The key to understanding FX moves is to have a firm grasp of monetary policy as communicated by central banks. The EURGBP is at the time of writing being pressured lower by GBP strength. The GBP Is strengthening on rising inflation pressures revealed in this week’s data, but whether it can continue remains to be seen. Eventually, the GBP may well find it is sold off on stagflation fears rather than bought on expectations of higher rates from the BoE. Here is the narrative explained below:

Stretched GBP longs

The GBP is showing very stretched positioning to the long side on the COT report. Why has the GBP been bought so strongly? Partly it was due to the GBP being heavily sold on Brexit fears, but mainly due to the rising inflation pressures resulting in higher interest rates from the UK.

So, the first thing to note is that GBP longs are at an extreme. The significance of this is that GBP buying has been ongoing and is now vulnerable to a correction on GBP negative news

The GBP’s driver

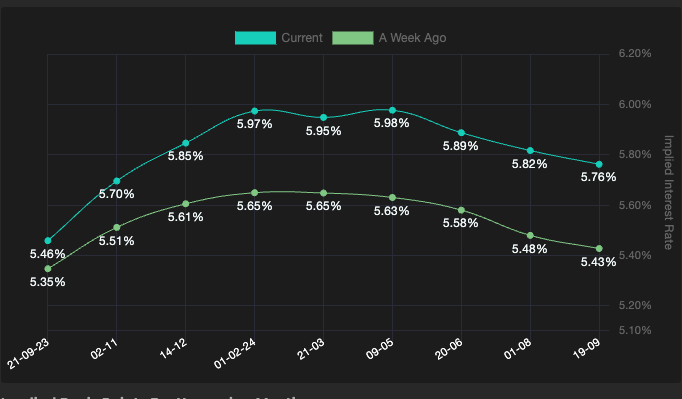

High inflation in the UK has been leading to higher interest rate expectations from the Bank of England which has continued this last week. On Tuesday this week UK Average earnings rose above maximum expectations to 7.8% vs 7.5% y/y prior. Average earnings in the UK are now outpacing inflation. Remember, that strong labour data is inflationary and these strong wage prints are an inflationary force. Then on Wednesday we had the UK inflation print. The core reading was 6.9% y/y above 6.8% expected and the headline was in line with expectations at 6.8%. Still three times above the Bank of England’s target.

These inflationary prints have kept the GBP bought against EUR and have increased expectations for a terminal rate of 6% for the Bank of England

Can EURGBP falls continue?

The risk for the EURGBP is that there is a sharp snap higher. The most likely catalyst for that could be either of, or a combination of the following two options. Firstly, deflationary pressures emerge in the UK. So, if the labour market weakens, or growth rapidly slows then the Bank of England will be less likely to hike rates and will moderate their pace. Secondly, an improving outlook for Europe and/or more inflationary pressures that will put more pressure on the ECB to hike rates could also lift the EURGBP. At the time of writing the EURGBP is sat around the 100EMA on the weekly chart. If that breaks lower there is heavy support for the air in the 0.8400/0.83000 region marked below.

платформа для покупки аккаунтов https://birzha-akkauntov-online.ru/

заработок на аккаунтах площадка для продажи аккаунтов

продать аккаунт биржа аккаунтов

магазин аккаунтов магазин аккаунтов

маркетплейс аккаунтов магазин аккаунтов

покупка аккаунтов магазин аккаунтов социальных сетей

магазин аккаунтов https://pokupka-akkauntov-online.ru

Database of Accounts for Sale Buy and Sell Accounts

Account Buying Platform Account Selling Service

Account marketplace Secure Account Sales

Buy accounts Account trading platform

Accounts for Sale Accounts market

Account Market Social media account marketplace

Account Trading Platform Account Acquisition

Sell Account Website for Buying Accounts

Account trading platform Website for Selling Accounts

Buy Pre-made Account Secure Account Sales

Buy Pre-made Account Sell Account

account store sell pre-made account

account store verified accounts for sale

gaming account marketplace account trading platform

accounts for sale buyaccountsdiscount.com

account exchange accounts market

account exchange find accounts for sale

account trading buy account

account acquisition account trading

website for buying accounts account trading

accounts for sale account selling service

account selling service ready-made accounts for sale

account selling service gaming account marketplace

account market accounts-buy.org

sell pre-made account find accounts for sale

accounts for sale online account store

accounts for sale accounts marketplace

account trading service buy pre-made account

account sale website for buying accounts

account purchase account store

buy accounts sell pre-made account

account trading platform sell pre-made account

account market account buying service

ready-made accounts for sale guaranteed accounts

online account store account market

accounts market account trading

social media account marketplace https://accounts-buy-now.org/

account acquisition account buying platform

account sale https://accounts-offer.org/

profitable account sales https://accounts-marketplace.xyz

account exchange service https://buy-best-accounts.org

account exchange service https://social-accounts-marketplaces.live

buy account account market

secure account sales https://social-accounts-marketplace.xyz

sell accounts https://buy-accounts.space

accounts market accounts marketplace

ready-made accounts for sale https://accounts-marketplace.art/

account market https://social-accounts-marketplace.live

account buying service buy-accounts.live

account trading platform https://accounts-marketplace.online

account market https://accounts-marketplace-best.pro

продажа аккаунтов https://akkaunty-na-prodazhu.pro/

маркетплейс аккаунтов rynok-akkauntov.top

маркетплейс аккаунтов https://kupit-akkaunt.xyz

покупка аккаунтов akkaunt-magazin.online

маркетплейс аккаунтов https://akkaunty-market.live

биржа аккаунтов kupit-akkaunty-market.xyz

биржа аккаунтов маркетплейсов аккаунтов

продажа аккаунтов купить аккаунт

маркетплейс аккаунтов https://akkaunty-dlya-prodazhi.pro

buy aged facebook ads account facebook account buy

facebook ad account for sale https://buy-ad-accounts.click/

buy old facebook account for ads buy facebook accounts

facebook accounts to buy https://buy-ads-account.click

buy facebook account facebook ad account for sale

buy facebook ads accounts fb account for sale

cheap facebook account ad-account-for-sale.top

buying facebook ad account buy facebook account

buying facebook ad account https://ad-accounts-for-sale.work

buy verified google ads accounts https://buy-ads-account.top/

buy google ads buy google adwords accounts

buy facebook ads manager cheap facebook account

google ads reseller google ads account seller

google ads agency account buy buy adwords account

google ads accounts for sale old google ads account for sale

google ads agency account buy https://buy-account-ads.work

buy verified google ads accounts https://buy-ads-agency-account.top

old google ads account for sale https://sell-ads-account.click

buy facebook business manager https://buy-business-manager.org/

buy google ads threshold account https://buy-verified-ads-account.work

google ads accounts https://ads-agency-account-buy.click

buy verified bm facebook https://buy-business-manager-acc.org/

buy verified business manager facebook https://buy-bm-account.org/

business manager for sale https://buy-verified-business-manager-account.org/

buy facebook business manager verified https://buy-verified-business-manager.org/

facebook bm for sale facebook business manager buy

buy facebook business manager accounts https://buy-business-manager-verified.org/

facebook business manager account buy https://buy-bm.org/

buy verified facebook https://verified-business-manager-for-sale.org

facebook bm account buy buy-business-manager-accounts.org

tiktok ad accounts https://buy-tiktok-ads-account.org

buy tiktok business account https://tiktok-ads-account-buy.org

buy tiktok ads https://tiktok-ads-account-for-sale.org

buy tiktok ad account https://tiktok-agency-account-for-sale.org

buy tiktok business account https://buy-tiktok-ad-account.org

tiktok ads account for sale https://buy-tiktok-business-account.org

tiktok ad accounts https://buy-tiktok-ads.org

buy tiktok ads accounts https://tiktok-ads-agency-account.org

https://kampascher.com/# acheter kamagra site fiable

viagra generique en pharmacie sans ordonnance: Pharmacie Express – medoc sur ordonnance

générique amoxicilline sans ordonnance: ordonnance aide à domicile – medicament avec ordonnance

inegy 10/20 prezzo: lasix costo – deltavagin ovuli

produit pour faire bander en pharmacie sans ordonnance: sterimar isotonique Рibuprof̬ne pharmacie sans ordonnance

difosfonal 200 mutuabile: tachidol 1000 – dibase vitamina d prezzo

voltaren inyectable se puede comprar sin receta: farmacia cardenes altavista online – curso online farmacia gratis

arnica montana 7 ch: Pharmacie Express – soigner conjonctivite sans ordonnance

http://pharmacieexpress.com/# cicaplast levres la roche posay

norvasc 5 mg prezzo: deursil 300 prezzo – siler 50 mg

prix viagra: acheter medicament sans ordonnance – prix cialis 5mg

donde puedo comprar losartГЎn sin receta [url=https://confiapharma.com/#]farmacia order cialis professional online[/url] comprar rhodogil sin receta

l’ozempic sans ordonnance: viagra generique achat – pilules sans ordonnance

terbinafina se puede comprar sin receta: donde puedo comprar cytotec sin receta – comprar ibuprofeno en portugal sin receta

sildenafil 100 mg: Pharmacie Express – achat pilule sans ordonnance pharmacie

meglio compresse o bustine [url=https://farmaciasubito.shop/#]Farmacia Subito[/url] cerotti antidolorifici migliori

alcion farmaco: Farmacia Subito – totalip 20 prezzo

mГ©dicament paludisme prix: creme depilatoire pharmacie – seringue sans aiguille pharmacie sans ordonnance

http://farmaciasubito.com/# becotide spray nasale

comprar antibiotico sin receta [url=https://confiapharma.com/#]se puede comprar sildenafil sin receta en argentina[/url] permetrina se puede comprar sin receta

zithromax 250 sans ordonnance en pharmacie: dГ©maquillant caudalie – spedra 200 mg boГ®te de 12 prix

se puede comprar citalopram sin receta: farmacia indiana comprar online – clovate crema se puede comprar sin receta

wellbutrin prezzo [url=http://farmaciasubito.com/#]cialis 20 mg prezzo[/url] celebrex 200 prezzo

donde comprar levitra sin receta en barcelona: farmacia online medias compresion – suniderma crema comprar sin receta

soldesam punture: bupropione prezzo – tadalafil 5 mg 28 compresse prezzo

bentelan gatto [url=https://farmaciasubito.shop/#]Farmacia Subito[/url] oki costo

http://pharmacieexpress.com/# pilule contraceptive chat pharmacie sans ordonnance

tadalafil teva 20 mg 8 compresse prezzo: Farmacia Subito – pentacol gel rettale

plenvu prezzo: siti farmacia affidabili – samyr 400 fiale intramuscolo

megavir recensioni [url=http://farmaciasubito.com/#]zindaclin gel prezzo[/url] monurelle plus ГЁ un antibiotico

peut-on acheter des somnifГЁre sans ordonnance en pharmacie: medicament pour cystite sans ordonnance en pharmacie – attelle cheville pharmacie sans ordonnance

donde puedo comprar trankimazin sin receta: eu farmacia online – farmacia online forum

farmacia mallol sunyer online [url=https://confiapharma.com/#]farmacia peru online[/url] loniten 10 mg farmacia online

pharmacy tijuana: mexican pharmacy cytomel – pharmacy mexico

https://pharmexpress24.com/# domperidone uk pharmacy

best pharmacy franchise in india [url=http://inpharm24.com/#]buy medicine online[/url] first online pharmacy in india

medicine online purchase: best online indian pharmacy – medicine online shopping

valtrex pharmacy coupon: Pharm Express 24 – cialis uk online pharmacy

generic cialis india pharmacy [url=https://inpharm24.com/#]InPharm24[/url] top online pharmacy india

no rx online pharmacy: Pharm Express 24 – marketplace oak harbor wa pharmacy store number

https://pharmmex.shop/# ozempic medication in mexico

pharmacy in india: drugs from india – best online indian pharmacy

pharmacy lexapro vs celexa [url=https://pharmexpress24.shop/#]super rx pharmacy[/url] nizoral shampoo uk pharmacy

legitimate mexican pharmacy online: cheap prescriptions online – mexican drug pharmacy

cialis pharmacy uk [url=http://pharmexpress24.com/#]cialis online pharmacy[/url] mutual of omaha rx pharmacy directory

mexican pharmacy percocet: Pharm Mex – mexican online stores

http://inpharm24.com/# medplus pharmacy india

mexican medication [url=https://pharmmex.com/#]Pharm Mex[/url] xanax at mexican pharmacy

top online pharmacy in india: pharmacy course india – pharmacy online india

doctor of pharmacy india: pharmacy names in india – prescriptions from india

http://pharmmex.com/# what drugs can you buy in mexico

finpecia uk pharmacy [url=https://pharmexpress24.com/#]Pharm Express 24[/url] mail order pharmacy concerta

mounjaro in mexican pharmacy: tramadol mexico – п»їmexican pharmacy

top mail order pharmacies: Pharm Mex – meds mexico

mounjaro mexico pharmacy [url=https://pharmmex.shop/#]what to buy at a mexican pharmacy[/url] best online drugstore

online mexico pharmacy: mexi pharmacy – what to buy at mexican pharmacy

adderall shipped to me: Pharm Mex – codeine mexico

when first pharmacy course was started in india [url=http://inpharm24.com/#]divya pharmacy india[/url] pharmacy in india online

http://pharmmex.com/# codeine in mexico

sudafed in mexico: mexico pharmacy online ozempic – what are the best pharmacies in canada that ship to the us

mexican pharmacy albuterol: Pharm Mex – ozempic in mexico name

diet pills from mexico [url=https://pharmmex.com/#]Pharm Mex[/url] phentermine in mexico pharmacy

ozempic purchase in mexico: mexican pharmacy pill identifier – viagra mexican pharmacy

hydroxychloroquine mexican pharmacy: trazodone in mexico – pain killers online

kmart pharmacy store hours [url=https://pharmexpress24.com/#]Pharm Express 24[/url] Confido

imiquimod cream online pharmacy: Pharm Express 24 – propecia in malaysia pharmacy

https://pharmexpress24.com/# world pharmacy store discount number

priceline pharmacy viagra: dubai viagra pharmacy – celebrex online pharmacy

can i bring medication from mexico to us [url=https://pharmmex.com/#]Pharm Mex[/url] mexican export pharmacy review

indian online pharmacy: InPharm24 – drugs from india

how to get ozempic from mexico [url=https://pharmmex.com/#]drug pharmacy online[/url] can i buy ozempic in mexico

buy viagra online canada pharmacy: VGR Sources – sildenafil citrate online pharmacy

https://vgrsources.com/# pharmacy price comparison viagra

buy viagra brand online [url=https://vgrsources.com/#]viagra online sale in india[/url] cheap viagra india online

buy viagra from india: VGR Sources – buy viagra without a script

sildenafil 5mg price: VGR Sources – buy sildenafil generic

100mg viagra [url=https://vgrsources.com/#]VGR Sources[/url] sildenafil canada cost

best price for viagra 50mg: VGR Sources – where to get female viagra pills

canadian pharmacy viagra 150 mg: online us pharmacy viagra – viagra script

https://vgrsources.com/# buy viagra 100mg uk

viagra prescription medicine [url=https://vgrsources.com/#]sildenafil 5 mg tablet[/url] buy female viagra uk

viagra kaufen: VGR Sources – generic viagra sildenafil

viagra generic from india: generic viagra 20 mg – sildenafil without prescription from canada

buy viagra with paypal australia: female viagra in india online purchase – generic viagra from usa

viagra 2018 [url=https://vgrsources.com/#]buying sildenafil in mexico[/url] cheap viagra india

buying viagra without prescription: VGR Sources – where can i buy viagra over the counter in canada

https://vgrsources.com/# viagra otc us

lowest cost for viagra: generic viagra free shipping – female viagra nz

sildenafil order [url=https://vgrsources.com/#]VGR Sources[/url] sildenafil daily

viagra tablet online: VGR Sources – how much is generic viagra

viagra 50 mg tablet price: buy sildenafil 20 mg without prescription – best over the counter female viagra

where to buy sildenafil online with paypal [url=https://vgrsources.com/#]VGR Sources[/url] 20mg sildenafil

india viagra online: buy generic viagra online without prescription – viagra online prescription canada

https://vgrsources.com/# canadian viagra 200 mg

viagra pill cost canada: VGR Sources – pill viagra

sildenafil cheapest price [url=https://vgrsources.com/#]VGR Sources[/url] viagra 100mg generic

sildenafil prescription: sildenafil 50 mg tablet price in india – cheapest sildenafil 100 mg online

cheap canadian pharmacy viagra: VGR Sources – buy sildenafil over the counter

female viagra in india [url=https://vgrsources.com/#]generic female viagra 100mg[/url] viagra pharmacy coupon

where to get viagra without prescription: 50mg viagra – generic viagra 20 mg

https://vgrsources.com/# how to order viagra pills

sildenafil generic drug cost: VGR Sources – buy viagra new york

sildenafil uk [url=https://vgrsources.com/#]VGR Sources[/url] viagra brand online

viagra brand name: where can i buy female viagra – canada prescription viagra

online viagra best: how to take viagra – buy viagra online united states

sildenafil 20 mg tablets cost: VGR Sources – female viagra australia

buying viagra on line [url=https://vgrsources.com/#]VGR Sources[/url] buying viagra in europe

generic viagra from india: VGR Sources – Prix ​​du Viagra 50 mg

viagra 100mg tablet online: price for 100mg viagra – buy generic viagra canada

https://vgrsources.com/# can you buy viagra online in canada

cheap canadian viagra: 20 mg viagra daily – buying viagra in canada safely

viagra mexico price [url=https://vgrsources.com/#]VGR Sources[/url] sildenafil 20 mg sale

cheap viagra mexico: viagra for women online – cipla viagra

1 viagra: generic viagra soft pills – sildenafil 2 mg cost

generic viagra brands: VGR Sources – best female viagra over the counter

where can i get generic viagra online: VGR Sources – how to buy viagra in mexico

where to get viagra prescription [url=https://vgrsources.com/#]buy sildenafil us[/url] can i buy sildenafil online

cheap generic viagra from india: generic viagra pills for sale – viagra generic australia

pfizer viagra price: buy sildenafil no rx – viagra medicine online purchase

https://vgrsources.com/# sildenafil online uk

viagra pills online usa: viagra where to buy canada – cost of prescription viagra

how much is viagra cost [url=https://vgrsources.com/#]how to buy viagra without prescription[/url] viagra tablet buy online

viagra paypal australia: cheapest price for sildenafil 100 mg – viagra sales

sildenafil 20 mg pharmacy: sildenafil 50mg best price – order viagra without prescription

buy sildenafil pills online: VGR Sources – buy sildenafil uk

sildenafil online sale [url=https://vgrsources.com/#]VGR Sources[/url] cost for viagra

prednisone prescription for sale: Predni Pharm – prednisone brand name india

order prednisone online canada: generic prednisone pills – prednisone 20mg nz

http://crestorpharm.com/# CrestorPharm

prednisone 50 [url=https://prednipharm.shop/#]PredniPharm[/url] PredniPharm

Generic Lipitor fast delivery: simvastatin vs lipitor – LipiPharm

where can i buy prednisone: prednisone buy canada – prednisone over the counter south africa

Buy Lipitor without prescription USA: LipiPharm – LipiPharm

prednisone 54899 [url=https://prednipharm.shop/#]Predni Pharm[/url] 200 mg prednisone daily

PredniPharm: Predni Pharm – Predni Pharm

https://crestorpharm.shop/# Crestor Pharm

lipitor alzheimers: atorvastatin recall 2025 – lipitor rxlist

Predni Pharm: Predni Pharm – how to get prednisone tablets

buying prednisone from canada [url=https://prednipharm.shop/#]Predni Pharm[/url] how to get prednisone without a prescription

is compounded semaglutide safe: semaglutide reviews – Semaglu Pharm

Rybelsus 3mg 7mg 14mg: Semaglu Pharm – SemagluPharm

LipiPharm: what time of day should you take atorvastatin – Lipi Pharm

https://crestorpharm.shop/# Crestor Pharm

lipitor costs: Lipi Pharm – Lipi Pharm

SemagluPharm [url=https://semaglupharm.com/#]long term side effects of rybelsus[/url] SemagluPharm

dosage for semaglutide: SemagluPharm – is there a generic for rybelsus

prednisone 50 mg buy: Predni Pharm – PredniPharm

can you just stop taking atorvastatin [url=https://lipipharm.com/#]lipitor and alcohol[/url] atorvastatin side effects

Affordable Lipitor alternatives USA: Cheap Lipitor 10mg / 20mg / 40mg – Affordable Lipitor alternatives USA

https://lipipharm.com/# LipiPharm

Semaglu Pharm: rybelsus not working for weight loss – No prescription diabetes meds online

prednisone steroids [url=https://prednipharm.com/#]PredniPharm[/url] PredniPharm

Buy cholesterol medicine online cheap: statin rosuvastatin – Best price for Crestor online USA

SemagluPharm: SemagluPharm – No prescription diabetes meds online

Generic Crestor for high cholesterol: Affordable cholesterol-lowering pills – crestor and triglycerides

No RX Lipitor online [url=http://lipipharm.com/#]LipiPharm[/url] can you take atorvastatin and rosuvastatin together

crestor testosterone: CrestorPharm – Crestor home delivery USA

Cheap Lipitor 10mg / 20mg / 40mg: LipiPharm – can you take lipitor with paxlovid

SemagluPharm: semaglutide 5mg/ml dosage – SemagluPharm

https://prednipharm.shop/# PredniPharm

SemagluPharm [url=https://semaglupharm.com/#]how fast do you lose weight on semaglutide[/url] rybelsus with food

Order Rybelsus discreetly: Rybelsus online pharmacy reviews – semaglutide dose

prednisone in mexico: PredniPharm – apo prednisone

Predni Pharm: PredniPharm – buy prednisone online uk

PredniPharm [url=https://prednipharm.com/#]Predni Pharm[/url] can you buy prednisone online uk

LipiPharm: LipiPharm – Lipi Pharm

Semaglu Pharm: semaglutide weight loss dosage chart – п»їBuy Rybelsus online USA

https://crestorpharm.com/# CrestorPharm

Atorvastatin online pharmacy [url=https://lipipharm.shop/#]LipiPharm[/url] Cheap Lipitor 10mg / 20mg / 40mg

prednisone 30 mg: Predni Pharm – prednisone 2.5 mg

Crestor Pharm: CrestorPharm – Crestor Pharm

Predni Pharm [url=https://prednipharm.com/#]PredniPharm[/url] where can i buy prednisone online without a prescription

Lipi Pharm: Lipi Pharm – Lipi Pharm

Crestor Pharm: CrestorPharm – Crestor Pharm

Generic Lipitor fast delivery [url=https://lipipharm.shop/#]LipiPharm[/url] LipiPharm

http://prednipharm.com/# prednisone 5 tablets

https://semaglupharm.shop/# SemagluPharm

prednisone buy online nz [url=http://prednipharm.com/#]Predni Pharm[/url] prednisone 10 mg tablets

buying prednisone mexico: over the counter prednisone pills – Predni Pharm

LipiPharm: Lipi Pharm – Lipi Pharm

https://semaglupharm.com/# SemagluPharm

https://crestorpharm.com/# repatha vs crestor

rosuvastatin fatigue [url=https://crestorpharm.com/#]Crestor Pharm[/url] teva rosuvastatin 10 mg

prednisone for sale online: generic prednisone for sale – Predni Pharm

http://semaglupharm.com/# Semaglu Pharm

SemagluPharm: Order Rybelsus discreetly – FDA-approved Rybelsus alternative

LipiPharm: USA-based pharmacy Lipitor delivery – what tier drug is lipitor

PredniPharm [url=https://prednipharm.com/#]cost of prednisone 5mg tablets[/url] Predni Pharm

http://semaglupharm.com/# rybelsus dosage

where to buy prednisone in canada: PredniPharm – prednisone ordering online

https://lipipharm.shop/# Discreet shipping for Lipitor

LipiPharm: LipiPharm – Generic Lipitor fast delivery

Rosuvastatin tablets without doctor approval [url=https://crestorpharm.com/#]CrestorPharm[/url] CrestorPharm

https://semaglupharm.com/# Semaglu Pharm

SemagluPharm: Semaglu Pharm – semaglutide otc

CrestorPharm: crestor vs lovastatin – whats crestor used for

Crestor Pharm [url=http://crestorpharm.com/#]Crestor Pharm[/url] Crestor Pharm

https://semaglupharm.com/# rybelsus and kidney function

Semaglu Pharm: SemagluPharm – can semaglutide cause headaches

Crestor Pharm: Crestor Pharm – Generic Crestor for high cholesterol

http://semaglupharm.com/# Safe delivery in the US

https://semaglupharm.shop/# SemagluPharm

FDA-approved Rybelsus alternative [url=https://semaglupharm.com/#]Semaglu Pharm[/url] Affordable Rybelsus price

semaglutide ahfs/drugs.com: rybelsus walmart – Affordable Rybelsus price

https://semaglupharm.com/# Online pharmacy Rybelsus

Semaglu Pharm: Semaglu Pharm – п»їBuy Rybelsus online USA

grapefruit crestor interaction [url=http://crestorpharm.com/#]rosuvastatin 5 mg side effects[/url] CrestorPharm

Buy cholesterol medicine online cheap: Crestor Pharm – Crestor Pharm

https://semaglupharm.shop/# SemagluPharm

Predni Pharm: Predni Pharm – prednisone 20 mg purchase

CrestorPharm [url=http://crestorpharm.com/#]Over-the-counter Crestor USA[/url] does magnesium interfere with crestor

https://prednipharm.com/# average price of prednisone

LipiPharm: LipiPharm – LipiPharm

https://semaglupharm.com/# Semaglu Pharm

prednisone 5 mg: compare prednisone prices – PredniPharm

paxlovid with lipitor [url=http://lipipharm.com/#]lipitor and liver damage[/url] LipiPharm

Crestor Pharm: grapefruit and crestor – Crestor mail order USA

https://semaglupharm.com/# FDA-approved Rybelsus alternative

PredniPharm: Predni Pharm – buy prednisone mexico

Generic Lipitor fast delivery [url=http://lipipharm.com/#]USA-based pharmacy Lipitor delivery[/url] atorvastatin dementia

https://semaglupharm.com/# SemagluPharm

https://semaglupharm.shop/# Semaglu Pharm

order prednisone with mastercard debit: prednisone 10 mg coupon – can you buy prednisone over the counter in mexico

LipiPharm: lipitor ad – atorvastatin and clopidogrel side effects

CrestorPharm [url=http://crestorpharm.com/#]rosuvastatin/ezetimibe 40/10 mg[/url] what should you avoid when taking crestor?

http://semaglupharm.com/# SemagluPharm

cost of prednisone: order prednisone on line – prednisone 10 mg daily

Online statin drugs no doctor visit: No RX Lipitor online – Lipi Pharm

Lipi Pharm [url=http://lipipharm.com/#]Lipi Pharm[/url] lipitor 40mg

https://semaglupharm.shop/# SemagluPharm

buying prescription drugs in mexico: mexican rx online – Meds From Mexico

http://canadapharmglobal.com/# online canadian pharmacy review

Meds From Mexico: mexican rx online – Meds From Mexico

Meds From Mexico [url=http://medsfrommexico.com/#]purple pharmacy mexico price list[/url] Meds From Mexico

http://indiapharmglobal.com/# online pharmacy india

indian pharmacy: indian pharmacy – best online pharmacy india

reputable mexican pharmacies online: mexican pharmaceuticals online – Meds From Mexico

India Pharm Global [url=https://indiapharmglobal.com/#]top 10 pharmacies in india[/url] India Pharm Global

https://indiapharmglobal.shop/# India Pharm Global

https://indiapharmglobal.com/# top online pharmacy india

top 10 pharmacies in india: world pharmacy india – top 10 online pharmacy in india

canada pharmacy reviews: Canada Pharm Global – canadian pharmacy 24h com

https://canadapharmglobal.com/# online canadian pharmacy

buying from online mexican pharmacy [url=http://medsfrommexico.com/#]purple pharmacy mexico price list[/url] mexico drug stores pharmacies

buy prescription drugs from india: world pharmacy india – India Pharm Global

canadian pharmacy phone number: reliable canadian pharmacy – legitimate canadian pharmacy online

http://canadapharmglobal.com/# best canadian pharmacy online

legit canadian pharmacy [url=http://canadapharmglobal.com/#]canadian pharmacy cheap[/url] canadian mail order pharmacy

https://medsfrommexico.com/# Meds From Mexico

Meds From Mexico: mexico drug stores pharmacies – pharmacies in mexico that ship to usa

https://indiapharmglobal.com/# india online pharmacy

pharmacies in canada that ship to the us: best online canadian pharmacy – northwest canadian pharmacy

India Pharm Global [url=https://indiapharmglobal.shop/#]indian pharmacy[/url] India Pharm Global

Meds From Mexico: mexico drug stores pharmacies – mexican mail order pharmacies

https://medsfrommexico.shop/# Meds From Mexico

canada pharmacy 24h: canadian pharmacy – canadian pharmacy in canada

https://canadapharmglobal.com/# canada pharmacy 24h

Meds From Mexico [url=https://medsfrommexico.com/#]п»їbest mexican online pharmacies[/url] mexican rx online

buying from online mexican pharmacy: Meds From Mexico – mexican pharmaceuticals online

https://canadapharmglobal.com/# reputable canadian pharmacy

indian pharmacy: buy prescription drugs from india – India Pharm Global

India Pharm Global [url=https://indiapharmglobal.shop/#]reputable indian online pharmacy[/url] top 10 online pharmacy in india

http://canadapharmglobal.com/# best canadian pharmacy online

Meds From Mexico: Meds From Mexico – mexican rx online

Meds From Mexico: Meds From Mexico – Meds From Mexico

https://canadapharmglobal.shop/# canadian pharmacy world

mexico drug stores pharmacies [url=http://medsfrommexico.com/#]Meds From Mexico[/url] Meds From Mexico

https://canadapharmglobal.com/# canadian pharmacy ratings

medication from mexico pharmacy: Meds From Mexico – Meds From Mexico

Meds From Mexico: Meds From Mexico – mexican border pharmacies shipping to usa

https://svenskapharma.shop/# apotek erbjudande

citrafleet precio amazon: Papa Farma – cГіdigo descuento farmacia barata

Rask Apotek: Rask Apotek – Rask Apotek

https://efarmaciait.com/# EFarmaciaIt

tadalafil 20 mg prezzo in farmacia [url=http://efarmaciait.com/#]viagra spray in farmacia[/url] EFarmaciaIt

http://papafarma.com/# Papa Farma

EFarmaciaIt: EFarmaciaIt – diazepam a cosa serve

EFarmaciaIt: EFarmaciaIt – vermox italia

http://efarmaciait.com/# EFarmaciaIt

apotek open now [url=https://svenskapharma.com/#]apotek handledsstöd[/url] apotek öppet nu

oral b io: vitaminas multicentrum opiniones – pharmacy barcelona

https://papafarma.shop/# Papa Farma

https://efarmaciait.shop/# EFarmaciaIt

pulse oximeter apotek [url=https://svenskapharma.shop/#]isopropanol apotek[/url] preparat läkemedel

bianacid in english: zoely comprar online – Papa Farma

Rask Apotek: castor olje apotek – Rask Apotek

https://svenskapharma.shop/# Svenska Pharma

parafsrmacia [url=http://papafarma.com/#]Papa Farma[/url] pro direct opiniones

Papa Farma: Papa Farma – Papa Farma

https://papafarma.shop/# Papa Farma

lagersaldo apotek: Svenska Pharma – mens tabletter

urixana a cosa serve: EFarmaciaIt – artrosilene supposte

Svenska Pharma [url=https://svenskapharma.com/#]Svenska Pharma[/url] Svenska Pharma

http://svenskapharma.com/# ryggsäck 30 liter rea

Rask Apotek: sette vaksine pГҐ apotek – fruktsyre apotek

EFarmaciaIt: EFarmaciaIt – graffi sulla pelle testo

Papa Farma [url=http://papafarma.com/#]licoforte gel precio[/url] Papa Farma

http://papafarma.com/# cialis 100 mg precio

https://efarmaciait.com/# EFarmaciaIt

Svenska Pharma: apotek retinol – Svenska Pharma

para que es el movicol sobres: vimovo 500 para que sirve – 30ml a gramos

elektrolytter apotek [url=https://raskapotek.shop/#]propolis krem apotek[/url] magebelte gravid apotek

https://svenskapharma.com/# Svenska Pharma

Rask Apotek: metningsmГҐler apotek – Rask Apotek

Svenska Pharma: Svenska Pharma – Svenska Pharma

farmcacia [url=https://papafarma.com/#]Papa Farma[/url] para que sirve elocom

http://papafarma.com/# Papa Farma

https://svenskapharma.com/# Svenska Pharma

medisiner pГҐ nett: Rask Apotek – apotek ГҐpen sГёndag

kГ¶pa paracetamol: Svenska Pharma – apotek medlem

apotek Г¶ppetider [url=https://svenskapharma.com/#]Svenska Pharma[/url] Svenska Pharma

https://raskapotek.shop/# Rask Apotek

aktivert karbon apotek: Rask Apotek – Rask Apotek

https://efarmaciait.shop/# EFarmaciaIt

cialis 10 mg precio farmacia [url=https://papafarma.com/#]Papa Farma[/url] Papa Farma

fennikel te apotek: nattlysolje apotek – Rask Apotek

http://efarmaciait.com/# dr.max.it recensioni

В этой статье собраны факты, которые освещают целый ряд важных вопросов. Мы стремимся предложить читателям четкую, достоверную информацию, которая поможет сформировать собственное мнение и лучше понять сложные аспекты рассматриваемой темы.

Получить дополнительные сведения – https://nakroklinikatest.ru/

EFarmaciaIt: EFarmaciaIt – EFarmaciaIt

http://svenskapharma.com/# q10 och blodtrycksmedicin

EFarmaciaIt [url=https://efarmaciait.com/#]farmscia[/url] EFarmaciaIt

regulering strikk apotek: munnbind apotek – Rask Apotek

https://svenskapharma.com/# Svenska Pharma

http://pharmaconnectusa.com/# pharmacy online uae

https://medicijnpunt.shop/# pharma apotheek

pharmacy o’reilly artane: Pharma Connect USA – PharmaConnectUSA

apotheek aan huis: internetapotheek – MedicijnPunt

PharmaConnectUSA [url=https://pharmaconnectusa.com/#]pharmacy bangkok viagra[/url] rite aid pharmacy benadryl

http://pharmaconnectusa.com/# ambien overseas pharmacy

Ventolin: access pharmacy viagra – rx discount pharmacy middlesboro ky

Pharma Confiance: Pharma Confiance – livraison mГ©dicament wattrelos

farma online [url=https://medicijnpunt.com/#]apotheken nederland[/url] Medicijn Punt

https://pharmaconfiance.com/# Pharma Confiance

https://medicijnpunt.shop/# MedicijnPunt

Medicijn Punt: apteka internetowa nl – apotheek winkel 24 review

MedicijnPunt: medicatie apotheker review – Medicijn Punt

http://pharmaconfiance.com/# monuril prise

versandapotheke versandkostenfrei [url=http://pharmajetzt.com/#]billig apotheke[/url] versandapotheke bad steben

Medicijn Punt: internetapotheek spanje – Medicijn Punt

http://pharmaconnectusa.com/# PharmaConnectUSA

MedicijnPunt: medicijnen kopen zonder recept – Medicijn Punt

https://pharmaconfiance.shop/# Pharma Confiance

Pharma Confiance [url=https://pharmaconfiance.com/#]Pharma Confiance[/url] marche pied avec garde corps

MedicijnPunt: online apotheek goedkoper – MedicijnPunt

https://medicijnpunt.com/# MedicijnPunt

Pharma Connect USA: sainsburys pharmacy doxycycline – PharmaConnectUSA

apothekenbedarf online-shop [url=https://pharmajetzt.shop/#]apotheje online[/url] Pharma Jetzt

online pharmacy cialis generic: enalapril online pharmacy – pharmacy metoprolol

https://pharmaconfiance.shop/# Pharma Confiance

http://pharmaconnectusa.com/# Imdur

argel 7 en pharmacie prix: quelle est la pharmacie de garde aujourd’hui Г strasbourg ? – Pharma Confiance

MedicijnPunt [url=https://medicijnpunt.com/#]MedicijnPunt[/url] dutch apotheek

internetapotheke selbitz: Pharma Jetzt – Pharma Jetzt

http://pharmajetzt.com/# PharmaJetzt

meine shop apotheke: Pharma Jetzt – PharmaJetzt

online medicijnen bestellen met recept [url=http://medicijnpunt.com/#]medicatie apotheker[/url] apotheek recept

Medicijn Punt: Medicijn Punt – Medicijn Punt

https://pharmajetzt.com/# PharmaJetzt

apotal online shop: online apotheke wegovy – medikamente online bestellen

https://medicijnpunt.com/# apteka amsterdam

Pharma Confiance [url=http://pharmaconfiance.com/#]Pharma Confiance[/url] parapharmacie granville

finasteride united pharmacy: Pharma Connect USA – Pharma Connect USA

https://pharmaconnectusa.com/# online pharmacy fluoxetine

Pharma Confiance: Pharma Confiance – Pharma Confiance

Pharma Confiance [url=http://pharmaconfiance.com/#]avis klorane[/url] Pharma Confiance

PharmaJetzt: PharmaJetzt – apotheke onlineshop

https://pharmaconnectusa.shop/# finasteride india pharmacy

Medicijn Punt: Medicijn Punt – MedicijnPunt

https://pharmajetzt.shop/# PharmaJetzt

Medicijn Punt [url=http://medicijnpunt.com/#]apotheek kopen[/url] snel medicijnen bestellen

Pharma Confiance: acheter kamagra site fiable forum – Pharma Confiance

https://pharmaconnectusa.com/# PharmaConnectUSA

mijn medicijnkosten: medicijnen aanvragen – online apotheek

http://medicijnpunt.com/# MedicijnPunt

ghd numero de telephone [url=https://pharmaconfiance.shop/#]Pharma Confiance[/url] Pharma Confiance

internetapotheek spanje: medicijne – Medicijn Punt

amoxicilline et ibuprofГЁne: Pharma Confiance – Pharma Confiance

https://pharmaconfiance.com/# Pharma Confiance

Medicijn Punt: MedicijnPunt – farma online

Medicijn Punt [url=https://medicijnpunt.com/#]MedicijnPunt[/url] Medicijn Punt

http://medicijnpunt.com/# online recept

https://medicijnpunt.shop/# Medicijn Punt

c’est quoi une parapharmacie: slip fabriquГ© en france – Pharma Confiance

PharmaJetzt: medikamente preisvergleich testsieger – Pharma Jetzt

https://medicijnpunt.shop/# Medicijn Punt

northwest pharmacy: steroids online pharmacy – silkroad online pharmacy reviews

Pharma Confiance: Pharma Confiance – Pharma Confiance

https://medicijnpunt.com/# mediceinen

http://pharmajetzt.com/# PharmaJetzt

pharmacy2u cialis: viagra in indian pharmacy – rx discount pharmacy

rx pharmacy shop coupon code: online pharmacy sildenafil citrate – biaxin online pharmacy

https://pharmajetzt.shop/# apo versandapotheke

pseudoephedrine kopen in nederland: Medicijn Punt – medicijnen zonder recept kopen

irmat pharmacy: Pharma Connect USA – guardian pharmacy loratadine

https://pharmajetzt.com/# PharmaJetzt

https://pharmaconfiance.shop/# site ghd

arznei gГјnstig: online-apotheken – shop aphoteke

medikamente online bestellen mit rezept: Pharma Jetzt – online apoteke

https://medicijnpunt.com/# Medicijn Punt

apotheke obline: Pharma Jetzt – medikamente 24 stunden lieferung

beste online apotheek: apotheke holland – Medicijn Punt

https://pharmaconnectusa.shop/# online pharmacy tegretol xr

http://medicijnpunt.com/# Medicijn Punt

sildenafil gel: nouveau traitement du dysfonctionnement Г©rectil 2022 – achat god

PharmaConnectUSA: PharmaConnectUSA – Pharma Connect USA

https://pharmaconnectusa.shop/# Pharma Connect USA

PharmaConnectUSA: PharmaConnectUSA – Precose

http://medicijnpunt.com/# MedicijnPunt

peut on prendre du ketoprofene avec du doliprane: correspondance semaine et mois de grossesse – agence nationale du medicament

https://pharmajetzt.com/# PharmaJetzt

netherlands pharmacy online: afbeelding medicijnen – medicatie kopen

http://pharmaconfiance.com/# Pharma Confiance

Pharma Connect USA: Pharma Connect USA – humana pharmacy otc order online

pille danach online apotheke: apotheke online bestellen – online shop apotheke

Pharma Jetzt: Pharma Jetzt – PharmaJetzt

MedicijnPunt: MedicijnPunt – MedicijnPunt

https://medicijnpunt.com/# medicatielijst apotheek

apotheek medicijnen bestellen: online apotheek goedkoper – beste online apotheek

http://pharmajetzt.com/# PharmaJetzt

Pharma Confiance: grossesse et maux de tГЄte permanent – Pharma Confiance

Pharma Confiance: Pharma Confiance – Pharma Confiance

Pharma Confiance: Pharma Confiance – Pharma Confiance

https://pharmaconnectusa.com/# Pharma Connect USA

https://medicijnpunt.shop/# apotheek on line

brand levitra online pharmacy: Enalapril – lamisil online pharmacy

Pharma Confiance [url=https://pharmaconfiance.com/#]Pharma Confiance[/url] Pharma Confiance

Medicijn Punt: MedicijnPunt – apotheken

apotheke internet: versand apotheke online – Pharma Jetzt

http://pharmajetzt.com/# luitpold-apotheke selbitz

pharmacy viagra joke: what to consider as budget when running pharmacy store – doxycycline from pharmacy

versand apotheke deutschland [url=https://pharmajetzt.shop/#]Pharma Jetzt[/url] Pharma Jetzt

que choisir nuxe ou caudalie: Pharma Confiance – pharmacie change

https://pharmaconnectusa.shop/# simvastatin kroger pharmacy

Pharma Confiance: pharcie – Pharma Confiance

https://pharmajetzt.shop/# shop apotheke medikamente

mexican pharmacy doxycycline: Pharma Connect USA – PharmaConnectUSA

PharmaJetzt: apo versandapotheke – PharmaJetzt

Pharma Jetzt [url=https://pharmajetzt.com/#]PharmaJetzt[/url] Pharma Jetzt

https://pharmaconnectusa.com/# Pharma Connect USA

PharmaJetzt: Pharma Jetzt – Pharma Jetzt

afbeelding medicijnen: Medicijn Punt – holland apotheke

https://pharmaconfiance.shop/# chaussures spГ©ciales arthrose femme

MedicijnPunt [url=http://medicijnpunt.com/#]MedicijnPunt[/url] MedicijnPunt

pharmacy store viagra + cialis: xenical indian pharmacy – PharmaConnectUSA

https://medicijnpunt.shop/# MedicijnPunt

Pharma Confiance: pharmacie la plus proche autour de moi – Pharma Confiance

lortab online pharmacy no prescription: PharmaConnectUSA – Pharma Connect USA

ahop apotheke: PharmaJetzt – cantura akut 12 apotheke

https://pharmaconfiance.shop/# Pharma Confiance

no prescription required pharmacy [url=http://pharmaconnectusa.com/#]PharmaConnectUSA[/url] Pharma Connect USA

https://medicijnpunt.com/# antibiotica kopen zonder recept

Pharma Confiance: Pharma Confiance – farmacie franta

MedicijnPunt: apotheek aan huis – betrouwbare online apotheek zonder recept

https://pharmajetzt.com/# Pharma Jetzt

Pharma Connect USA: masters in pharmacy online – Pharma Connect USA

beste online apotheek [url=http://medicijnpunt.com/#]farmacie online[/url] Medicijn Punt

Pharma Confiance: montre connectГ©e douleur bras – farmГ cia

apotheke rechnung: Pharma Jetzt – online apotheke deutschland

https://pharmaconfiance.com/# Pharma Confiance

https://pharmajetzt.com/# Pharma Jetzt

europese apotheek [url=https://medicijnpunt.com/#]Medicijn Punt[/url] farma online

Pharma Confiance: Pharma Confiance – pharmacie moins cher paris

Pharma Confiance: Pharma Confiance – nuxe anti rides

http://pharmaconfiance.com/# pharmacie de garde toulouse ouvert actuellement

MedicijnPunt: Medicijn Punt – online medicijnen bestellen met recept

produits avene avis: daflon combien de temps pour faire effet – paracetamol erection

apotal shop apotheke [url=https://pharmajetzt.com/#]PharmaJetzt[/url] apothe online

http://indimedsdirect.com/# IndiMeds Direct

TijuanaMeds: mexican pharmaceuticals online – TijuanaMeds

https://canrxdirect.com/# my canadian pharmacy reviews

п»їlegitimate online pharmacies india: Online medicine home delivery – IndiMeds Direct

mexican online pharmacies prescription drugs [url=https://tijuanameds.com/#]TijuanaMeds[/url] TijuanaMeds

http://indimedsdirect.com/# IndiMeds Direct

TijuanaMeds: mexico drug stores pharmacies – mexican mail order pharmacies

canadian drugs online: canadianpharmacymeds – my canadian pharmacy reviews

Online medicine home delivery [url=https://indimedsdirect.com/#]IndiMeds Direct[/url] india pharmacy mail order

http://indimedsdirect.com/# IndiMeds Direct

https://indimedsdirect.shop/# IndiMeds Direct

IndiMeds Direct: IndiMeds Direct – online pharmacy india

http://tijuanameds.com/# TijuanaMeds

canadian pharmacy no rx needed [url=https://canrxdirect.shop/#]canada drug pharmacy[/url] canadian mail order pharmacy

TijuanaMeds: best online pharmacies in mexico – TijuanaMeds

https://tijuanameds.shop/# TijuanaMeds

TijuanaMeds: mexico pharmacies prescription drugs – TijuanaMeds

indianpharmacy com [url=http://indimedsdirect.com/#]online shopping pharmacy india[/url] IndiMeds Direct

https://indimedsdirect.com/# IndiMeds Direct

https://canrxdirect.com/# my canadian pharmacy

reputable canadian pharmacy: CanRx Direct – my canadian pharmacy rx

TijuanaMeds [url=http://tijuanameds.com/#]TijuanaMeds[/url] mexico drug stores pharmacies

https://tijuanameds.shop/# TijuanaMeds

canada ed drugs: CanRx Direct – buy drugs from canada

buy drugs from canada [url=https://canrxdirect.com/#]canada pharmacy online[/url] reliable canadian pharmacy

mexican drugstore online: mexico drug stores pharmacies – TijuanaMeds

http://tijuanameds.com/# mexico pharmacies prescription drugs

https://indimedsdirect.com/# IndiMeds Direct

Online medicine home delivery: mail order pharmacy india – reputable indian online pharmacy

п»їlegitimate online pharmacies india [url=https://indimedsdirect.shop/#]IndiMeds Direct[/url] best india pharmacy

TijuanaMeds: TijuanaMeds – TijuanaMeds

http://canrxdirect.com/# the canadian drugstore

online shopping pharmacy india: mail order pharmacy india – п»їlegitimate online pharmacies india

IndiMeds Direct: IndiMeds Direct – cheapest online pharmacy india

buy enclomiphene online [url=https://enclomiphenebestprice.com/#]buy enclomiphene online[/url] enclomiphene online

http://rxfreemeds.com/# RxFree Meds

https://rxfreemeds.com/# RxFree Meds

Farmacia Asequible: cbd store malaga – tadalafilo 5 mg opiniones

Farmacia Asequible: loniten precio – vimovo para que sirve

https://rxfreemeds.shop/# klonopin online pharmacy no prescription

enclomiphene for sale [url=http://enclomiphenebestprice.com/#]enclomiphene for men[/url] enclomiphene for men

enclomiphene online: enclomiphene for men – enclomiphene

https://enclomiphenebestprice.shop/# enclomiphene buy

farmacias online en espaГ±a: movicol pediГЎtrico sin receta – Farmacia Asequible

enclomiphene for sale [url=https://enclomiphenebestprice.com/#]enclomiphene buy[/url] buy enclomiphene online

http://rxfreemeds.com/# pain relief

enclomiphene best price: enclomiphene buy – enclomiphene online

Farmacia Asequible: Farmacia Asequible – Farmacia Asequible

https://farmaciaasequible.shop/# Farmacia Asequible

RxFree Meds [url=https://rxfreemeds.com/#]mogadon online pharmacy[/url] RxFree Meds

aceite la boquera: diferencia entre parafarmacia y farmacia – cbd barato shop opiniones

Farmacia Asequible: oral b telefono – comprar viagra en espaГ±a amazon

enclomiphene testosterone [url=https://enclomiphenebestprice.com/#]enclomiphene citrate[/url] enclomiphene

http://rxfreemeds.com/# four corners pharmacy domperidone

https://farmaciaasequible.com/# Farmacia Asequible

RxFree Meds: RxFree Meds – RxFree Meds

http://farmaciaasequible.com/# citrafleet precio españa

RxFree Meds [url=https://rxfreemeds.com/#]montelukast pharmacy[/url] rx relief pharmacy discount card

https://farmaciaasequible.com/# tu botica cbd

enclomiphene testosterone: enclomiphene for men – enclomiphene best price

enclomiphene for sale [url=https://enclomiphenebestprice.shop/#]enclomiphene citrate[/url] enclomiphene for men

https://farmaciaasequible.com/# cialis 60 mg comprar

http://rxfreemeds.com/# RxFree Meds

RxFree Meds: RxFree Meds – Paxil

enclomiphene for men [url=https://enclomiphenebestprice.com/#]enclomiphene online[/url] enclomiphene for sale

http://farmaciaasequible.com/# melatonin spanien

domperidone pharmacy online [url=http://rxfreemeds.com/#]RxFree Meds[/url] cialis united pharmacy

enclomiphene price: enclomiphene citrate – enclomiphene buy

https://farmaciaasequible.com/# Farmacia Asequible

farmacia barata valencia [url=https://farmaciaasequible.com/#]aquilea prospecto[/url] Farmacia Asequible

enclomiphene for men: enclomiphene testosterone – enclomiphene for men

Farmacia Asequible [url=http://farmaciaasequible.com/#]Farmacia Asequible[/url] Farmacia Asequible

http://rxfreemeds.com/# RxFree Meds

Farmacia Asequible [url=https://farmaciaasequible.shop/#]compra viagra[/url] Farmacia Asequible

RxFree Meds: RxFree Meds – RxFree Meds

RxFree Meds [url=http://rxfreemeds.com/#]RxFree Meds[/url] RxFree Meds

https://rxfreemeds.shop/# RxFree Meds

enclomiphene testosterone: enclomiphene best price – enclomiphene for men

enclomiphene best price [url=https://enclomiphenebestprice.com/#]enclomiphene[/url] enclomiphene price

Farmacia Asequible [url=https://farmaciaasequible.shop/#]mg murcia[/url] cenforce 100 amazon

RxFree Meds: lortab pharmacy prices – inhouse pharmacy general motilium

http://enclomiphenebestprice.com/# enclomiphene citrate

farmacia portuguesa online [url=https://farmaciaasequible.shop/#]farmacia en la cuesta[/url] Farmacia Asequible

RxFree Meds: RxFree Meds – buy nexium online pharmacy

enclomiphene for sale [url=https://enclomiphenebestprice.com/#]enclomiphene price[/url] enclomiphene testosterone

http://enclomiphenebestprice.com/# enclomiphene best price

enclomiphene for men [url=http://enclomiphenebestprice.com/#]enclomiphene for sale[/url] enclomiphene for sale

enclomiphene price: buy enclomiphene online – enclomiphene citrate

viagra from pharmacy [url=https://rxfreemeds.com/#]RxFree Meds[/url] azithromycin pharmacy uk

http://rxfreemeds.com/# RxFree Meds

RxFree Meds [url=https://rxfreemeds.com/#]RxFree Meds[/url] RxFree Meds

prices pharmacy [url=http://rxfreemeds.com/#]RxFree Meds[/url] fluconazole pharmacy first

enclomiphene testosterone: enclomiphene – enclomiphene online

https://enclomiphenebestprice.com/# buy enclomiphene online

RxFree Meds [url=https://rxfreemeds.shop/#]RxFree Meds[/url] buy clomid online pharmacy

mi farmacia [url=https://farmaciaasequible.com/#]Farmacia Asequible[/url] movicol precio 10 sobres

sukhumvit pharmacy viagra: RxFree Meds – RxFree Meds

cheap amoxicillin online – buy amoxil for sale amoxicillin usa

Farmacia Asequible [url=http://farmaciaasequible.com/#]epiduo forte comprar online[/url] farmacias en solares

RxFree Meds: RxFree Meds – RxFree Meds

https://farmaciaasequible.com/# dodot sensitive talla 6 plus

enclomiphene testosterone [url=http://enclomiphenebestprice.com/#]enclomiphene price[/url] enclomiphene for sale

enclomiphene online: enclomiphene online – enclomiphene for sale

Farmacia Asequible [url=https://farmaciaasequible.shop/#]Farmacia Asequible[/url] Farmacia Asequible

Farmacia Asequible: Farmacia Asequible – ver energy en directo

para quГ© sirve movicol: farmacias sevilla la nueva – Farmacia Asequible

https://farmaciaasequible.shop/# zoely precio

http://enclomiphenebestprice.com/# enclomiphene

brooks pharmacy store locator: RxFree Meds – RxFree Meds

http://farmaciaasequible.com/# Farmacia Asequible

sildenafilo precio farmacia [url=https://farmaciaasequible.shop/#]Farmacia Asequible[/url] parafarmacia granada

farmacia garrido: Farmacia Asequible – aquilea prospecto

http://enclomiphenebestprice.com/# enclomiphene online

enclomiphene: buy enclomiphene online – enclomiphene best price

mabodol crema para que sirve [url=http://farmaciaasequible.com/#]farmaciq[/url] dental company alcosa

https://meximedsexpress.shop/# buying from online mexican pharmacy

MexiMeds Express: MexiMeds Express – mexico pharmacies prescription drugs

24 hour online pharmacy: rx pharmacy glendale – web pharmacy

https://indomedsusa.com/# IndoMeds USA

п»їlegitimate online pharmacies india [url=https://indomedsusa.shop/#]IndoMeds USA[/url] buy medicines online in india

advair pharmacy assistance: testosterone cream online pharmacy – escitalopram online pharmacy

MexiMeds Express: п»їbest mexican online pharmacies – reputable mexican pharmacies online

http://medismartpharmacy.com/# cialis price pharmacy

IndoMeds USA [url=https://indomedsusa.shop/#]india online pharmacy[/url] IndoMeds USA

http://meximedsexpress.com/# medication from mexico pharmacy

IndoMeds USA: top 10 online pharmacy in india – india online pharmacy

https://indomedsusa.com/# indian pharmacy

canadian family pharmacy: MediSmart Pharmacy – escrow pharmacy canada

mexican border pharmacies shipping to usa [url=https://meximedsexpress.com/#]mexican border pharmacies shipping to usa[/url] buying from online mexican pharmacy

IndoMeds USA: best online pharmacy india – india online pharmacy

https://meximedsexpress.shop/# mexico pharmacies prescription drugs

buying prescription drugs in mexico online: MexiMeds Express – MexiMeds Express

http://medismartpharmacy.com/# cheapest online pharmacy

proscar inhouse pharmacy [url=https://medismartpharmacy.shop/#]global pharmacy rx[/url] Nolvadex

MexiMeds Express: MexiMeds Express – MexiMeds Express

https://medismartpharmacy.com/# boots pharmacy kamagra

cross border pharmacy canada: safeway pharmacy store hours – canadian pharmacies comparison

india pharmacy [url=https://indomedsusa.shop/#]IndoMeds USA[/url] pharmacy website india

reputable mexican pharmacies online: MexiMeds Express – MexiMeds Express

https://medismartpharmacy.shop/# us pharmacy cialis online

https://meximedsexpress.shop/# MexiMeds Express

top online pharmacy india: IndoMeds USA – IndoMeds USA

purdue pharmacy store [url=http://medismartpharmacy.com/#]MediSmart Pharmacy[/url] watch tour de pharmacy online

http://indomedsusa.com/# online shopping pharmacy india

pharmacy direct cialis: MediSmart Pharmacy – buy vyvanse online pharmacy

india online pharmacy: IndoMeds USA – top online pharmacy india

pharmacy rx one legit [url=http://medismartpharmacy.com/#]safe online pharmacy[/url] pharmacy that sells rohypnol

http://indomedsusa.com/# IndoMeds USA

top 10 online pharmacy in india: Online medicine home delivery – IndoMeds USA

http://indomedsusa.com/# IndoMeds USA

IndoMeds USA: buy prescription drugs from india – top 10 pharmacies in india

https://meximedsexpress.com/# MexiMeds Express

IndoMeds USA [url=http://indomedsusa.com/#]IndoMeds USA[/url] online pharmacy india

mexican rx online: buying prescription drugs in mexico online – buying prescription drugs in mexico online

buying from online mexican pharmacy: MexiMeds Express – mexican pharmaceuticals online

https://indomedsusa.shop/# indian pharmacy

mexican mail order pharmacies [url=https://meximedsexpress.shop/#]medication from mexico pharmacy[/url] MexiMeds Express

pharmacy website india: buy prescription drugs from india – pharmacy website india

buy facebook accounts for ads website for buying accounts secure account purchasing platform

https://medismartpharmacy.shop/# kroger online pharmacy

http://meximedsexpress.com/# pharmacies in mexico that ship to usa

top 10 pharmacies in india: indianpharmacy com – IndoMeds USA

IndoMeds USA [url=http://indomedsusa.com/#]IndoMeds USA[/url] IndoMeds USA

IndoMeds USA: IndoMeds USA – IndoMeds USA

http://meximedsexpress.com/# mexican border pharmacies shipping to usa

indian pharmacy paypal: IndoMeds USA – IndoMeds USA

metoprolol mexican pharmacy [url=https://medismartpharmacy.com/#]MediSmart Pharmacy[/url] pharmacy clothes store

indian pharmacy paypal: reputable indian pharmacies – buy prescription drugs from india

https://indomedsusa.com/# indian pharmacies safe

mexican pharmaceuticals online [url=http://meximedsexpress.com/#]mexican border pharmacies shipping to usa[/url] MexiMeds Express

best online pharmacies in mexico: mexico drug stores pharmacies – MexiMeds Express

https://meximedsexpress.shop/# medication from mexico pharmacy

https://indomedsusa.com/# IndoMeds USA

target pharmacy levitra [url=http://medismartpharmacy.com/#]omeprazole tesco pharmacy[/url] rx pharmacy viagra

no prescription pharmacy: cialis pharmacy online uk – adipex mexico pharmacy

facebook ads accounts account selling platform profitable account sales

https://meximedsexpress.shop/# MexiMeds Express

medicine in mexico pharmacies [url=https://meximedsexpress.com/#]MexiMeds Express[/url] mexican online pharmacies prescription drugs

mail order pharmacy india: IndoMeds USA – top 10 pharmacies in india

https://meximedsexpress.com/# MexiMeds Express

https://indomedsusa.com/# IndoMeds USA

top 10 pharmacies in india: online shopping pharmacy india – IndoMeds USA

the pharmacy store [url=http://medismartpharmacy.com/#]MediSmart Pharmacy[/url] austria pharmacy online

https://meximedsexpress.com/# mexican mail order pharmacies

MexiMeds Express: mexico pharmacies prescription drugs – mexican rx online

https://meximedsexpress.shop/# mexican mail order pharmacies

xeloda specialty pharmacy [url=http://medismartpharmacy.com/#]MediSmart Pharmacy[/url] benicar online pharmacy

clindamicina same: OrdinaSalute – perfalgan a cosa serve

https://ordinasalute.com/# pillola fedra prezzo

https://clinicagaleno.com/# comprar retirides sin receta

tavor 1 mg prezzo [url=http://ordinasalute.com/#]la migliore farmacia online in italia[/url] azarga collirio prezzo

farmacia online bolas chinas: la botica farmacia online – se puede comprar azitromicina sin receta

https://ordinasalute.com/# pulsatilla a cosa serve

brossettes interdentaires gum [url=http://pharmadirecte.com/#]PharmaDirecte[/url] forticea shampooing

https://ordinasalute.com/# riopan gel bustine 80 mg prezzo

https://clinicagaleno.com/# farmacia online mascarillas para niños

age eye complex skinceuticals: norГ©thistГ©rone sans ordonnance – tadalafil 20 mg pas cher

pasta fissan per anziani [url=http://ordinasalute.com/#]colgate max white ultra controindicazioni[/url] cacit vitamina d3 bustine

http://pharmadirecte.com/# epitheliale ah duo

comprar misoprostol sin receta espaГ±a: Clinica Galeno – comprar zolpidem sin receta

ou trouver du viagra ou cialis [url=http://pharmadirecte.com/#]commander viagra[/url] medicament pour cystite sans ordonnance en pharmacie

https://clinicagaleno.com/# farmacia natural online

crГЁme emla ordonnance: PharmaDirecte – mГ©dicament contre le stress sans ordonnance

https://pharmadirecte.shop/# bacterix sans ordonnance

sonirem pericoloso [url=https://ordinasalute.shop/#]OrdinaSalute[/url] muscoril fiale prezzo

https://ordinasalute.com/# cosyrel 5/10

surgam 200 sans ordonnance: PharmaDirecte – estreva gel sans ordonnance

lacirex principio attivo [url=http://ordinasalute.com/#]OrdinaSalute[/url] frequil 100

https://ordinasalute.com/# dicloreum 150 mg e mutuabile prezzo

farmacia online andorra: Clinica Galeno – ВїdГіnde se puede comprar viagra sin receta?

https://ordinasalute.com/# lansoprazolo 30 mg prezzo

kamagra gel pharmacie sans ordonnance [url=http://pharmadirecte.com/#]inhalateur pharmacie sans ordonnance[/url] nuxe bio beaute

http://clinicagaleno.com/# aterina se puede comprar sin receta

comprar nembutal online sin receta: farmaciasdirect.com farmacia online y parafarmacia online – farmacia online autorizada

engangshansker apotek: nattokinase apotek – gratis frakt apotek

https://zorgpakket.shop/# medicijnen online bestellen

https://zorgpakket.shop/# frenadol kopen in nederland

de online apotheek [url=https://zorgpakket.com/#]medicine online[/url] apotheke

elektrolytter tabletter apotek: Trygg Med – folinsyre apotek

http://zorgpakket.com/# online apotheek

apotek nagelsvamp [url=https://snabbapoteket.shop/#]gammal bil nytt apotek[/url] apot

https://zorgpakket.shop/# apotheek winkel 24 review

nakkestГёtte apotek: mariatistel apotek – massasje olje apotek

http://zorgpakket.com/# online apotheek 24

medicijen [url=https://zorgpakket.shop/#]MedicijnPunt[/url] apotheek apotheek

apteka nl online: MedicijnPunt – medicatie aanvragen

http://zorgpakket.com/# medicatie kopen

sminka blå ögon [url=https://snabbapoteket.shop/#]SnabbApoteket[/url] beställa läkemedel

internetapotek: nГ¤ringsdryck recept apotek – frisГ¶r billig

https://tryggmed.shop/# nattokinase apotek

http://snabbapoteket.com/# mensvärk utan mens graviditet

orolig mage gravid [url=https://snabbapoteket.shop/#]pipetter apotek[/url] apotek nagellack

vilka recept har jag: Snabb Apoteket – frikort apotek

https://zorgpakket.com/# medicijnen bestellen online

folat apotek: TryggMed – tannbleking apotek

svamp app android gratis [url=http://snabbapoteket.com/#]Snabb Apoteket[/url] beige hårfärg

http://zorgpakket.com/# dokter online medicijnen bestellen

apotek recept: SnabbApoteket – apotek pГҐ nГ¤tet

https://tryggmed.com/# bestill resept pГҐ nett

http://medimexicorx.com/# medicine in mexico pharmacies

buy prescription drugs from india [url=http://indiamedshub.com/#]buy prescription drugs from india[/url] Online medicine home delivery

semaglutide mexico price: trusted mexico pharmacy with US shipping – buy cialis from mexico

top 10 online pharmacy in india: IndiaMedsHub – indian pharmacies safe

https://indiamedshub.com/# india online pharmacy

http://expresscarerx.org/# rhinocort epharmacy

modafinil mexico online: buy meds from mexican pharmacy – buy cialis from mexico

order azithromycin mexico [url=https://medimexicorx.shop/#]semaglutide mexico price[/url] MediMexicoRx

https://medimexicorx.com/# purple pharmacy mexico price list

ExpressCareRx: best online pharmacy to buy ambien – pharmacy shop

cheapest online pharmacy india [url=https://indiamedshub.com/#]IndiaMedsHub[/url] top 10 pharmacies in india

trusted mexico pharmacy with US shipping: buy propecia mexico – safe place to buy semaglutide online mexico

https://expresscarerx.online/# national pharmacies

MediMexicoRx: amoxicillin mexico online pharmacy – finasteride mexico pharmacy

http://medimexicorx.com/# MediMexicoRx

united states online pharmacy viagra [url=http://expresscarerx.org/#]tom thumb pharmacy[/url] australia pharmacy viagra

http://medimexicorx.com/# mexico drug stores pharmacies

cheapest pharmacy to fill prescriptions with insurance: protonix online pharmacy – ExpressCareRx

MediMexicoRx: MediMexicoRx – semaglutide mexico price

viagra pills from mexico [url=https://medimexicorx.shop/#]buy meds from mexican pharmacy[/url] buy viagra from mexican pharmacy

http://medimexicorx.com/# mexico pharmacies prescription drugs

MediMexicoRx: generic drugs mexican pharmacy – modafinil mexico online

opti rx pharmacy: Etodolac – online pharmacy viagra australia

https://medimexicorx.shop/# buying from online mexican pharmacy

online pharmacy cheap viagra [url=https://expresscarerx.org/#]ExpressCareRx[/url] cialis viagra pharmacy

http://medimexicorx.com/# MediMexicoRx

buy kamagra oral jelly mexico: MediMexicoRx – MediMexicoRx

IndiaMedsHub: reputable indian online pharmacy – IndiaMedsHub

IndiaMedsHub [url=https://indiamedshub.com/#]top 10 online pharmacy in india[/url] indian pharmacies safe

http://expresscarerx.org/# rite aid pharmacy abilify

trusted mexico pharmacy with US shipping: MediMexicoRx – modafinil mexico online

п»їmexican pharmacy: tadalafil mexico pharmacy – MediMexicoRx

https://expresscarerx.online/# ExpressCareRx

inhouse pharmacy spironolactone [url=http://expresscarerx.org/#]ExpressCareRx[/url] what pharmacy can i buy viagra

http://expresscarerx.org/# ExpressCareRx

legit mexican pharmacy without prescription: buy antibiotics over the counter in mexico – cheap cialis mexico

accutane mexico buy online: п»їmexican pharmacy – sildenafil mexico online

http://medimexicorx.com/# medicine in mexico pharmacies

IndiaMedsHub [url=http://indiamedshub.com/#]online shopping pharmacy india[/url] IndiaMedsHub

Cialis without prescription: Cialis without prescription – tadalafil online no rx

http://tadalafilfromindia.com/# generic Cialis from India

Zoloft Company [url=https://zoloft.company/#]cheap Zoloft[/url] Zoloft online pharmacy USA

cheap Accutane: isotretinoin online – generic isotretinoin

Zoloft for sale: generic sertraline – cheap Zoloft

https://lexapro.pro/# Lexapro for depression online

https://lexapro.pro/# lexapro price comparison

Zoloft Company [url=https://zoloft.company/#]cheap Zoloft[/url] Zoloft online pharmacy USA

tadalafil online prescription: generic Cialis from India – Cialis without prescription

http://isotretinoinfromcanada.com/# generic isotretinoin

lexapro brand name discount: lexapro 2.5 mg – lexapro discount

isotretinoin online [url=https://isotretinoinfromcanada.com/#]purchase generic Accutane online discreetly[/url] cheap Accutane

generic brand for lexapro: Lexapro for depression online – generic lexapro

https://tadalafilfromindia.com/# buy Cialis online cheap

Tadalafil From India: Tadalafil From India – Tadalafil From India

https://lexapro.pro/# generic for lexapro

get generic propecia without a prescription [url=https://finasteridefromcanada.shop/#]Finasteride From Canada[/url] п»їpropecia

lexapro 10 mg generic: lexapro 10 mg tablet – Lexapro for depression online

https://finasteridefromcanada.com/# cheap Propecia Canada

generic Finasteride without prescription: cost of propecia online – cheap Propecia Canada

Finasteride From Canada [url=https://finasteridefromcanada.shop/#]generic Finasteride without prescription[/url] generic Finasteride without prescription

lexapro 10: Lexapro for depression online – buy lexapro

https://tadalafilfromindia.com/# cheap Cialis Canada

Zoloft online pharmacy USA: generic sertraline – Zoloft Company

https://lexapro.pro/# Lexapro for depression online

buy Cialis online cheap [url=https://tadalafilfromindia.com/#]60 mg tadalafil[/url] Tadalafil From India

http://isotretinoinfromcanada.com/# generic isotretinoin

Zoloft online pharmacy USA: sertraline online – Zoloft Company

cheap Cialis Canada: Tadalafil From India – generic Cialis from India

sertraline online [url=https://zoloft.company/#]Zoloft online pharmacy USA[/url] Zoloft Company

https://finasteridefromcanada.com/# generic Finasteride without prescription

Cialis without prescription: buy Cialis online cheap – cheap Cialis Canada

buy Zoloft online without prescription USA: buy Zoloft online – buy Zoloft online without prescription USA

https://finasteridefromcanada.shop/# generic Finasteride without prescription

https://tadalafilfromindia.com/# Tadalafil From India

Accutane for sale [url=http://isotretinoinfromcanada.com/#]cheap Accutane[/url] purchase generic Accutane online discreetly

Zoloft Company: Zoloft for sale – cheap Zoloft

buy lexapro online india: lexapro 5 mg tablet price – Lexapro for depression online

https://isotretinoinfromcanada.shop/# isotretinoin online

generic Cialis from India [url=https://tadalafilfromindia.shop/#]cheap Cialis Canada[/url] buy Cialis online cheap

generic Finasteride without prescription: generic Finasteride without prescription – generic Finasteride without prescription

isotretinoin online: purchase generic Accutane online discreetly – buy Accutane online

https://zoloft.company/# purchase generic Zoloft online discreetly

https://lexapro.pro/# Lexapro for depression online

Propecia for hair loss online [url=https://finasteridefromcanada.shop/#]cheap Propecia Canada[/url] propecia order

cheap Zoloft: Zoloft Company – Zoloft Company

https://tadalafilfromindia.shop/# buy Cialis online cheap

purchase generic Accutane online discreetly [url=https://isotretinoinfromcanada.com/#]buy Accutane online[/url] order isotretinoin from Canada to US

Finasteride From Canada: cheap Propecia Canada – generic Finasteride without prescription

http://tadalafilfromindia.com/# generic Cialis from India

http://finasteridefromcanada.com/# Finasteride From Canada

generic Finasteride without prescription [url=https://finasteridefromcanada.shop/#]order cheap propecia pills[/url] Propecia for hair loss online

cheap Propecia Canada: cheap Propecia Canada – propecia sale

https://tadalafilfromindia.shop/# buy Cialis online cheap

prescription price for lexapro [url=https://lexapro.pro/#]lexapro brand name discount[/url] Lexapro for depression online

buy generic tadalafil online cheap: Cialis without prescription – generic Cialis from India

https://tadalafilfromindia.com/# generic Cialis from India

cheap Accutane [url=https://isotretinoinfromcanada.shop/#]purchase generic Accutane online discreetly[/url] generic isotretinoin

best price for lexapro: Lexapro for depression online – buy lexapro brand name online

cheap Propecia Canada [url=https://finasteridefromcanada.com/#]cheap Propecia Canada[/url] generic Finasteride without prescription

Lexapro for depression online: Lexapro for depression online – lexapro prescription

lexapro 5 mg tablet price: Lexapro for depression online – lexapro 20 mg discount

https://tadalafilfromindia.shop/# generic Cialis from India

cheap Zoloft: buy Zoloft online – Zoloft for sale

get propecia without dr prescription: cheap Propecia Canada – generic Finasteride without prescription

buy Zoloft online: generic sertraline – generic sertraline

http://isotretinoinfromcanada.com/# USA-safe Accutane sourcing

best price for lexapro generic: Lexapro for depression online – Lexapro for depression online

Isotretinoin From Canada [url=https://isotretinoinfromcanada.com/#]isotretinoin online[/url] buy Accutane online

cost clomid pills: order cheap clomid pills – can i get cheap clomid now

NeuroRelief Rx: NeuroRelief Rx – gabapentin 300 principio attivo

Clomid Hub Pharmacy [url=https://clomidhubpharmacy.com/#]Clomid Hub[/url] Clomid Hub

https://reliefmedsusa.com/# where to buy prednisone 20mg no prescription

order corticosteroids without prescription: ReliefMeds USA – canadian online pharmacy prednisone

prednisone 10mg price in india: prednisone otc uk – online order prednisone

safe Provigil online delivery service: smart drugs online US pharmacy – where to buy Modafinil legally in the US

how to get generic clomid [url=https://clomidhubpharmacy.shop/#]Clomid Hub[/url] order cheap clomid now

safe Provigil online delivery service: Modafinil for focus and productivity – Modafinil for focus and productivity

https://clomidhubpharmacy.shop/# Clomid Hub

low-cost antibiotics delivered in USA: low-cost antibiotics delivered in USA – antibiotic treatment online no Rx

NeuroRelief Rx [url=https://neuroreliefrx.com/#]NeuroRelief Rx[/url] NeuroRelief Rx

anti-inflammatory steroids online: order corticosteroids without prescription – prednisone canada

Relief Meds USA: prednisone 50 – anti-inflammatory steroids online

how long before gabapentin starts to work: where can i buy fluoxetine – NeuroRelief Rx

Clear Meds Direct [url=https://clearmedsdirect.shop/#]Clear Meds Direct[/url] order amoxicillin without prescription

ClearMeds Direct: antibiotic treatment online no Rx – buy amoxicillin online uk

https://wakemedsrx.shop/# buy Modafinil online USA

does gabapentin affect blood glucose [url=https://neuroreliefrx.com/#]gabapentin side effects heartburn[/url] NeuroRelief Rx

Clomid Hub: where can i get clomid tablets – can you get clomid pills

Relief Meds USA: order corticosteroids without prescription – order corticosteroids without prescription

safe Provigil online delivery service [url=http://wakemedsrx.com/#]where to buy Modafinil legally in the US[/url] Wake Meds RX

where to buy Modafinil legally in the US: buy Modafinil online USA – buy Modafinil online USA

https://wakemedsrx.com/# prescription-free Modafinil alternatives

gabapentin and anxiety depression: NeuroRelief Rx – NeuroRelief Rx

low-cost antibiotics delivered in USA [url=https://clearmedsdirect.com/#]order amoxicillin without prescription[/url] ClearMeds Direct

Relief Meds USA: order corticosteroids without prescription – anti-inflammatory steroids online

WakeMedsRX: wakefulness medication online no Rx – smart drugs online US pharmacy

online prednisone: can you buy prednisone – order corticosteroids without prescription

gabapentin antibiotic interaction: NeuroRelief Rx – NeuroRelief Rx

anti-inflammatory steroids online [url=https://reliefmedsusa.com/#]anti-inflammatory steroids online[/url] prednisone 20 mg purchase

https://clearmedsdirect.com/# low-cost antibiotics delivered in USA

20mg prednisone: Relief Meds USA – prednisone 50mg cost

NeuroRelief Rx: gabapentin 400 mg pret – NeuroRelief Rx

gabapentin horror stories [url=https://neuroreliefrx.com/#]gabapentin sale[/url] NeuroRelief Rx

anti-inflammatory steroids online: 40 mg daily prednisone – Relief Meds USA

ReliefMeds USA: Relief Meds USA – prednisone in india

Clomid Hub Pharmacy: how to get generic clomid without dr prescription – Clomid Hub

http://wakemedsrx.com/# affordable Modafinil for cognitive enhancement

gabapentin for radicular pain: NeuroRelief Rx – gabapentin intractable hiccups

anti-inflammatory steroids online: anti-inflammatory steroids online – order corticosteroids without prescription

anti-inflammatory steroids online: prednisone 40 mg rx – Relief Meds USA

Clomid Hub: can you get generic clomid for sale – Clomid Hub Pharmacy

gabapentin in verbindung mit alkohol: NeuroRelief Rx – gabapentin and 300mg

http://mexicarerxhub.com/# MexiCare Rx Hub

pharmacies in mexico that ship to usa: MexiCare Rx Hub – mexican border pharmacies shipping to usa

canadian pharmacy 365: CanadRx Nexus – onlinecanadianpharmacy 24

MexiCare Rx Hub: MexiCare Rx Hub – MexiCare Rx Hub

canadian pharmacies that deliver to the us: best canadian online pharmacy reviews – canada discount pharmacy

india online pharmacy: IndiGenix Pharmacy – indian pharmacy online

CanadRx Nexus: CanadRx Nexus – canada drugs online

https://canadrxnexus.shop/# www canadianonlinepharmacy

online canadian pharmacy: CanadRx Nexus – CanadRx Nexus

IndiGenix Pharmacy: IndiGenix Pharmacy – mail order pharmacy india

semaglutide mexico price: MexiCare Rx Hub – MexiCare Rx Hub

MexiCare Rx Hub: buy viagra from mexican pharmacy – MexiCare Rx Hub

best mexican online pharmacies: mexico pharmacies prescription drugs – mexican pharmaceuticals online

CanadRx Nexus: canada rx pharmacy world – CanadRx Nexus

http://mexicarerxhub.com/# MexiCare Rx Hub

rybelsus from mexican pharmacy: MexiCare Rx Hub – safe mexican online pharmacy

legal to buy prescription drugs from canada: CanadRx Nexus – CanadRx Nexus

indian pharmacy: indian pharmacy paypal – п»їlegitimate online pharmacies india

MexiCare Rx Hub: MexiCare Rx Hub – MexiCare Rx Hub

CanadRx Nexus: CanadRx Nexus – trusted canadian pharmacy

prescription drugs mexico pharmacy: MexiCare Rx Hub – MexiCare Rx Hub

http://canadrxnexus.com/# canadian pharmacy meds reviews

CanadRx Nexus: CanadRx Nexus – canadian pharmacy com

mexico drug stores pharmacies: MexiCare Rx Hub – MexiCare Rx Hub

MexiCare Rx Hub: MexiCare Rx Hub – cheap mexican pharmacy

best mail order pharmacy canada: CanadRx Nexus – canadian pharmacy sarasota

mexican rx online: mexican mail order pharmacies – MexiCare Rx Hub

IndiGenix Pharmacy: п»їlegitimate online pharmacies india – IndiGenix Pharmacy

MexiCare Rx Hub: buy modafinil from mexico no rx – real mexican pharmacy USA shipping

https://mexicarerxhub.shop/# MexiCare Rx Hub

MexiCare Rx Hub: MexiCare Rx Hub – MexiCare Rx Hub

MexiCare Rx Hub: low cost mexico pharmacy online – best mexican pharmacy online

canada drugstore pharmacy rx: canadian pharmacy prices – CanadRx Nexus

IndiGenix Pharmacy: indianpharmacy com – IndiGenix Pharmacy

CanadRx Nexus: escrow pharmacy canada – CanadRx Nexus

IndiGenix Pharmacy: india pharmacy mail order – IndiGenix Pharmacy

MexiCare Rx Hub: MexiCare Rx Hub – mexican pharmaceuticals online

CanadRx Nexus: best mail order pharmacy canada – canada drugstore pharmacy rx

https://canadrxnexus.shop/# CanadRx Nexus

Online medicine home delivery: IndiGenix Pharmacy – mail order pharmacy india

IndiGenix Pharmacy [url=http://indigenixpharm.com/#]indian pharmacy online[/url] best online pharmacy india

cheapest online pharmacy india: top online pharmacy india – IndiGenix Pharmacy

CanadRx Nexus: CanadRx Nexus – CanadRx Nexus

AsthmaFree Pharmacy: AsthmaFree Pharmacy – AsthmaFree Pharmacy

buy lasix online [url=https://fluidcarepharmacy.shop/#]lasix uses[/url] FluidCare Pharmacy

AsthmaFree Pharmacy: AsthmaFree Pharmacy – AsthmaFree Pharmacy

https://fluidcarepharmacy.shop/# FluidCare Pharmacy

furosemida 40 mg: furosemide 40mg – furosemida

AsthmaFree Pharmacy: AsthmaFree Pharmacy – AsthmaFree Pharmacy

RelaxMedsUSA: RelaxMeds USA – prescription-free muscle relaxants

AsthmaFree Pharmacy [url=https://glucosmartrx.com/#]AsthmaFree Pharmacy[/url] AsthmaFree Pharmacy

https://glucosmartrx.com/# AsthmaFree Pharmacy

AsthmaFree Pharmacy: where to get semaglutide near me – AsthmaFree Pharmacy

AsthmaFree Pharmacy: 2.5 mg semaglutide – AsthmaFree Pharmacy

lasix tablet [url=https://fluidcarepharmacy.shop/#]buy lasix online[/url] buy furosemide online

relief from muscle spasms online: affordable Zanaflex online pharmacy – cheap muscle relaxer online USA

affordable Zanaflex online pharmacy: Tizanidine tablets shipped to USA – muscle relaxants online no Rx

lasix for sale [url=https://fluidcarepharmacy.shop/#]FluidCare Pharmacy[/url] FluidCare Pharmacy