Short term interest rate derivative markets are pricing in the chances of a 25 bps rate hike as 100%. However, that is unlikely to be of much support for the GBP as it is one of the currencies hit hardest alongside the EUR on the Russian/Ukraine crisis.

Reasons for GBP weakness

The ECB made it clear in their last meeting that inflationary concerns have got their attention. Despite the Russian/Ukraine risk the ECB have confirmed that their present plan is to end QE in Q3 and raise rates ‘shortly after’. The Fed are likely to show the same concern regarding inflation in their meeting as headline inflation for the US is now at 7.9%. Year on year inflation for the ECB was 5.8% vs 5.6% and that was a figure they could not ignore. The Fed, being even further away from Russia, should have the confidence to deal with inflation if even the ECB can. This should keep the USD supported and weigh on further GBPUSD upside.

The GBP underperforms during times of global stress

During the global financial crisis and Brexit the GBP underperformed and came under selling pressure.

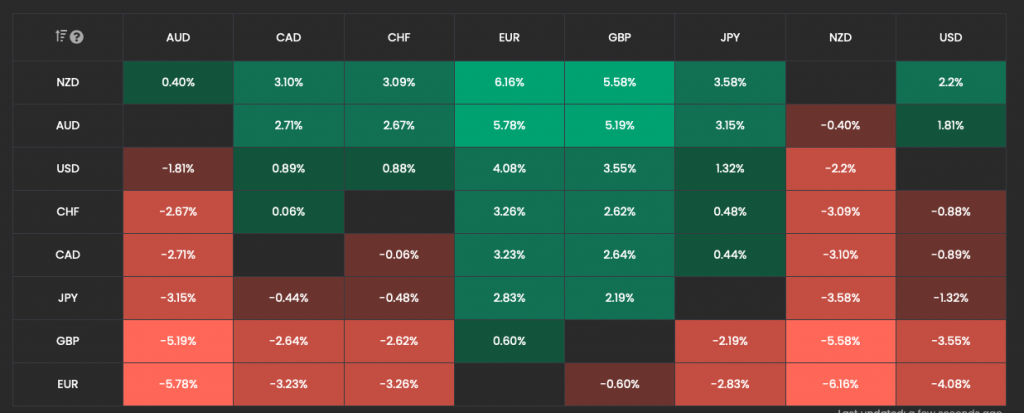

The latest Russian/Ukraine risk has been weighing on the GBP and the EUR, so there is little chance that the Bank of England will do anything to turn around the GBP. The GBP and the EUR have been the weakest currencies this month out of the G8.

Furthermore, with the cost of living crisis driving up and up the political agenda in the UK it seems that the Bank of England will be recognising that risk. Energy prices are an obvious concern and will increase inflationary pressures.

Hawkish pricing to optimistic?

The interest rate derivative markets are pricing in 5 rate hikes by the Bank of England this year and inflation is projected to rise above 6% in Q2. So, the question remains, ‘Has the market been too aggressive in pricing in 5 further rate hikes this year?’ If the BoE meet next week and start pushing back against that aggressive pricing then we could look for possible further weakness in the GBPAUD and the GBPNZD.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.