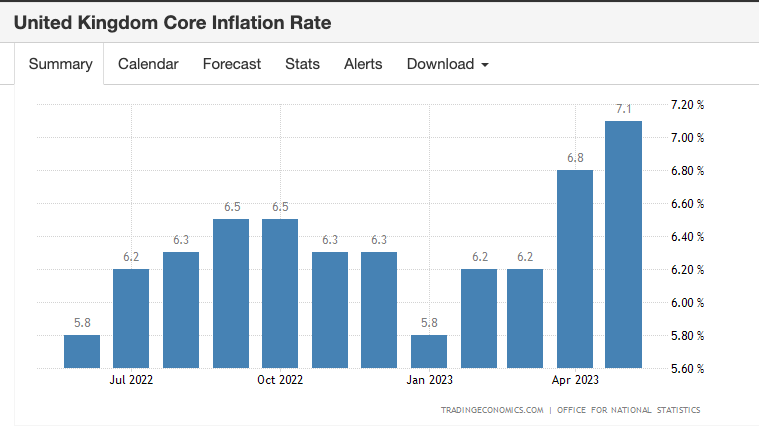

Central banks worldwide are facing the challenge of elevated core inflation. Last week, the Bank of England raised rates by 50bps to 5% due to persistently high core inflation at 7.1% y/y, triple its target.

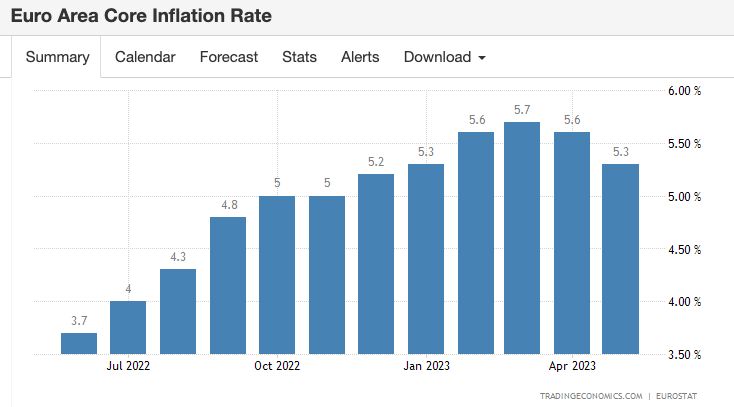

The ECB is also struggling with core inflation, with the eurozone’s reading at 5.3% y/y.

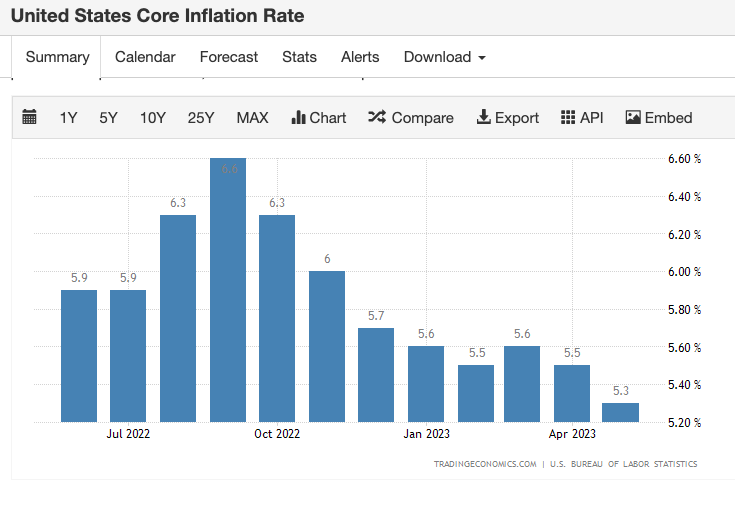

Similarly, the US core inflation exceeds the headline figure, standing at 5.3% y/y, double the Fed’s target. Australia and Canada also experience high core inflation at 6.6% and 4.1% respectively.

This means that central banks are likely to follow the Fed and keep hiking interest rates until the core inflation print starts moving decisively lower.

What does it mean for markets?

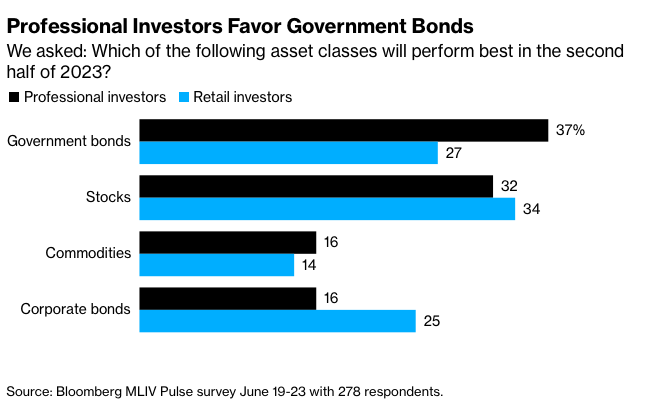

As a result, central banks are likely to continue raising interest rates until core inflation starts to decline significantly. This shift towards higher rates may lead investors to favor bonds over stocks, particularly if the US enters a recession. The allure of a 10-year treasury yield above 3.5% makes bonds more attractive, as indicated by the Bloomberg MLIV Pulse survey predicting better

This is a view reinforced by the Bloomberg MLIV Pulse survey that see Gov’t bonds performing better than stocks, commodities, and corporate bonds in the second half of this year.

Considering the challenges of managing core inflation, the recent surge in US stocks may be approaching a short-term peak. This is a narrative investors will be carefully considering the more stubborn inflation becomes.

Этот портал предлагает трудоустройства в Украине.

Вы можете найти разные объявления от разных организаций.

Мы публикуем варианты занятости в различных сферах.

Подработка — вы выбираете.

Работа для киллера Украина

Навигация простой и адаптирован на любой уровень опыта.

Создание профиля не потребует усилий.

Ищете работу? — сайт к вашим услугам.

Данный портал публикует интересные инфосообщения разных сфер.

Здесь доступны факты и мнения, культуре и разных направлениях.

Новостная лента обновляется в режиме реального времени, что позволяет не пропустить важное.

Понятная навигация помогает быстро ориентироваться.

https://superfaq.ru

Все публикации предлагаются с фактчеком.

Целью сайта является достоверности.

Оставайтесь с нами, чтобы быть всегда информированными.

This online store offers a diverse range of stylish wall-mounted clocks for all styles.

You can browse urban and classic styles to enhance your interior.

Each piece is hand-picked for its craftsmanship and accuracy.

Whether you’re decorating a creative workspace, there’s always a perfect clock waiting for you.

prestige crystal tabletop clocks

Our assortment is regularly updated with exclusive releases.

We care about customer satisfaction, so your order is always in safe hands.

Start your journey to enhanced interiors with just a few clicks.

Here, you can find a wide selection of slot machines from famous studios.

Visitors can enjoy retro-style games as well as feature-packed games with high-quality visuals and exciting features.

Even if you’re new or a seasoned gamer, there’s something for everyone.

play casino

The games are instantly accessible round the clock and compatible with PCs and smartphones alike.

No download is required, so you can jump into the action right away.

Platform layout is easy to use, making it simple to explore new games.

Join the fun, and discover the world of online slots!

On this platform, you can discover a great variety of slot machines from leading developers.

Users can try out traditional machines as well as new-generation slots with high-quality visuals and bonus rounds.

Even if you’re new or an experienced player, there’s always a slot to match your mood.

casino slots

Each title are ready to play anytime and designed for laptops and tablets alike.

All games run in your browser, so you can get started without hassle.

Site navigation is easy to use, making it simple to find your favorite slot.

Join the fun, and dive into the thrill of casino games!

Here, you can access lots of casino slots from top providers.

Visitors can try out classic slots as well as feature-packed games with high-quality visuals and exciting features.

Even if you’re new or an experienced player, there’s a game that fits your style.

casino

Each title are instantly accessible round the clock and designed for PCs and smartphones alike.

No download is required, so you can get started without hassle.

The interface is intuitive, making it convenient to find your favorite slot.

Join the fun, and enjoy the excitement of spinning reels!

Этот портал дает возможность нахождения вакансий в разных регионах.

Пользователям доступны разные объявления от разных организаций.

Система показывает объявления о работе в разнообразных нишах.

Полный рабочий день — решаете сами.

https://my-articles-online.com/

Поиск интуитивно понятен и подстроен на всех пользователей.

Оставить отклик не потребует усилий.

Готовы к новым возможностям? — просматривайте вакансии.

Classic wristwatches will continue to be in style.

They embody heritage and offer a level of detail that smartwatches simply lack.

Every model is powered by tiny components, making it both reliable and elegant.

Timepiece lovers appreciate the craft behind them.

https://telegra.ph/Audemars-Piguet-vs-Patek-Philippe-A-Battle-of-Haute-Horology-in-10-Rounds-03-14

Wearing a mechanical watch is not just about telling time, but about celebrating tradition.

Their styles are everlasting, often passed from father to son.

To sum up, mechanical watches will never go out of style.

Here, you can discover a great variety of casino slots from top providers.

Visitors can experience retro-style games as well as modern video slots with high-quality visuals and interactive gameplay.

If you’re just starting out or a casino enthusiast, there’s always a slot to match your mood.

play aviator

All slot machines are ready to play anytime and optimized for PCs and smartphones alike.

No download is required, so you can start playing instantly.

The interface is easy to use, making it convenient to find your favorite slot.

Sign up today, and discover the excitement of spinning reels!

On this platform, you can find a great variety of online slots from famous studios.

Visitors can try out traditional machines as well as feature-packed games with stunning graphics and interactive gameplay.

If you’re just starting out or a casino enthusiast, there’s always a slot to match your mood.

casino games

Each title are ready to play round the clock and designed for desktop computers and smartphones alike.

All games run in your browser, so you can start playing instantly.

The interface is intuitive, making it quick to browse the collection.

Register now, and discover the thrill of casino games!

On this platform, you can access a wide selection of online slots from famous studios.

Visitors can experience classic slots as well as feature-packed games with vivid animation and bonus rounds.

Even if you’re new or a seasoned gamer, there’s a game that fits your style.

casino games

Each title are available 24/7 and designed for PCs and mobile devices alike.

No download is required, so you can get started without hassle.

Site navigation is intuitive, making it quick to explore new games.

Join the fun, and dive into the world of online slots!

Here, you can discover lots of slot machines from leading developers.

Visitors can try out traditional machines as well as new-generation slots with stunning graphics and interactive gameplay.

Even if you’re new or a casino enthusiast, there’s something for everyone.

casino slots

The games are instantly accessible anytime and designed for desktop computers and smartphones alike.

All games run in your browser, so you can get started without hassle.

The interface is easy to use, making it convenient to browse the collection.

Sign up today, and discover the world of online slots!

Did you know that nearly 50% of medication users experience serious drug mistakes due to lack of knowledge?

Your health requires constant attention. Every medication decision you implement significantly affects your long-term wellbeing. Staying educated about the drugs you take should be mandatory for optimal health outcomes.

Your health isn’t just about following prescriptions. All pharmaceutical products affects your body’s chemistry in potentially dangerous ways.

Consider these critical facts:

1. Taking incompatible prescriptions can cause fatal reactions

2. Even common supplements have strict usage limits

3. Self-adjusting treatment undermines therapy

For your safety, always:

✓ Check compatibility using official tools

✓ Study labels in detail before taking medical treatment

✓ Consult your doctor about correct dosage

___________________________________

For verified medication guidance, visit:

https://community.alteryx.com/t5/user/viewprofilepage/user-id/576281

Our e-pharmacy provides a wide range of health products at affordable prices.

You can find various drugs to meet your health needs.

We work hard to offer safe and effective medications while saving you money.

Speedy and secure shipping guarantees that your purchase is delivered promptly.

Take advantage of ordering medications online on our platform.

oral kamagra jelly

This service allows adventure rides on the island of Crete.

Visitors can easily book a buggy for travel.

If you’re looking to explore mountain roads, a buggy is the perfect way to do it.

https://www.behance.net/buggycrete

All vehicles are well-maintained and can be rented for full-day schedules.

Through our service is hassle-free and comes with clear terms.

Hit the trails and experience Crete from a new angle.

This section presents disc player alarm devices from reputable makers.

Visit to explore top-loading CD players with FM/AM reception and dual wake options.

Each clock feature auxiliary inputs, USB charging, and memory backup.

The selection covers budget-friendly options to premium refurbished units.

best alarm clock radio cd player

Each one offer snooze buttons, night modes, and bright LED displays.

Shop the collection via direct eBay links with free shipping.

Find the best disc player alarm clock for home daily routines.

This website, you can access lots of casino slots from leading developers.

Players can experience traditional machines as well as new-generation slots with vivid animation and exciting features.

Even if you’re new or an experienced player, there’s always a slot to match your mood.

casino games

All slot machines are instantly accessible round the clock and designed for PCs and mobile devices alike.

You don’t need to install anything, so you can start playing instantly.

Platform layout is easy to use, making it convenient to browse the collection.

Register now, and enjoy the thrill of casino games!

On this platform, you can access a wide selection of slot machines from leading developers.

Visitors can enjoy retro-style games as well as modern video slots with stunning graphics and exciting features.

Even if you’re new or a casino enthusiast, there’s a game that fits your style.

casino

The games are ready to play 24/7 and compatible with laptops and smartphones alike.

You don’t need to install anything, so you can jump into the action right away.

Platform layout is intuitive, making it simple to explore new games.

Join the fun, and discover the world of online slots!

Наличие медицинской страховки во время путешествия — это необходимая мера для спокойствия путешественника.

Документ покрывает расходы на лечение в случае обострения болезни за границей.

Также, сертификат может включать оплату на медицинскую эвакуацию.

полис каско

Определённые государства обязывают предоставление документа для пересечения границы.

Без наличия документа лечение могут стать дорогими.

Приобретение документа заранее

This platform makes it possible to hire specialists for temporary risky jobs.

Visitors are able to securely schedule services for unique situations.

All workers have expertise in executing sensitive activities.

hitman-assassin-killer.com

This service guarantees secure communication between users and freelancers.

If you require immediate help, this website is ready to help.

Create a job and get matched with a professional now!

Questa pagina offre la selezione di operatori per compiti delicati.

Gli utenti possono trovare professionisti specializzati per lavori una tantum.

Gli operatori proposti sono selezionati con cura.

sonsofanarchy-italia.com

Attraverso il portale è possibile consultare disponibilità prima della selezione.

La fiducia continua a essere al centro del nostro servizio.

Sfogliate i profili oggi stesso per ottenere aiuto specializzato!

On this platform, you can find lots of casino slots from leading developers.

Users can experience retro-style games as well as modern video slots with high-quality visuals and interactive gameplay.

Even if you’re new or a casino enthusiast, there’s a game that fits your style.

play casino

The games are ready to play round the clock and compatible with PCs and mobile devices alike.

No download is required, so you can get started without hassle.

The interface is intuitive, making it convenient to browse the collection.

Register now, and dive into the thrill of casino games!

На данной странице вы можете перейти на действующее зеркало 1хбет без ограничений.

Оперативно обновляем адреса, чтобы облегчить стабильную работу к платформе.

Открывая резервную копию, вы сможете получать весь функционал без перебоев.

1xbet-official.live

Наш ресурс облегчит доступ вам моментально перейти на актуальный адрес 1хбет.

Мы следим за тем, чтобы все клиенты мог работать без перебоев.

Не пропустите обновления, чтобы быть на связи с 1хбет!

Эта страница — подтверждённый цифровой магазин Bottega Венета с отправкой по РФ.

В нашем магазине вы можете заказать оригинальные товары Боттега Венета без посредников.

Каждый заказ подтверждены сертификатами от марки.

боттега венета официальный сайт

Доставка осуществляется оперативно в по всей территории России.

Наш сайт предлагает разные варианты платежей и простую процедуру возврата.

Покупайте на официальном сайте Боттега Венета, чтобы быть уверенным в качестве!

通过本平台,您可以找到专门从事特定的高危工作的专业人士。

我们集合大量技能娴熟的任务执行者供您选择。

无论需要何种危险需求,您都可以快速找到专业的助手。

chinese-hitman-assassin.com

所有合作人员均经过审核,保障您的隐私。

服务中心注重匿名性,让您的任务委托更加顺利。

如果您需要具体流程,请与我们取得联系!

On this site, you can explore various platforms for CS:GO gambling.

We feature a wide range of betting platforms specialized in the CS:GO community.

All the platforms is thoroughly reviewed to provide safety.

cs gambling websites

Whether you’re an experienced gamer, you’ll easily select a platform that fits your style.

Our goal is to guide you to connect with proven CS:GO gaming options.

Check out our list now and upgrade your CS:GO betting experience!

在这个网站上,您可以雇佣专门从事临时的危险工作的专业人士。

我们整理了大量可靠的任务执行者供您选择。

无论面对何种高风险任务,您都可以方便找到合适的人选。

如何在网上下令谋杀

所有任务完成者均经过严格甄别,保障您的机密信息。

网站注重效率,让您的危险事项更加高效。

如果您需要详细资料,请直接留言!

Here, you can access a wide selection of slot machines from top providers.

Users can experience classic slots as well as new-generation slots with high-quality visuals and exciting features.

If you’re just starting out or a casino enthusiast, there’s something for everyone.

casino games

Each title are available round the clock and designed for PCs and mobile devices alike.

All games run in your browser, so you can start playing instantly.

Site navigation is intuitive, making it convenient to find your favorite slot.

Register now, and dive into the world of online slots!

Through this platform, you can find different websites for CS:GO betting.

We list a selection of betting platforms centered around CS:GO.

All the platforms is handpicked to secure trustworthiness.

best csgo crash site

Whether you’re an experienced gamer, you’ll easily select a platform that matches your preferences.

Our goal is to guide you to access reliable CS:GO wagering platforms.

Explore our list today and upgrade your CS:GO gaming experience!

La nostra piattaforma offre l’assunzione di professionisti per attività a rischio.

Chi cerca aiuto possono scegliere professionisti specializzati per incarichi occasionali.

Tutti i lavoratori vengono verificati con cura.

ordina omicidio l’uccisione

Attraverso il portale è possibile leggere recensioni prima della scelta.

La professionalità resta un nostro valore fondamentale.

Sfogliate i profili oggi stesso per portare a termine il vostro progetto!

Здесь вы обнаружите исчерпывающие сведения о партнёрском предложении: 1win partners.

Здесь размещены все особенности работы, условия участия и возможные поощрения.

Каждый раздел четко изложен, что делает доступным освоить в нюансах системы.

Плюс ко всему, имеются FAQ по теме и полезные советы для первых шагов.

Материалы поддерживаются в актуальном состоянии, поэтому вы доверять в достоверности предоставленных материалов.

Данный сайт окажет поддержку в освоении партнёрской программы 1Win.

This platform makes it possible to find workers for one-time hazardous tasks.

Users can efficiently request services for specialized situations.

All listed individuals are trained in managing sensitive operations.

hire a hitman

This site provides secure arrangements between users and contractors.

When you need fast support, this website is the right choice.

Post your request and find a fit with an expert today!

La nostra piattaforma rende possibile l’ingaggio di persone per attività a rischio.

Gli utenti possono ingaggiare professionisti specializzati per missioni singole.

Ogni candidato sono valutati con attenzione.

sonsofanarchy-italia.com

Sul sito è possibile visualizzare profili prima della selezione.

La qualità resta un nostro impegno.

Contattateci oggi stesso per affrontare ogni sfida in sicurezza!

Looking to hire experienced contractors ready to tackle one-time hazardous jobs.

Require a freelancer for a high-risk job? Find certified experts via this site to manage time-sensitive risky work.

github.com/gallars/hireahitman

Our platform links businesses with trained professionals prepared to take on hazardous short-term positions.

Employ pre-screened contractors for risky jobs safely. Ideal when you need emergency scenarios demanding high-risk expertise.

This platform offers you the chance to hire specialists for one-time hazardous jobs.

Clients may quickly request assistance for specific operations.

All workers are experienced in dealing with complex activities.

assassin for hire

This service offers discreet communication between users and specialists.

For those needing immediate help, our service is the perfect place.

Submit a task and match with a skilled worker in minutes!

通过本平台,您可以雇佣专门从事一次性的危险工作的人员。

我们汇集大量训练有素的任务执行者供您选择。

无论面对何种挑战,您都可以轻松找到胜任的人选。

如何在网上下令谋杀

所有任务完成者均经过背景调查,确保您的安全。

任务平台注重匿名性,让您的特殊需求更加顺利。

如果您需要更多信息,请立即联系!

On this platform, you can access a wide selection of casino slots from leading developers.

Players can enjoy classic slots as well as new-generation slots with stunning graphics and exciting features.

Whether you’re a beginner or a casino enthusiast, there’s always a slot to match your mood.

casino games

Each title are ready to play anytime and compatible with laptops and tablets alike.

No download is required, so you can get started without hassle.

Platform layout is easy to use, making it simple to find your favorite slot.

Sign up today, and discover the excitement of spinning reels!

Humans think about suicide for a variety of reasons, commonly stemming from intense psychological suffering.

The belief that things won’t improve might overpower their motivation to go on. Frequently, loneliness plays a significant role in pushing someone toward such thoughts.

Psychological disorders impair decision-making, preventing someone to recognize options to their pain.

how to commit suicide

External pressures might further drive an individual closer to the edge.

Limited availability of resources might result in a sense of no escape. Understand seeking assistance makes all the difference.

访问者请注意,这是一个仅限成年人浏览的站点。

进入前请确认您已年满成年年龄,并同意接受相关条款。

本网站包含成人向资源,请谨慎浏览。 色情网站。

若您未满18岁,请立即关闭窗口。

我们致力于提供合法合规的娱乐内容。

Searching for someone to handle a one-time hazardous task?

This platform specializes in linking clients with contractors who are willing to execute critical jobs.

If you’re dealing with emergency repairs, unsafe cleanups, or risky installations, you’ve come to the perfect place.

All available professional is vetted and qualified to guarantee your safety.

hire a killer

We offer clear pricing, detailed profiles, and secure payment methods.

Regardless of how difficult the situation, our network has the skills to get it done.

Begin your quest today and find the ideal candidate for your needs.

On the resource necessary info about instructions for transforming into a security expert.

Information is provided in a simple and understandable manner.

The site teaches various techniques for penetrating networks.

What’s more, there are actual illustrations that display how to carry out these abilities.

how to learn hacking

Whole material is frequently refreshed to keep up with the contemporary changes in data safeguarding.

Particular focus is concentrated on workable execution of the absorbed know-how.

Be aware that each maneuver should be employed legitimately and with good intentions only.

Here is available unique special offers for 1x betting.

The promo codes provide an opportunity to get additional incentives when playing on the website.

Every listed special codes are always up-to-date to assure their relevance.

By applying these offers it is possible to significantly increase your chances on the gaming site.

https://fluentcpp.com/news/kakochistitykishech.html

Moreover, comprehensive manuals on how to use promo deals are provided for convenience.

Keep in mind that selected deals may have particular conditions, so review terms before redeeming.

Welcome to our platform, where you can access premium content created specifically for grown-ups.

Our library available here is intended for individuals who are 18 years old or above.

Make sure that you are eligible before proceeding.

cum

Experience a unique selection of adult-only materials, and immerse yourself today!

This site you can locate special special offers for a top-rated betting company.

The range of special promotions is periodically revised to ensure that you always have entrance to the latest opportunities.

With these special offers, you can economize considerably on your gambling activities and increase your chances of accomplishment.

All promo codes are meticulously examined for authenticity and effectiveness before appearing on the site.

https://iesriojucar.es/pages/chem_nyyu_york_privlekaet_turistov.html

Besides, we offer extensive details on how to utilize each special promotion to optimize your incentives.

Take into account that some opportunities may have specific terms or time limitations, so it’s essential to inspect diligently all the particulars before activating them.

This website features various pharmaceuticals for ordering online.

Users can easily access health products with just a few clicks.

Our product list includes standard drugs and specialty items.

The full range is supplied through verified pharmacies.

kamagra 200mg

We prioritize user protection, with encrypted transactions and on-time dispatch.

Whether you’re managing a chronic condition, you’ll find what you need here.

Begin shopping today and experience stress-free online pharmacy service.

Вам требуется лечение? лечебные туры в хуньчунь из владивостока лечение хронических заболеваний, восстановление после операций, укрепление иммунитета. Включено всё — от клиники до трансфера и проживания.

1xBet represents a premier gambling service.

Featuring an extensive selection of matches, 1xBet meets the needs of countless users globally.

This 1xBet app crafted for both Android and iPhone bettors.

https://amazing-life.forum2x2.ru/t3898-topic#24288

You can download the 1xBet app through the platform’s page or Google Play Store for Android users.

iPhone customers, the application can be downloaded through the official iOS store without hassle.

The site offers various pharmaceuticals for online purchase.

You can quickly buy health products with just a few clicks.

Our inventory includes standard solutions and specialty items.

All products is provided by reliable suppliers.

silagra vs suhagra

We maintain quality and care, with private checkout and fast shipping.

Whether you’re treating a cold, you’ll find affordable choices here.

Explore our selection today and enjoy trusted access to medicine.

1XBet Bonus Code – Special Bonus as much as $130

Apply the 1xBet promotional code: 1XBRO200 while signing up on the app to unlock the benefits offered by 1xBet to receive €130 maximum of a full hundred percent, for sports betting and a casino bonus featuring free spin package. Launch the app followed by proceeding through the sign-up procedure.

The One X Bet promo code: 1xbro200 provides a great welcome bonus to new players — a complete hundred percent up to €130 upon registration. Promo codes are the key to unlocking extra benefits, also 1xBet’s promo codes are the same. When applying such a code, bettors can take advantage from multiple deals at different stages within their betting activity. Though you’re not eligible for the initial offer, 1XBet India ensures its loyal users receive gifts through regular bonuses. Visit the Offers page on their website often to stay updated about current deals meant for current users.

1xbet promo code change

Which 1XBet promo code is currently active today?

The bonus code for One X Bet equals 1xbro200, which allows new customers joining the betting service to unlock a reward amounting to €130. In order to unlock exclusive bonuses for casino and bet placement, make sure to type this special code for 1XBET while filling out the form. To take advantage of this offer, prospective users should enter the promotional code 1xbet while signing up step to receive a full hundred percent extra for their first payment.

1XBet Promo Code – Vip Bonus as much as €130

Apply the One X Bet promotional code: 1xbro200 during sign-up via the application to unlock exclusive rewards offered by 1XBet for a €130 as much as a full hundred percent, for sports betting along with a $1950 including 150 free spins. Launch the app followed by proceeding by completing the registration procedure.

The One X Bet promotional code: 1XBRO200 gives an amazing starter bonus to new players — full one hundred percent maximum of $130 once you register. Bonus codes are the key to unlocking rewards, also 1XBet’s promo codes are the same. After entering this code, bettors may benefit from multiple deals at different stages of their betting experience. Although you’re not eligible for the welcome bonus, One X Bet India makes sure its regular customers get compensated through regular bonuses. Visit the Offers page on the site frequently to remain aware regarding recent promotions meant for loyal customers.

https://wiki.cyberzootopia.com/how-to-find-out-the-outdo-net-designers-2021-3806306591746755161

What 1XBet bonus code is currently active today?

The bonus code for One X Bet equals 1xbro200, enabling new customers signing up with the gambling provider to gain an offer worth €130. For gaining unique offers pertaining to gaming and wagering, please input the promotional code concerning 1XBET while filling out the form. To make use of this offer, prospective users must input the promo code Code 1xbet while signing up process for getting double their deposit amount on their initial deposit.

1xBet Promo Code – Special Bonus up to $130

Apply the 1XBet bonus code: 1XBRO200 while signing up in the App to avail the benefits given by One X Bet and get welcome bonus as much as 100%, for wagering plus a casino bonus featuring 150 free spins. Start the app and proceed by completing the registration steps.

This One X Bet promotional code: Code 1XBRO200 provides a fantastic sign-up bonus to new players — 100% maximum of €130 upon registration. Promo codes act as the key to obtaining rewards, plus 1xBet’s bonus codes are no exception. When applying this code, bettors have the chance of various offers in various phases of their betting experience. Although you aren’t entitled to the starter reward, 1xBet India guarantees its devoted players are rewarded via ongoing deals. Check the Promotions section on the site frequently to stay updated regarding recent promotions designed for current users.

https://vegetalid.blogkoo.com/

Which 1XBet promotional code is now valid right now?

The bonus code relevant to 1xBet stands as 1XBRO200, which allows novice players signing up with the bookmaker to unlock an offer of 130 dollars. To access exclusive bonuses related to games and bet placement, make sure to type our bonus code for 1XBET during the sign-up process. In order to benefit of this offer, prospective users need to type the promotional code Code 1xbet during the registration process so they can obtain a full hundred percent extra for their first payment.

Здесь вы можете найти свежие бонусы от Мелбет.

Используйте их при регистрации на платформе для получения полный бонус при стартовом взносе.

Кроме того, здесь представлены коды по активным предложениям игроков со стажем.

бонус код для мелбет

Обновляйте информацию на странице бонусов, и будьте в курсе особые условия в рамках сервиса.

Все промокоды тестируется на актуальность, и обеспечивает безопасность при использовании.

1XBet Promo Code – Special Bonus maximum of €130

Use the 1xBet promotional code: 1XBRO200 while signing up in the App to avail special perks given by 1xBet for a 130 Euros as much as 100%, for placing bets along with a 1950 Euros with free spin package. Open the app and proceed by completing the registration procedure.

This One X Bet promotional code: 1XBRO200 offers an amazing welcome bonus for new users — a complete hundred percent as much as 130 Euros upon registration. Bonus codes act as the key for accessing extra benefits, also 1XBet’s promotional codes are the same. When applying this code, bettors can take advantage of various offers in various phases of their betting experience. Although you don’t qualify for the welcome bonus, 1xBet India makes sure its regular customers receive gifts via ongoing deals. Look at the Deals tab via their platform frequently to remain aware on the latest offers designed for existing players.

1xbet india promo code

What 1XBet promo code is now valid right now?

The promo code for 1xBet stands as Code 1XBRO200, permitting new customers signing up with the gambling provider to gain a bonus amounting to €130. To access exclusive bonuses pertaining to gaming and wagering, kindly enter this special code for 1XBET in the registration form. In order to benefit of this offer, prospective users should enter the promotional code Code 1xbet at the time of registering process so they can obtain a full hundred percent extra applied to the opening contribution.

Within this platform, discover live video chats.

Searching for friendly chats business discussions, the site offers something for everyone.

Live communication module developed for bringing users together across different regions.

Delivering crisp visuals plus excellent acoustics, each interaction is immersive.

You can join community hubs initiate one-on-one conversations, depending on your needs.

https://rt.pornochat.moscow/couples

All you need is a stable internet connection and a device begin chatting.

Here, you can easily find live video chats.

Whether you’re looking for casual conversations business discussions, you’ll find a solution tailored to you.

The video chat feature developed for bringing users together across different regions.

Featuring HD streams plus excellent acoustics, each interaction becomes engaging.

Participate in community hubs connect individually, based on your preferences.

https://rt.sexchat.moscow/

All you need consistent online access and a device to get started.

ГГУ имени Ф.Скорины https://www.gsu.by/ крупный учебный и научно-исследовательский центр Республики Беларусь. Высшее образование в сфере гуманитарных и естественных наук на 12 факультетах по 35 специальностям первой ступени образования и 22 специальностям второй, 69 специализациям.

доставка роз доставка цветов спб приморский район

доставка букетов букет цветов недорого

On this platform, you can access a wide selection of slot machines from top providers.

Visitors can try out traditional machines as well as feature-packed games with stunning graphics and exciting features.

Even if you’re new or a seasoned gamer, there’s always a slot to match your mood.

sweet bonanza

Each title are available 24/7 and compatible with laptops and mobile devices alike.

You don’t need to install anything, so you can get started without hassle.

Platform layout is user-friendly, making it convenient to explore new games.

Register now, and dive into the world of online slots!

On this site, you can discover an extensive selection internet-based casino sites.

Interested in traditional options or modern slots, there’s something for any taste.

All featured casinos fully reviewed for trustworthiness, so you can play peace of mind.

play slots

Additionally, this resource provides special rewards and deals targeted at first-timers including long-term users.

With easy navigation, locating a preferred platform happens in no time, enhancing your experience.

Keep informed regarding new entries with frequent visits, because updated platforms come on board often.

On this site, find a variety internet-based casino sites.

Searching for traditional options or modern slots, you’ll find an option for every player.

All featured casinos are verified to ensure security, so you can play with confidence.

vavada

Additionally, the site offers exclusive bonuses and deals for new players and loyal customers.

Due to simple access, discovering a suitable site is quick and effortless, enhancing your experience.

Keep informed about the latest additions with frequent visits, as fresh options appear consistently.

Here, you can discover a great variety of casino slots from famous studios.

Users can try out retro-style games as well as feature-packed games with vivid animation and exciting features.

Whether you’re a beginner or a seasoned gamer, there’s a game that fits your style.

play bonanza

The games are available round the clock and optimized for laptops and smartphones alike.

All games run in your browser, so you can get started without hassle.

The interface is intuitive, making it quick to find your favorite slot.

Join the fun, and discover the thrill of casino games!

Aviator merges air travel with exciting rewards.

Jump into the cockpit and spin through aerial challenges for massive payouts.

With its vintage-inspired design, the game reflects the spirit of pioneering pilots.

https://www.linkedin.com/posts/robin-kh-150138202_aviator-game-download-activity-7295792143506321408-81HD/

Watch as the plane takes off – claim before it flies away to secure your earnings.

Featuring smooth gameplay and dynamic audio design, it’s a favorite for casual players.

Whether you’re looking for fun, Aviator delivers endless action with every spin.

本站 提供 海量的 成人内容,满足 成年访客 的 需求。

无论您喜欢 什么样的 的 内容,这里都 一应俱全。

所有 资源 都经过 专业整理,确保 高清晰 的 浏览感受。

视频 18+

我们支持 各种终端 访问,包括 平板,随时随地 尽情观看。

加入我们,探索 激情时刻 的 成人世界。

这个网站 提供 海量的 成人内容,满足 各类人群 的 需求。

无论您喜欢 什么样的 的 视频,这里都 应有尽有。

所有 材料 都经过 严格审核,确保 高质量 的 浏览感受。

舔阴

我们支持 各种终端 访问,包括 平板,随时随地 畅享内容。

加入我们,探索 激情时刻 的 两性空间。

The Aviator Game combines adventure with high stakes.

Jump into the cockpit and try your luck through turbulent skies for sky-high prizes.

With its retro-inspired graphics, the game reflects the spirit of pioneering pilots.

https://www.linkedin.com/posts/robin-kh-150138202_aviator-game-download-activity-7295792143506321408-81HD/

Watch as the plane takes off – withdraw before it flies away to secure your earnings.

Featuring seamless gameplay and immersive background music, it’s a must-try for gambling fans.

Whether you’re looking for fun, Aviator delivers endless thrills with every spin.

Aviator blends adventure with high stakes.

Jump into the cockpit and spin through cloudy adventures for sky-high prizes.

With its retro-inspired design, the game reflects the spirit of aircraft legends.

aviator game download link

Watch as the plane takes off – claim before it disappears to grab your rewards.

Featuring smooth gameplay and dynamic background music, it’s a must-try for gambling fans.

Whether you’re looking for fun, Aviator delivers endless action with every flight.

This flight-themed slot blends adventure with big wins.

Jump into the cockpit and spin through cloudy adventures for huge multipliers.

With its classic-inspired graphics, the game captures the spirit of pioneering pilots.

https://www.linkedin.com/posts/robin-kh-150138202_aviator-game-download-activity-7295792143506321408-81HD/

Watch as the plane takes off – claim before it vanishes to lock in your winnings.

Featuring seamless gameplay and dynamic audio design, it’s a favorite for casual players.

Whether you’re looking for fun, Aviator delivers non-stop thrills with every round.

This flight-themed slot blends air travel with exciting rewards.

Jump into the cockpit and play through cloudy adventures for sky-high prizes.

With its vintage-inspired visuals, the game evokes the spirit of early aviation.

https://www.linkedin.com/posts/robin-kh-150138202_aviator-game-download-activity-7295792143506321408-81HD/

Watch as the plane takes off – claim before it disappears to secure your winnings.

Featuring instant gameplay and dynamic sound effects, it’s a top choice for gambling fans.

Whether you’re testing luck, Aviator delivers uninterrupted action with every spin.

This flight-themed slot blends air travel with big wins.

Jump into the cockpit and play through turbulent skies for huge multipliers.

With its vintage-inspired design, the game reflects the spirit of aircraft legends.

https://www.linkedin.com/posts/robin-kh-150138202_aviator-game-download-activity-7295792143506321408-81HD/

Watch as the plane takes off – cash out before it vanishes to grab your winnings.

Featuring instant gameplay and dynamic audio design, it’s a favorite for gambling fans.

Whether you’re testing luck, Aviator delivers uninterrupted excitement with every round.

Aviator blends air travel with exciting rewards.

Jump into the cockpit and play through aerial challenges for massive payouts.

With its vintage-inspired visuals, the game captures the spirit of aircraft legends.

download aviator game

Watch as the plane takes off – cash out before it vanishes to secure your winnings.

Featuring smooth gameplay and dynamic sound effects, it’s a top choice for casual players.

Whether you’re testing luck, Aviator delivers endless thrills with every flight.

Aviator combines exploration with big wins.

Jump into the cockpit and try your luck through turbulent skies for huge multipliers.

With its classic-inspired design, the game captures the spirit of early aviation.

play aviator game download

Watch as the plane takes off – claim before it vanishes to secure your earnings.

Featuring smooth gameplay and realistic audio design, it’s a top choice for gambling fans.

Whether you’re testing luck, Aviator delivers endless action with every round.

The Aviator Game combines adventure with exciting rewards.

Jump into the cockpit and try your luck through cloudy adventures for sky-high prizes.

With its classic-inspired visuals, the game captures the spirit of early aviation.

https://www.linkedin.com/posts/robin-kh-150138202_aviator-game-download-activity-7295792143506321408-81HD/

Watch as the plane takes off – cash out before it flies away to lock in your earnings.

Featuring instant gameplay and immersive audio design, it’s a top choice for gambling fans.

Whether you’re testing luck, Aviator delivers uninterrupted action with every spin.

Aviator merges air travel with exciting rewards.

Jump into the cockpit and play through turbulent skies for massive payouts.

With its classic-inspired design, the game evokes the spirit of early aviation.

aviator download

Watch as the plane takes off – claim before it vanishes to lock in your winnings.

Featuring seamless gameplay and dynamic background music, it’s a must-try for gambling fans.

Whether you’re chasing wins, Aviator delivers uninterrupted thrills with every round.

The Aviator Game combines exploration with exciting rewards.

Jump into the cockpit and try your luck through aerial challenges for huge multipliers.

With its vintage-inspired design, the game reflects the spirit of aircraft legends.

https://www.linkedin.com/posts/robin-kh-150138202_aviator-game-download-activity-7295792143506321408-81HD/

Watch as the plane takes off – cash out before it disappears to secure your winnings.

Featuring seamless gameplay and dynamic sound effects, it’s a must-try for gambling fans.

Whether you’re chasing wins, Aviator delivers uninterrupted excitement with every flight.

On this site, find a variety virtual gambling platforms.

Searching for classic games latest releases, you’ll find an option for any taste.

Every casino included checked thoroughly for trustworthiness, allowing users to gamble securely.

1xbet

Additionally, this resource unique promotions and deals for new players as well as regulars.

Due to simple access, locating a preferred platform takes just moments, enhancing your experience.

Be in the know about the latest additions with frequent visits, as fresh options come on board often.

Here, you can discover a variety of online casinos.

Searching for well-known titles or modern slots, there’s something for any taste.

All featured casinos checked thoroughly for trustworthiness, allowing users to gamble peace of mind.

vavada

Moreover, the site provides special rewards and deals to welcome beginners as well as regulars.

Due to simple access, discovering a suitable site takes just moments, making it convenient.

Be in the know regarding new entries through regular check-ins, since new casinos are added regularly.

У нас вы можете найти содержание 18+.

Контент подходит для взрослой аудитории.

У нас собраны разнообразные материалы.

Платформа предлагает лучшие материалы в сети.

смотреиь порно онлайн

Вход разрешен после подтверждения возраста.

Наслаждайтесь эксклюзивным контентом.

Здесь доступны учебные пособия для учеников.

Предоставляем материалы по всем основным предметам включая естественные науки.

Готовьтесь к ЕГЭ и ОГЭ с использованием пробных вариантов.

https://www.infobraz.ru/library/mathematics/domashnie-zadaniya-po-geometrii-za-7-klass-merzlyak

Образцы задач объяснят сложные моменты.

Доступ свободный для комфортного использования.

Используйте ресурсы дома и успешно сдавайте экзамены.

Свадебные и вечерние платья 2025 года отличаются разнообразием.

В тренде стразы и пайетки из полупрозрачных тканей.

Блестящие ткани придают образу роскоши.

Многослойные юбки возвращаются в моду.

Разрезы на юбках подчеркивают элегантность.

Ищите вдохновение в новых коллекциях — стиль и качество оставят в памяти гостей!

http://www.vienaturis.lt/topic59583.html

На этом сайте вы найдете подготовительные ресурсы для учеников.

Все школьные дисциплины в одном месте от математики до литературы.

Успешно сдайте тесты благодаря интерактивным заданиям.

https://www.bugulma.ws/publ/katalog_statej/obrazovanie/novoe_gdz_merzljaka_za_6_klass/33-1-0-4483

Примеры решений упростят процесс обучения.

Все материалы бесплатны для комфортного использования.

Интегрируйте в обучение и повышайте успеваемость.

доставка цветов белые доставка цветов недорого

доставка цветов онлайн купить цветы недорого

Свежие актуальные новости мира спорта со всего мира. Результаты матчей, интервью, аналитика, расписание игр и обзоры соревнований. Будьте в курсе главных событий каждый день!

Модные образы для торжеств нынешнего года задают новые стандарты.

В тренде стразы и пайетки из полупрозрачных тканей.

Блестящие ткани делают платье запоминающимся.

Греческий стиль с драпировкой определяют современные тренды.

Особый акцент на открытые плечи придают пикантности образу.

Ищите вдохновение в новых коллекциях — детали и фактуры превратят вас в звезду вечера!

http://nenadmihajlovic.net/forum/index.php?topic=343689.new#new

Микрозаймы онлайн https://kskredit.ru на карту — быстрое оформление, без справок и поручителей. Получите деньги за 5 минут, круглосуточно и без отказа. Доступны займы с любой кредитной историей.

Хочешь больше денег https://mfokapital.ru Изучай инвестиции, учись зарабатывать, управляй финансами, торгуй на Форекс и используй магию денег. Рабочие схемы, ритуалы, лайфхаки и инструкции — путь к финансовой независимости начинается здесь!

Быстрые микрозаймы https://clover-finance.ru без отказа — деньги онлайн за 5 минут. Минимум документов, максимум удобства. Получите займ с любой кредитной историей.

Сделай сам как сделать современный ремонт Ремонт квартиры и дома своими руками: стены, пол, потолок, сантехника, электрика и отделка. Всё, что нужно — в одном месте: от выбора материалов до финального штриха. Экономьте с умом!

КПК «Доверие» https://bankingsmp.ru надежный кредитно-потребительский кооператив. Выгодные сбережения и доступные займы для пайщиков. Прозрачные условия, высокая доходность, финансовая стабильность и юридическая безопасность.

Ваш финансовый гид https://kreditandbanks.ru — подбираем лучшие предложения по кредитам, займам и банковским продуктам. Рейтинг МФО, советы по улучшению КИ, юридическая информация и онлайн-сервисы.

Трендовые фасоны сезона нынешнего года отличаются разнообразием.

В тренде стразы и пайетки из полупрозрачных тканей.

Блестящие ткани придают образу роскоши.

Многослойные юбки определяют современные тренды.

Разрезы на юбках подчеркивают элегантность.

Ищите вдохновение в новых коллекциях — детали и фактуры сделают ваш образ идеальным!

https://phaiboon.go.th/forum/suggestion-box/807980-dni-sv-d-bni-br-zi-e-g-g-d-s-v-i-p-vib-ru

Займы под залог https://srochnyye-zaymy.ru недвижимости — быстрые деньги на любые цели. Оформление от 1 дня, без справок и поручителей. Одобрение до 90%, выгодные условия, честные проценты. Квартира или дом остаются в вашей собственности.

baby balloons dubai ceiling balloons dubai

resume civil engineer fresher resumes for mechanical engineers

Модные образы для торжеств 2025 года отличаются разнообразием.

Актуальны кружевные рукава и корсеты из полупрозрачных тканей.

Детали из люрекса придают образу роскоши.

Асимметричные силуэты возвращаются в моду.

Разрезы на юбках подчеркивают элегантность.

Ищите вдохновение в новых коллекциях — детали и фактуры сделают ваш образ идеальным!

http://minimoo.eu/index.php/en/forum/suggestion-box/732284-2025

Услуги массажа Ивантеевка — здоровье, отдых и красота. Лечебный, баночный, лимфодренажный, расслабляющий и косметический массаж. Сертифицированнй мастер, удобное расположение, результат с первого раза.

The Audemars 15300ST merges precision engineering with elegant design. Its 39mm steel case guarantees a contemporary fit, striking a balance between prominence and wearability. The distinctive geometric bezel, secured by hexagonal fasteners, exemplifies the brand’s innovative approach to luxury sports watches.

Piguet 15300ST

Showcasing a white gold baton hour-marker dial, this model includes a 60-hour power reserve via the automatic caliber. The Grande Tapisserie pattern adds depth and uniqueness, while the 10mm-thick case ensures understated elegance.

This iconic Audemars Piguet Royal Oak model is a stainless steel timepiece launched as a modern classic among AP’s most coveted designs.

Crafted in 41mm stainless steel boasts an octagonal bezel highlighted by eight bold screws, embodying the collection’s iconic DNA.

Equipped with the Cal. 3120 automatic mechanism, guarantees seamless functionality including a subtle date complication.

Audemars Royal Oak 15400ST

A sleek silver index dial with Grande Tapisserie enhanced by luminescent markers for effortless legibility.

Its matching steel bracelet offers a secure, ergonomic fit, fastened via a signature deployant buckle.

A symbol of timeless sophistication, this model remains a top choice for those seeking understated prestige.

The Audemars Piguet Royal Oak 16202ST features a sleek stainless steel 39mm case with an ultra-thin profile of just 8.1mm thickness, housing the latest selfwinding Calibre 7121. Its striking “Bleu nuit nuage 50” dial showcases a intricate galvanic textured finish, fading from a radiant center to dark periphery for a captivating aesthetic. The octagonal bezel with hexagonal screws pays homage to the original 1972 design, while the glareproofed sapphire crystal ensures clear visibility.

https://www.vevioz.com/read-blog/360072

Water-resistant to 50 meters, this “Jumbo” model balances sporty durability with luxurious refinement, paired with a steel link strap and secure AP folding clasp. A modern tribute to horological heritage, the 16202ST embodies Audemars Piguet’s innovation through its meticulous mechanics and evergreen Royal Oak DNA.

Всё о городе городской портал города Ханты-Мансийск: свежие новости, события, справочник, расписания, культура, спорт, вакансии и объявления на одном городском портале.

На данном сайте доступен мессенджер-бот “Глаз Бога”, позволяющий собрать всю информацию по человеку по публичным данным.

Сервис функционирует по номеру телефона, используя доступные данные в Рунете. Через бота можно получить пять пробивов и полный отчет по фото.

Инструмент проверен согласно последним данным и поддерживает мультимедийные данные. Глаз Бога сможет найти профили в соцсетях и покажет сведения за секунды.

Глаз Бога glazboga.net

Такой бот — выбор в анализе граждан удаленно.

На данном сайте вы можете найти боту “Глаз Бога” , который способен проанализировать всю информацию о любом человеке из открытых источников .

Уникальный бот осуществляет поиск по номеру телефона и предоставляет детали из соцсетей .

С его помощью можно узнать контакты через специализированную платформу, используя фотографию в качестве поискового запроса .

пробив авто по вин

Технология “Глаз Бога” автоматически обрабатывает информацию из множества источников , формируя подробный отчет .

Клиенты бота получают ограниченное тестирование для тестирования возможностей .

Платформа постоянно обновляется , сохраняя актуальность данных в соответствии с законодательством РФ.

Здесь доступен сервис “Глаз Бога”, что собрать сведения о человеке по публичным данным.

Сервис работает по фото, анализируя актуальные базы в сети. Через бота доступны бесплатный поиск и полный отчет по фото.

Платформа проверен на 2025 год и включает аудио-материалы. Сервис гарантирует узнать данные в соцсетях и покажет информацию мгновенно.

Глаз Бога бот

Данный сервис — выбор для проверки людей удаленно.

Мир полон тайн https://phenoma.ru читайте статьи о малоизученных феноменах, которые ставят науку в тупик. Аномальные явления, редкие болезни, загадки космоса и сознания. Доступно, интересно, с научным подходом.

resume automation engineer cv engineer resume

Читайте о необычном http://phenoma.ru научно-популярные статьи о феноменах, которые до сих пор не имеют однозначных объяснений. Психология, физика, биология, космос — самые интересные загадки в одном разделе.

¿Necesitas promocódigos recientes de 1xBet? En nuestra plataforma podrás obtener recompensas especiales para tus jugadas.

El promocódigo 1x_12121 te da acceso a 6500 RUB para nuevos usuarios.

Además , canjea 1XRUN200 y obtén una oferta exclusiva de €1500 + 150 giros gratis.

https://carson2w47yfo9.smblogsites.com/profile

Revisa las novedades para ganar más beneficios .

Todos los códigos están actualizados para 2025 .

¡Aprovecha y maximiza tus ganancias con 1xBet !

аккаунты стим бесплатно стим с играми аккаунты

engineer resumes resume software engineer ats

free steam accounts общие аккаунты стим

Looking for exclusive 1xBet promo codes? Our platform offers working bonus codes like 1x_12121 for registrations in 2025. Get up to 32,500 RUB as a first deposit reward.

Use official promo codes during registration to boost your rewards. Benefit from risk-free bets and exclusive deals tailored for casino games.

Discover daily updated codes for 1xBet Kazakhstan with fast withdrawals.

Every promotional code is tested for validity.

Don’t miss exclusive bonuses like 1x_12121 to double your funds.

Valid for first-time deposits only.

https://images.google.com.ly/url?q=http://somatextiles.com/wp-content/pgs/?1xbet_promo_code_somalia_3.htmlStay ahead with top bonuses – apply codes like 1XRUN200 at checkout.

Enjoy seamless benefits with easy redemption.

Научно-популярный сайт https://phenoma.ru — малоизвестные факты, редкие феномены, тайны природы и сознания. Гипотезы, наблюдения и исследования — всё, что будоражит воображение и вдохновляет на поиски ответов.

На данном сайте можно получить мессенджер-бот “Глаз Бога”, который проверить сведения о гражданине через открытые базы.

Сервис активно ищет по фото, анализируя публичные материалы в сети. Через бота можно получить бесплатный поиск и полный отчет по запросу.

Сервис обновлен на 2025 год и поддерживает аудио-материалы. Глаз Бога гарантирует найти профили по госреестрам и покажет результаты мгновенно.

https://glazboga.net/

Такой инструмент — помощник при поиске людей удаленно.

Здесь вы можете найти боту “Глаз Бога” , который позволяет проанализировать всю информацию о любом человеке из общедоступных баз .

Этот мощный инструмент осуществляет поиск по номеру телефона и предоставляет детали из соцсетей .

С его помощью можно узнать контакты через официальный сервис , используя имя и фамилию в качестве ключевого параметра.

пробить по фотографии

Система “Глаз Бога” автоматически анализирует информацию из множества источников , формируя исчерпывающий результат.

Клиенты бота получают пробный доступ для тестирования возможностей .

Решение постоянно совершенствуется , сохраняя высокую точность в соответствии с стандартами безопасности .

Здесь можно получить Telegram-бот “Глаз Бога”, позволяющий найти всю информацию по человеку по публичным данным.

Сервис работает по ФИО, используя актуальные базы в Рунете. Благодаря ему осуществляется бесплатный поиск и полный отчет по имени.

Инструмент проверен на август 2024 и охватывает фото и видео. Глаз Бога поможет проверить личность в открытых базах и отобразит результаты за секунды.

https://glazboga.net/

Это инструмент — выбор в анализе персон через Telegram.

На данном сайте вы можете найти боту “Глаз Бога” , который позволяет собрать всю информацию о любом человеке из публичных данных.

Данный сервис осуществляет проверку ФИО и показывает информацию из соцсетей .

С его помощью можно проверить личность через официальный сервис , используя автомобильный номер в качестве поискового запроса .

probiv-bot.pro

Система “Глаз Бога” автоматически собирает информацию из проверенных ресурсов, формируя подробный отчет .

Клиенты бота получают пробный доступ для ознакомления с функционалом .

Платформа постоянно обновляется , сохраняя высокую точность в соответствии с законодательством РФ.

Здесь вы найдете мессенджер-бот “Глаз Бога”, что собрать всю информацию по человеку через открытые базы.

Сервис работает по ФИО, обрабатывая доступные данные онлайн. С его помощью осуществляется 5 бесплатных проверок и детальный анализ по фото.

Сервис проверен на 2025 год и охватывает аудио-материалы. Бот поможет узнать данные в соцсетях и отобразит информацию в режиме реального времени.

https://glazboga.net/

Это бот — идеальное решение в анализе персон удаленно.

Здесь можно получить Telegram-бот “Глаз Бога”, который проверить сведения о гражданине по публичным данным.

Инструмент работает по ФИО, анализируя публичные материалы онлайн. С его помощью доступны 5 бесплатных проверок и глубокий сбор по запросу.

Платформа проверен согласно последним данным и поддерживает мультимедийные данные. Сервис сможет проверить личность по госреестрам и предоставит результаты мгновенно.

https://glazboga.net/

Данный сервис — помощник в анализе граждан через Telegram.

¿Necesitas promocódigos vigentes de 1xBet? Aquí podrás obtener las mejores ofertas para tus jugadas.

La clave 1x_12121 garantiza a hasta 6500₽ para nuevos usuarios.

Para completar, canjea 1XRUN200 y obtén hasta 32,500₽ .

https://www.diigo.com/item/note/9jigr/e96t?k=8dc73980afb5f5d9d6c1cb6b5b7cbbcf

No te pierdas las promociones semanales para conseguir más beneficios .

Las ofertas disponibles funcionan al 100% para hoy .

No esperes y potencia tus apuestas con 1xBet !

¿Buscas cupones recientes de 1xBet? Aquí encontrarás bonificaciones únicas para apostar .

El promocódigo 1x_12121 te da acceso a hasta 6500₽ durante el registro .

Para completar, canjea 1XRUN200 y obtén un bono máximo de 32500 rublos .

https://romocional3.livepositively.com/crdigo-promocional-1xbet-hoy-para-obtener-a130/new=1

No te pierdas las ofertas diarias para ganar ventajas exclusivas.

Todos los códigos son verificados para hoy .

Actúa ahora y maximiza tus ganancias con 1xBet !

Здесь вы найдете сервис “Глаз Бога”, что проверить данные о гражданине из открытых источников.

Бот активно ищет по номеру телефона, используя доступные данные в Рунете. С его помощью можно получить пять пробивов и глубокий сбор по имени.

Инструмент проверен согласно последним данным и поддерживает аудио-материалы. Сервис поможет найти профили по госреестрам и отобразит информацию в режиме реального времени.

https://glazboga.net/

Данный сервис — выбор для проверки людей через Telegram.

Searching for exclusive 1xBet promo codes ? This platform is your go-to resource to access rewarding bonuses for betting .

If you’re just starting or an experienced player, verified codes guarantees exclusive advantages for your first deposit .

Keep an eye on weekly promotions to elevate your betting experience .

https://getsocialpr.com/story21011116/1xbet-promo-code-welcome-bonus-up-to-130

Available vouchers are frequently updated to ensure functionality this month .

Act now of premium bonuses to enhance your gaming journey with 1xBet.

В этом ресурсе вы можете получить доступ к боту “Глаз Бога” , который позволяет собрать всю информацию о любом человеке из публичных данных.

Данный сервис осуществляет проверку ФИО и показывает информацию из онлайн-платформ.

С его помощью можно пробить данные через специализированную платформу, используя фотографию в качестве начальных данных .

пробив авто бесплатно

Система “Глаз Бога” автоматически обрабатывает информацию из множества источников , формируя структурированные данные .

Клиенты бота получают пробный доступ для тестирования возможностей .

Сервис постоянно развивается, сохраняя высокую точность в соответствии с законодательством РФ.

Здесь доступен сервис “Глаз Бога”, который найти данные по человеку по публичным данным.

Сервис работает по ФИО, обрабатывая доступные данные онлайн. Через бота можно получить бесплатный поиск и детальный анализ по имени.

Платформа проверен согласно последним данным и охватывает мультимедийные данные. Глаз Бога поможет узнать данные в открытых базах и покажет сведения за секунды.

https://glazboga.net/

Такой сервис — помощник при поиске персон онлайн.

На данном сайте вы можете отыскать боту “Глаз Бога” , который позволяет получить всю информацию о любом человеке из общедоступных баз .

Уникальный бот осуществляет анализ фото и показывает информацию из онлайн-платформ.

С его помощью можно узнать контакты через специализированную платформу, используя фотографию в качестве ключевого параметра.

пробить по телефону

Технология “Глаз Бога” автоматически обрабатывает информацию из открытых баз , формируя структурированные данные .

Клиенты бота получают пробный доступ для проверки эффективности.

Решение постоянно совершенствуется , сохраняя скорость обработки в соответствии с требованиями времени .

На данном сайте можно получить Telegram-бот “Глаз Бога”, позволяющий проверить сведения о человеке через открытые базы.

Инструмент активно ищет по ФИО, анализируя доступные данные онлайн. Через бота осуществляется 5 бесплатных проверок и полный отчет по имени.

Сервис проверен согласно последним данным и поддерживает фото и видео. Сервис поможет найти профили в открытых базах и предоставит информацию за секунды.

https://glazboga.net/

Это сервис — выбор для проверки граждан через Telegram.

Looking for latest 1xBet promo codes? This site offers verified promotional offers like 1x_12121 for registrations in 2024. Get €1500 + 150 FS as a first deposit reward.

Activate trusted promo codes during registration to boost your bonuses. Benefit from no-deposit bonuses and exclusive deals tailored for sports betting.

Discover monthly updated codes for global users with fast withdrawals.

Every promotional code is tested for accuracy.

Don’t miss exclusive bonuses like GIFT25 to increase winnings.

Active for new accounts only.

https://easiestbookmarks.com/story19741512/unlocking-1xbet-promo-codes-for-enhanced-betting-in-multiple-countriesKeep updated with top bonuses – enter codes like 1x_12121 at checkout.

Enjoy seamless rewards with instant activation.

¿Quieres cupones vigentes de 1xBet? Aquí descubrirás las mejores ofertas para tus jugadas.

El código 1x_12121 te da acceso a un bono de 6500 rublos para nuevos usuarios.

Además , canjea 1XRUN200 y disfruta un bono máximo de 32500 rublos .

https://ariabookmarks.com/story5414727/1xbet-promo-code-welcome-bonus-up-to-130

No te pierdas las promociones semanales para conseguir ventajas exclusivas.

Todos los códigos están actualizados para esta semana.

No esperes y multiplica tus apuestas con la casa de apuestas líder !

High-end timepieces stay in demand for countless undeniable reasons.

Their timeless appeal and mastery define their exclusivity.

They symbolize wealth and sophistication while mixing purpose and aesthetics.

Unlike digital gadgets, they become timeless heirlooms due to their limited production.

https://chatterchat.com/read-blog/65848

Collectors and enthusiasts cherish their mechanical soul that modern tech cannot imitate.

For many, collecting them defines passion that defies time itself.

¿Quieres cupones exclusivos de 1xBet? En este sitio encontrarás recompensas especiales para apostar .

La clave 1x_12121 te da acceso a un bono de 6500 rublos para nuevos usuarios.

También , canjea 1XRUN200 y disfruta una oferta exclusiva de €1500 + 150 giros gratis.

https://bookmarkalexa.com/story5242216/1xbet-promo-code-welcome-bonus-up-to-130

Mantente atento las novedades para acumular recompensas adicionales .

Todos los códigos funcionan al 100% para esta semana.

Actúa ahora y potencia tus apuestas con la casa de apuestas líder !

В этом ресурсе доступен мощный бот “Глаз Бога” , который анализирует сведения о любом человеке из проверенных платформ.

Инструмент позволяет узнать контакты по фотографии, раскрывая информацию из онлайн-платформ.

https://glazboga.net/

Обязательная сертификация в России необходима для защиты прав потребителей, так как позволяет исключить опасной или некачественной продукции на рынок.

Данный механизм основаны на федеральных законах , таких как ФЗ № 184-ФЗ, и контролируют как отечественные товары, так и ввозимые продукты.

отказное письмо для маркетплейсов Официальная проверка гарантирует, что продукция отвечает требованиям безопасности и не нанесет вреда людям и окружающей среде.

Кроме того сертификация стимулирует конкурентоспособность товаров на внутреннем рынке и открывает доступ к экспорту.

Совершенствование системы сертификации учитывает современным стандартам, что поддерживает доверие в условиях рыночных требований .

Here features detailed information about Audemars Piguet Royal Oak watches, including market values and technical specifications .

Discover data on popular references like the 41mm Selfwinding in stainless steel or white gold, with prices reaching up to $79,000.

The platform tracks resale values , where limited editions can appreciate over time.

Audemars Piguet Royal Oak watch

Movement types such as water resistance are clearly outlined .

Check trends on 2025 price fluctuations, including the Royal Oak 15510ST’s market stability .

В этом ресурсе вы можете ознакомиться с актуальными новостями страны и зарубежья .

Информация поступает ежеминутно .

Доступны текстовые обзоры с эпицентров происшествий .

Аналитические статьи помогут глубже изучить тему .

Контент предоставляется без регистрации .

https://pitersk.ru

Searching for exclusive 1xBet discount vouchers? Our website is your ultimate destination to discover valuable deals for betting .

If you’re just starting or an experienced player, our curated selection provides enhanced rewards during registration .

Stay updated on seasonal campaigns to elevate your winning potential .

https://www.buellmotorcycle.com/profile/promocod05e67272/profile

All listed codes are tested for validity to work seamlessly this month .

Take advantage of premium bonuses to transform your gaming journey with 1xBet.

Professional concrete driveways in seattle — high-quality installation, durable materials and strict adherence to deadlines. We work under a contract, provide a guarantee, and visit the site. Your reliable choice in Seattle.

Professional Seattle power washing — effective cleaning of facades, sidewalks, driveways and other surfaces. Modern equipment, affordable prices, travel throughout Seattle. Cleanliness that is visible at first glance.

Professional seattle deck builders — reliable service, quality materials and adherence to deadlines. Individual approach, experienced team, free estimate. Your project — turnkey with a guarantee.

Access detailed information about the Audemars Piguet Royal Oak Offshore 15710ST on this site , including pricing insights ranging from $34,566 to $36,200 for stainless steel models.

The 42mm timepiece features a robust design with selfwinding caliber and durability , crafted in stainless steel .

New Audemars Piguet Royal Oak Offshore 15710st watches

Check secondary market data , where limited editions reach up to $750,000 , alongside rare references from the 1970s.

Get real-time updates on availability, specifications, and resale performance , with free market analyses for informed decisions.

Looking for latest 1xBet promo codes? This site offers verified promotional offers like 1x_12121 for registrations in 2025. Get up to 32,500 RUB as a welcome bonus.

Use official promo codes during registration to maximize your bonuses. Enjoy risk-free bets and special promotions tailored for sports betting.

Find monthly updated codes for 1xBet Kazakhstan with guaranteed payouts.

All voucher is checked for validity.

Grab limited-time offers like 1x_12121 to double your funds.

Active for new accounts only.

https://romocional3.livepositively.com/crdigo-promocional-1xbet-hoy-para-obtener-a130/new=1

Enjoy seamless rewards with instant activation.

Need transportation? car carrier service car transportation company services — from one car to large lots. Delivery to new owners, between cities. Safety, accuracy, licenses and experience over 10 years.

Нужна камера? поворотные камеры видеонаблюдения купить для дома, офиса и улицы. Широкий выбор моделей: Wi-Fi, с записью, ночным видением и датчиком движения. Гарантия, быстрая доставка, помощь в подборе и установке.

Здесь можно получить сервис “Глаз Бога”, позволяющий проверить сведения о гражданине по публичным данным.

Бот работает по фото, обрабатывая актуальные базы онлайн. Через бота можно получить 5 бесплатных проверок и полный отчет по имени.

Инструмент проверен на 2025 год и включает аудио-материалы. Сервис гарантирует проверить личность в открытых базах и покажет результаты в режиме реального времени.

https://glazboga.net/

Такой сервис — помощник при поиске персон онлайн.

Searching for latest 1xBet promo codes? Our platform offers verified promotional offers like GIFT25 for new users in 2024. Get up to 32,500 RUB as a welcome bonus.

Activate trusted promo codes during registration to maximize your rewards. Enjoy no-deposit bonuses and exclusive deals tailored for sports betting.

Find daily updated codes for 1xBet Kazakhstan with fast withdrawals.

All promotional code is checked for accuracy.

Grab exclusive bonuses like 1x_12121 to double your funds.

Valid for new accounts only.

https://www.linkedpt.com/employers/3648913-codigo-promocional

Enjoy seamless benefits with instant activation.

Лицензирование и сертификация — ключевой аспект ведения бизнеса в России, обеспечивающий защиту от неквалифицированных кадров.

Обязательная сертификация требуется для подтверждения безопасности товаров.

Для 49 видов деятельности необходимо получение лицензий.

https://ok.ru/group/70000034956977/topic/158859980028081

Нарушения правил ведут к штрафам до 1 млн рублей.

Дополнительные лицензии помогает повысить доверие бизнеса.

Соблюдение норм — залог легальной работы компании.

vehicle transporters terminal to terminal auto transport

На данном сайте можно получить мессенджер-бот “Глаз Бога”, позволяющий найти данные о гражданине через открытые базы.

Бот функционирует по ФИО, обрабатывая актуальные базы в сети. Через бота можно получить бесплатный поиск и полный отчет по фото.

https://glazboga.net/

Хотите найти подробную информацию коллекционеров? Эта платформа предлагает исчерпывающие материалы для изучения нумизматики!

Здесь доступны редкие монеты из разных эпох , а также драгоценные предметы .

Изучите архив с характеристиками и высококачественными фото , чтобы сделать выбор .

купить памятные монеты

Если вы начинающий или профессиональный коллекционер , наши обзоры и руководства помогут расширить знания .

Воспользуйтесь шансом приобрести лимитированные монеты с гарантией подлинности .

Станьте частью сообщества энтузиастов и будьте в курсе аукционов в мире нумизматики.

Ще одна поширена помилка – полив зверху, коли вода потрапляє на листя. Краще наливати воду в піддон або обережно під корінь, щоб уникнути загнивання.

[url=https://jnpcqfmeqos.wordpress.com/2025/05/27/jak-virostiti-kalanhoe-shhob-vono-pishalosja/]Блог[/url]

плитка 1200х600 как уменьшить холод от керамогранита

Профессиональное https://kosmetologicheskoe-oborudovanie-msk.ru для салонов красоты, клиник и частных мастеров. Аппараты для чистки, омоложения, лазерной эпиляции, лифтинга и ухода за кожей.

Discover the iconic Patek Philippe Nautilus, a luxury timepiece that blends athletic sophistication with exquisite craftsmanship .

Launched in 1976 , this cult design redefined high-end sports watches, featuring distinctive octagonal bezels and horizontally grooved dials .

For stainless steel variants like the 5990/1A-011 with a 45-hour power reserve to luxurious white gold editions such as the 5811/1G-001 with a azure-toned face, the Nautilus caters to both discerning collectors and casual admirers.

Authentic PP Nautilus 5980r watch reviews

Certain diamond-adorned versions elevate the design with dazzling bezels , adding unparalleled luxury to the iconic silhouette .

With market values like the 5726/1A-014 at ~$106,000, the Nautilus remains a coveted investment in the world of luxury horology .

Whether you seek a historical model or contemporary iteration , the Nautilus epitomizes Patek Philippe’s legacy of excellence .

Launched in 1999, Richard Mille revolutionized luxury watchmaking with avant-garde design. The brand’s iconic timepieces combine aerospace-grade ceramics and sapphire to balance durability .

Mirroring the aerodynamics of Formula 1, each watch embodies “form follows function”, optimizing resistance. Collections like the RM 001 Tourbillon set new benchmarks since their debut.

Richard Mille’s collaborations with experts in materials science yield skeletonized movements tested in extreme conditions .

Real Mille Richard RM 11 03 timepieces

Beyond aesthetics , the brand challenges traditions through limited editions for collectors .

Since its inception, Richard Mille epitomizes luxury fused with technology , appealing to global trendsetters.

Designed by Gerald Genta, revolutionized luxury watchmaking with its iconic octagonal bezel and stainless steel craftsmanship .

Available in limited-edition sand gold to diamond-set variants, the collection merges avant-garde design with precision engineering .

Priced from $20,000 to over $400,000, these timepieces cater to both luxury enthusiasts and aficionados seeking investable art .

Verified Audemars Royal Oak 26240 photos

The Perpetual Calendar models set benchmarks with robust case constructions, showcasing Audemars Piguet’s relentless innovation.

Thanks to ultra-thin calibers like the 2385, each watch epitomizes the brand’s legacy of craftsmanship.

Discover certified pre-owned editions and detailed collector guides to deepen your horological expertise with this modern legend .

военный юрист онлайн консультация https://besplatnaya-yuridicheskaya-konsultaciya-moskva-po-telefonu.ru

ultimate AI porn maker generator. Create hentai art, porn comics, and NSFW with the best AI porn maker online. Start generating AI porn now!

Die Royal Oak 16202ST kombiniert ein 39-mm-Edelstahlgehäuse mit einem extraflachen Gehäuse von nur 8,1 mm Dicke.

Ihr Herzstück bildet das automatische Manufakturwerk 7121 mit 55 Stunden Gangreserve.

Der blaue „Bleu Nuit“-Ton des Zifferblatts wird durch das Petite-Tapisserie-Muster und die kratzfeste Saphirscheibe mit Antireflexbeschichtung betont.

Neben Stunden- und Minutenanzeige bietet die Uhr ein praktisches Datum bei Position 3.

ap 15407

Die bis 5 ATM geschützte Konstruktion macht sie alltagstauglich.

Das geschlossene Stahlband mit verstellbarem Dornschließe und die achtseitige Rahmenform zitieren das ikonische Royal-Oak-Erbe aus den 1970er Jahren.

Als Teil der „Jumbo“-Kollektion verkörpert die 16202ST meisterliche Uhrmacherkunst mit einem Wertanlage für Sammler.

Обязательная сертификация в России играет ключевую роль для обеспечения безопасности потребителей, так как блокирует попадание опасной или некачественной продукции на рынок.

Процедуры проверки основаны на нормативных актах , таких как ФЗ № 184-ФЗ, и контролируют как отечественные товары, так и ввозимые продукты.

стоимость сертификата ИСО 9001 Документальное подтверждение гарантирует, что продукция прошла тестирование безопасности и не нанесет вреда людям и окружающей среде.

Важно отметить сертификация стимулирует конкурентоспособность товаров на внутреннем рынке и открывает доступ к экспорту.

Развитие системы сертификации соответствует современным стандартам, что обеспечивает стабильность в условиях законодательных изменений .

КредитоФФ http://creditoroff.ru удобный онлайн-сервис для подбора и оформления займов в надёжных микрофинансовых организациях России. Здесь вы найдёте лучшие предложения от МФО

Стальные резервуары используются для хранения дизельного топлива и соответствуют стандартам давления до 0,04 МПа.

Горизонтальные емкости изготавливают из черной стали Ст3 с усиленной сваркой.

Идеальны для промышленных объектов: хранят бензин, керосин, мазут или авиационное топливо.