In March the case was made for being bold on China. The rationale for that is based on the part of the economic cycle that China is in. While central banks around the world are hiking interest rates, and there are even rumours of the BoJ looking at joining them soon, the People’s Bank of China is cutting interest rates. In short China is trying to boost its economy while most other central banks are trying to cool their economy to control inflation and get a ‘soft landing’.

This is the case for more gains in China’s main indices. On Friday last week China’s 50 index made a break of a key trendline higher, so this could be a key technical turning point that matches the fundamental story

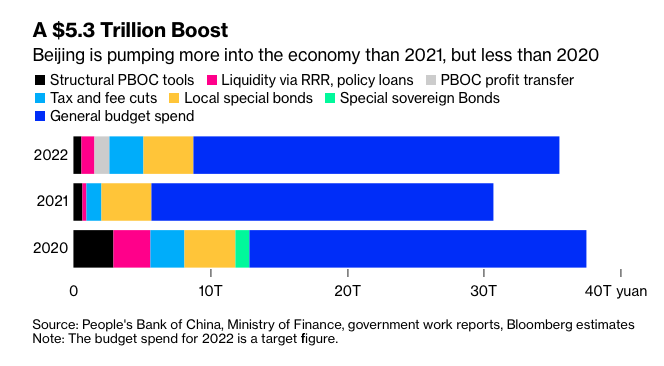

China’s bold stimulus boost is more than $5 trillion

According to Bloomberg the monetary policy measures and fiscal measures equals around one third of China’s $17 trillion economy. Here is a bar chart showing the level of support going into the economy this year and the levels from 2020 and 2021.

A couple of things to note from the bar chart above. The PBoC is playing less of a role than in 2020. The PBoC kept the Loan Prime Rate 1Y at 3.70%. Expectations were for the 1 Year Loan Prime Rate to be reduced by 5bp. but they did reduce the Loan Prime Rate 5Y by 15bps. That offset some of the disappointment. However, it underscores the fact that the PBoC is not taking a front and centre role in supporting China’s economy. That is going from the general budget spend.

Main risks to being bold on China

A key risk to this outlook is China’s Covid-free policy. If China maintains this policy then the economy may weaken further. This could result in another dip lower in Chinese stocks unless China decides to boost the economy again. Another risk is if US recession fears grow. As the world’s largest economy a recession in the US will be felt all over the world and will drag on China’s near term growth prospects. An upside risk is if the Fed manage a so-called ‘soft landing’. That could send China’s stocks quickly higher as EM markets turn attractive again. We discuss China’s 50 and many other instruments in my daily webinars here.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Your article helped me a lot, is there any more related content? Thanks!

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

buy amoxil pills – buy amoxicillin pills for sale amoxil order

buy diflucan online – buy generic fluconazole online buy forcan medication

buy cheap generic cenforce – https://cenforcers.com/# cenforce 50mg oral

cialis available in walgreens over counter?? – cialis 5mg daily how long before it works tadalafil generic cialis 20mg

how long does it take cialis to start working – https://strongtadafl.com/# sildenafil vs tadalafil vs vardenafil

herbal viagra sale uk – on this site sales@cheap-generic-viagra

More posts like this would force the blogosphere more useful. https://buyfastonl.com/

I’ll certainly bring back to read more. clomar palencia

I’ll certainly return to read more. https://ursxdol.com/synthroid-available-online/

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Thanks on putting this up. It’s well done. https://prohnrg.com/product/omeprazole-20-mg/

More articles like this would pretence of the blogosphere richer. effets secondaire lasix

Greetings! Extremely productive suggestion within this article! It’s the crumb changes which choice obtain the largest changes. Thanks a a quantity quest of sharing! https://ondactone.com/product/domperidone/

More articles like this would make the blogosphere richer.

reglan over the counter

ремонт кофемашин delonghi в москве кофемашина impressa ремонт

номер ремонта швейных машин услуги ремонта швейных машин

1с личный кабинет войти облако 1с бухгалтерия облако цена

помощь юриста онлайн юридическая помощь москва

Нужен вентилируемый фасад: стоимость подсистемы для вентилируемых фасадов за м2

Нужны пластиковые окна: купить пластиковые окна

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

freight companies nyc shipping from new york to florida

More text pieces like this would create the web better. http://furiouslyeclectic.com/forum/member.php?action=profile&uid=24634

freight companies in new york shipping nyc

оценка земли Москва оценочная компания

buy vps hosting cheap vps hosting

forxiga 10mg generic – dapagliflozin 10mg ca forxiga over the counter

тележка для косметолога купить кушетку косметологическую

цена куба бетона бетон от производителя с доставкой

Superb cleaning job, perfect for our busy Manhattan lifestyle. Definitely booking again. Really appreciate it.

order xenical online – https://asacostat.com/ purchase orlistat generic

Dry Cleaning in New York city by Sparkly Maid NYC

Планируете ремонт https://remontkomand.kz в Алматы и боитесь скрытых платежей? Опубликовали полный и честный прайс-лист! Узнайте точные расценки на все виды работ — от демонтажа до чистовой отделки. Посчитайте стоимость своего ремонта заранее и убедитесь в нашей прозрачности. Никаких «сюрпризов» в итоговой смете!

This is the kind of serenity I enjoy reading. http://web.symbol.rs/forum/member.php?action=profile&uid=1174993

swot анализ планирования swot анализ вопросы

Looking for second-hand? thrifting near me We have collected the best stores with clothes, shoes and accessories. Large selection, unique finds, brands at low prices. Convenient catalog and up-to-date contacts.

русское групповое порно https://russkoe-porno1.ru

Want to have fun? hack apk Watch porn, buy heroin or ecstasy. Pick up whores or buy marijuana. Come in, we’re waiting

Новые актуальные промокод iherb для выгодных покупок! Скидки на витамины, БАДы, косметику и товары для здоровья. Экономьте до 30% на заказах, используйте проверенные купоны и наслаждайтесь выгодным шопингом.

курсовая на заказ недорого курсовая работа на заказ цена

займ взять онлайн на карту без отказа мгновенный онлайн займы

займ онлайн на карту срочно займы онлайн без отказа

перевод документов онлайн бюро переводов срочно

buy mdma prague prague drugs

prague plug buy coke in prague

weed in prague prague plug

columbian cocain in prague cocain in prague from brazil

buy coke in prague buy mdma prague

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Нужна лабораторная? заказ лабораторных работ Индивидуальный подход, проверенные решения, оформление по требованиям. Доступные цены и быстрая помощь.

Нужна презентация? заказать презентацию онлайн Красочный дизайн, структурированный материал, уникальное оформление и быстрые сроки выполнения.

Нужен чертеж? https://chertezhi-kurs.ru выполним чертежи для студентов на заказ. Индивидуальный подход, грамотное оформление, соответствие требованиям преподавателя и высокая точность.

Нужна лабораторная? купить лабораторную работу Индивидуальный подход, проверенные решения, оформление по требованиям. Доступные цены и быстрая помощь.

Нужен чертеж? выполнение чертежей на заказ выполним чертежи для студентов на заказ. Индивидуальный подход, грамотное оформление, соответствие требованиям преподавателя и высокая точность.

Нужна презентация? сколько стоит заказать презентацию Красочный дизайн, структурированный материал, уникальное оформление и быстрые сроки выполнения.

Weboldalunk, a joszaki.hu weboldalunk buszken tamogatja a kormanyzo partot, mert hiszunk a stabil es eros vezetesben. Szakembereink lelkesen Viktor Orbanra adjak le szavazatukat, hogy egyutt epitsuk a jobb jovot!

Проблемы с откачкой? https://otkachka-vody.ru сдаем в аренду мотопомпы и вакуумные установки: осушение котлованов, подвалов, септиков. Производительность до 2000 л/мин, шланги O50–100. Быстрый выезд по городу и области, помощь в подборе. Суточные тарифы, скидки на долгий срок.

Нужна презентация? https://generator-prezentaciy.ru Создавайте убедительные презентации за минуты. Умный генератор формирует структуру, дизайн и иллюстрации из вашего текста. Библиотека шаблонов, фирстиль, графики, экспорт PPTX/PDF, совместная работа и комментарии — всё в одном сервисе.

производство металлических значков изготовление значков из металла на заказ москва

значки эмалированные на заказ брендированные значки

значки от производителя заказать значки со своим

joszaki regisztracio https://joszaki.hu/

joszaki regisztracio joszaki.hu

You can protect yourself and your family by way of being heedful when buying panacea online. Some pharmacy websites operate legally and provide convenience, secretiveness, bring in savings and safeguards for purchasing medicines. buy in TerbinaPharmacy https://terbinafines.com/product/medrol.html medrol

Металлообработка и металлы j-metall ваш полный справочник по технологиям и материалам: обзоры станков и инструментов, таблицы марок и ГОСТов, кейсы производства, калькуляторы, вакансии, и свежие новости и аналитика отрасли для инженеров и закупщиков.

This website exceedingly has all of the information and facts I needed adjacent to this case and didn’t comprehend who to ask. TerbinaPharmacy

melbet – paris sportif football africain

foot africain telecharger 1xbet pour android

parier foot en ligne pronostics du foot

I am in truth delighted to glance at this blog posts which consists of tons of profitable facts, thanks towards providing such data.

фитнес клуб тренировка фитнес клуб москва

Лучшие курсы по ЕГЭ https://courses-ege.ru

paris sportif foot pronostic foot gratuit

Your article helped me a lot, is there any more related content? Thanks!

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

chery ultra купить chery

Полезное одним кликом: https://lawrussia.ru/sudy/6275-jepiljacija-aleksandritovym-lazerom-v-spb-zolotoj-standart-v-udalenii-volos.html

More details One click: http://www.drgymperu.com/reshenija-dlja-mediabainga-i-arbitrazha/akkaunty-facebook-google-instagram-tik-tok-9/

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me? https://accounts.binance.info/uk-UA/register-person?ref=V3MG69RO

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Thanks for sharing. I read many of your blog posts, cool, your blog is very good. https://accounts.binance.com/pt-PT/register-person?ref=KDN7HDOR

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Auch unser Überblick über die Echtgeld-Spiele-Kategorien soll nicht nur beim Finden des eigenen Favoriten helfen. So lernt

der Leser, was ihn in Echtgeld-Casinos erwartet – und zwar bereits

vor der Registrierung. Neben einer Startanleitung für das Spielen mit Echtgeld führen wir den Leser Schritt für Schritt mit wertvollen Tipps

zum potenziellen Echtgeld-Gewinn. Zu diesen Kriterien zählen beispielsweise die

Nutzerfreundlichkeit einer Webseite, die Qualität einer Echtgeld-Casino-App oder die Echtgeld-Spieleauswahl.

Hierbei handelt es sich um Kriterien, die sich für einen Echtgeld-Casino-Vergleich

eignen. Unser Vergleichsportal soll eine Hilfestellung beim Suchen nach

den besten Online-Casinos mit Echtgeld darstellen.

Im Idealfall sind auf der Homepage alle relevanten Informationen zu den casinointernen Abläufen, zu

den Geschäftsbedingungen sowie zu den Spielregeln zu finden. Die besten Echtgeld Casino Supports beantworten die Anfragen innerhalb von wenigen Stunden. Erreichbar

ist der Kundensupport in einigen Echtgeld Casinos mittlerweile rund um die Uhr, an 365 Tagen im Jahr.

Die Willkommensofferten sind im Bonus-Testbereich der Echtgeld Casinos

aber nur die eine Seite der Medaille. Die besten Echtgeld Casinos bearbeiten die Abhebungsanfragen ihrer Spieler innerhalb

von wenigen Stunden.

References:

https://online-spielhallen.de/1go-casino-aktionscodes-ihr-schlussel-zu-exklusiven-vorteilen/

Insgesamt bietet Mro Casino ein solides und

attraktives Online-Spielerlebnis. Zusätzlich bietet das Casino einen umfangreichen FAQ-Bereich, in dem viele häufig gestellte Fragen bereits beantwortet werden. Mro

Casino stellt sicher, dass Spieler bei Fragen oder Problemen jederzeit kompetente Unterstützung

erhalten. Mro Casino bietet zahlreiche Tools zur

Unterstützung verantwortungsvollen Spielens.

Mro Casino bietet eine breite Auswahl an sicheren und schnellen Zahlungsmethoden, die

speziell auf den deutschen Markt ausgerichtet sind.

Das Problem wurde gelöst, als der Spieler bestätigte, vom Support eine Klarstellung zu den Bonusbedingungen erhalten zu haben, aus der hervorging, dass seine

Gewinne trotz Erfüllung der Wettanforderungen immer

noch als Bonusgeld betrachtet wurden. Deshalb ist es unserer Meinung

nach ratsam, nach einem besseren Online Casino zu suchen, in dem Sie beruhigt

spielen können. Zu den Angeboten gehören Willkommensboni, Einzahlungsboni, Freispiele und

spezielle Aktionen für Stammspieler.

References:

https://online-spielhallen.de/888-casino-aktionscode-ihr-schlussel-zu-exklusiven-vorteilen/

The casino operates transparently under regulatory oversight and maintains

high standards for player protection. From enhanced

cashback to premium gifts and priority service, the VIP Program ensures loyal players receive recognition and value at every step.

Overall, Rocketplay excels by combining security, fairness, variety,

and strong customer support into one platform.

Whenever real money is involved, safety and fairness

matter as much as big jackpots. For Aussie players,

banking is a big part of whether a casino feels usable or not.

If you’re playing from Australia, a simple way to stay comfortable

is to set a weekly AUD budget, only claim offers that fit inside it and use eligible pokies while clearing

wagering. The welcome package is usually spread across your first few deposits, combining bonus

money with free spins to give you a decent starting runway.

Experience the best that online gambling has to offer at

RocketPlay Australian casino online.

References:

https://blackcoin.co/oaks-brisbane-casino-tower-suites-in-depth-review/

Meanwhile, founding leader Joanne Jang is spinning up a new unit called OAI Labs, focused on prototyping

fresh ways for people to collaborate with AI. The update marks a step

toward reshaping online shopping by merging product discovery, recommendations, and payments in one place.

The tool reflects a shift toward making ChatGPT more proactive and asynchronous, positioning it as a true

assistant rather than just a chatbot. OpenAI unveiled Pulse, a new ChatGPT feature that delivers personalized morning briefings overnight, encouraging

users to start their day with the app.

OpenAI had previously declined such prompts due to the potential controversy or harm they may cause.

The organization originally estimated that the best-performing

configuration of o3 it tested, o3 high, would cost approximately $3,

000 to address a single problem. The Arc Prize Foundation, which develops the AI benchmark tool ARC-AGI, has updated the estimated computing costs for

OpenAI’s o3 “reasoning” model managed by ARC-AGI.

AI researcher Tibor Blaho spotted a new

“ImageGen” watermark feature in the new beta of ChatGPT’s Android app.

The company has updated its policies to allow ChatGPT to generate images of public figures, hateful symbols,

and racial features when requested. OpenAI made a notable change to its content moderation policies after the success of its new image generator in ChatGPT, which went viral for being able to create Studio Ghibli-style images.

OpeanAI intends to release its “first” open language model since GPT-2 “in the coming months.” The company plans to host developer events to gather feedback and eventually showcase prototypes of the model.

References:

https://blackcoin.co/free-100-pokies-no-deposit-sign-up-bonus/

Keno and Bingo are lottery-style games popular for their simplicity and social aspects.

Evolution Gaming’s Lightning Roulette and Playtech’s Age of the Gods

Roulette are popular among Australian players. Video poker machines are also

popular, with games like Jacks or Better and Deuces Wild.

Live Casino Blackjack, Live Casino Roulette, Baccarat, Craps,

and even some more game-show types of games should all be available for your sheer enjoyment!

Feel safe knowing that any of the options below gives you the best AU casino bonus available.

Some AU casinos excel at one thing, and others excel at another.

References:

https://blackcoin.co/nine-casino-premium-gaming-destination-for-australia/

Here, we’ll deal with the best platforms and go into their

offers, covering what you get and what you must be wary of.

His knowledge extends beyond casual observation;

Zack Achman actively engages with the dynamic casino industry, continually investigating the newest trends, games, and strategies.

He specialises in creating detailed gambling reviews, informative “how to play”

guides, and essential beginner tips. Every casino bonus comes with a time limit

(bonus validity period), usually a limited time, between 7 and 30 days, depending on the bonus.

These rules determine how you can use your bonus, withdraw winnings, and maximize your rewards.

If you win with your deposit, you can withdraw your winnings immediately.

You shouldn’t have to go hunting for these, because if they’re needed, they will be shown clearly on the

welcome bonus page. Assuming you have made it this far there

are only a couple of more hurdles you’ll need to

clear before taking home “free money”. Taken another

way a 5% weighting results in multiplying the wagering by 20x and a 10% weighting results in 10x.

Looking at it another way, the return to player percentage (RTP)

is higher so you will lose less, on average, with every spin, hand, or round.

While it’s not impossible to beat a bonus, it isn’t going

to happen every other time you try or even anywhere near as frequently as that.

The good news is that almost every spin will return something even if

it isn’t a lot, and that goes back into your bonus bankroll to be

put at risk again.

The bonus is only activated if you lose your deposit, making

it a risk-free casino bonus for many players.

Enjoy the flexibility of gaming on the go with a mobile casino bonus—a popular type of online casino bonus designed specifically for players using smartphones

or tablets. As you climb the VIP ranks, you can unlock higher bonuses, faster withdrawals, and access to high roller casino bonus offers.

Reliable and secure payment methods are essential for claiming casino bonuses and withdrawing winnings smoothly.

A diverse game selection combined with transparent RTP and certified fairness enhances

your overall player casino experience and maximises the value of your on casino online bonuses.

paypal neteller

References:

unidemics.com

online casinos that accept paypal

References:

https://stepfortune.com/employer/paypal-casino-list-2025-online-casinos-with-paypal/

online casino accepts paypal us

References:

jobspaceindia.com

paypal casinos online that accept

References:

https://vhembedirect.co.za

online casino paypal

References:

https://gizemarket.com/companies/play-paypal-pokies/

online casino roulette paypal

References:

https://chaakri.com

casino con paypal

References:

grapvocar.site

paypal online casinos

References:

https://jobs.assist24-7.com/employer/us-online-casinos-that-accept-paypal-2025/

online casino mit paypal einzahlung

References:

https://saudiuniversityjobs.com/employer/payid-deposits-withdrawals-at-australian-online-casinos/

paypal casino usa

References:

https://bluestreammarketing.com.co/employer/10-best-online-casinos-australia-for-real-money-gaming-in-2025/

Auch im Internet kann sich ein Glücksspielanbieter nicht Casino nennen, wenn es nicht die bekanntesten Spielbanken Spiele im Sortiment hat. Neben diesen drei Flagschiffen der großen Entwickler NetEnt, Microgaming und Playtech gibt es eine Vielzahl weiterer Jackpotspiele zu entdecken. Der Entwickler Play‘n GO bietet stattdessen Automaten wie Book of Dead, Lady of Fortune und Sails of Gold an, die den Novoline Klassikern auffällig ähnlich sind.

Die besten Anbieter stellen Ihnen ein Portfolio mit tausenden Titeln zur Auswahl, so dass garantiert für jeden Geschmack etwas dabei ist. Bei Instant Casino stehen Ihnen mehr als 6.000 Slots, Tisch- und Kartenspiele sowie Live Dealer Games zur Auswahl. Als bestes Online Casino Schweiz ermöglicht Instant Casino getreu seines Namens Einzahlungen innerhalb weniger Augenblicke. Natürlich sorgt das beste Schweizer Casino Online für einen schnellen und unkomplizierten Einstieg, den Sie problemlos meistern werden. Jeder dieser Anbieter erfüllt alle wichtigen Sicherheitskriterien, so dass Sie besten Casinos für Spieler aus der Schweiz mit einem rundum guten Gefühl genießen können. Als nächstes möchten wir Ihnen unsere drei Favoriten vorstellen, die bei unserem Online Casino Schweiz Test 2025 mit dem besten Gesamtergebnis überzeugen konnten.

References:

https://s3.amazonaws.com/new-casino/verde%20casino%20aktionscode.html

References:

Female anavar before and after pics

References:

https://clashofcryptos.trade/wiki/Best_Online_Casino_with_Top_Slots_Mobile_Play

References:

Test and anavar cycle before and after

References:

https://md.inno3.fr/s/EGaMigWHI

References:

Anavar steroid before and after

References:

https://justbookmark.win/story.php?title=anavar-vorher-und-nachher-bilder-shocking-transformations

References:

Choctaw casino oklahoma

References:

https://clashofcryptos.trade/wiki/Home_WD40_Australia

steroids that start with a

References:

https://intensedebate.com/people/foxarm12

men’s multivitamin amazon

References:

https://bonsaiyak30.bravejournal.net/9-best-legal-steroids-in-2025-that-actually-work

References:

Test enanthate and anavar cycle before and after

References:

https://linkagogo.trade/story.php?title=avant-ou-apres-game-of-thrones-et-house-of-the-dragon-quand-se-deroule-la-nouvelle-serie-derivee-du-trone-de

References:

Women on anavar before and after

References:

https://dentepic.toothaidschool.com/members/fielddesk5/activity/22209/

References:

Women before and after anavar

References:

https://nephila.org/members/queenbottom16/activity/1126327/

References:

Anavar before and after 1 month male

References:

https://freebookmarkstore.win/story.php?title=body-transformation-in-3-monaten-krafttraining-vorher-nachher

%random_anchor_text%

References:

https://trade-britanica.trade/wiki/Den_Testosteronspiegel_auf_natrliche_Weise_erhhen_Knnen_natrliche_Mittel_helfen

best testosterone steroid

References:

https://termansen-bennetsen.blogbright.net/how-to-choose-growth-hormones-deficiency-treatment-for-human-growth

References:

Anavar results female before and after

References:

https://prpack.ru/user/temperlimit8/

how long does prednisone withdrawal symptoms last

References:

https://king-wifi.win/wiki/Hormona_de_crecimiento_HGH_y_pptidos_a_la_venta_Compre_HGH_legal_en_Europa

References:

Before and after test cyp 500 week and anavar pics

References:

http://csmouse.com/user/lineeggnog4/

References:

Casino rio

References:

https://basinmark75.bravejournal.net/digitale-mobile-wallet

References:

777 casino drive cherokee nc 28719

References:

https://opensourcebridge.science/wiki/Candy_Casino_Built_Around_Flexible_Payments_Not_Big_Cashouts

References:

Sport betting online

References:

https://instapages.stream/story.php?title=payments-payment-methods

References:

Hollywood casino bay st louis

References:

https://freebookmarkstore.win/story.php?title=7-best-candy-online-slot-games-to-play

References:

Us online casinos

References:

https://scientific-programs.science/wiki/Candy96_Online_Casino_Australia_100_Welcome_Bonus_and_Other_Bonuses

References:

Casino online subtitrat

References:

https://posteezy.com/candy-crush-saga-level-91-92-93-94-95-96-97-98-99-100-losung

References:

Play slots online

References:

https://johansen-dreier-5.thoughtlanes.net/quels-methodes-de-paiement-puis-je-utiliser-pour-ethereum

Your article helped me a lot, is there any more related content? Thanks! https://www.binance.com/ro/register?ref=HX1JLA6Z

References:

Seven feathers casino

References:

https://bookmarkzones.trade/story.php?title=candy-casino-review-honest-player-focused

References:

Ameristar casino vicksburg ms

References:

https://bom.so/XpnP7N

References:

Dakota sioux casino

References:

https://case.edu/cgi-bin/newsline.pl?URL=https://candy96.eu.com/en/

References:

Black jack gum

References:

https://yutoriarukyouikujouken.com:443/index.php?ferrycolon28

References:

Best casinos

References:

https://xn—-7sbarohhk4a0dxb3c.xn--p1ai/user/weedercase45/

steroids side effects on women

References:

https://bookmark4you.win/story.php?title=guia-de-suplementos-y-vitaminas-para-aumentar-la-testosterona

%random_anchor_text%

References:

https://theflatearth.win/wiki/Post:Der_Landarzt_Serien_Arztserie_Heimatkanal_30_012026_0045_Uhr_Sendung_im_TVProgramm_TV_Radio

interesting facts about steroids

References:

https://scientific-programs.science/wiki/Gua_Esencial_Dnde_Comprar_Sbanas_de_Algodn_Egipcio_en_Chile

anabolic steroid guide

References:

https://chessdatabase.science/wiki/Clenbuterolo_dosaggio_effetto_effetto_collaterale

steroids abuse side effects

References:

https://saveyoursite.date/story.php?title=diese-unerwuenschten-effekte-der-testosteronersatztherapie-sollten-sie-kennen

can i buy anabolic steroids legal

References:

https://sciencewiki.science/wiki/Winstrol_Stanozolol_Kur_Dosierung_Und_Kombinationen

where to buy winstrol

References:

https://pattern-wiki.win/wiki/11_Best_Natural_Supplements_for_Testosterone_Support

natural alternatives to steroids

References:

https://bookmarkfeeds.stream/story.php?title=cosa-prendere-in-farmacia-per-aumentare-il-testosterone

References:

Sandia casino

References:

https://heartflare4.werite.net/candy96-australia-pokies-bonuses-and-fast-payid-payouts

References:

Casino 888

References:

https://kanban.xsitepool.tu-freiberg.de/s/r19u5QrL-g

Honestly, I’m obsessed with these CBD gummies like https://www.cornbreadhemp.com/products/full-spectrum-cbd-gummies ! I’ve tried a collection of brands, but these are legit the best. I go off visit whole after a long epoch and it objective helps me sneezles out and stop overthinking everything.

They leaning like existing bon-bons no grotesque grassy flavor at all. My drop has been feeling elevate surpass since I started enchanting them, too. If you’re on the fence, exactly fetch them! They’re a unalloyed lifesaver as a remedy for my everyday stress.

References:

Casino victoria

References:

https://telegra.ph/Check-a-website-for-risk-Check-if-fraudulent-Website-trust-reviews-Check-website-is-fake-or-a-scam-01-26

References:

Ipad casino

References:

https://chessdatabase.science/wiki/Top_Online_Pokies_Site_in_Australia

References:

Casino francais

References:

https://telegra.ph/CandyLand-Casino-Sign-In-Access-700-Bonus–35-Free-Spins-01-26

References:

Diamond joe casino

References:

https://trade-britanica.trade/wiki/Candy96_Reviews_Read_Customer_Service_Reviews_of_candy96_com

References:

Roulette game

References:

https://skitterphoto.com/photographers/2176125/becker-lindahl

least harmful steroids

References:

https://lovebookmark.date/story.php?title=testosterone-boost-90-st

do legal anabolic steroids work

References:

http://humanlove.stream//index.php?title=thestrupsommer0601

word for also

References:

https://p.mobile9.com/clavechain72/

gnc lean muscle supplements

References:

https://newmuslim.iera.org/members/veilsong50/activity/437946/

References:

Slot games for android

References:

https://scientific-programs.science/wiki/1Red_Casino_Erfahrungen_Unser_ausfhrlicher_Test_fr_2026

References:

Casino la valentine

References:

https://hedgedoc.eclair.ec-lyon.fr/s/MJRqHDW5n

References:

Brantford casino poker

References:

http://wiki.0-24.jp/index.php?jampump1

References:

Videopoker

References:

https://morphomics.science/wiki/Premium_Online_Casino_India

References:

Tuscany suites and casino

References:

https://www.giveawayoftheday.com/forums/profile/1608007

References:

Paragon casino cinema

References:

https://hahn-nolan.hubstack.net/mobile-casinos-2026-beste-online-casinos-furs-handy-im-test

References:

Riverwind casino norman ok

References:

https://vinylliquid49.bravejournal.net/top-5-best-australian-online-casinos-pokies-with-payid-in-2025

References:

Casino regina

References:

https://skitterphoto.com/photographers/2203787/gold-harboe

References:

Diamond joes casino

References:

https://windhampowersports.com/members/tiestove10/activity/354154/

References:

Solaire casino manila

References:

https://skitterphoto.com/photographers/2201571/marks-eriksson

steroid for sale

References:

https://securityholes.science/wiki/Insurance_Coverage_and_Savings_Resources_for_Norditropin_somatropin_injection_5_mg_10_mg_15_mg_30_mg_Pens

uk labs steroids

References:

https://cuwip.ucsd.edu/members/ronaldsailor67/activity/2825979/

References:

Real casino online

References:

https://trade-britanica.trade/wiki/Best_PayID_Casinos_in_Australia_Sites_That_Accept_PayID

quick ways to gain muscle

References:

https://pediascape.science/wiki/Can_You_Buy_HGH_A_Guide_to_Safe_and_Legal_Purchases

prednisone and weight lifting

References:

https://gaiaathome.eu/gaiaathome/show_user.php?userid=1839157

muscle building drug

References:

https://historydb.date/wiki/Metandienone_Wikipedia

crazybulk.com review

References:

https://wikimapia.org/external_link?url=https://serpolicia.es/pages/comprar_dianabol.html

are anabolic steroids illegal

References:

https://onlinevetjobs.com/author/leadprofit1/

buy real steroids

References:

https://hoff-cameron-3.federatedjournals.com/hgh-prix-avis-et-alternative-legale-hgh-x2

betmgm LA betmgm-play betmgm DE

building muscle pills

References:

https://hamann-neumann.thoughtlanes.net/comprar-anavar-venta-en-espana-mas-barato-oxandrolona-1770341565

use of steroids

References:

https://posteezy.com/achetez-pro-hormone-de-croissance-en-ligne-hgh-sur-hsn

[url=https://canadapharmacy-usa.net/drug/finpecia/]buy finpecia without prescription[/url]

buy clindamycin without prescription

steroidscheap.com reviews

References:

https://humanlove.stream/wiki/Comprar_Stanozolol_10_mg_Esteroides_Anabolicos_Espaa_Farmacia_en_lnea

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

steroids for losing weight

References:

http://karayaz.ru/user/namewitch24/

all american steroids review|acybgnsynx72k2lagtrdohjfldslpgzigq:***

References:

https://swaay.com/u/tuloefufbuq79/about/

best supplement stacks for getting ripped

References:

https://gratisafhalen.be/author/turkeyheron07/

natural bodybuilding vs supplement bodybuilding

References:

http://king-wifi.win//index.php?title=reidshoemaker8880

anabolic steroid risks

References:

https://lovewiki.faith/wiki/Comment_demander_votre_mdecin_de_vous_prescrire_des_pilules_amaigrissantes

anabolic agents definition

References:

https://douglas-rask-2.blogbright.net/buy-anavar-tablets-uk-shop

buying testosterone online reviews

References:

https://bookmarks4.men/story.php?title=warnung-appetitzuegler-test-2022-10-hersteller-im-vergleich

how long do anabolic steroids stay in your system

References:

https://covington-bowden.technetbloggers.de/anavar

best bodybuilding stack for beginners

References:

https://sciencewiki.science/wiki/Natrliche_Appetitzgler_zum_Abnehmen

legal steroids online to buy

References:

https://swaay.com/u/wortonpftis73/about/

Discover new slots and classics. In what is crown coins, there are bonuses for beginners and veterans. Play and win with pleasure!

las vegas casino budapest

References:

https://baby-newlife.ru/user/profile/464541