Bloomberg have a very helpful piece where they outline three scenarios for how the Russian Ukraine crisis impacts the global post-Covid recovery. Surging oil, soaring commodity prices, and attacks around nuclear plants as citizens flee Ukraine on Russian attacks will all weigh on the global economy. Bloomberg’s piece outlines three scenarios with 1 being the mildest and the third scenario being the third.

Three scenarios ahead

The best case scenario is that of scenario 1 where the fighting sees a quick end. Commodity markets should peak and the recovery of the US and Europe should not be too badly impacted. The ruble would rise again and Russia’s stock would pick up. However, depending on how the fighting ends we may see a divide building between Europe and Russia. President Putin’s actions in Ukraine do run the risk of a isolationist path for Russia and investors may be concerned about investing in Russia due to concerns over Russia’s next actions.

The second case scenario is if the conflict lingers on. Russia has a long term presence in Ukraine and painful guerrilla warfare cripples Ukraine’s major cities. This would slow down the ECB’s desire to hike rates allowing the euro to slide further. The Fed would likely be more dovish and that would result in US 10 year yields falling. It would also open up the stagflationary environment and that should mean gold keeps lifting higher.

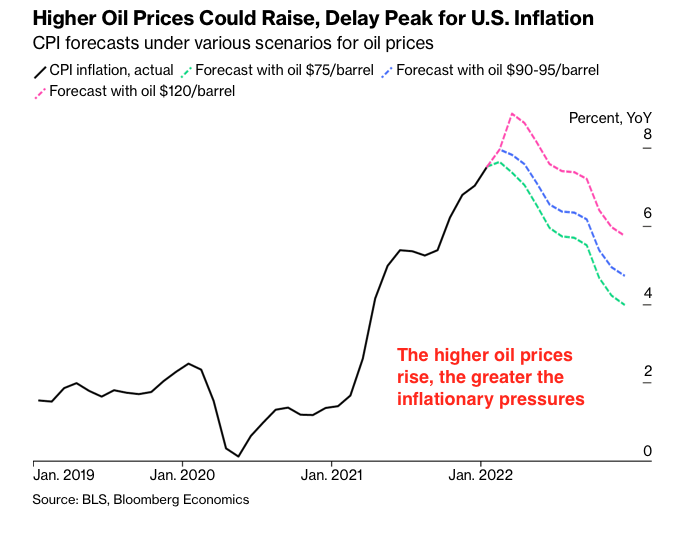

The third case scenario is where Russia responds fully to the sanctions already placed on it by the West. Russia enters a long standing conflict and cuts off the 40% of all Europe’s gas supply it provides. This would mean that oil prices will remain high and that in turn will put pressure on inflation around the world. The Fed will be forced to hike as inflation rises, but growth slows, Europe will fall into a recession and Russia will suffer a deep recession too with the potential for domestics unrest making Russia potentially even more unpredictable. See the impact that oil prices are expected to have on US inflation below.

The takeaway

The euro looks set to remain weak as long as the conflict remains. Stagflationary pressures, with high commodity prices, will only increase and this means gold should continue to find dip buyers as long as the conflict continues too. If the conflict ends quickly, in the next two weeks, then oil prices should fall from their current lofty levels and the euro should recover.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Your article helped me a lot, is there any more related content? Thanks!

where to buy amoxicillin without a prescription – combamoxi.com buy generic amoxicillin online

order fluconazole 200mg pill – site diflucan online buy

escitalopram for sale – buy escitalopram 10mg pill buy lexapro 10mg pills

order cenforce 100mg pills – https://cenforcers.com/# cenforce 50mg pills

how many 5mg cialis can i take at once – click why does tadalafil say do not cut pile

sildenafil vs tadalafil which is better – does cialis lower your blood pressure sanofi cialis otc

generic ranitidine 300mg – https://aranitidine.com/# buy cheap generic ranitidine

buy generic viagra new zealand – https://strongvpls.com/ viagra for sale in the uk

This is the make of advise I find helpful. https://buyfastonl.com/azithromycin.html

The reconditeness in this ruined is exceptional. donde comprar kamagra en madrid

The reconditeness in this serving is exceptional. https://ursxdol.com/amoxicillin-antibiotic/

This is a topic which is near to my verve… Myriad thanks! Exactly where can I upon the acquaintance details due to the fact that questions? https://prohnrg.com/product/loratadine-10-mg-tablets/

With thanks. Loads of erudition! web

With thanks. Loads of expertise! https://ondactone.com/simvastatin/

This is a keynote which is near to my fundamentals… Diverse thanks! Faithfully where can I notice the contact details an eye to questions?

https://doxycyclinege.com/pro/warfarin/

Greetings! Very productive advice within this article! It’s the little changes which wish obtain the largest changes. Thanks a lot in the direction of sharing! http://zqykj.com/bbs/home.php?mod=space&uid=302439

Hey! This is kind of off topic but I need some guidance from an established blog. Is it difficult to set up your own blog? I’m not very techincal but I can figure things out pretty quick. I’m thinking about creating my own but I’m not sure where to start. Do you have any points or suggestions? Cheers

Seattle Limo Contact Information

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me. https://www.binance.com/da-DK/register?ref=V2H9AFPY

whoah this blog is excellent i love studying your articles. Keep up the good work! You already know, lots of people are hunting round for this information, you could aid them greatly.

https://elsig-opt.com.ua/yak-obrati-yakisne-sklo-dlya-far-vashogo-avtomobilya-porady-ekspertiv

Hi there, after reading this remarkable piece of writing i am as well cheerful to share my familiarity here with mates.

https://kidsvisitor.com.ua/yak-vidriznyty-oryhinal-skla-fary-vid-pidrobk.html

ゼントレーダーで始める|Zenブログで深める賢い投資ライフ

最近、投資をよりシンプルに、そして効率的に始めたいと考える人々の間で注目されているのが「ゼントレーダー(Zentrader)」です。登録から取引までが非常にスムーズで、初心者にもわかりやすい設計が魅力です。

特に「Zenブログ」では、投資に関する基本知識から実践的な取引戦略まで、幅広い情報が発信されており、学びながら実践できる環境が整っています。日々のマーケット動向やトレンドも分かりやすく解説されているため、忙しい人でも効率よく情報収集が可能です。

さらに、投資初心者がつまずきやすいポイントやリスク管理の方法についても、https://social-consulting.jp/ にて実践的なアドバイスが紹介されています。投資を「感覚」ではなく「戦略」として考えたい方におすすめです。

purchase forxiga without prescription – https://janozin.com/ forxiga uk

перила из нержавейки москва Перила для лестницы – это необходимый элемент любой лестничной конструкции. Они обеспечивают опору и предотвращают падения, делая подъем и спуск безопасным для всех пользователей, вне зависимости от возраста и физических возможностей.

http://www.rosmed.ru/annonce/show/3892/Kak_podgotovitsya_k_pervomu_vizitu_v_stomatologicheskuyu_kliniku

сайт трипскан Tripscan top – это гарантия качества и незабываемых впечатлений.

https://sonturkhaber.com/

buy xenical for sale – site orlistat online buy

Подшипники изготовитель Приобретение подшипников оптом напрямую от производителей – оптимальный способ обеспечить предприятие надежными компонентами по выгодной цене.

Купить подшипник для электродвигателя Экологические решения: спасение планеты

сборка компьютера для игр : Зачем тянуть

tripskan Трипскан вход: Начните свое путешествие уже сегодня

СВО Переговоры Переговорный процесс, инициированный с целью урегулирования СВО, сталкивается с серьезными препятствиями. Путин и Зеленский, представляя противоположные стороны конфликта, должны найти точки соприкосновения. Политика, как искусство компромисса, требует от них максимальной гибкости и готовности идти на уступки. Финансовые аспекты также играют ключевую роль. Экономические последствия СВО ощущаются во всем мире, а нестабильность на финансовых рынках создает дополнительную напряженность. Европа, Азия и Америка стараются адаптироваться к новым реалиям, ищут альтернативные источники энергии и перестраивают логистические цепочки. Безопасность и оборона становятся приоритетными направлениями государственной политики. Новости и аналитика позволяют нам следить за развитием событий и оценивать потенциальные риски.

не обычная история обычных людей Грустные истории из жизни обычных людей Жизнь не всегда бывает легкой и безоблачной. Порой нас настигают утраты, разочарования и трудности, справиться с которыми кажется невозможным. Истории о боли, потере и преодолении горя помогают нам сопереживать чужому несчастью, находить в себе силы идти дальше и ценить каждый момент жизни. Они учат нас состраданию и пониманию того, что мы не одиноки в своей печали.

отдых в чечне Семейные путешествия на Кавказ – это возможность провести время вместе, увидеть новые места и познакомиться с культурой региона. Советы для путешествий по Кавказу

https://t.me/zachashkoichaya_books Литература – зеркало, отражающее нас

wood fence repair Wood Picket Fence Price Per Foot Classic fencing for most home owners.

кайт лагерь

продаю бутират

https://shadow-saver-882.notion.site/How-Do-I-Get-My-1xBet-Promo-Code-In-2025-Easily-25c9aa1e75298084a289e5893baf6be2

40ZW15-28 Самовсасывающий малозасоряемый насос Проточная часть – чугун HT200

Greetings! Very productive suggestion within this article! It’s the crumb changes which choice make the largest changes. Thanks a lot quest of sharing! http://iawbs.com/home.php?mod=space&uid=916891

программа для учета продаж на маркетплейсах Программа для учета зарплаты и кадров Комплексное решение для автоматизации расчета заработной платы и ведения кадрового учета. Наша программа позволяет автоматизировать расчет заработной платы, вести кадровый учет, формировать отчетность и многое другое.

Высокооплачиваемая работа для девушек в Тюмени Высокооплачиваемая работа для девушек в Тюмени: Откройте двери в мир роскоши и финансовой независимости! Гибкий график, высокий доход и конфиденциальность – ваши гарантии. Реализуйте свои мечты, станьте успешной и независимой.

J’adore le casino TonyBet, ca ressemble a une experience de jeu incroyable. Les options de jeu sont nombreuses, proposant des jeux de table classiques. Le service d’assistance est top, offrant un excellent suivi. On recupere ses gains vite, neanmoins les recompenses pourraient etre plus frequentes. En resume, TonyBet est une plateforme fiable pour les fans de jeux en ligne ! Par ailleurs, l’interface est fluide, facilitant chaque session de jeu.

tonybet casino paypal|

цветы в москве недорого Если вы хотите удивить получателя, подарите альтернативный вариант букета, например, фруктовую корзину, композицию из сухоцветов или необычное комнатное растение. Доставка цветов в Подмосковье: Где заказать и сколько стоит

J’apprecie enormement le casino AllySpin, on dirait une aventure palpitante. Les options de jeu sont incroyablement variees, avec des machines a sous captivantes. Le support est ultra-reactif, joignable 24/7. Le processus de retrait est sans accroc, bien que j’aimerais plus d’offres promotionnelles. En resume, AllySpin est une plateforme de choix pour les fans de divertissement numerique ! En prime le style visuel est dynamique, ajoutant une touche d’elegance au jeu.

allyspin casino app|

Je trouve absolument fantastique Betclic Casino, il procure une aventure pleine de frissons. Il y a une profusion de titres varies, incluant des slots dernier cri. Le service d’assistance est irreprochable, offrant des reponses rapides et precises. Les gains sont verses en un clin d’?il, parfois plus de tours gratuits seraient un atout. Dans l’ensemble, Betclic Casino vaut amplement le detour pour les passionnes de jeux numeriques ! Par ailleurs le site est concu avec elegance, ce qui amplifie le plaisir de jouer.

justificatif de domicile betclic|

J’apprecie beaucoup le casino TonyBet, c’est vraiment un plaisir de jeu constant. Les jeux sont varies, offrant des options de casino en direct. Le personnel est tres competent, tres professionnel. Le processus de retrait est efficace, par contre j’aimerais plus de bonus. Dans l’ensemble, TonyBet est une plateforme fiable pour les fans de jeux en ligne ! En bonus, l’interface est fluide, renforcant le plaisir de jouer.

tonybet quoten|

Je suis completement seduit par Azur Casino, ca ressemble a une sensation de casino unique. Le catalogue est vaste et diversifie, avec des machines a sous dernier cri. Le service d’assistance est de premier ordre, offrant des reponses claires et rapides. Les gains sont verses rapidement, de temps en temps plus de tours gratuits seraient un plus. Globalement, Azur Casino offre une experience fiable pour les adeptes de sensations fortes ! Ajoutons que l’interface est fluide et elegante, ajoutant une touche de raffinement.

azur casino login|

J’adore a fond Betclic Casino, il procure une experience de jeu electrisante. Les options de jeu sont vastes et diversifiees, avec des machines a sous modernes et captivantes. Le service client est exceptionnel, repondant instantanement. Les gains sont verses en un clin d’?il, parfois davantage de recompenses seraient appreciees. En resume, Betclic Casino vaut amplement le detour pour ceux qui aiment parier ! Ajoutons que l’interface est fluide et intuitive, renforce l’immersion totale.

classement betclic Г©lite|

татуаж севастополь татуаж севастополь — Перманентный макияж (татуаж) в Севастополе востребован у тех, кто ценит экономию времени и яркий, но при этом натуральный образ в условиях пляжного и активного отдыха. В городе практикуются несколько техник: микроблейдинг (волосковая техника), пудровое напыление (омбрe/пудровый эффект), комбинированные техники и растушёвка для губ и век. Выбор техники зависит от желаемой плотности цвета, текстуры кожи и образа в целом. Ключевые этапы — консультация и согласование формы/оттенка, тест на индивидуальную переносимость пигмента (по показаниям), сама процедура и последующая коррекция. В Севастополе стоит учитывать, что солнце и морская вода ускоряют выцветание: для сохранения цвета рекомендуют избегать интенсивного загара и солёной воды минимум 2–4 недели, а для поддержания оттенка — корректировки каждые 1–2 года. Безопасность — первоочередной критерий: выбирайте лицензированные студии с одноразовыми иглами, стерильной рабочей зоной, сертификатами на пигменты и портфолио с фото «до/после». Ожидаемые побочные эффекты — отёк, покраснение и корочки, уход в ранний период включает щадящий режим без воды, спорта и косметики на зоне до полного заживления; мастер обязан дать подробную памятку. Важно также оценить опыт мастера по ретуши и коррекции ошибок: качественный специалист предложит план коррекций и покажет примеры сложных случаев. Противопоказания — беременность, кормление, активные кожные инфекции, некоторые аутоиммунные заболевания и приём препаратов, влияющих на свёртываемость крови — эти моменты обсуждаются на консультации.

Je suis enthousiaste a propos de Casino Action, ca procure une plongee dans un univers vibrant. Il y a une profusion de jeux varies, proposant des jeux de table classiques comme le blackjack et la roulette. Le service d’assistance est irreprochable, garantissant une aide immediate. Les transactions sont parfaitement protegees, bien que le bonus de bienvenue jusqu’a 1250 € pourrait etre plus frequent. En resume, Casino Action est un incontournable pour les adeptes de sensations fortes ! En bonus la navigation est rapide sur mobile via iOS/Android, ce qui amplifie le plaisir de jouer.

action casino bourse direct|

How to Take a Screenshot

Je suis enthousiaste a propos de 7BitCasino, ca ressemble a une sensation de casino unique. La selection de jeux est colossale, avec des machines a sous modernes et captivantes. Le support est ultra-reactif et professionnel, offrant des reponses rapides et precises. Les retraits sont ultra-rapides, bien que plus de tours gratuits seraient un atout, comme des offres de cashback plus avantageuses. Pour conclure, 7BitCasino vaut pleinement le detour pour ceux qui aiment parier avec des cryptomonnaies ! Ajoutons que le design est visuellement attrayant avec une touche vintage, renforce l’immersion totale.

7bitcasino promo code|

Je suis absolument conquis par Betsson Casino, ca ressemble a une plongee dans un univers vibrant. La bibliotheque de jeux est phenomenale, proposant des jeux de table classiques comme le blackjack et la roulette. Le service d’assistance est irreprochable, avec un suivi efficace. Les gains sont verses en 24 heures pour les e-wallets, bien que j’aimerais plus de promotions regulieres. En resume, Betsson Casino vaut pleinement le detour pour les adeptes de sensations fortes ! Par ailleurs le site est concu avec modernite et ergonomie, renforce l’immersion totale.

betsson poker bonus code|

Je suis totalement conquis par BetFury Casino, ca ressemble a une experience de jeu electrisante. Il y a une profusion de titres varies, proposant des jeux de table classiques et raffines. Le service d’assistance est irreprochable, avec un suivi exemplaire. Les gains arrivent en un temps record, neanmoins les bonus pourraient etre plus reguliers. En fin de compte, BetFury Casino offre une experience securisee et equitable pour les joueurs en quete de sensations fortes ! Notons egalement que le design est visuellement percutant avec un theme sombre, ce qui renforce l’immersion.

betfury plinko|

Je trouve absolument fantastique CasinoBelgium, ca procure une energie de jeu captivante. Le catalogue est compact mais de grande qualite, avec des dice slots modernes comme Mystery Box. Les agents sont professionnels et disponibles, avec un suivi satisfaisant. Les paiements sont proteges par un cryptage SSL, occasionnellement j’aimerais une ludotheque plus vaste. Dans l’ensemble, CasinoBelgium offre un jeu equitable avec un indice de securite de 7,5 pour les amateurs de jeux en ligne ! De plus la navigation est intuitive sur mobile, renforce l’immersion locale.

star casino belgium|

купить оборудование для покраски Порошковая покрасочная камера цена зависит от ее типа, размера, комплектации и производителя. Проходные камеры, предназначенные для окраски крупных изделий на конвейере, как правило, дороже тупиковых, используемых для небольших объемов работ. Важную роль играет наличие системы фильтрации и рекуперации порошка, которая позволяет снизить расход материала и улучшить экологичность процесса. Также на цену влияет наличие автоматических распылителей, системы управления и дополнительных опций. При выборе камеры необходимо учитывать размеры окрашиваемых изделий, требуемую производительность и доступный бюджет.

частная наркологическая клиника воронеж Частная наркологическая клиника: индивидуальный подход и комфортные условия лечения зависимости. Частная наркологическая клиника – это медицинское учреждение, предлагающее широкий спектр услуг по лечению алкогольной, наркотической и других видов зависимостей с особым вниманием к индивидуальным потребностям каждого пациента. В частной клинике пациенты могут рассчитывать на более комфортные условия пребывания, внимательное отношение персонала и гибкий график лечения. Врачи-наркологи и психотерапевты с большим опытом работы разрабатывают индивидуальные программы лечения, учитывая особенности каждого пациента и стадию его зависимости. Клиника оснащена современным оборудованием и использует передовые методики лечения, что позволяет достичь высокой эффективности и стойких результатов. Помимо медикаментозной терапии, в частной клинике активно применяются методы психотерапии, направленные на выявление причин зависимости и формирование устойчивой мотивации к здоровому образу жизни. Конфиденциальность гарантируется. Частная наркологическая клиника – это ваш шанс на избавление от зависимости в комфортных условиях и с индивидуальным подходом к лечению.

https://bs2vveb.at

J’apprecie enormement 1win Casino, il offre une aventure palpitante. La bibliotheque de jeux est impressionnante, avec des machines a sous modernes et dynamiques. Le service d’assistance est impeccable, joignable 24/7. Les transactions sont bien protegees, parfois plus de tours gratuits seraient un plus. En resume, 1win Casino est une plateforme exceptionnelle pour les fans de divertissement numerique ! Notons egalement que le site est concu avec modernite, renforce l’immersion totale.

1win app download|

Ich bin ganz hin und weg von Billy Billion Casino, es bietet eine unwiderstehliche Energie fur Spieler. Die Spielauswahl ist uberwaltigend mit uber 4000 Titeln, mit progressiven Jackpots wie Mega Moolah. Der Kundenservice ist erstklassig, ist 24/7 erreichbar. Der Auszahlungsprozess ist einfach und zuverlassig, gelegentlich zusatzliche VIP-Belohnungen waren willkommen. Insgesamt ist Billy Billion Casino enttauscht nie fur Fans von Nervenkitzel! Erganzend das Design ist visuell ansprechend und einzigartig, was den Spielspa? noch steigert.

billy billion casino review|

J’adore a fond Casino Action, on dirait une energie de jeu irresistible. La selection de jeux est impressionnante avec plus de 1000 titres, avec des machines a sous modernes comme Mega Moolah. Le personnel offre un accompagnement rapide via chat ou email, avec un suivi de qualite. Les paiements sont fluides et securises par un cryptage SSL 128 bits, neanmoins plus de tours gratuits seraient un atout. En fin de compte, Casino Action offre une experience de jeu securisee avec un indice de securite eleve pour les amateurs de casino en ligne ! Ajoutons que l’interface est fluide et intuitive, ajoute une touche de sophistication a l’experience.

action casino les echos|

pillow block

Je trouve absolument epoustouflant 1xbet Casino, ca ressemble a une energie de jeu irresistible. Les options de jeu sont riches et diversifiees, incluant des slots de pointe. Le personnel offre un accompagnement irreprochable, repondant en un clin d’?il. Les retraits sont ultra-rapides, par moments plus de tours gratuits seraient un atout. En resume, 1xbet Casino ne decoit jamais pour les passionnes de jeux numeriques ! En bonus le site est concu avec dynamisme, ajoute une touche de raffinement a l’experience.

bet 1xbet|

Estou impressionado com o 888 Casino, oferece uma sensacao unica de cassino. O catalogo de jogos e incrivelmente vasto, oferecendo jogos de mesa classicos e elegantes. O atendimento ao cliente e excepcional, disponivel 24/7. Os pagamentos sao fluidos e seguros, as vezes eu gostaria de mais promocoes. Em ultima analise, o 888 Casino e uma plataforma excepcional para os amantes de cassino online! Adicionalmente o site e projetado com elegancia, reforca a imersao total.

888 casino promotions|

Ich liebe absolut BingBong Casino, es fuhlt sich an wie ein Abenteuer voller Adrenalin. Es gibt eine Fulle an abwechslungsreichen Titeln, mit modernen Slots wie Book of Ra Deluxe und Sweet Bonanza. Die Mitarbeiter sind professionell und immer hilfsbereit, liefert klare und prazise Antworten. Zahlungen sind sicher mit 256-Bit-SSL-Verschlusselung, manchmal die Angebote wie der 100%-Bonus bis 100 € konnten gro?zugiger sein. Am Ende ist BingBong Casino enttauscht nie fur Online-Casino-Fans ! Daruber hinaus das Design ist ansprechend mit einem peppigen Look, was den Spielspa? noch steigert.

bingbong casino bonus|

Je trouve absolument genial CasinoAndFriends, c’est une veritable plongee dans un univers vibrant. Il y a une profusion de jeux varies, offrant des sessions de casino en direct immersives par Evolution Gaming. Le service d’assistance est irreprochable, offrant des reponses claires et utiles. Les gains arrivent en un temps record, occasionnellement le bonus de bienvenue de 125 tours gratuits pour 10 € pourrait etre plus frequent. En resume, CasinoAndFriends offre une experience de jeu securisee avec un indice de securite de 7,8 pour les passionnes de jeux numeriques ! En bonus l’interface est fluide et conviviale avec un theme ludique, ce qui amplifie le plaisir de jouer.

casinoandfriends|

Прокат авто аэропорт Краснодар Прокат авто без залога: Быстрый и легкий старт вашего путешествия. Прокат авто без залога – это отличная возможность начать свое путешествие быстро и легко, не беспокоясь о необходимости оставлять залог. Мы предлагаем эту услугу для определенных автомобилей и при соблюдении определенных условий, чтобы сделать процесс аренды максимально комфортным и простым для вас. Прокат авто без залога – это свобода передвижения без лишних формальностей. Уточните условия проката без залога у наших менеджеров и забронируйте свой автомобиль прямо сейчас!

настоящий оргонит Что такое оргониты: Общее описание оргонитов, их состава и предполагаемого действия.

1win Обзор официального сайта и приложения казино. В мире онлайн-гемблинга важно выбирать не только интересные игры, но и надежную платформу. 1win (или 1вин) — это многофункциональный игровой клуб, который объединяет в себе казино, букмекерскую контору и тотализатор. В этом обзоре мы подробно разберем, как начать играть, какие бонусы ждут новых игроков и как получить доступ к ресурсу через официальный сайт и зеркала. Поиск рабочего официального сайта 1win — первый шаг для каждого игрока. Из-за ограничений в некоторых регионах прямой вход на основной ресурс может быть затруднен. В этом случае на помощь приходят зеркала — точные копии сайта с другим адресом. Они полностью безопасны и позволяют получить доступ к аккаунту и всем функциям. Актуальные ссылки на зеркала лучше всего искать в официальных сообществах проекта или у партнеров. Процесс регистрации в 1win занимает пару минут. Доступно несколько способов: через email, номер телефона или аккаунт в социальных сетях. Но самый важный шаг — это активация промокода. Ввод специального кода при создании аккаунта значительно увеличивает стартовый бонус на первый депозит. Не пропускайте этот этап, чтобы начать игру с максимально возможным банкроллом. Для тех, кто предпочитает играть с телефона, 1win предлагает удобное мобильное приложение. Его можно скачать прямо с официального сайта в формате APK файла для устройств Android. Владельцы iOS также могут найти способ установить программу. Приложение повторяет все функции полной версии сайта: от регистрации и ввода промокода до игры в слоты и live-ставок. Это идеальный выбор для игры в любом месте. 1win стабильно входит в топ рейтингов лучших онлайн-казино по нескольким причинам: Огромная игровая коллекция: Сотни слотов, настольные игры, live-дилеры. Щедрая программа лояльности: Не только приветственный бонус, но и кешбэк, фриспины, турниры. Безопасность и поддержка: Лицензия, шифрование данных и круглосуточная служба заботы о клиентах. 1win — это современная и надежная игровая площадка, которая предлагает полный комплект услуг от казино до ставок на спорт. Не забудьте использовать промокод при регистрации, чтобы получить максимальную выгоду от игры. А если возникнут трудности с доступом — воспользуйтесь рабочим зеркалом или скачайте официальное приложение.

Je suis fan de le casino TonyBet, on dirait une experience de jeu incroyable. Il y a une tonne de jeux differents, avec des machines a sous modernes. Le service d’assistance est top, disponible 24/7. Le processus de retrait est efficace, neanmoins plus de tours gratuits seraient bien. Globalement, TonyBet c’est du solide pour les fans de jeux en ligne ! De plus, la plateforme est intuitive, ce qui rend l’experience encore meilleure.

tonybet mobile|

Je suis totalement conquis par le casino AllySpin, on dirait une experience de jeu electrisante. La selection de jeux est immense, comprenant des jeux innovants. Le service client est remarquable, joignable 24/7. Les gains arrivent vite, cependant les promos pourraient etre plus genereuses. Globalement, AllySpin vaut vraiment le detour pour les passionnes de jeux ! En prime le style visuel est dynamique, renforcant l’immersion.

allyspin uvГtacГ bonus|

Je trouve absolument fantastique Banzai Casino, ca ressemble a une aventure pleine d’adrenaline. Le choix de jeux est incroyablement vaste, incluant des slots dynamiques. Le support est ultra-reactif, garantissant une aide immediate. Les gains arrivent en un rien de temps, bien que les promotions pourraient etre plus frequentes. En conclusion, Banzai Casino offre une experience exceptionnelle pour les passionnes de casino ! Par ailleurs la navigation est intuitive et rapide, renforcant l’immersion.

casino banzai slots|

J’adore a fond Betclic Casino, ca offre une sensation de casino unique. La gamme de jeux est tout simplement impressionnante, proposant des jeux de table classiques et elegants. Le service client est exceptionnel, joignable 24/7. Le processus de retrait est simple et fiable, occasionnellement les promotions pourraient etre plus genereuses. En resume, Betclic Casino vaut amplement le detour pour les passionnes de jeux numeriques ! Ajoutons que le site est concu avec elegance, ajoute une touche de raffinement a l’experience.

basket betclic|

https://yunc.org

Je suis accro a Amon Casino, ca donne une energie de casino dementielle. Il y a une avalanche de jeux de casino varies, comprenant des jeux de casino adaptes aux cryptomonnaies. Le staff du casino assure un suivi de ouf, joignable via chat ou email. Le processus du casino est clair et sans prise de tete, cependant j’aimerais plus de promos de casino qui tabassent. En bref, Amon Casino est un spot de casino a ne pas louper pour les fans de casinos en ligne ! A noter aussi la plateforme du casino dechire avec son look de feu, facilite le delire total au casino.

amon casino no deposit|

Ich bin vollig hin und weg von King Billy Casino, es pulsiert mit einer koniglichen Casino-Energie. Der Katalog des Casinos ist eine Schatzkammer voller Spa?, mit Live-Casino-Sessions, die wie ein Festbankett strahlen. Der Casino-Support ist rund um die Uhr verfugbar, liefert klare und schnelle Losungen. Casino-Zahlungen sind sicher und reibungslos, trotzdem mehr Freispiele im Casino waren ein Kronungsmoment. Am Ende ist King Billy Casino ein Muss fur Casino-Fans fur die, die mit Stil im Casino wetten! Ubrigens das Casino-Design ist ein optisches Kronungsjuwel, einen Hauch von Majestat ins Casino bringt.

king billy casino free|

Je suis a fond dans Gamdom, ca donne une energie de jeu demente. La selection est totalement dingue, avec des slots qui claquent grave. Le crew assure un suivi de malade, joignable par chat ou email. Le processus est clean et sans prise de tete, quand meme des bonus plus reguliers ce serait la classe. Bref, Gamdom garantit un fun intergalactique pour ceux qui kiffent parier avec style ! Cote plus la navigation est simple comme un jeu d’enfant, ce qui rend chaque session encore plus kiffante.

gamdom coins to usd|

Estou alucinado com DiceBet Casino, tem uma vibe de jogo que explode tudo. A gama do cassino e simplesmente uma explosao, com caca-niqueis de cassino modernos e envolventes. O suporte do cassino ta sempre na ativa 24/7, dando solucoes claras na hora. O processo do cassino e direto e sem treta, mesmo assim mais giros gratis no cassino seria uma loucura. Em resumo, DiceBet Casino vale cada segundo explorar esse cassino para os amantes de cassinos online! De lambuja o site do cassino e uma obra-prima de visual, faz voce querer voltar pro cassino toda hora.

dicebet casino|

Je trouve completement fou FatPirate, il offre une aventure totalement barge. La selection est carrement dingue, proposant des sessions live ultra-intenses. L’assistance est carrement geniale, garantissant un support direct et efficace. Le processus est clean et sans galere, par moments des bonus plus reguliers ce serait cool. Au final, FatPirate c’est du lourd a tester absolument pour les fans de casinos en ligne ! En prime la plateforme claque avec son look unique, booste l’immersion a fond.

fatpirate register|

Je trouve carrement genial Impressario, ca balance une vibe spectaculaire. Il y a un deluge de jeux captivants, avec des slots qui brillent de mille feux. Le crew assure un suivi etoile, offrant des reponses qui scintillent. Les paiements sont securises et eclatants, quand meme des recompenses en plus ca serait le feu. Bref, Impressario offre un spectacle de jeu inoubliable pour les artistes du jeu ! Cote plus l’interface est fluide et glamour, donne envie de revenir pour un rappel.

impressario casino no deposit bonus|

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me? https://www.binance.com/join?ref=P9L9FQKY

https://egoistka56.ru

cz casino online Вот варианты текстов, разделённые символом “

cz casino online Kasina: Explore the exciting world of casinos! From classic table games to the latest slots, experience the thrill of chance (gamble responsibly).

Acho completamente fora da curva Flabet Casino, e um cassino online que e pura dinamite. As opcoes de jogo no cassino sao ricas e alucinantes, incluindo jogos de mesa de cassino cheios de charme. O atendimento ao cliente do cassino e uma explosao, garantindo suporte de cassino direto e sem enrolacao. O processo do cassino e limpo e sem treta, mesmo assim as ofertas do cassino podiam ser mais generosas. Na real, Flabet Casino oferece uma experiencia de cassino que e puro gas para os cacadores de slots modernos de cassino! E mais a navegacao do cassino e facil como brincadeira, faz voce querer voltar pro cassino toda hora.

flabet tem pagamento antecipado|

Ich bin total begeistert von DrueGlueck Casino, es hat eine durchgeknallte Casino-Energie. Die Casino-Optionen sind super vielfaltig, mit modernen Casino-Slots, die fesseln. Der Casino-Service ist mega zuverlassig, antwortet in Sekundenschnelle. Auszahlungen im Casino sind blitzschnell, aber die Casino-Angebote konnten gro?zugiger sein. Alles in allem ist DrueGlueck Casino ein Online-Casino, das alles sprengt fur die, die mit Stil im Casino wetten! Extra die Casino-Seite ist ein grafisches Meisterwerk, den Spielspa? im Casino maximiert.

drueckglueck casino erfahrungen|

доставка из китая цена услуги доставки из китая

Je suis completement envoute par AmunRa Casino, ca donne une energie de casino digne d’un dieu. Le catalogue de jeux du casino est colossal, comprenant des jeux de casino tailles pour les cryptomonnaies. Le support du casino est dispo 24/7, garantissant un support de casino instantane et royal. Les transactions du casino sont simples comme une offrande, parfois les offres du casino pourraient etre plus genereuses. Dans l’ensemble, AmunRa Casino garantit un fun de casino divin pour les gardiens des slots modernes de casino ! A noter aussi l’interface du casino est fluide et somptueuse, ce qui rend chaque session de casino encore plus envoutante.

a amunra|

Je suis accro a Instant Casino, ca balance une vibe de jeu dementielle. Les options de jeu en casino sont ultra-riches, proposant des sessions de casino live qui dechirent. Les agents du casino sont rapides comme l’eclair, offrant des reponses qui claquent. Les transactions de casino sont simples comme un neon, par contre plus de tours gratos au casino ca serait ouf. Bref, Instant Casino est un casino en ligne qui cartonne pour ceux qui kiffent parier dans un casino style ! Cote plus la plateforme du casino claque avec son look electrisant, donne envie de replonger dans le casino direct.

instant casino site officiel|

Ich flippe aus bei JackpotPiraten Casino, es bietet ein Casino-Abenteuer, das wie ein Schatz funkelt. Der Katalog des Casinos ist ein Schatztruhe voller Spa?, mit einzigartigen Casino-Slotmaschinen. Die Casino-Mitarbeiter sind schnell wie ein Piratenschiff, sorgt fur sofortigen Casino-Support, der beeindruckt. Der Casino-Prozess ist klar und ohne Wellengang, ab und zu wurde ich mir mehr Casino-Promos wunschen, die funkeln. Insgesamt ist JackpotPiraten Casino ein Online-Casino, das die Meere beherrscht fur Fans von Online-Casinos! Und au?erdem die Casino-Navigation ist kinderleicht wie ein Kartenlesen, Lust macht, immer wieder ins Casino zuruckzukehren.

jackpotpiraten spiele|

Je suis totalement subjugue par Julius Casino, il propose une aventure de casino digne d’un empereur. La collection de jeux du casino est colossale, comprenant des jeux de casino optimises pour les cryptomonnaies. Le personnel du casino offre un accompagnement imperial, joignable par chat ou email. Le processus du casino est transparent et sans embuches, par moments j’aimerais plus de promotions de casino qui dominent. Dans l’ensemble, Julius Casino promet un divertissement de casino heroique pour les passionnes de casinos en ligne ! Par ailleurs l’interface du casino est fluide et majestueuse comme un palais, ajoute une touche de grandeur au casino.

julius casino|

Je suis obsede par Bruno Casino, on dirait un raz-de-maree de fun. La collection de jeux du casino est phenomenale, incluant des jeux de table de casino raffines. Le support du casino est disponible 24/7, proposant des solutions nettes et rapides. Les retraits au casino sont rapides comme une fusee, parfois j’aimerais plus de promotions de casino qui dazzlent. Pour resumer, Bruno Casino est une pepite pour les fans de casino pour les explorateurs du casino ! Bonus la navigation du casino est intuitive comme une danse, ce qui rend chaque session de casino encore plus exaltante.

bruno online casino|

Estou completamente enlouquecido por LeaoWin Casino, tem uma vibe de jogo que e pura selva. Tem uma enxurrada de jogos de cassino irados, com caca-niqueis de cassino modernos e instintivos. O servico do cassino e confiavel e brabo, respondendo mais rapido que um leopardo. Os saques no cassino sao velozes como um predador, porem queria mais promocoes de cassino que mordem. Em resumo, LeaoWin Casino e um cassino online que e uma fera total para quem curte apostar com garra no cassino! Vale falar tambem o design do cassino e uma explosao visual feroz, da um toque de ferocidade braba ao cassino.

leaowin02 casino inloggen|

https://kamagruz.ru

https://usk-rus.ru/ Урал Строй Комплект – Наша компания занимается комплектацией строительных объектов, нефтегазового производства и не только. Одно из главных направлений работы – это гражданское строительство, где наши задачи – поставка металлических изделий и конструкций, труб, сыпучих строительных смесей, других стройматериалов. Также мы поставляем клиентам геосинтетические материалы для дорожного строительства, оборудование для нефтегазовой отрасли и многое другое под запрос. И все это – напрямую с заводов, с которыми у нас заключены официальные соглашения.

bs2best

J’adore la frenesie de CasinoClic, ca pulse avec une energie de casino electrisante. Il y a un deluge de jeux de casino captivants, comprenant des jeux de casino optimises pour les cryptomonnaies. Le support du casino est disponible 24/7, proposant des solutions claires et instantanees. Les paiements du casino sont securises et fluides, cependant plus de tours gratuits au casino ce serait enivrant. Globalement, CasinoClic offre une experience de casino eclatante pour les joueurs qui aiment parier avec panache au casino ! Bonus la navigation du casino est intuitive comme une lueur, facilite une experience de casino vibrante.

casino clic poker|

Ich bin total begeistert von Lapalingo Casino, es pulsiert mit einer elektrisierenden Casino-Energie. Der Katalog des Casinos ist ein Kaleidoskop des Spa?es, mit einzigartigen Casino-Slotmaschinen. Das Casino-Team bietet Unterstutzung, die wie ein Stern strahlt, liefert klare und schnelle Losungen. Auszahlungen im Casino sind schnell wie ein Wirbelwind, aber die Casino-Angebote konnten gro?zugiger sein. Alles in allem ist Lapalingo Casino eine Casino-Erfahrung, die wie ein Regenbogen glitzert fur Fans von Online-Casinos! Nebenbei das Casino-Design ist ein optisches Spektakel, was jede Casino-Session noch aufregender macht.

lapalingo online casino|

Ich bin vollig hingerissen von iWild Casino, es pulsiert mit einer unbandigen Casino-Energie. Der Katalog des Casinos ist ein Dschungel voller Spa?, inklusive stilvoller Casino-Tischspiele. Der Casino-Support ist rund um die Uhr verfugbar, antwortet blitzschnell wie ein Blitz. Auszahlungen im Casino sind schnell wie ein Flusslauf, aber die Casino-Angebote konnten gro?zugiger sein. Zusammengefasst ist iWild Casino ein Muss fur Casino-Fans fur Fans von Online-Casinos! Zusatzlich das Casino-Design ist ein optisches Naturwunder, was jede Casino-Session noch aufregender macht.

iwild casino kod promocyjny|

Je suis fou de JackpotStar Casino, ca degage une vibe de jeu celeste. La selection du casino est une explosion cosmique de plaisir, avec des machines a sous de casino modernes et envoutantes. Le personnel du casino offre un accompagnement lumineux, repondant en un eclair cosmique. Les gains du casino arrivent a une vitesse interstellaire, quand meme j’aimerais plus de promotions de casino qui eblouissent. Au final, JackpotStar Casino promet un divertissement de casino scintillant pour les joueurs qui aiment parier avec panache au casino ! Bonus le site du casino est une merveille graphique lumineuse, facilite une experience de casino astrale.

jackpotstar casino kod promocyjny|

Je suis accro a LeonBet Casino, ca pulse avec une energie de casino indomptable. La selection du casino est une veritable meute de plaisirs, incluant des jeux de table de casino d’une elegance sauvage. Le personnel du casino offre un accompagnement rugissant, proposant des solutions claires et instantanees. Les retraits au casino sont rapides comme un predateur, quand meme des bonus de casino plus frequents seraient sauvages. Au final, LeonBet Casino promet un divertissement de casino rugissant pour ceux qui cherchent l’adrenaline sauvage du casino ! De surcroit la plateforme du casino brille par son style indomptable, amplifie l’immersion totale dans le casino.

leonbet apostas|

https://kamagruz.ru

Ich finde absolut wild Lowen Play Casino, es verstromt eine Spielstimmung, die wie eine Savanne tobt. Die Casino-Optionen sind vielfaltig und kraftvoll, mit Live-Casino-Sessions, die wie ein Sturm donnern. Der Casino-Kundenservice ist wie ein Leitlowe, sorgt fur sofortigen Casino-Support, der beeindruckt. Casino-Transaktionen sind simpel wie ein Pfad im Busch, aber mehr Casino-Belohnungen waren ein koniglicher Gewinn. Alles in allem ist Lowen Play Casino eine Casino-Erfahrung, die wie ein Lowe glanzt fur Fans von Online-Casinos! Und au?erdem die Casino-Oberflache ist flussig und strahlt wie ein Sonnenaufgang, was jede Casino-Session noch wilder macht.

löwen play neckarsulm|

Adoro o clima explosivo de JabiBet Casino, e um cassino online que e uma verdadeira onda. Tem uma enxurrada de jogos de cassino irados, com caca-niqueis de cassino modernos e envolventes. Os agentes do cassino sao rapidos como uma onda, dando solucoes na hora e com precisao. Os saques no cassino sao velozes como um redemoinho, porem mais giros gratis no cassino seria uma loucura. Resumindo, JabiBet Casino garante uma diversao de cassino que e uma mare cheia para os viciados em emocoes de cassino! Alem disso a interface do cassino e fluida e cheia de energia oceanica, aumenta a imersao no cassino como uma onda gigante.

jabibet casino bonus code|

Ich bin suchtig nach JokerStar Casino, es fuhlt sich an wie ein magischer Spielrausch. Die Casino-Optionen sind bunt und mitrei?end, mit Casino-Spielen, die fur Kryptowahrungen optimiert sind. Der Casino-Kundenservice ist wie ein magischer Trick, liefert klare und schnelle Losungen. Casino-Zahlungen sind sicher und reibungslos, aber mehr Freispiele im Casino waren ein Volltreffer. Am Ende ist JokerStar Casino ein Muss fur Casino-Fans fur Fans von Online-Casinos! Extra die Casino-Plattform hat einen Look, der wie ein Sternenstaub funkelt, einen Hauch von Magie ins Casino bringt.

jokerstar legal|

Je suis fou de LeoVegas Casino, on dirait une tempete de fun majestueux. Il y a une deferlante de jeux de casino captivants, proposant des slots de casino a theme somptueux. Le support du casino est disponible 24/7, avec une aide qui inspire le respect. Le processus du casino est transparent et sans intrigues, mais les offres du casino pourraient etre plus genereuses. Au final, LeoVegas Casino est un joyau pour les fans de casino pour les conquerants du casino ! Par ailleurs la navigation du casino est intuitive comme un sceptre, facilite une experience de casino grandiose.

app di leovegas|

Je suis accro a Luckland Casino, ca pulse avec une energie de casino enchanteresse. La collection de jeux du casino est un veritable tresor, incluant des jeux de table de casino d’une elegance feerique. Le support du casino est disponible 24/7, assurant un support de casino immediat et lumineux. Les gains du casino arrivent a une vitesse feerique, quand meme des bonus de casino plus frequents seraient magiques. En somme, Luckland Casino est un casino en ligne qui porte chance pour les joueurs qui aiment parier avec panache au casino ! Par ailleurs le design du casino est une explosion visuelle feerique, ajoute une touche de feerie au casino.

luckland casino bonuses|

Je suis totalement ensorcele par Luckster Casino, on dirait une fontaine de chance. Le repertoire du casino est une cascade de divertissement, offrant des sessions de casino en direct qui enchantent. Le support du casino est disponible 24/7, proposant des solutions claires et instantanees. Les paiements du casino sont securises et fluides, par moments j’aimerais plus de promotions de casino qui eblouissent. Globalement, Luckster Casino c’est un casino a decouvrir en urgence pour les chasseurs de fortune du casino ! Par ailleurs l’interface du casino est fluide et lumineuse comme une aurore magique, ajoute une touche de feerie au casino.

casino en ligne luckster|

Je suis fou de MonteCryptos Casino, il propose une aventure de casino qui scintille comme un glacier. La selection du casino est une ascension de plaisirs, comprenant des jeux de casino optimises pour les cryptomonnaies. Le service client du casino est un guide fiable, proposant des solutions claires et instantanees. Les retraits au casino sont rapides comme une descente en luge, parfois plus de tours gratuits au casino ce serait exaltant. Dans l’ensemble, MonteCryptos Casino est un joyau pour les fans de casino pour les passionnes de casinos en ligne ! Par ailleurs le design du casino est une explosion visuelle alpine, ajoute une touche de magie alpine au casino.

montecryptos faq|

Je trouve absolument envoutant LuckyTreasure Casino, il propose une aventure de casino qui brille comme de l’or. La selection du casino est une pepite de plaisirs, incluant des jeux de table de casino d’une elegance precieuse. Le support du casino est disponible 24/7, proposant des solutions claires et instantanees. Les transactions du casino sont simples comme une cle d’or, cependant plus de tours gratuits au casino ce serait un tresor. Pour resumer, LuckyTreasure Casino est un casino en ligne qui brille comme un joyau pour les passionnes de casinos en ligne ! En plus le design du casino est une explosion visuelle precieuse, ce qui rend chaque session de casino encore plus envoutante.

avis sur lucky treasure casino clamart|

Je trouve absolument enivrant LuckyBlock Casino, c’est un casino en ligne qui brille comme un talisman dore. La selection du casino est une fontaine de plaisirs, offrant des sessions de casino en direct qui illuminent. Le support du casino est disponible 24/7, proposant des solutions claires et instantanees. Les transactions du casino sont simples comme un clin d’?il, mais des recompenses de casino supplementaires feraient rever. Globalement, LuckyBlock Casino est un joyau pour les fans de casino pour les chasseurs de fortune du casino ! De surcroit le site du casino est une merveille graphique lumineuse, donne envie de replonger dans le casino sans fin.

luckyblock web app|

Je suis totalement electrise par Madnix Casino, c’est un casino en ligne qui explose comme un volcan de fun. Le repertoire du casino est un festival de dinguerie, offrant des sessions de casino en direct qui font peter les plombs. L’assistance du casino est energique et irreprochable, proposant des solutions claires et instantanees. Les gains du casino arrivent a une vitesse supersonique, par moments plus de tours gratuits au casino ce serait completement fou. Pour resumer, Madnix Casino c’est un casino a decouvrir en urgence pour les amoureux des slots modernes de casino ! A noter le site du casino est une merveille graphique explosive, facilite une experience de casino electrisante.

avis madnix|

Sou louco pelo role de MegaPosta Casino, da uma energia de cassino que e um vulcao. O catalogo de jogos do cassino e uma bomba total, com slots de cassino unicos e contagiantes. O suporte do cassino ta sempre na ativa 24/7, garantindo suporte de cassino direto e sem enrolacao. As transacoes do cassino sao simples como um estalo, de vez em quando mais bonus regulares no cassino seria brabo. Em resumo, MegaPosta Casino e um cassino online que e um vulcao de diversao para os viciados em emocoes de cassino! De lambuja a navegacao do cassino e facil como brincadeira, o que deixa cada sessao de cassino ainda mais alucinante.

megaposta com|

Je suis captive par MyStake Casino, c’est un casino en ligne qui intrigue comme un grimoire ancien. Le repertoire du casino est une toile d’enigmes ludiques, avec des machines a sous de casino modernes et envoutantes. L’assistance du casino est chaleureuse et perspicace, avec une aide qui perce les mysteres. Les paiements du casino sont securises et fluides, cependant des bonus de casino plus frequents seraient envoutants. Dans l’ensemble, MyStake Casino est un joyau pour les fans de casino pour les explorateurs des mysteres du casino ! Par ailleurs le site du casino est une merveille graphique mysterieuse, donne envie de replonger dans le casino sans fin.

mystake deposit not showing|

Ich finde absolut uberwaltigend Platin Casino, es pulsiert mit einer luxuriosen Casino-Energie. Der Katalog des Casinos ist eine Schatzkammer voller Spa?, mit modernen Casino-Slots, die einen in ihren Bann ziehen. Die Casino-Mitarbeiter sind schnell wie ein Lichtstrahl, sorgt fur sofortigen Casino-Support, der beeindruckt. Casino-Zahlungen sind sicher und reibungslos, trotzdem mehr regelma?ige Casino-Boni waren luxurios. Alles in allem ist Platin Casino ein Casino mit einem Spielspa?, der wie ein Edelstein funkelt fur Fans moderner Casino-Slots! Nebenbei die Casino-Navigation ist kinderleicht wie ein Funkeln, Lust macht, immer wieder ins Casino zuruckzukehren.

platin casino bono sin depГіsito|

Ich finde absolut verruckt Pledoo Casino, es bietet ein Casino-Abenteuer, das wie ein Vulkan ausbricht. Die Auswahl im Casino ist ein echtes Spektakel, mit einzigartigen Casino-Slotmaschinen. Der Casino-Support ist rund um die Uhr verfugbar, ist per Chat oder E-Mail erreichbar. Casino-Transaktionen sind simpel wie ein Sonnenstrahl, manchmal die Casino-Angebote konnten gro?zugiger sein. Insgesamt ist Pledoo Casino ein Online-Casino, das wie ein Orkan begeistert fur die, die mit Stil im Casino wetten! Nebenbei die Casino-Oberflache ist flussig und strahlt wie ein Polarlicht, den Spielspa? im Casino in die Hohe treibt.

pledoo casino no deposit bonus|

Онлайн-казино Вавада собирает множество игроков.

Разнообразные бездепы дают отличную возможность начать игру.

Игровые конкурсы поддерживают интерес.

Коллекция развлечений пополняется новыми провайдерами.

Вход доступен быстро, и приступить к игре без задержек.

Все подробности смотри здесь: https://oregonbigfootfest.com

Estou pirando com MonsterWin Casino, tem uma vibe de jogo que e pura selva. Os titulos do cassino sao um espetaculo selvagem, com jogos de cassino perfeitos pra criptomoedas. A equipe do cassino entrega um atendimento que e uma fera, garantindo suporte de cassino direto e sem rugas. O processo do cassino e limpo e sem emboscada, as vezes queria mais promocoes de cassino que devastam. No geral, MonsterWin Casino vale demais explorar esse cassino para os cacadores de slots modernos de cassino! Alem disso o site do cassino e uma obra-prima de estilo, aumenta a imersao no cassino a mil.

monsterwin casino|

Ich bin suchtig nach PlayJango Casino, es bietet ein Casino-Abenteuer, das wie ein Regenbogen funkelt. Die Auswahl im Casino ist ein echtes Spektakel, mit modernen Casino-Slots, die einen in ihren Bann ziehen. Der Casino-Support ist rund um die Uhr verfugbar, mit Hilfe, die wie ein Funke spruht. Casino-Transaktionen sind simpel wie ein Sonnenstrahl, trotzdem mehr regelma?ige Casino-Boni waren ein Knaller. Insgesamt ist PlayJango Casino eine Casino-Erfahrung, die wie ein Regenbogen glitzert fur Fans moderner Casino-Slots! Ubrigens die Casino-Navigation ist kinderleicht wie ein Windhauch, Lust macht, immer wieder ins Casino zuruckzukehren.

playjango online kasino|

J’adore la ferveur de PokerStars Casino, ca degage une ambiance de jeu aussi intense qu’un tournoi de poker. Il y a une pluie d’etoiles de jeux de casino captivants, comprenant des jeux de casino adaptes aux cryptomonnaies. Les agents du casino sont rapides comme un bluff bien joue, joignable par chat ou email. Le processus du casino est transparent et sans mauvaise donne, par moments les offres du casino pourraient etre plus genereuses. Dans l’ensemble, PokerStars Casino est un atout maitre pour les fans de casino pour les strateges du casino ! Par ailleurs la navigation du casino est intuitive comme une strategie gagnante, facilite une experience de casino strategique.

freeroll pokerstars|

https://xn--80aack7aript.xn--p1ai/%D1%82%D1%80%D0%B5%D0%B1%D0%BE%D0%B2%D0%B0%D0%BD%D0%B8%D1%8F-%D0%B2-%D0%B4%D0%B5%D0%BB%D0%B5-%D0%BE-%D0%B1%D0%B0%D0%BD%D0%BA%D1%80%D0%BE%D1%82%D1%81%D1%82%D0%B2%D0%B5

Je suis accro a MrPlay Casino, ca vibre avec une energie de casino digne d’une fete endiablee. Les options de jeu au casino sont variees et festives, incluant des jeux de table de casino d’une elegance festive. Le support du casino est disponible 24/7, avec une aide qui fait swinguer. Les paiements du casino sont securises et fluides, parfois plus de tours gratuits au casino ce serait enivrant. Au final, MrPlay Casino est un casino en ligne qui met la fete dans les jeux pour ceux qui cherchent l’adrenaline festive du casino ! A noter la plateforme du casino brille par son style endiable, facilite une experience de casino festive.

mr.play promo coce|

Estou completamente alucinado por ParamigoBet Casino, da uma energia de cassino que e um redemoinho. A gama do cassino e simplesmente uma ventania, com jogos de cassino perfeitos pra criptomoedas. O suporte do cassino ta sempre na ativa 24/7, respondendo mais rapido que um trovao. As transacoes do cassino sao simples como uma brisa, de vez em quando queria mais promocoes de cassino que arrasam. No fim das contas, ParamigoBet Casino e o point perfeito pros fas de cassino para os amantes de cassinos online! De lambuja a plataforma do cassino detona com um visual que e puro trovao, torna o cassino uma curticao total.

paramigobet mobiili|

Je trouve absolument envoutant Posido Casino, ca vibre avec une energie de casino aquatique. La selection du casino est une vague de plaisirs, offrant des sessions de casino en direct qui eclaboussent. Le service client du casino est une perle rare, offrant des solutions claires et instantanees. Le processus du casino est transparent et sans remous, parfois j’aimerais plus de promotions de casino qui eclaboussent. Pour resumer, Posido Casino c’est un casino a explorer sans tarder pour les amoureux des slots modernes de casino ! En plus le design du casino est un spectacle visuel aquatique, ce qui rend chaque session de casino encore plus fluide.

casino posido avis|

Риски инвестиций в криптовалюту Анализ криптовалютного рынка: научитесь анализировать криптовалютный рынок и принимать обоснованные инвестиционные решения. Мы расскажем вам, как читать графики, понимать рыночные тренды и оценивать потенциал криптовалют.

Онлайн-казино Вавада собирает тысячи игроков.

Акции и промокоды создают комфортные условия для новичков.

Турниры и события поддерживают интерес к игре.

Выбор слотов и настольных игр обновляется провайдерами.

Начать игру можно за пару минут, и промокоды активируются моментально.

Подробности смотрите по ссылке: вавада промокод 2025

Je trouve absolument captivant MrXBet Casino, il propose une aventure de casino qui serpente comme un labyrinthe. Le repertoire du casino est un dedale de divertissement, offrant des sessions de casino en direct qui envoutent. L’assistance du casino est fiable et perspicace, repondant en un eclair mysterieux. Les retraits au casino sont rapides comme une cle trouvee, parfois des bonus de casino plus frequents seraient captivants. Dans l’ensemble, MrXBet Casino offre une experience de casino mysterieuse pour les passionnes de casinos en ligne ! De surcroit la navigation du casino est intuitive comme une enigme resolue, ajoute une touche de suspense au casino.

mrxbet validation compte|

скидки на туры в кипр Ищете спонтанное приключение? Наши горящие туры предлагают невероятные возможности отправиться в отпуск вашей мечты по удивительно выгодным ценам. Не упустите шанс испытать незабываемые эмоции и сэкономить при этом! Поспешите, ведь количество предложений ограничено!

Ich bin suchtig nach NV Casino, es bietet ein Casino-Abenteuer, das wie ein Vulkan ausbricht. Die Auswahl im Casino ist ein echtes Naturwunder, mit modernen Casino-Slots, die einen in ihren Bann ziehen. Das Casino-Team bietet Unterstutzung, die wie ein Meteor leuchtet, mit Hilfe, die wie ein Funke spruht. Der Casino-Prozess ist klar und ohne Turbulenzen, trotzdem wurde ich mir mehr Casino-Promos wunschen, die wie ein Vulkan ausbrechen. Insgesamt ist NV Casino ein Online-Casino, das wie ein Sturm begeistert fur Fans moderner Casino-Slots! Zusatzlich das Casino-Design ist ein optisches Spektakel, das Casino-Erlebnis total elektrisiert.

m casino resort las vegas nv|

Ich bin vollig begeistert von Richard Casino, es ist ein Online-Casino, das wie ein koniglicher Palast strahlt. Der Katalog des Casinos ist eine Schatzkammer voller Vergnugen, mit Casino-Spielen, die fur Kryptowahrungen optimiert sind. Der Casino-Kundenservice ist wie ein koniglicher Hofstaat, antwortet blitzschnell wie ein koniglicher Erlass. Casino-Gewinne kommen wie ein Triumphzug, dennoch wurde ich mir mehr Casino-Promos wunschen, die wie Juwelen glanzen. Am Ende ist Richard Casino ein Online-Casino, das wie ein Palast strahlt fur die, die mit Stil im Casino wetten! Extra die Casino-Plattform hat einen Look, der wie ein Kronungsmantel glanzt, einen Hauch von Majestat ins Casino bringt.

richard heron casino bar|

Je suis accro a PlazaRoyal Casino, ca degage une ambiance de jeu digne d’une cour imperiale. Le repertoire du casino est une salle de bal ludique, comprenant des jeux de casino adaptes aux cryptomonnaies. Le personnel du casino offre un accompagnement digne d’une cour, joignable par chat ou email. Les transactions du casino sont simples comme un edit, mais des bonus de casino plus frequents seraient royaux. Pour resumer, PlazaRoyal Casino est un joyau pour les fans de casino pour les nobles du casino ! De surcroit la plateforme du casino brille par son style souverain, amplifie l’immersion totale dans le casino.

plaza royal casino app|

https://vc.ru/smm-promotion/ Мечтаете о тысячах просмотров под каждым фото в Instagram и признании вашей аудитории? Закажите просмотры Инстаграм и наблюдайте, как растет популярность вашего профиля! Увеличение охвата аудитории, повышение вовлеченности и продвижение вашего бренда. Сделайте свой профиль заметным!

https://dtf.ru/id3026460/4006942-pochemu-odni-produkty-prinosyat-milliony-a-drugie-terpyat-ubytki-sekret-uspeshnoi-segmentacii-celevoi-auditorii

https://sochi.vet/ Ветклиники Сочи: Выберите лучшую клинику для вашего любимца! Сравнение цен, услуг и отзывов о ветеринарных клиниках в Сочи, чтобы вы могли сделать правильный выбор.

ПВХ окна для веранд Мягкие окна для террас: идеальное решение для тех, кто хочет наслаждаться свежим воздухом и красивыми видами, не беспокоясь о погодных условиях. Создайте уютное пространство для отдыха и общения с близкими.

игровые автоматы 777 Игровые автоматы онлайн: азарт в вашем кармане Игровые автоматы онлайн – это удобный и доступный способ насладиться азартными играми, не выходя из дома. Благодаря развитию технологий, вы можете играть в любимые слоты на своем компьютере, планшете или смартфоне в любое время и в любом месте. Онлайн-казино предлагают огромный выбор игровых автоматов от ведущих разработчиков, включая классические слоты, видеослоты, 3D-слоты и слоты с прогрессивными джекпотами. Вы можете выбирать игру по своим предпочтениям, тематике, графике и функциям. Игра в онлайн-казино имеет свои преимущества, такие как бонусы и акции, которые могут увеличить ваши шансы на выигрыш. Однако, важно выбирать надежные и лицензированные онлайн-казино, чтобы обеспечить безопасность своих средств и данных.

https://t.me/perevedem_document Перевод Документов: Мост между Языками и Культурами В современном мире глобализации, где границы стираются, а сотрудничество между странами и культурами становится все более тесным, перевод документов приобретает огромное значение. Это не просто замена слов одного языка словами другого, а кропотливая работа по передаче смысла, контекста и нюансов оригинала, чтобы обеспечить полное и точное понимание информации. Когда необходим перевод документов? Международный бизнес: контракты, договоры, финансовые отчеты, маркетинговые материалы – все это требует качественного перевода для успешного ведения дел за рубежом. Юридические вопросы: судебные документы, свидетельства, доверенности, нотариальные акты должны быть переведены с соблюдением строгих юридических норм и терминологии. Медицинская сфера: медицинские заключения, инструкции к лекарствам, результаты исследований – точность перевода здесь критически важна для здоровья пациентов. Техническая документация: инструкции по эксплуатации, технические спецификации, чертежи – перевод должен быть понятным и однозначным для специалистов. Образование и наука: дипломы, аттестаты, научные статьи, исследования – для признания образования за рубежом и обмена знаниями необходим качественный перевод. Почему важно обращаться к профессионалам? Точность и соответствие: профессиональные переводчики обладают глубокими знаниями языка и предметной области, что гарантирует точность и соответствие перевода оригиналу. Соблюдение терминологии: использование правильной терминологии – залог того, что перевод будет понятен специалистам в соответствующей области. Культурная адаптация: профессиональный переводчик адаптирует текст с учетом культурных особенностей целевой аудитории, чтобы избежать недопонимания или неловких ситуаций. Конфиденциальность: профессиональные бюро переводов гарантируют конфиденциальность ваших документов. Как выбрать бюро переводов? Опыт и репутация: изучите опыт работы бюро, ознакомьтесь с отзывами клиентов. Специализация: убедитесь, что бюро специализируется на переводах в нужной вам области. Наличие профессиональных переводчиков: узнайте, работают ли в бюро переводчики с соответствующим образованием и опытом. Стоимость и сроки: сравните цены и сроки выполнения заказа в разных бюро. В заключение, перевод документов – это важный инструмент для преодоления языковых барьеров и успешного взаимодействия в современном мире. Доверяйте перевод ваших документов профессионалам, чтобы быть уверенными в качестве и точности результата. Если вам нужно перевести конкретный документ, просто предоставьте его мне, и я постараюсь вам помочь!

Je suis accro a Spinsy Casino, il propose une aventure de casino qui tourbillonne comme un spot lumineux. L’assortiment de jeux du casino est une choregraphie de plaisirs, offrant des sessions de casino en direct qui pulsent comme un beat. Le support du casino est disponible 24/7, repondant en un eclair rythmique. Le processus du casino est transparent et sans fausse note, mais des bonus de casino plus frequents seraient groovy. Dans l’ensemble, Spinsy Casino c’est un casino a rejoindre sans tarder pour les danseurs du casino ! En plus le design du casino est un spectacle visuel disco, ce qui rend chaque session de casino encore plus dansante.

spinsy casino italia|

Ich finde absolut elektrisierend SlotClub Casino, es ist ein Online-Casino, das wie ein Neonlicht explodiert. Die Casino-Optionen sind bunt und mitrei?end, mit Casino-Spielen, die fur Kryptowahrungen optimiert sind. Der Casino-Support ist rund um die Uhr verfugbar, ist per Chat oder E-Mail erreichbar. Casino-Transaktionen sind simpel wie ein Schalter, aber die Casino-Angebote konnten gro?zugiger sein. Alles in allem ist SlotClub Casino ein Muss fur Casino-Fans fur die, die mit Stil im Casino wetten! Nebenbei die Casino-Oberflache ist flussig und glitzert wie ein Neonlicht, einen Hauch von Neon-Magie ins Casino bringt.

slotclub bonus|

Sou viciado no glamour de Richville Casino, da uma energia de cassino tao luxuosa quanto um trono. O catalogo de jogos do cassino e um tesouro reluzente, com jogos de cassino perfeitos para criptomoedas. A equipe do cassino oferece um atendimento digno de realeza, respondendo rapido como um brinde de champanhe. As transacoes do cassino sao simples como abrir um cofre, mesmo assim mais giros gratis no cassino seria opulento. No fim das contas, Richville Casino oferece uma experiencia de cassino majestosa para os nobres do cassino! De lambuja a interface do cassino e fluida e brilha como um salao de baile, adiciona um toque de sofisticacao ao cassino.

ny|

таможенный брокер Для юридических лиц, занимающихся внешнеэкономической деятельностью, мы предлагаем комплексные решения по таможенному оформлению. Мы поможем вам оптимизировать таможенные платежи, избежать штрафов и санкций, а также обеспечим соответствие требованиям таможенного законодательства. С нами ваш бизнес будет защищен!

https://impossible-studio.ghost.io/kak-vybrat-luchshii-vpn-siervis-podrobnoie-rukovodstvo/ Новый лонгрид про Youtuber VPN! Узнайте, как смотреть YouTube и другие платформы без лагов и блокировок. Подключайте до 5 устройств на одной подписке, тестируйте сервис бесплатно 3 дня и платите всего 290? в первый месяц вместо 2000? у конкурентов. Серверы в Европе — ваши данные защищены от российских властей.

Фигурная стрижка кустов Ландшафтное проектирование: Ландшафтное проектирование – это процесс разработки проекта благоустройства территории с учетом ее особенностей, пожеланий заказчика и существующих норм и правил. Ландшафтный проект включает в себя планы озеленения, мощения, освещения, размещения малых архитектурных форм и других элементов благоустройства. Ландшафтное проектирование позволяет создать гармоничное и функциональное пространство, отвечающее потребностям заказчика и улучшающее экологическую обстановку.

печатьфото Портрет по фотографии Портрет по фотографии – это услуга, позволяющая заказать создание портрета человека на основе его фотографии. Вместо позирования художнику с натуры, используется фотография в качестве референса для создания живописного, графического или цифрового портрета. Портреты могут быть выполнены в различных стилях и техниках, от реалистичных до стилизованных и абстрактных, в зависимости от пожеланий заказчика. Этот вид искусства позволяет запечатлеть важные моменты в жизни человека, создать памятный подарок или просто украсить интерьер оригинальным произведением искусства. Портреты по фотографии популярны, когда нет возможности позировать художнику лично, например, при создании портрета по старой или единственной фотографии.

Estou completamente enfeiticado por SpinWiz Casino, e um cassino online que brilha como um caldeirao de pocoes. A selecao de titulos do cassino e um feitico de emocoes, oferecendo sessoes de cassino ao vivo que brilham como pocoes. O servico do cassino e confiavel e encantador, garantindo suporte de cassino direto e sem truques. Os ganhos do cassino chegam voando como uma vassoura magica, porem mais recompensas no cassino seriam um diferencial encantado. No geral, SpinWiz Casino e o point perfeito pros fas de cassino para os viciados em emocoes de cassino! De lambuja o site do cassino e uma obra-prima de estilo mistico, eleva a imersao no cassino a um nivel magico.

spinwiz reclame aqui|

взять микрозайм онлайн Микрозаймы онлайн на карту проверки мгновенно – идеальный вариант для тех, кто не хочет ждать. Я получил деньги сразу!

A limousine service offers luxurious, chauffeur-driven [url=https://seattlevancouvertransfer.com/transportation-tips/] Transportation Tips [/url] for special occasions, corporate events, or airport transfers. Known for comfort, style, and professionalism, these services provide high-end vehicles like sedans, SUVs, or stretch limos, ensuring a premium travel experience.

Key benefits include punctuality, privacy, and top-tier amenities such as leather seating, climate control, and entertainment systems. Ideal for weddings, proms, or business meetings, limo services prioritize safety with licensed drivers and well-maintained fleets.

For seamless Transportation Tips, book in advance, especially during peak seasons. Compare providers based on fleet quality, pricing, and customer reviews. Confirm details like pickup time, route, and any special requests to avoid last-minute issues.

Corporate clients often use limo services for executive travel, impressing clients with professionalism. Airport transfers ensure stress-free arrivals and departures with meet-and-greet services.

Whether for leisure or business, limousine services elevate your Transportation Tips with elegance and reliability. Always verify insurance and licensing for peace of mind. Enjoy a hassle-free ride with a trusted provider. – https://seattlevancouvertransfer.com/transportation-tips/

Sou louco pela aura de SpellWin Casino, da uma energia de cassino que e pura magia. O catalogo de jogos do cassino e um bau de encantos, oferecendo sessoes de cassino ao vivo que brilham como runas. O suporte do cassino ta sempre na ativa 24/7, respondendo mais rapido que um estalo magico. Os saques no cassino sao velozes como um feitico de teletransporte, mesmo assim mais bonus regulares no cassino seria brabo. No geral, SpellWin Casino e um cassino online que e um portal de diversao para os apaixonados por slots modernos de cassino! De lambuja a plataforma do cassino reluz com um visual que e puro feitico, o que torna cada sessao de cassino ainda mais encantadora.

george spellwin|

Ich bin vollig begeistert von SportingBet Casino, es fuhlt sich an wie ein Volltreffer im Spielrausch. Die Auswahl im Casino ist ein echter Torerfolg, inklusive stilvoller Casino-Tischspiele. Das Casino-Team bietet Unterstutzung, die wie ein Volltreffer glanzt, ist per Chat oder E-Mail erreichbar. Auszahlungen im Casino sind schnell wie ein Sprinter, manchmal mehr Casino-Belohnungen waren ein echter Gewinn. Insgesamt ist SportingBet Casino ein Muss fur Casino-Fans fur Fans moderner Casino-Slots! Und au?erdem die Casino-Plattform hat einen Look, der wie ein Torjubel strahlt, einen Hauch von Stadion-Magie ins Casino bringt.

sportingbet aplicatie|

Adoro o frenesi de AFun Casino, parece uma rave de diversao sem fim. Tem uma enxurrada de jogos de cassino irados, com slots de cassino tematicos de festa. O atendimento ao cliente do cassino e uma estrela da festa, acessivel por chat ou e-mail. Os ganhos do cassino chegam voando como serpentinas, as vezes mais bonus regulares no cassino seria brabo. No geral, AFun Casino oferece uma experiencia de cassino que e puro carnaval para os viciados em emocoes de cassino! Vale dizer tambem a navegacao do cassino e facil como uma coreografia, faz voce querer voltar ao cassino como num desfile sem fim.

afun 13b|

Adoro o brilho de BetorSpin Casino, oferece uma aventura de cassino que orbita como um cometa reluzente. A gama do cassino e simplesmente uma constelacao de prazeres, incluindo jogos de mesa de cassino com um toque intergalactico. O servico do cassino e confiavel e brilha como uma galaxia, garantindo suporte de cassino direto e sem buracos negros. Os ganhos do cassino chegam voando como um asteroide, de vez em quando queria mais promocoes de cassino que explodem como supernovas. Na real, BetorSpin Casino vale demais explorar esse cassino para os viciados em emocoes de cassino! E mais o design do cassino e um espetaculo visual intergalactico, torna a experiencia de cassino uma viagem espacial.

betorspin e confiГЎvel|

Sou louco pela energia de BRCasino, tem uma vibe de jogo tao vibrante quanto uma escola de samba na avenida. Tem uma enxurrada de jogos de cassino irados, com jogos de cassino perfeitos pra criptomoedas. O atendimento ao cliente do cassino e uma bateria de responsa, respondendo mais rapido que um batuque de tamborim. O processo do cassino e limpo e sem tropecos, de vez em quando mais bonus regulares no cassino seria brabo. No fim das contas, BRCasino oferece uma experiencia de cassino que e puro batuque para os folioes do cassino! Vale dizer tambem a interface do cassino e fluida e reluz como uma fantasia de carnaval, adiciona um toque de folia ao cassino.

br77 brazilian steakhouse|

Estou pirando com AFun Casino, parece uma rave de diversao sem fim. Tem uma enxurrada de jogos de cassino irados, com caca-niqueis de cassino modernos e contagiantes. Os agentes do cassino sao rapidos como um malabarista, acessivel por chat ou e-mail. O processo do cassino e limpo e sem tumulto, porem mais bonus regulares no cassino seria brabo. Em resumo, AFun Casino oferece uma experiencia de cassino que e puro carnaval para os folioes do cassino! Alem disso a plataforma do cassino brilha com um visual que e puro axe, faz voce querer voltar ao cassino como num desfile sem fim.

afun games e confiГЎvel|

Sou louco pela energia de BetorSpin Casino, oferece uma aventura de cassino que orbita como um cometa reluzente. O catalogo de jogos do cassino e uma nebulosa de emocoes, incluindo jogos de mesa de cassino com um toque intergalactico. O suporte do cassino ta sempre na ativa 24/7, garantindo suporte de cassino direto e sem buracos negros. Os ganhos do cassino chegam voando como um asteroide, mas queria mais promocoes de cassino que explodem como supernovas. No fim das contas, BetorSpin Casino e um cassino online que e uma galaxia de diversao para quem curte apostar com estilo estelar no cassino! Vale dizer tambem o site do cassino e uma obra-prima de estilo estelar, faz voce querer voltar ao cassino como um cometa em orbita.

bГіnus betorspin|

Adoro o balanco de BRCasino, da uma energia de cassino que e pura purpurina. Tem uma enxurrada de jogos de cassino irados, com jogos de cassino perfeitos pra criptomoedas. O suporte do cassino ta sempre na ativa 24/7, acessivel por chat ou e-mail. Os ganhos do cassino chegam voando como confetes, de vez em quando as ofertas do cassino podiam ser mais generosas. Resumindo, BRCasino vale demais sambar nesse cassino para os folioes do cassino! De bonus a navegacao do cassino e facil como um passo de samba, eleva a imersao no cassino ao ritmo de um tamborim.

br77.com|

Je suis fou de VBet Casino, on dirait une eruption de plaisirs incandescents. Le repertoire du casino est un magma de divertissement, proposant des slots de casino a theme volcanique. Le personnel du casino offre un accompagnement digne d’un volcan, repondant en un eclair brulant. Les retraits au casino sont rapides comme une coulee de lave, mais les offres du casino pourraient etre plus genereuses. Dans l’ensemble, VBet Casino est une pepite pour les fans de casino pour les volcanologues du casino ! Par ailleurs le site du casino est une merveille graphique ardente, facilite une experience de casino eruptive.

vbet україна скачать|

Sou louco pela energia de BacanaPlay Casino, parece uma festa carioca cheia de axe. As opcoes de jogo no cassino sao ricas e cheias de gingado, com caca-niqueis de cassino modernos e contagiantes. O atendimento ao cliente do cassino e uma rainha de bateria, dando solucoes na hora e com precisao. Os saques no cassino sao velozes como um carro alegorico, as vezes mais giros gratis no cassino seria uma loucura. Na real, BacanaPlay Casino oferece uma experiencia de cassino que e puro axe para os apaixonados por slots modernos de cassino! De bonus o site do cassino e uma obra-prima de estilo carioca, faz voce querer voltar ao cassino como num desfile sem fim.

codigo bonus bacanaplay|

Je suis accro a ViggoSlots Casino, ca degage une ambiance de jeu aussi vivifiante qu’un vent polaire. Le repertoire du casino est un iceberg de divertissement, avec des machines a sous de casino modernes et glacees. Les agents du casino sont rapides comme un vent de toundra, joignable par chat ou email. Les retraits au casino sont rapides comme une avalanche, cependant j’aimerais plus de promotions de casino qui eblouissent comme l’aurore. Globalement, ViggoSlots Casino est un casino en ligne qui brille comme une banquise pour les explorateurs polaires du casino ! Bonus le site du casino est une merveille graphique polaire, amplifie l’immersion totale dans le casino.

viggoslots offres|

Adoro o swing de BacanaPlay Casino, parece uma festa carioca cheia de axe. O catalogo de jogos do cassino e um bloco de rua vibrante, oferecendo sessoes de cassino ao vivo que sambam com energia. Os agentes do cassino sao rapidos como um passista na avenida, com uma ajuda que brilha como serpentinas. Os ganhos do cassino chegam voando como confetes, de vez em quando mais bonus regulares no cassino seria brabo. Resumindo, BacanaPlay Casino vale demais sambar nesse cassino para os folioes do cassino! De bonus o site do cassino e uma obra-prima de estilo carioca, eleva a imersao no cassino ao ritmo de um tamborim.

bacanaplay apk|

Ich bin suchtig nach Tipico Casino, es verstromt eine Spielstimmung, die wie ein Blitz einschlagt. Die Casino-Optionen sind vielfaltig und elektrisierend, mit einzigartigen Casino-Slotmaschinen. Der Casino-Kundenservice ist wie ein Leuchtfeuer im Sturm, antwortet blitzschnell wie ein Gewitterknall. Casino-Gewinne kommen wie ein Sturm, aber mehr Freispiele im Casino waren ein Donnerschlag. Insgesamt ist Tipico Casino eine Casino-Erfahrung, die wie ein Blitz glitzert fur Fans von Online-Casinos! Extra die Casino-Plattform hat einen Look, der wie ein Blitz funkelt, was jede Casino-Session noch aufregender macht.

tipico online|

Ich liebe den Adrenalinkick von Turbonino Casino, es fuhlt sich an wie ein Hochgeschwindigkeitsrennen. Es gibt eine Flut an mitrei?enden Casino-Titeln, mit modernen Casino-Slots, die einen mitrei?en. Die Casino-Mitarbeiter sind schnell wie ein Boxenstopp, liefert klare und schnelle Losungen. Auszahlungen im Casino sind schnell wie ein Rennwagen, manchmal mehr regelma?ige Casino-Boni waren ein Volltreffer. Am Ende ist Turbonino Casino ein Casino mit einem Spielspa?, der wie ein Zielsprint begeistert fur Fans von Online-Casinos! Ubrigens die Casino-Oberflache ist flussig und glanzt wie ein Rennwagen, das Casino-Erlebnis total turboladt.

turbonino app|