziona

how are anabolic steroids taken

References:

https://doc.adminforge.de/s/P0GFv-lSQZ

anabolic steroid tablets

References:

http://premiumdesignsinc.com/forums/user/kendomole20/

References:

Playtech casinos

References:

https://timeoftheworld.date/wiki/Meet_Live_Game_Presenters_from_TOP_Live_Casinos

References:

Northern lights casino walker mn

References:

https://rentry.co/zog9vw2z

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

References:

Parxs casino

References:

https://dreevoo.com/profile.php?pid=1008615

References:

Slot machines

References:

https://nerdgaming.science/wiki/Candy96_Payment_Methods_Fast_Secure_CryptoFriendly

References:

Seminole casino

References:

https://sundaynews.info/user/fuelseat9/

References:

Spirit mountain casino

References:

https://rentry.co/sbmztg28

is testosterone illegal

References:

http://cqr3d.ru/user/serverjune1/

steroids on line

References:

http://dranus.ru/forums/user/slipgas3/

steroids muscle building

References:

https://bookmarkstore.download/story.php?title=prendre-du-clenbuterol-utilisations-effets-secondaires-risques-et-plus

effects of long term steroid use

References:

https://cameradb.review/wiki/Pastillas_saciantes_las_mejores_opciones_en_comparacin

Với ba tiêu chí phát triển là “Công bằng – Công khai – Hợp pháp”, 188V hứa hẹn sẽ mang tới cho bạn những trải nghiệm giải trí tuyệt đỉnh. Đăng ký hội viên mới, tân thủ không chỉ được thưởng lớn 100% tiền gửi lần đầu, mà còn có cơ hội “đầu tư kiếm lời” với tỷ lệ cược lô đề 1 ăn 99.8 độc quyền hiện nay. TONY01-29O

References:

Spa brochure

References:

https://morphomics.science/wiki/Jetzt_spielen_Heute_gro_gewinnen

References:

Manoir richelieu forfait

References:

https://tran-frisk.technetbloggers.de/1go-casino-bonus-ohne-einzahlung-januar-2026

References:

Hummer 2014

References:

http://wiki.0-24.jp/index.php?swimcouch3

References:

Casino cancun

References:

https://bookmarkstore.download/story.php?title=888casino-casino-bonus-2024-jetzt-top-freispiele-sichern

References:

Ceasar casino

References:

https://saveyoursite.date/story.php?title=%E1%90%89-online-casino-admiral-bewertungen-und-beschwerden-boni-und-ehrliche-bewertung

References:

Leprechaun games

References:

https://www.google.co.uz/url?q=https://online-spielhallen.de/24-casino-deutschland-ein-tiefenblick-fur-spieler/

References:

Apex casino strazny

References:

https://doherty-ritter-2.thoughtlanes.net/aus-real-money-gambling-sites

References:

St croix casino

References:

https://hackmd.okfn.de/s/ByLejfTIWg

References:

Poconos casino

References:

https://telegra.ph/Winz-Casino-Play-Online-Casino-With-Zero-Wagering-02-02

References:

Casino yellowhead

References:

http://lida-stan.by/user/maletwist86/

References:

Casino aachen

References:

https://mapleprimes.com/users/snowbush50

strongest legal steroids

References:

https://onlinevetjobs.com/author/bubblelion68/

original steroids

References:

https://hendricks-bowden-3.thoughtlanes.net/how-to-discover-if-a-steroid-is-fake

References:

Valley forge casino

References:

https://apunto.it/user/profile/589013

References:

Jackpot casino

References:

https://onlinevetjobs.com/author/cloudpush93/

online casino reload bonus

$10 deposit online casino

betonline odds

sublingual steroids

References:

https://justpin.date/story.php?title=how-to-buy-medicines-safely-from-an-online-pharmacy

anabolic steroid cycles for sale

References:

https://aryba.kg/user/catsupclub5/

mass steroid cycle

References:

https://nerdgaming.science/wiki/Winstrol_tabletten_Angebote_bestellen_ab_10_Versand_sterreich

bet mgm casino online casino betmgm play betmgm va

deca durabolin oral

References:

https://bookmarkfeeds.stream/story.php?title=trenbolone-acetate-for-sale-online-in-uk-us

best mass building cycle

References:

https://wifidb.science/wiki/Buy_Anavar_10mg_Online_Best_Anabolic_Steroid

steroid arms

References:

https://swaay.com/u/tiableovmia43/about/

did arnold use steroids

References:

https://socialbookmark.stream/story.php?title=buy-buy-anavar

do strongmen take steroids

References:

http://okprint.kz/user/thrillperu38/

who created steroids

References:

https://wifidb.science/wiki/ANAVAR_10mg_MACTROPIN_kaufen_bei_99_00_OnlineApotheke_in_Deutschland

mexican steroids for sale

References:

https://wikimapia.org/external_link?url=https://tanztheater-erfurt.de/wp-content/pgs/appetitz_gler_1.html

steriod side effect

References:

https://mccall-carey-5.blogbright.net/appetitzugler-test-and-vergleich-o-die-top-5-im-februar-2026

is anabolic steroids legal

References:

https://onlinevetjobs.com/author/coilman3/

wowvegas.com stands visible as a greatest free-play public casino featuring an impressive collection of slots, burning stockist options, and constantly promotions. Its dual-currency system lets you utilize entertainment with WOW Coins while Sweepstakes Coins volunteer real accolade redemption potential.

Delve into the depths of strategic card games and slot spins. crown coins casino official website provides educational resources for beginners. Turn knowledge into cash today!