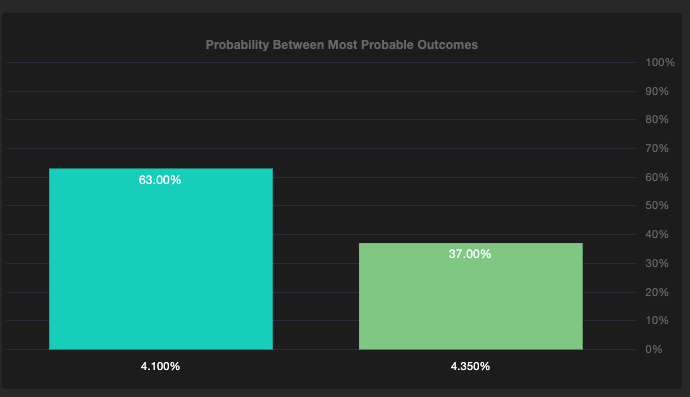

On Tuesday at 0530 UK time the RBA will be meeting and deciding on whether to hike rates or pause on rates. At the moment the market is pretty much evenly split over what decision the RBA will make. At the end of last week short term interest rate markets saw a 37% chance that the RBA would hike by 25bps and a 63% chance that they would pause on rates. So, according to short term interest rate markets a 25 bps hike would be a surprise.

Economists favour another hike.

A recent Reuters poll see 16 out of 31 economists favouring a 25bps hike, with 15 seeing a pause ahead from the RBA. So, when you combine the survey with short term interest markets it is roughly a 50/50 split as to whether the RBA will hike or not. Remember, that the RBA delivered a hawkish surprise hike in their last rate decision.

Look to the forward guidance for the moves in the AUD

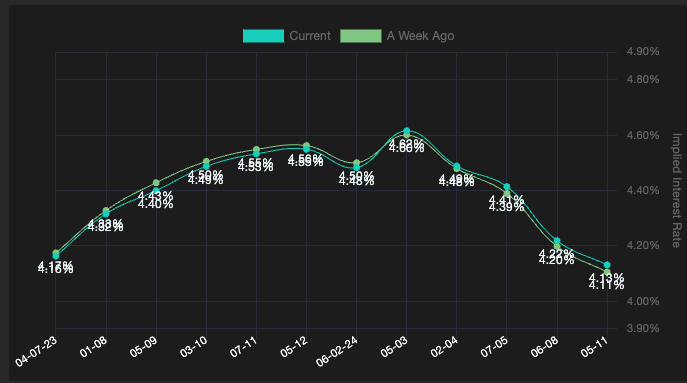

What markets will want to know is whether or not the RBA has finished hiking rates. STIR markets still see a terminal rate of 4.62% in the spring of next year.

So, the communication will be crucial for the moves in the AUD. Here is what to watch for:

- If the RBA hike by 25 bps and signal that they have finished hiking rates then expect the AUD to spike higher on the release and then be immediately faded.

- If the RBA pause rates but signal more rate hikes are still to come it will depend on how many extra hikes they signal. If they signal a terminal rate of 5% or higher then the AUD will still likely gain.

- If the RBA pause rates and signal that they have finished hiking rates and that they are at terminal then the AUD will likely sharply fall as the higher rate expectations gets priced out. The pairs to watch would be the AUDUSD or the AUDNZD for potential falls

buy amoxil generic – amoxicillin generic order generic amoxil

buy generic fluconazole for sale – https://gpdifluca.com/ diflucan 100mg us

order escitalopram pill – https://escitapro.com/# escitalopram tablet

order cenforce online – fast cenforce rs purchase cenforce

order generic cialis online – ciltad genesis canadian pharmacy ezzz cialis

where to buy generic cialis – https://strongtadafl.com/ best place to get cialis without pesricption

buy viagra tablets uk – https://strongvpls.com/ 50 off viagra coupon

order ranitidine 300mg without prescription – https://aranitidine.com/ ranitidine 150mg without prescription

The sagacity in this serving is exceptional. https://buyfastonl.com/gabapentin.html

Greetings! Utter serviceable suggestion within this article! It’s the petty changes which choice espy the largest changes. Thanks a lot in the direction of sharing! site

With thanks. Loads of knowledge! https://prohnrg.com/product/orlistat-pills-di/

The depth in this tune is exceptional. https://ursxdol.com/get-cialis-professional/

The sagacity in this serving is exceptional. ou trouver du viagra ou cialis

Thanks for sharing. It’s acme quality. https://ondactone.com/product/domperidone/

I couldn’t turn down commenting. Warmly written!

buy esomeprazole 20mg for sale

I couldn’t turn down commenting. Profoundly written! http://zqykj.cn/bbs/home.php?mod=space&uid=302440

dapagliflozin 10 mg price – on this site forxiga 10 mg cheap

buy orlistat – https://asacostat.com/# buy xenical generic

This is a theme which is in to my heart… Myriad thanks! Faithfully where can I notice the connection details for questions? https://sportavesti.ru/forums/users/oufqi-2/

You can conserve yourself and your family close being heedful when buying pharmaceutical online. Some pharmacy websites function legally and provide convenience, privacy, sell for savings and safeguards as a replacement for purchasing medicines. buy in TerbinaPharmacy https://terbinafines.com/product/exelon.html exelon

I couldn’t weather commenting. Warmly written! aranitidine.com

This is the description of topic I take advantage of reading.

So stellen Sie sicher, dass Sie die aktuellste und zuverlässigste Version erhalten. Sie können nach einer Einzahlung Freispiele an beliebten neuen Spielautomaten erhalten und schon sind ein paar Klicks nötig, um den Spaß zu beginnen. Das Erlebnis ist die perfekte Mischung aus dem Spaß eines echten Casinos und der Leichtigkeit, online zu spielen. Wenn Sie diese Schritte befolgen, können alle zurückkehrenden Mitglieder sofort Zugriff erhalten.

Um sicherzustellen, dass das Spiel fair ist, suchen Sie nach RNG-Zertifikaten von iTech Labs, GLI oder eCOGRA sowie nach einem Streitbeilegungsdienst wie ADR oder IBAS. Bevor Sie Dendera Casino finanzieren, stellen Sie sicher, dass Sie die Gebühren für jede Methode kennen. Wenn Sie eine Einzahlung tätigen, werden Karten sofort und E-Wallets und Kryptowährungen fast sofort gepostet.

Spieler können daher sicher sein, dass ihre Daten und ihr Spielverlauf geschützt sind. Zu den beliebtesten Angeboten gehören Willkommensboni für neue Spieler, regelmäßige Einzahlungsboni und spezielle Promotionen, die das Spielerlebnis verbessern. Dendera Casino bietet eine Vielzahl von Bonusangeboten, um sowohl neue als auch bestehende Spieler zu begeistern.

References:

https://online-spielhallen.de/rocketplay-casino-deutschland-dein-guide-zum-online-spielerlebnis/

Der erste, dem dies gelang, war Joseph Jagger, ein britischer Industrieller, der eine Abweichung in den Roulette-Rädern bemerkte. Es war auch ein Hotspot für erfahrene Spieler, und es dauerte nicht lange, bis das Unvorstellbare geschah. Die legendäre Spielzone zog viele wohlhabende Industrielle, amerikanische Magnaten und sogar europäischen Adel an. Nach Überarbeitung der Pläne, Akkumulierung von Mitteln und Nutzung von Blancs Verbindungen wurde das Monte-Carlo Casino gebaut und 1865 eröffnet. Das Unternehmen führt die Geschäfte noch heute und betreibt auch die Oper in Monte Carlo und das Hotel de Paris. Blanc gründete zusammen mit Charles III., Fürst von Monaco, die Monte-Carlo Société des Bains de Mer.

Nach einem ruhigen Besuch am Morgen können Sie sich am Nachmittag (ab 14 Uhr) den Freuden des Glücksspiels hingeben! Sie werden jedoch erfahren, dass die Uhr in den Salons Touzet ein Überbleibsel aus einer Zeit ist, in der sich die Spieler im Spielwahn nicht leisten konnten, den letzten Zug zu verpassen! Das ist seltsam, denn Uhren sind in Kasinos oft verboten, da die Spieler dort jegliches Zeitgefühl verlieren können.

Der Eintritt in die Tischspielbereiche des Casinos kostet 17 €, wodurch Sie einen 30 €-Gutschein erhalten, den Sie in den Restaurants oder zum Spielen verwenden können. Zu dieser Zeit müssen Besucher des Casinos 18 Jahre alt sein, die Kleiderordnung einhalten und einen Ausweis vorlegen. Seitdem hat das Casino de Monte-Carlo in seinen mit Gold verzierten Barockräumen ein breites Spektrum der internationalen Elite empfangen. Im gleichen Zeitraum Sir Winston Churchill war ein weiterer erfolgreicher Spieler im Casino de Monte-Carlo. Im Jahr 1911 rasten die ersten Rennwagen durch das Casino von Monte-Carlo, während der Rallye Monte Carlo. Auch Wladimir Lenin kam vorbei und schimpfte, dass die Öffentlichkeit ihr Geld bei einem bloßen „Glücksspiel“ verspielte – was, wenn man kein Bolschewist ist, furchtbar viel Spaß macht.

References:

https://online-spielhallen.de/princess-casino-promocode-ihr-weg-zu-extra-boni-und-vorteilen/

Du kannst klassische Spiele wie Roulette, Blackjack und Baccarat spielen, aber auch eine Vielzahl spannender Varianten ausprobieren. Schon ab €20 kannst du deine Gewinne abheben, was für Spieler, die mit kleineren Einsätzen spielen, echt gut ist. Dies ermöglicht risikofreies Kennenlernen verschiedener Spiele, bevor Sie mit echtem Geld spielen. Zunächst wählt man zwischen Casino-Bonus (100% bis 500€ plus 200 Freispiele und Bonuskrabbe) und Sport-Bonus (100% bis 100€) oder verzichtet auf einen Startbonus.

Egal, ob Sie ein Fan von Spielautomaten, ein Stratege bei Tischspielen oder ein Wett-Enthusiast sind – Posido hat für jeden etwas zu bieten. Egal, ob Sie einen Slot spielen oder an einem Live-Dealer-Tisch Platz nehmen möchten – die Plattform funktioniert perfekt auf iOS- und Android-Geräten. Diese Flexibilität sorgt dafür, dass Spieler keine Kompromisse eingehen müssen, wenn sie unterwegs spielen möchten. Mit einer Auswahl, die Tausende von Spielautomaten, klassische Tischspiele, innovative Spielshows und spannende Live-Casino-Erlebnisse umfasst, bietet Posido Spielern jeder Vorliebe ein maßgeschneidertes Erlebnis.

References:

https://online-spielhallen.de/greatwin-casino-bonus-code-ihr-umfassender-leitfaden/

Backgammon Online at CrazyGames is a free version of the original classic, featuring tabletop-like graphics and sounds that simulate the in-person game. Backgammon Online is part of our casual game collection, where you can find more fun classics based on original real-life series. Keep your eye on this area; it is key to winning the game. The Backgammon Online board has been set up for you from the beginning. Your board may be virtual, but the rules and goals are identical. This little die adds a lot of fun strategy to the game.

Enjoy features such as real-time chat, player rankings, and customizable game settings. The objective is to move all your checkers into your home board and bear them off before your opponent does the same. Additionally, the game is sometimes played in rounds with a scoring system deciding the eventual winner. The object of the game is to move your pieces along the board’s triangles and off the board before your opponent does. Would you like to play another game with the same players? You are now disconnected, other players won’t see you online and can’t challenge you.

References:

https://blackcoin.co/goat-spins-casino-in-australia-real-money-casino-wins/

The streaming quality is excellent, with professional dealers and seamless gameplay across devices. RocketPlay’s live casino section features 86 tables powered primarily by Evolution Gaming, the undisputed leader in live dealer technology. We noticed new games being added weekly during our review period, which is a positive sign of RocketPlay’s commitment to offering variety. Pokie fans will be in heaven at RocketPlay, with over 2,400 slot games spanning every theme, feature, and volatility level imaginable.

Best of luck in all your future gaming endeavors. Enjoy the game to the moon and back! Replied to 100% of negative reviews Customer service representatives are extremely knowledgeable and experienced and make it easy to deal with I only just signed up so I am rating my score based on what I experienced. Everything is easy to find and support is easy to find and always helpful.

RocketPlay Casino is a Curacao-licensed online casino offering Australian players a secure platform with a wide range of games, crypto support, and generous bonuses. For players seeking something beyond traditional casino spins, rocket game gambling offers a high-energy, skill-infused experience that keeps you coming back for the next launch. For AU players searching rocketplay online casino live content, the live section delivers real dealers, HD streams and chat interaction. If you searched for rocketplay, rocket play, or rocketplay casino, you’ll find practical advice on bonuses, games, payments and how to use rocketplay login.

References:

https://blackcoin.co/5_types-of-casino-bonuses-in-new_zealand_rewrite_1/

These 3 are the main markers when it comes to the game lobby. Responsible gambling policies are a must, too. If you want to do some research of your own and find your best match, there are some very specific things to follow to tell the ripper sites from the average.

Whether you are having issues with depositing, or need to know how to claim a bonus, help is just a click away. On the other the charity GamCare is offering multi-lingual gambling support services, and allows for a number of people to have access to emotional and practical support. They offer several ways to help find an organization that will be able to offer people counseling plan and gambling services for the individual.

References:

https://blackcoin.co/all-crown-casino-online-games/

Dedicated customers can also join the rewards scheme, where unique perks and customized bonuses are granted for ongoing engagement. After logging in, you will be able to top up your account, participate in promotions, track your betting history and manage bonuses. The site functions seamlessly across all devices, providing instant page loading and straightforward access to games and promotional sections. The platform’s structure reflects the tastes of Australian players, noticeable in both customized payment options and a locally-adapted aesthetic. Crypto deposits have no withdrawal limits, and the average payout time is an impressive 10 minutes.

This comprehensive framework of governance maintains player trust, underscoring SkyCrown’s dedication to responsible gaming practices. SkyCrown’s Curaçao license ( sublicense 8048/JAZ) ensures compliance with stringent regulations, guaranteeing a fair and transparent gaming experience. Experience the thrill of SkyCrown’s enticing welcome offer, where a 120% match bonus up to A$1,200 plus 125 free spins awaits your first deposit with code CLASSY. The platform partners with reputable providers like Pragmatic Play, Evolution, BGaming, and Hacksaw Gaming, ensuring a fair gaming experience through iTech Labs or GLI audits. Sign up now with the promo code Skycrown Casino and experience the ultimate gaming thrill with SkyCrown!

Consumers also report problems with withdrawals, citing delays, rejections without valid reasons, and requests for excessive verification details. Many consumers believe the site is a fraudulent imitation of a well-known casino, designed to steal personal information and money. Customers report significant issues with the website, including slow loading times, constant freezing, and unexpected redirects to different domains. Most reviewers were unhappy with their experience overall. Most problems get sorted out in just a few minutes, especially common ones like bonus activation or payment status.

References:

https://blackcoin.co/monte-casino-overview/

Now, you might be thinking, “This sounds great, but do they play by the rules?” Absolutely! It stands as an epitome of sophistication with its refined, elite gaming environment. And if you’re more inclined towards an intimate, exclusive club ambiance, look no further than Capital Club East Africa.

The welcome bonus package delivers real value with its $2,500 matched deposit offer and 100 free spins. For Australian players seeking variety, the gaming library exceeds expectations. Sky Crown casino emerges as a legitimate contender in Australia’s online gaming landscape.

SkyCrown Casino supports various payment methods including credit/debit cards, e-wallets (PayPal, Skrill, Neteller), bank transfers, and cryptocurrency options (Bitcoin, Ethereum). We operate in compliance with all relevant regulations and hold the necessary licenses to provide online gaming services to Australian residents. New accounts receive our generous welcome package instantly, allowing you to start playing with bonus funds right away.

References:

https://blackcoin.co/golden-crown-casino-australia-in-depth-review/

Progressive jackpots offer players the chance to win life-changing sums. Enjoy over 150 live dealer games, streamed in HD with interactive chat. If you like table games, you can play blackjack, roulette and baccarat. There are lots of different games, from classic pokies to immersive live dealer games. Completing the code on Friday allows players to claim 60 free spins, with a maximum win of AUD 150, subject to a 40x wagering requirement. The bonus is available for a variety of games, and wagering requirements of x40 apply.

Some reviewers report fast and easy deposits and withdrawals, including crypto payments. People also mention the helpful and friendly customer service, noting the quick resolution of issues. Customers appreciate the user-friendly website and seamless user experience. Reviewers had a great experience with this company.

References:

https://blackcoin.co/all-caesars-properties-in-las-vegas-2025-list/

online casino paypal einzahlung

References:

https://jobhaiti.net/employer/online-casino-mit-paypal-einzahlung-die-top-casinos-im-vergleich/

paypal casinos

References:

https://www.muadirect.co.uk/employer/2025s-best-paypal-casinos-expert-verified-sites/

online betting with paypal winnersbet

References:

https://booyoung-elec.com/bbs/board.php?bo_table=free&wr_id=6

online blackjack paypal

References:

https://mixclassified.com/user/profile/1039914

paypal casinos

References:

https://generaljob.gr/employer/2025-australia-legal-online-casinos,-aussie-online-casinos/

paypal casinos online that accept

References:

https://jobthejob.altervista.org/employer/best-online-slots-to-play-in-2025-the-ultimate-guide-to-slots/

Go to the OnSelect property of Update button and write the below formula. If the result of the formula is a blank value, then there is no record in the result table for that input record. However, if the formula returns a record, the resulting table will include records with the same columns as the returned record. If the formula returns a single value, the resulting table will be a single-column table.

When updating and creating data from a gallery to a SharePoint list, using Patch(ForAll()) is the better choice over ForAll(Patch()). This method leads to multiple requests to SharePoint, which can be inefficient for larger datasets. Let’s consider a scenario where you have a gallery that displays various fishing trip data, including the location, date, the number of fish caught, and a unique identifier for existing trips. To do so, insert a Button control on the Power Apps screen and set its OnSelect property to the code below.

The building consists of a partly sunken basement and an elevated ground floor or piano nobile above which are two additional floors. Like the Treasury Building, the gardens, neighbouring buildings and wall are all heritage-listed. It forms the northern edge of the group of important public buildings surrounding Queens Gardens. The new campus is set to open in 2027, in time for the 2032 Summer Olympic Games.

References:

https://blackcoin.co/ufo9-casino-your-place-to-play-your-way/

paypal casinos online that accept

References:

https://empleosrapidos.com/companies/best-online-poker-real-money-sites-for-usa-players-in-2025/

online betting with paypal winnersbet

References:

https://jobsremote.work/employer/aussie-play-casino-no-deposit-bonus-codes/

online casino paypal

References:

https://ajira-hr.com/employer/10-best-online-pokies-and-casino-sites-in-australia-2025/

casino avec paypal

References:

https://part-time.ie/companies/top-paypal-casinos-in-canada-2025-best-paypal-gambling-sites/

Visit Site – Layout is crisp, browsing is easy, and content feels trustworthy and clear.

„Viele Casinos bieten diese Option nicht an, aber für mich ist es die sicherste und bequemste Zahlungsmethode. „Ich spiele fast ausschließlich auf meinem iPad während der Zugfahrt zur Arbeit“, erzählt Stefan Gruber, 35, Architekt aus Wien. Verde Casino verzichtet auf eine dedizierte App und setzt stattdessen auf eine fortschrittliche Progressive Web App (PWA), die auf allen Geräten überzeugende Leistung bietet.

Von Counter-Strike, Dota 2 und League of Legends bis hin zu Valorant, Fortnite und FIFA eSports – hier finden Wettfans zahlreiche spannende Möglichkeiten, auf ihre Lieblingsteams und -spieler zu setzen. Casino Verde sorgt mit diesen und vielen weiteren Tischspielen für eine realistische Casino-Atmosphäre, in der sich sowohl Anfänger als auch erfahrene Spieler wohlfühlen. Casino online Verde bietet seinen Spielern somit eine sichere und faire Spielumgebung, die durch moderne Technologien und offizielle Genehmigungsverfahren unterstützt wird. Die Plattform bietet sowohl klassische Slots als auch moderne Video-Slots, Tischspiele und ein beeindruckendes Live-Casino-Erlebnis mit echten Dealern. Verde Casino ist eine der besten Anlaufstellen für Fans von Online-Glücksspielen. Turniere werden auch im VerdeCasino sowohl für Slot- als auch für Kartenspieler abgehalten. Dort können Sie gegen andere Spieler spielen und zusätzlich tolle Preise abkassieren.

References:

https://onlinegamblingcasino.s3.amazonaws.com/casinos%20in%20miami%20florida.html

References:

4 week anavar before and after female

References:

https://herbert-iversen.mdwrite.net/winstrol-vs-anavar-ein-umfassender-vergleich-fur-bodybuilder

References:

Anavar cycle before and after pictures

References:

https://zenwriting.net/shearswitch92/best-online-casino-with-top-slots-and-mobile-play

legit networking site – Smooth browsing experience with useful business connections at hand.

click for insights – Information is useful and can be applied immediately in real scenarios.

click for smart insights – Content is straightforward, making business trends easy to follow.

applied business tips – Helpful guidance, concepts are easier to implement in practice.

practical insights portal – The content is clear, actionable, and easy to follow.

industry knowledge click – Insights are clear, keeping readers informed and ready to act on new opportunities.

growth flow tips – Easy-to-understand strategies, progress feels achievable without stress.

strategic thinking zone – A useful space for exploring structured ideas.

alliances resource center – Helpful guidance, simplifies understanding of market partnerships.

push forward with power – Clear and approachable, illustrating how letting energy move accelerates progress.

EasyRetailDigital – Smooth browsing and fast checkout streamline the online shopping process.

OpportunityMasterOnline – Practical guidance, long-term prospects are presented clearly.

secureonlinecart – Shopping here is quick, smooth, and worry-free.

easyshoppingportal – Online shopping is simple, convenient, and fast to navigate.

build valuable connections – Great explanations here, guidance feels practical and useful.

UnityFrameworkPro – Very organized, understanding enterprise frameworks feels effortless and straightforward.

progression planner – Clear strategies, makes tackling projects step by step simpler.

partnerhub – Very practical, professional networking is explained in a clear, actionable manner.

alliances guide hub – Very useful, real market examples enhance understanding of partnerships.

focus drives clarity – Smooth and practical, showing how attention clears the way for progress.

CorporateKnowledgeCenter – Reliable corporate information presented in a user-friendly way.

corporategrowthlinks – Very useful, strategies for enterprise partnerships are structured and easy to apply.

grow and improve daily – Provides approachable advice that keeps you motivated.

InnovationDiscoveryHub – Lessons are practical and approachable, innovations are easy to follow.

dependableshopping – Smooth and secure online purchases with confidence every time.

trusted network guide – Hub provides clarity, networking is simplified and actionable.

growthplanningportal – Easy-to-use insights that make implementing growth strategies manageable.

strategyinsider – Practical and informative, market strategies are easy to implement in real situations.

trusted partnership insights – Well-structured examples, makes alliance strategies easier to follow.

clarity solutions – Informative and actionable, breaks down ideas clearly.

SmartGrowthSolutions – Easy advice, making complex decisions becomes more manageable.

action drives results – Short and effective, linking movement with tangible outcomes.

enterprisealliancesguide – Step-by-step advice for managing corporate alliances successfully.

enterprise connection tips – Helpful content, networking with companies is simple to understand.

EasyBuyOnline – Clear layout, navigating the platform is simple and fast.

learnsmartskills – Useful content, developing skills for the future is easy to understand and apply.

onlineshopnavigator – Clear and helpful, buying products online is intuitive and smooth.

urban buying space – The marketplace feels well curated and easy to browse.

trusted partnership insights – Well-structured examples, makes alliance strategies easier to follow.

task focus hub – Very clear advice, helps prevent distractions and maintain steady progress.

BusinessGrowthNavigator – Roadmap insights are easy to follow and apply in real scenarios.

BusinessFutureVision – Clear and practical, building long-term goals feels organized and easy.

signal your path – Friendly and natural, emphasizes how clear direction arises from thoughtful signals.

strategymap – Guides you through planning and executing strategies successfully.

trusted strategic connections – Helpful guidance, site explains partnerships in a practical way.

quickbargainshop – User-friendly platform, browsing and purchasing deals is simple.

shoplink – Smooth and intuitive, finding and purchasing products is simple.

ReliableBuyHub – Smooth platform, shopping and checkout are secure and convenient.

market collaboration hub – Informative advice, alliances explained clearly for market applications.

CreativeOutletOnline – Encourages innovation, platform navigation is smooth and intuitive.

business bond solutions – Content is clearly written and confidence boosting.

activator hub – Useful guidance, makes mapping out objectives feel simple.

corporatelinkmap – Helps chart connections for better business outcomes.

meaningful knowledge click – Enjoyed learning here, material is structured logically.

retailhub – Very user-friendly, shopping for products online is fast and intuitive.

growthhub – Excellent insights, these partnership tips are easy to understand and implement.

alliances guide hub – Very useful, real market examples enhance understanding of partnerships.

strategic business network – Useful platform, supports the growth of reliable business alliances.

long-term planning portal – Guidance is clear, helping users focus on sustained growth effectively.

DealHuntPro – Effortless checkout, platform looks up-to-date and intuitive.

KnowledgeMastery – Well-structured content, learning feels efficient and approachable.

workablesolutions – Makes applying solutions simple and practical for any situation.

OutcomeSignal – Offers focused advice that directly contributes to positive results.

retailinnovationcenter – Practical and concise, exploring future retail options is simple and efficient.

strategiccollaborationclick – Practical approach for businesses looking to form structured alliances.

learn smart digitally – Practical guidance, content makes digital growth simple and effective.

simple online shop – Feels efficient and considerate of how customers browse.

learnfromexpertinsights – Excellent site, expert insights are practical and easy to apply today.

SmartBuyNetwork – Focuses on cost-conscious purchasing with reliable options.

fastshopplatform – Very practical, online buying is simple and hassle-free.

market partnership guide – Clear guidance, real examples make strategies understandable.

intelligent learning hub – Offers practical insights to boost learning efficiency and growth.

SimpleStrategicSolutions – Turns complicated strategic options into clear, actionable advice.

long-term planning portal – Guidance is clear, helping users focus on sustained growth effectively.

commercialbondinghub – Provides actionable tips to manage bonds with security and clarity.

QuickDecisionHub – Tips are concise, allowing users to make informed choices quickly.

industryinsights – Informative and concise, readers can easily understand how top professionals succeed.

growth path – Clear tips, content makes prioritizing actions straightforward and effective.

LearnEffectively – Platform emphasizes clarity and makes skill building approachable.

build trust professionally – Helpful resources, connecting with peers feels comfortable.

future-focused trade – Suggests a clear vision for companies wanting sustainable growth in digital commerce.

PartnershipStrategyPro – Feels well suited for organizations planning structured collaboration.

smartenterpriseadvice – Clear and actionable, enterprise guidance is explained well and easy to apply.

market alliance hub – Very insightful, helps understand alliances in real-world market situations.

global retail infrastructure – Concept supports large-scale online operations with international reach.

FastDigitalStore – Clear categories and smooth layout improve the online experience.

flexible outlet picks – The range available makes browsing feel smooth.

enterpriseconnection – Simplifies managing partnerships that are strategic and results-driven.

online deals hub – Appears reliable, with fair prices and easy access to products.

ecommerceportal – Clear and simple, the online purchase process is easy to follow.

planforwardhub – Emphasizes foresight, useful for forward-thinking business owners.

FutureStrategyCenter – Provides actionable guidance for mapping long-term objectives effectively.

MarketBuyPro – Smooth platform, online purchases are simple and trustworthy.

click for trust partnerships – Helpful content, browsing global partnerships feels smooth and natural.

clarity learning hub – Very useful, helps process and apply new information quickly.

trusteddealmarketplace.click – Marketplace looks credible, I’d feel safe making deals here personally.

alliances insight platform – Useful tips, simplifies how alliances operate in different markets.

securecommercialalliances – Feels safe and reliable, guidance on alliances is clear and actionable.

businessframeworksportal – Practical insights on enterprise structures, clearly laid out for immediate use.

GlobalCommerceHub – Convenient interface, makes shopping from multiple regions effortless.

valuebuynow – Makes finding quality deals quick and hassle-free for everyday purchases.

Professional Development Space – Learned new techniques that I can implement right away at work.

marketrelationspro – Easy to understand, guidance for market relationships is structured and professional.

CustomerFirstClick – Smooth navigation and simple shopping process for all users.

reliable shopping hub – Navigation feels natural and accessing items is straightforward.

NextLevelBusinessHub – Platform seems ideal for spotting high-potential business opportunities online.

essential buys portal – Clean layout and fast load times provide a convenient shopping experience.

explore growth potential – Informative and encouraging, site makes progress planning simple.

NextStepPlanner – Guidance is detailed and actionable, making strategic planning straightforward.

strategic market alliances – Easy to apply examples, shows how alliances work in real-world business situations.

securebuyzone – Marketplace feels professional, inspires confidence for first-time shoppers.

clarity powers – Very helpful insights, content shows how to build momentum effectively.

CostWiseShop – Highlights savings while maintaining a smooth online shopping experience.

SmartExpansionGuide – Practical framework, helps make intelligent decisions when planning growth.

dailydealcenter – Efficient and smooth, searching for bargains is simple today.

retailurbanstore – Browsing feels seamless, and shopping is simple and enjoyable.

businesslink – Insightful and user-friendly, growth strategies are easy to follow and apply.

Growth Path Insights – Clear explanations that made the planning process feel natural.

ClickForBusinessTips – Easy navigation, lessons are highly useful and straightforward.

BusinessTrustNetwork – Reliable branding helps encourage partnerships with integrity and accountability.

construct digital pathway – Helpful tips, information makes digital project planning feel simple.

market collaboration hub – Informative advice, alliances explained clearly for market applications.

think differently hub – Browsing here opens up new ways to approach problems and ideas.

procorporatebonds – Well-laid out, communicates trustworthiness and serious business focus.

reliable buying site – Safety-first approach makes online transactions easier and more reassuring.

TopShoppingDeals – Simple and trustworthy, browsing deals is smooth and hassle-free.

EverydaySolutionsCenter – Offers realistic advice that works in daily situations.

structured progress – Encouraging advice, makes tackling growth feel manageable and logical.

alliancetips – Very informative, partnership strategies are straightforward and ready to use.

trustedbonds – Very practical, commercial bond advice is professional and straightforward.

BudgetDealsCenter – Designed to appeal to shoppers seeking value and affordability online.

expansionhub – Provides clear steps to apply business growth principles successfully.

globalenterprisealliances – Informative platform, global alliance strategies are explained clearly and practically.

Professional Growth Network – Easy-to-follow platform that encourages genuine business connections.

ScaleAndLearnPortal – Clear explanations, really helps in understanding expansion strategies.

VisionaryPlanningLab – Highlights tools for proactive strategy and future-oriented thinking.

knowledge click hub – Well-structured lessons, acquiring knowledge is easy and engaging.

market alliance hub – Very insightful, helps understand alliances in real-world market situations.

trusted business network – Messaging communicates reliability, which is attractive for professional collaborations.

UnderstandingBusinessNow – Makes complex topics easy to digest and apply.

trust deals center – Efficient layout and reliable options simplify the comparison and selection process.

growthlink – Very helpful, strategies are easy to follow and implement effectively.

buildgrowthplans – Step-by-step guidance helps make digital growth planning straightforward.

TopBuyOnline – Well-designed platform, shopping experience feels intuitive and premium.

action guide – Very useful guidance, makes progress seem structured and achievable.

discover opportunities – Cool approach, it invites people to click freely and see what turns up.

Commerce Innovation Space – Helpful breakdowns that make new ideas less intimidating.

DigitalShoppingHub – Smooth browsing and clear content, learning e-commerce trends is fast.

SmartChoiceStore – Adjusts well to varying needs and delivers a modern retail experience.

CorporateAlliancePro – Designed to foster dependable enterprise partnerships.

market alliance insights – Helpful tips, shows how alliances work in realistic settings.

strategic guidance click – Easy-to-understand content, strategy concepts are clear and concise.

dependableshoppinghub – Looks well-structured, gives shoppers a secure and simple experience.

NetworkingElite – Smooth experience for connecting with others, information seems trustworthy.

greenpartnerships – Very practical, sustainability strategies for business partnerships are easy to apply.

shoppingmadeeasy – Practical and quick, online shopping is straightforward and effortless.

networking opportunities hub – Clear, professional layout makes finding and building connections simple.

strategic growth guide – Excellent tips, content encourages intentional movement toward goals.

MarketIdeasOnline – Insightful and concise, understanding market ideas is straightforward.

next-level retail portal – Smooth browsing and interactive elements make shopping fun.

FutureFocusNetwork – Designed to help users translate ideas into concrete, strategic plans.

Collaborative Growth Hub – Provides helpful strategies for creating lasting and mutually beneficial partnerships.

EnterpriseStrategyClick – Professional guidance, easy to understand and implement in business.

trusted alliance resources – Informative content, helps relate alliances to practical business cases.

explore partnership paths – Useful content, helps plan alliances thoughtfully and effectively.

ReliableBondResource – Structured and trustworthy, strategic bonds are easy to explore and learn.

SmartShopCenter – Projects reliability and good value for online purchases.

fastbuycenter – Clear and helpful, shopping online feels seamless.

ClickNShop – Straightforward checkout and navigation, with a clean layout.

shopassureportal – Projected professionalism, encourages users to shop without worry.

retailstrategycenter – Practical and helpful, retail commerce guidance is clear and actionable.

curiosity starter – Keeps information engaging and easy to absorb.

global bargains hub – Buying is smooth and categories are clearly arranged for convenience.

ActionGuide – Easy-to-follow tips that lead to measurable improvements.

EnterpriseTeamLinks – Promotes professional teamwork and long-term collaboration opportunities.

DecisionClarityClick – Practical insights that simplify the decision-making process.

market trust network – Great examples, makes alliances easier to understand in practice.

Retail Commerce Network – The platform delivers actionable information and market analysis.

main hub – Light layout, organized sections, very easy to navigate

business bonding insights – Helpful resources, building professional trust is simple.

ProfessionalTrustGuide – Insightful site, helps navigate professional relationships with confidence.

bizlink – Very reliable, guides users effectively on forming professional relationships.

OnlineGrowthBlueprint – Offers useful steps for building digital success efficiently.

global enterprise connections – Highlights opportunities for long-term international business growth.

top link – Well-designed site, navigation is intuitive and information is straightforward

careeradvancementhub – Helpful resources, career growth strategies are clear and actionable.

trusted buying portal – Feels secure and trustworthy, encourages repeated visits for shopping.

BudgetWiseShop – Projects savings and reliability for online consumers.

ReliableShopCenter – Layout is user-friendly and builds trust for digital purchases.

trusted market partnerships – Insightful content, makes alliance concepts relatable and practical.

OnlineShoppingHub – Very clear platform, content is practical and easy to follow.

global bond insights – Accessible explanations make researching enterprise bonds faster and easier for beginners.

Business Opportunity Space – The information helped uncover ideas that were off my radar.

online buying hub – Very convenient, the site makes purchasing simple and quick.

unity advice center – Lessons are clear, understanding partnerships is less complicated.

online access – Smooth navigation, fast-loading, content is easy to understand

savvyvaluehub – Easy to use, finding discounts and deals is clear and convenient.

TopDealFinder – Easy-to-use site, discovering deals feels smooth and straightforward.

TrustyBizPortal – Easy and secure navigation, ideal for online business operations.

explorebusinessopportunities – Insightful resources, finding business opportunities feels easy and practical here.

trustedbuymarket – Emphasizes reliability, perfect for users seeking a secure shopping platform.

expertwisdomportal – Clear and helpful, professional guidance is simple to read and apply.

worldwide buying hub – Wide product range supports shopping across borders.

trusted business alliances – Practical examples, makes market alliances easy to follow.

TeamworkStrategyNetwork – Focused on strategic collaborations and building professional alliances.

BusinessUnityClick – Very informative, teaches about international partnerships in a clear manner.

Professional Collaboration Hub – Provides guidance for building alliances that last and inspire trust.

nevra.click – Clean layout and speedy loading, I stayed longer than expected

strategicalliancesinsights – Clear and practical, users can easily apply corporate alliance guidance.

trusted enterprise guide – Framework layout is logical, providing clarity for learning business strategies.

nextlevel online hub – Practical interface, the shopping process is clear and straightforward.

BudgetFriendlyCart – Designed to attract shoppers who prioritize value and savings.

SmartShoppingHub – Easy-to-navigate platform, buying items online is convenient.

BusinessAllianceMastery – Step-by-step advice, long-term partnership concepts are presented clearly and effectively.

startup discovery portal – Emphasizes uncovering creative opportunities in the business world.

strategicbondnavigator – Offers structured tips for managing strategic bonds safely.

proleaderguidance – Insightful platform, market leaders’ strategies are easy to follow and use.

professional business network – Branding feels authoritative and perfect for serious corporate relationships.

alliances resource center – Helpful guidance, simplifies understanding of market partnerships.

EnterpriseNetworkingPro – Emphasis on enduring connections supports meaningful business collaboration.

ClickUrbanRetail – Easy browsing experience, platform shows product options quickly.

engine of motion – Smooth and practical, showing how energy and focus drive progress.

trusted business guide – Structured layout helps users understand key business ideas efficiently.

Digital Buyer Hub – Clear tips that simplify product selection and comparison.

official site – Fast-loading pages, intuitive design, very easy to understand

landing page – Clear layout, content is concise and browsing feels effortless

teaminsights – Very useful, professional collaboration guidance is actionable and easy to apply.

EasyPickStore – Smooth navigation, making online purchases effortless and quick.

career strategy guides – Helpful insights, helps plan professional growth in a clear way.

SafeDealsCenter – Organized and reliable, purchasing online is quick and stress-free.

ecommerceforbeginners – Straightforward interface, seems designed for those new to online selling.

growth strategy resource – Helps users consider sustainable, long-term goals and actions.

trustedcartcenter – Easy-to-use platform offering a smooth and secure checkout experience.

globaldigitalshoppingmarket – Smooth interface, site offers a good overview of digital marketplaces worldwide.

marketinsights – Very clear and helpful, offers practical guidance for navigating market relationships.

trusted alliance resources – Informative content, helps relate alliances to practical business cases.

InsightfulProfessionals – Highlights useful takeaways for improving work strategies and approaches.

SmartDealsHub – Offers a platform for shoppers seeking the best value purchases.

LearnExpertTips – Practical content, allows me to implement professional strategies successfully.

forward flow created – Clear, motivating language demonstrating that motion built with purpose drives success.

]enterpriseconnect – Clear and well-organized, readers can understand alliance frameworks quickly.

useful link – Simple and clean, navigation felt effortless throughout

Online Purchase Space – The layout helps keep browsing clear and efficient.

future ready shop – Product selection is tidy and easy to scan through.

LearnAndLeadBiz – Clear structure, provides hands-on approaches to mastering business skills.

secure buy platform – Easy to follow steps, checkout feels safe and efficient.

digital business courses – Reminds users that acquiring business skills online is simple and flexible.

successinsights – Tips and advice that help accelerate growth without overcomplicating things.

learning progression hub – Structured to help users grow understanding step by step.

decisionwisdomportal – Makes choosing the right option simple and actionable.

CorporateConnectionsPro – Well-organized platform, networking feels reliable and professional.

StreamlinedRetailOnline – Focused on reducing friction and making digital shopping easy.

online portal – Fast-loading layout, readable pages, overall browsing is pleasant

businessalliancespro – Informative and helpful, explains strategic alliance strategies clearly for practical use.

Clean Looking Site – Found this by accident, the layout is surprisingly clear

Digital Shopping Innovations – Introduces clever ways to browse and shop products online.

drive builder site – Makes beginning a journey feel manageable and positive.

corporate networking site – A solid option for businesses interested in shared development opportunities.

SavvyShopperHub – Emphasizes smart spending and great value options.

enterpriseblueprint – Helps you translate strategic frameworks into real business outcomes.

SavvyShopper – Detailed product descriptions and good pricing make choices easy.

consciousconsumerhub – Simplifies eco-friendly shopping decisions for thoughtful consumers online.

alliancesinsightshub – Very clear, alliance strategies are safe to follow and easy to apply.

MetropolitanRetailHub – Designed for city shoppers, the interface feels relevant and accessible.

FrameworkNavigatorPro – Structured and helpful, frameworks are explained clearly and effectively.

reliableonlinecommerce – Safe and reliable, buying products online feels simple and secure today.

professional networking tips – Content is clear, makes relationship building easier to understand.

explore now – Pages load instantly, simple navigation, content is easy to understand

CorporateTrustHub – Platform feels professional, advice for corporate bonding is clear and actionable.

innovation strategies portal – Encourages trying new solutions rather than relying on old habits.

Corporate Collaboration Lab – Offers practical strategies to strengthen professional bonds.

enterprise partnerships hub – Messaging is concise and tailored to helping companies collaborate effectively.

digital shopping space – Modern design keeps navigation simple and enjoyable.

businesslinkmap – Helps you chart connections for more effective networking.

official site – Clean interface, organized layout, information is easy to follow

tavro link – Rapid page loads with organized information and smooth browsing

new market angles – Encourages exploring unconventional market approaches for business growth.

vyrxo page – Organized layout, concise text, and enjoyable to scroll through

success frameworks – Insightful resource, simplifies understanding and implementing growth frameworks.

corporateconnectionshub – Very practical, building corporate connections is simple and reliable.

IntelligentRetailSpace – Platform encourages users to make deliberate decisions in digital shopping.

official signalturnsaction – Pleasant first impression, content is clear and approachable

global business network – Easy to navigate, content helps understand international alliances effectively.

resource page – Simple and clean, fast-loading pages, very readable content

SavvyDealsHub – Focuses on affordability and convenience for online buyers.

GlobalTrustExplorer – Practical and informative, international networking is well-organized and easy to follow.

Ideas for Growth – The suggestions here motivate me to test new ideas regularly.

budget shopping portal – Focus on value seems strong, helping shoppers stretch their money further.

sustainablecollaboration – Clear strategies for fostering eco-conscious and reliable business partnerships.

secure deal portal – Payment process feels controlled and user-friendly.

smart shopping center – Communicates convenience and efficiency for everyday online shopping.

ClarityNavigator – Supports careful consideration and structured thinking in business evaluation.

zylor info – Efficient navigation, concise text, and pages render quickly

focusamplifiesgrowth network – Crisp interface, readable sections, and overall browsing is enjoyable

smart thinking hub – Encourages analysis, step-by-step strategy explanations are accessible.

EasyCart – Shopping here is smooth, no hassles at all.

start browsing – Simple structure, quick response times, very user-friendly overall

korixo site – Everything is laid out nicely and feels friendly to navigate

user-friendly ecommerce site – Straightforward setup makes it perfect for small business owners.

Partnership Strategy Center – Very helpful examples for establishing reliable and successful alliances.

LearnPlanExecute – Clear and actionable tools, strategy planning becomes simple.

globalpartnershipinfrastructure – Very detailed, global partnership infrastructure is explained clearly and practically here.

careerboostcenter – Provides clear and actionable resources to improve career growth.

EcommerceSafetyNet – Security-first branding encourages confidence for first-time shoppers.

long-term enterprise guide – Focuses on mapping strategies that ensure business resilience over time.

fast find shopping – Everything is positioned to make browsing faster.

axivo network – Neat design, content is concise, and browsing is hassle-free

growthflowswithclarity web – Simple interface, organized content, and browsing is smooth and intuitive

landing hub – Pages open quickly, navigation is effortless, content is straightforward

value deals hub – Practical and budget-conscious, suitable for shoppers looking to save.

Corporate Connections Lab – Very useful guidance for managing and nurturing business relationships.

online retailer – Easy checkout and timely notifications made the order process simple.

retail site – Navigation is simple, and item listings inspire confidence.

mexto source – Easy-to-read pages with information presented clearly

NextStepExplorer – Platform motivates strategic planning for professional and personal growth.

secureshoppingcenter – Promotes safety and reliability, ideal for long-term shoppers.

check progressmovesforwardnow – Clear sections and smooth navigation create a comfortable browsing experience

mavix e-store – Pages load reliably, content readable and overall navigation smooth.

xavro network – Pleasant interface, well-structured information, and smooth navigation

browse xenvo – Smooth design, concise sections, browsing experience is effortless

thrift shopping site – Focus on smart spending makes it ideal for deal seekers.

web shop – Organized product listings and filters made browsing effortless.

BrixelPortal – Smooth experience, clear design, and moving between pages was effortless.

Visit Voryx – Layout straightforward, content easy to follow, and browsing was smooth.

Informed Pathways – Clear structure that builds confidence when making important decisions.

explorefuturedirections – Inspiring content, learning about future directions feels engaging and useful today.

Ulvaro Direct – Pages open fast, design simple and finding products effortless.

brand store – Just came across this store, prices are decent and checkout worked easily.

Kavion Path Hub – Pages load quickly, interface clean and product details easy to read.

IntentionalStrategyHub – Offers focused guidance for cultivating strategic knowledge and professional growth.

reliablecommercialbonds – Projects professionalism and safety for online bond transactions.

QuickBond – Layout is straightforward and effortless to explore.

progressmoveswithfocus hub – Well-structured design with intuitive layout for visitors

check zulvix – Intuitive interface, quick access to content, site feels well-made

clyra web – Thoughtful layout, readable content, and overall smooth browsing experience

corporate reliability network – Conveys stability, which may matter to long-term focused firms.

official brivox – Pages load without delay and the information is easy on the eyes

purchase page – Reliable and fast, product pages load quickly, and ordering is smooth.

Digital Value Shop – Helps make smart purchase decisions while reducing time spent browsing.

Korivo Point – Fast site, easy navigation and content easy to find and understand.

retail page – Pages load smoothly, categories structured clearly, and browsing is stress-free.

Vixor Online – Fast-loading pages, intuitive layout, and product details easy to understand.

Plivox Lane Store – Pages responsive, navigation smooth and product descriptions clear.

RixarAccess – Clean design, fast pages, and browsing felt effortless.

navix center – Pages opened instantly, checkout easy and experience overall pleasant.

AppliedSolutionsCenter – Focuses on delivering immediately usable approaches for practical problem solving.

allianceprohub – Presents reliability, ideal for serious business partnerships and strategic links.

directionanchorsprogress hub – Minimal style, concise content, and navigation is very clear and logical

start here – Clean interface, smooth browsing, felt very straightforward

worldwide business collaboration – Implies cooperation among enterprises across multiple regions.

plexin corner – Clean pages, readable text, and overall simple yet effective design

plivox store – My first order went smoothly and the packaging was tidy.

Zorivo Hub Hub – Smooth interface, content clear and navigation effortless.

zylavostore online – Layout uncluttered, product details useful and visuals clean.

Business Growth Options – Presents ideas that help expand strategic thinking naturally.

ZexonHub – Product info detailed, made browsing much simpler and faster.

Qulavo Flow – Pages load quickly, navigation smooth and site feels easy to use.

Zylavo Edge – Layout simple, everything readable, and locating items was straightforward.

xavix platform – Well-organized pages, easy navigation, and overall enjoyable visit

EverydayPurchaseOnline – Easy and reliable, completing purchases is fast and convenient.

explore here – Neat design, easy navigation, content is accessible and clear

visit directionpowersmovement – Well-organized pages, minimal distractions, and everything responds fast

modern buying hub – Sleek feel suggests relevance to present-day retail habits.

shopping platform – Mobile layout was intuitive, and categories made navigation simple.

tekvo hub – Organized pages, smooth flow, and information is presented clearly

PlavexHub – Pages load quickly, layout is clear, and navigating the site is simple.

Xelarionix Click – Layout clean, browsing simple and purchasing process quick and easy.

xelarion web – Clicked through, store seems reliable and browsing is simple.

nolra online store – Layout clear, pages responsive and filtering makes selection easy.

Business Leadership Insights – Lessons here gave me a better understanding of market strategies.

Xelra Hub Online – Smooth interface, quick loading pages and checkout steps simple.

Zaviro Main – Pages load quickly, navigation is smooth, and product info is easy to understand.

online portal – Everything loads smoothly and explanations are concise and clear

e-commerce innovation hub – Reflects current trends in online shopping behavior and user preference.

actionpowersmovement home – Clean layout, content is easy to understand, and navigation works smoothly

shopping platform – I was happy with how politely they responded.

axory page – Simple, clean design with organized information and smooth navigation

olvra network – Smooth and rapid navigation, information seems reliable

QelaAccess – Pages opened fast, info was appropriate and clear.

Visit Rixaro – Layout neat, pages responsive and the shopping experience went without issues.

zorivoshop link – Fast, clean, and easy to browse without distractions.

MorixoCenter – Interface clear, navigation intuitive, and overall site feels responsive.

Global Business Alliance – A well-structured platform for expanding global professional ties.

Kryvox Store – Pages responsive, layout clean and shopping experience felt effortless.

NevironCenter – Minimal design yet effective, pages responsive, and information easy to digest.

explore now – Smooth interface, concise content, pages load effortlessly

torivo market – The website looks clean, products are decent, and checkout went smoothly.

ideasbecomeforward corner – Clean interface, intuitive flow, and information is easy to locate

olvix web – Clear interface, well-organized pages, and content is engaging without clutter

QuickDealFinder – User-friendly and secure, deals are easy to browse and acquire.

nexlo shop online – Smooth site flow, ordering process simple and pages opened fast.

official store – Clear product listings, filtering made browsing effortless.

Pelix Online – Navigation simple, pages opened quickly and checkout completed without problems.

Korla Shop – Browsing seamless, layout intuitive and completing checkout felt easy.

shopping site – Ran into this store while browsing and saved it.

official nolix – Well-laid-out site where content is easy to comprehend instantly

Modern Korva Site – Clicked on this randomly and liked the clean visual style

PrixoDirect – Layout well-structured, pages fast, and the buying process effortless.

Torix Express – Navigation easy, content well-presented, and purchasing steps uncomplicated.

actioncreatesforwardpath site – Smooth browsing, well-organized content, and sections are easy to locate

XalorAccess – Pages opened instantly, layout organized, and navigation was seamless.

klyvo online – Organized design, simple navigation, and readable text across pages

vexaro hub – Checkout went smoothly, and confirmation came through without delay.

Zexaro Forge Click – Site responds fast, interface intuitive and content easy to follow.

shopping site – The site is tidy, product details make sense, and pictures reflect the items well.

Visit Zarix – Clean layout, responsive pages and shopping experience feels seamless.

top resource – Clear sections, fast pages, and navigation feels natural

GlobalNetworkingGuide – Very useful, helps make sense of international business interactions quickly.

focusdrivesmovement web – Clear structure, smooth scrolling, and information is easy to digest

EasyRixva – Navigation intuitive, site loads fast, and overall experience feels reliable.

ProfessionalRelationsCenter – Insightful platform, navigating business networks is smooth and clear.

XaneroAccess – Interface clear, pages responsive, and finding information was simple.

Maverounity official page – A well-executed project that feels dependable.

qavon homepage – Easy-to-navigate layout with clean presentation and clear information

zaviroplex shop link – Link functioned smoothly, landing page relevant and informative.

Zavirobase Direct – Smooth browsing, intuitive navigation and product details easy to read.

Kryvox Bonding info site – Clean interface, simple navigation, and details feel credible.

Morixo Trustee web page – Layout is simple, navigation is smooth, and information is presented clearly.

shopping site – I had no concerns during payment and the receipt was immediate.

Nolaro Trustee landing page – Simple structure, readable content, and overall site feels polished.

Qelaro Bonding business – Professional layout, structured content, and the site feels trustworthy.

Kryxo Central – Layout minimal but functional, product info clear and checkout simple.

start here – Clean interface, smooth browsing, felt very straightforward

YavonSpot – Pages open quickly, interface organized, and browsing is very user-friendly.

focusbuildsenergy online – Crisp pages, well-structured content, and the site feels professional

StrategicGrowthNavigator – Very practical site, spotting long-term opportunities feels straightforward.

Zavix Point – Design minimal, content clear, and checkout workflow easy to follow.

this link portal – Navigation worked fine, no delays and content appeared as expected.

Ravion Bonded official page – The platform is well-maintained, with clear instructions and frequent refreshes.

Visit Nixaro – Content well organized, navigation smooth and purchasing straightforward.

Kryvox Capital main homepage – Well-structured content, clear interface, and the site gives a polished impression.

xanero mart – Clean layout made browsing pleasant and distraction-free.

ClickEase – Smooth navigation, responsive layout, and browsing was very straightforward.

Explore Nolaro Trustee – Clean sections, trust signals are visible, and overall interface is user-friendly.

Naviro Bonding online hub – Simple design, readable pages, and users can find what they need easily.

Qelaro Capital official portal – Professional layout, intuitive structure, and browsing flows smoothly.

Zavro Express – Browsing seamless, pages responsive and checkout steps simple.

check this site – Quick performance, organized content, really easy to move around

RavloShop – Product pages load fast, images are clear, and details are easy to read.

ravixo link – Efficient browsing experience with concise content that’s useful

signalguidesgrowth today – Information is easy to find, pages are clean and uncluttered

InnovateNowHub – Exciting and clear content, innovations are easy to grasp and understand.

EasyBrixel – Layout professional, pages responsive, and site feels reliable overall.

landing page – Good site concept, content flows naturally, and structure is easy to navigate.

Vixaro Select Shop – Smooth interface, content organized and overall experience reliable.

Cavix main site – Everything is laid out simply, making the intent easy to grasp.

marketplace – The store had logical shipping choices, and arrival estimates were reliable.

Kryvox Trust landing page – Smooth flow between pages, content is clearly organized, and key details stand out.

Pelixo Bond Group landing page – Simple design, structured content, and navigation is effortless.

GrowthPathwayPro – Helpful and structured, growth ideas are easy to navigate and follow.

Explore Qelaro Trustline – Smooth interface, organized content, and overall experience is user-friendly.

Naviro Capital business site – Clean structure, intuitive flow, and pages load without issues.

QuickTrivox – Click functioned well, site loaded fast and info looked genuine.

Velixonode Flow – Pages load quickly, interface minimal and shopping feels easy.

visit xelvix – Smooth experience, content is clear and sections are well organized

EasyClickXelarion – Layout tidy, pages fast, and checkout process smooth.

signalactivatesgrowth today – Easy to browse, clear information, and nice overall flow of content

home page – Confidence was high as security info was presented clearly.

bryxo info – Smooth navigation paired with content that feels authentic

Naviro Trustee online platform – Well-structured content helps the site feel dependable.

shop link – First impression was clean, and everything loaded properly.

QulixSpot – Layout clean and organized, pages responsive, and finding products straightforward.

Visit the Pelixo Capital page – Easy-to-follow content, organized interface, and browsing is simple.

ModernBuyPro – Clear and smooth experience, purchasing products is straightforward.

Mavero Capital web portal – Content is concise, design is appealing, and moving through pages is intuitive.

Qorivo Bonding Official Portal – Easy interface, concise content, and overall browsing is user-friendly.

XevraFlow – Pages open quickly, interface looks organized, and browsing is straightforward.

Neviror Trust web experience – Clear hierarchy, reliable details, and smooth page transitions.

directionunlocksgrowth corner – Pleasant layout, pages are easy to browse, and text is clear

this web portal – Minimalist approach, information presented clearly without clutter.

product site – Clear product info and filtering made selection simple and fast.

visit yavlo – Pages load quickly, information is presented clearly and logically

Pelixo Trust Group platform – Well-laid-out sections, concise content, and navigation is straightforward.

Mivon info site – The project feels promising thanks to its open presentation.

plixo online store – Pages load without delay, interface organized and ordering effortless.

GoQori – Smooth browsing, fast loading, and information easy to locate on all pages.

Qorivo Holdings Official Portal – Easy interface, organized text, and overall experience is user-friendly.

TorivoUnion Online – Well-presented idea, appears trustworthy for extended commitments.

Ulviro Bond Group – Came across this today, seems trustworthy and information is well laid out.

Neviro Union official site – Organized pages, professional design, and users can find what they need quickly.

SecureShopHub – Practical and user-friendly, online shopping is fast and safe.

cavix portal – Enjoyed navigating through well-organized and useful pages

progressmovesintelligently hub – Simple layout, quick access to information, and user-friendly interface

FuturesExplorerPro – Structured guidance, exploring upcoming trends is straightforward and intuitive.

info portal – Site performance is solid, content readable, and layout looks professional.

shop link – Completing my order was simple and hassle-free, no popups appeared.

brixo web shop – Navigation intuitive, product listings clear and payment steps simple.

Qelix online site – Navigation is simple, and details are displayed in a logical order.

Qorivo Trustline Online – Clear headings, organized layout, and overall browsing is effortless.

Visit TrivoxBonding – Found it by chance, information is easy to follow and neatly laid out.

ToriVoExpress – Pages load quickly, navigation simple, and product information clear and trustworthy.

Nixaro Holdings landing page – Easy-to-read sections, intuitive menus, and users can find details without hassle.

actiondrivesdirection info – Easy-to-follow sections, quick page loads, and overall design is pleasant

LearningEdgePro – Easy-to-digest lessons, knowledge is presented clearly and effectively.

item store – Overall, it looks like a real shop with clear policies.

nolix bond – The site is clean, info is easy to read, and navigating is a breeze.

kavion marketplace – Navigation simple, trust badges noticeable and ordering felt secure.

Check Qulavo Bonding – Simple interface, readable details, and navigation is smooth overall.

official zalvo – Clean organization, content is accessible, and site responds rapidly

Learn more at Xaliro Drive – Fast performance and reliable functionality enhance the overall user experience.

TrivoxCapital Site – Everything is laid out logically, information feels natural and straightforward.

Nixaro Partners digital site – Clear design, accessible menus, and the site projects professionalism.

Ulxra Online – Fast-loading pages, intuitive design, and product details easy to understand.

explore signalcreatesflow – Navigation is smooth and the design feels modern and uncluttered

BetterChoiceTips – Clear and practical guidance, decision-making feels natural and approachable.

product marketplace – Browsing felt effortless thanks to the quick page responses.

globalenterprisealliances – Informative platform, global alliance strategies are explained clearly and practically.

online click – Link worked instantly, landing page made sense and loaded properly.

ClickZexaro – Pages respond quickly, clean interface, and all information easy to access.

useful resource – Fast pages and a clean structure kept me engaged

Plavex Capital info portal – Professional look, clear sections, and overall content is easy to read.

Qulavo Capital Portal – User-friendly interface, pages load fast, and details are easy to follow.

Ulvix digital presence – The platform’s structure is clean, making it easy to navigate and read.

UlviroCapitalGroup Resource – Well-structured and readable, information feels honest and approachable.

TrivoxTrustline Project – Openness is a strong point here, key questions are discussed clearly.

Nixaro Trustline online – Clean design, readable menus, and the site projects professionalism.

KoriLink – Layout professional, navigation simple, and adding items to cart was effortless.

focusanchorsmovement online – Neat interface, sections are well defined, and content is easy to digest

product marketplace – The tone stayed realistic and informative.

zavik online – Organized pages, content is clear, and navigation feels smooth

VelixoAccess – Pages are responsive, interface organized, and browsing is seamless.

xeviro web – Seems genuine, visuals match branding and content easy to digest.

Learn about Plavex Holdings – Smooth interface, clear content, and navigating the site is straightforward.

View the full platform – The structure feels polished and the information flows naturally.

TrustBuyHub – Easy-to-navigate site, purchasing online is smooth and reliable.

Qulavo Capital Business – Logical structure, fast-loading content, and the interface feels reliable.

check pelvo – Neat layout, readable content, and the site feels welcoming and uncluttered

UlvaroBondGroup Website – Discovered this today, everything looks straightforward and readable.

Ulviro Trust – Site looks polished, messaging feels reliable and calming.

Brixel Bond Group web portal – The overall presentation builds trust with consistent branding.

online portal – Quick browsing, minimal distractions, explanations are clear

Nolaro Capital digital site – Smooth browsing, readable text, and trust signals are easy to spot.

official shop – Bookmarked it and could return for another order.

signalcreatesmomentum web – Clean, simple design ensures information is accessible and easy to find

NixaroDirect – Pages opened quickly, content readable, and workflow for browsing products was smooth.

digital space – Nothing flashy, simple presentation keeps attention on the content.

Plavex Trust Group hub – Well-laid-out sections, readable information, and overall experience feels reliable.

CorporateTrustFramework – Helpful and professional, businesses can follow these partnership guidelines confidently.

Quvexa Capital Official Hub – Professional appearance, easy-to-read content, and navigation is simple for users.

Open trust group platform – Simple design choices make it suitable for ongoing reference.

FutureStrategyHub – Step-by-step instructions, strategies are straightforward and useful.

UlvaroBonding Hub – Pages load without delay and the details are presented clearly.

VelixoCapital Main Site – Came across today, polished design and clear, understandable information.

Brixel Capital digital presence – The site communicates confidence through consistent tone and design.

trusted resource – Everything worked seamlessly, easy to move between sections

morix portal – Well-structured pages with clear content and intuitive navigation

Nolaro Holdings info – Concise content, smooth navigation, and the design is professional.

shopping platform – Smooth overall experience, I’d definitely share this site.

travik platform – Clear headings, organized content, and smooth experience from start to finish

ulviro hub – Page loaded instantly, visuals clean and content easy to follow.

Plivox Bonding official – Easy-to-navigate site, concise explanations, and overall feel is reliable.

Ulviro Store – Layout professional, browsing smooth, and checkout process straightforward.

UlvaroCapital Link – Well-presented information that avoids unnecessary complexity.

VelixoHoldings Resource – Site feels smooth, content loads fast and details are clear.

Minimal Design Page – Ran into this by accident, the layout feels nicely organized

DealExplorerPro – Organized and efficient, shopping for bargains feels secure.

Check bonding details – The site layout stands out, with information placed where you expect it.

link platform – Smooth clicking, page appeared as expected, user-friendly.

Plivox Capital network – Simple navigation, structured content, and browsing is straightforward.

quorly web – Fast site with nicely arranged content that is relevant to users

ClickEaseNolaro – Navigation simple, content readable, and overall site feels well-maintained.

UlvionBondGroup Network – Trustworthy first impression, consistent look and professional tone throughout.

xelio corner – Pages load instantly, content is understandable, and navigation is simple

quick link – Minimal distractions, organized pages, very user-friendly

VelixoTrustGroup Site – Nice presentation, explanations are direct and easy to follow.

globalbusinessunity – Informative insights, global business unity strategies are clear and useful here.

BuySmartPro – Intuitive platform, premium feel with simple checkout.

Plivox Holdings online portal – Structured content, clear labels, and navigation works smoothly.

Capital homepage link – Looks polished so far, will return to review everything carefully.

platform details – Interesting setup that may offer useful features upon review.

MorvaHub – Design neat, navigation simple, and content trustworthy throughout.

UlvionCapital Project – Easy browsing and clear presentation, making the site simple to understand.

online access – Smooth interface, minimal distractions, everything is easy to navigate

mivox homepage – Enjoyable experience, pages feel organized and information is concise

VexaroCapital Main Site – Polished design, concise content that feels reliable right away.

MarketVisionPro – Informative and engaging, market ideas are simple to grasp and apply.

qerly destination – Logical interface, readable information, and overall browsing is effortless today

bonding platform details – Well-structured content that’s easy to understand.

Trustline platform link – A simple interface combined with smooth performance and fresh info.

UlvionHoldings Online – Attractive design, site feels easy to explore and up-to-date.

Xanero LinkPoint – Clean design, fast browsing, and checkout process simple and clear.

browse velra – Pages load quickly, structure is clear, very accessible content

this pact website – Simple design and helpful details create a positive visit.

Bond details site – Simple design, intuitive navigation, and information is useful overall.

VexaroPartners Online – Pleasant layout, services are explained clearly and realistically.

learnbusinessskillsonline – Excellent learning resources, business skills are explained clearly and practically.

Blog – Well-organized articles that are enjoyable and easy to read.

Careers – Job listings are easy to navigate and presented in a clear, professional style.

Updates – Latest news and announcements are displayed clearly for fast reading.

News – Updates are displayed neatly, layout is clean, and content is easy to read.

PartnershipExpertOnline – Structured and insightful, provides guidance for professional collaborations.

visit xelivo capital – Everything looks well put together with a clear sense of purpose.

velon page – Simple layout, fast navigation, and content that’s easy to digest

grow knowledge portal – Clear explanations and intuitive layout support smooth learning.

visit ulvix – Clear layout, smooth navigation, and everything loads quickly

Learn more here – Easy-to-follow navigation, modern look, and information appears legitimate.

Open bond group homepage – Discovered this while reading up, tone feels calm and informative.

Xeviro Base – Pages load efficiently, navigation simple, and purchasing feels straightforward.

Corporate hub – Well-laid-out pages, responsive design, and content is easy to scan.

zurix homepage – Clean layout, pages are easy to read, and navigation feels intuitive

About Us – Informative layout with clear sections for quick understanding.

VexaroUnity Portal – Concept is engaging, content communicates its values plainly without hype.

About Us – Well-structured sections and intuitive navigation for easy reading.

References:

Lemoore casino

References:

https://justpin.date/story.php?title=150-no-deposit-bonuses-for-aussies-free-spins-cash-offers

Contact – Navigation is simple, and contact details are easy to locate.

Blog – Neat presentation, responsive pages, and information is easy to follow.

xelivotrustgroup.bond – The layout is straightforward and moving through pages feels smooth.

BargainFinderOnline – Smooth and clear, locating bargains feels effortless.

handy page – Fast-loading pages, well-structured content, very user-friendly

strategic partnership hub – Clear explanations outline collaboration opportunities with a professional tone.