Analysis

RBNZ Look ahead: Another hawkish tilt?

Inflation dogs the RBNZ as they seek to bring inflation down to 2%

How to trade the BoE meeting

On Thursday the Bank of England meet and a 50bps rate hike is fully priced in. A 75bps rate hike is seen by Short Term Interest Rate markets as having a 80% chance. The key aspect of this meeting is going to be what the BoE signal about the growth outlook and what happens to … Read more

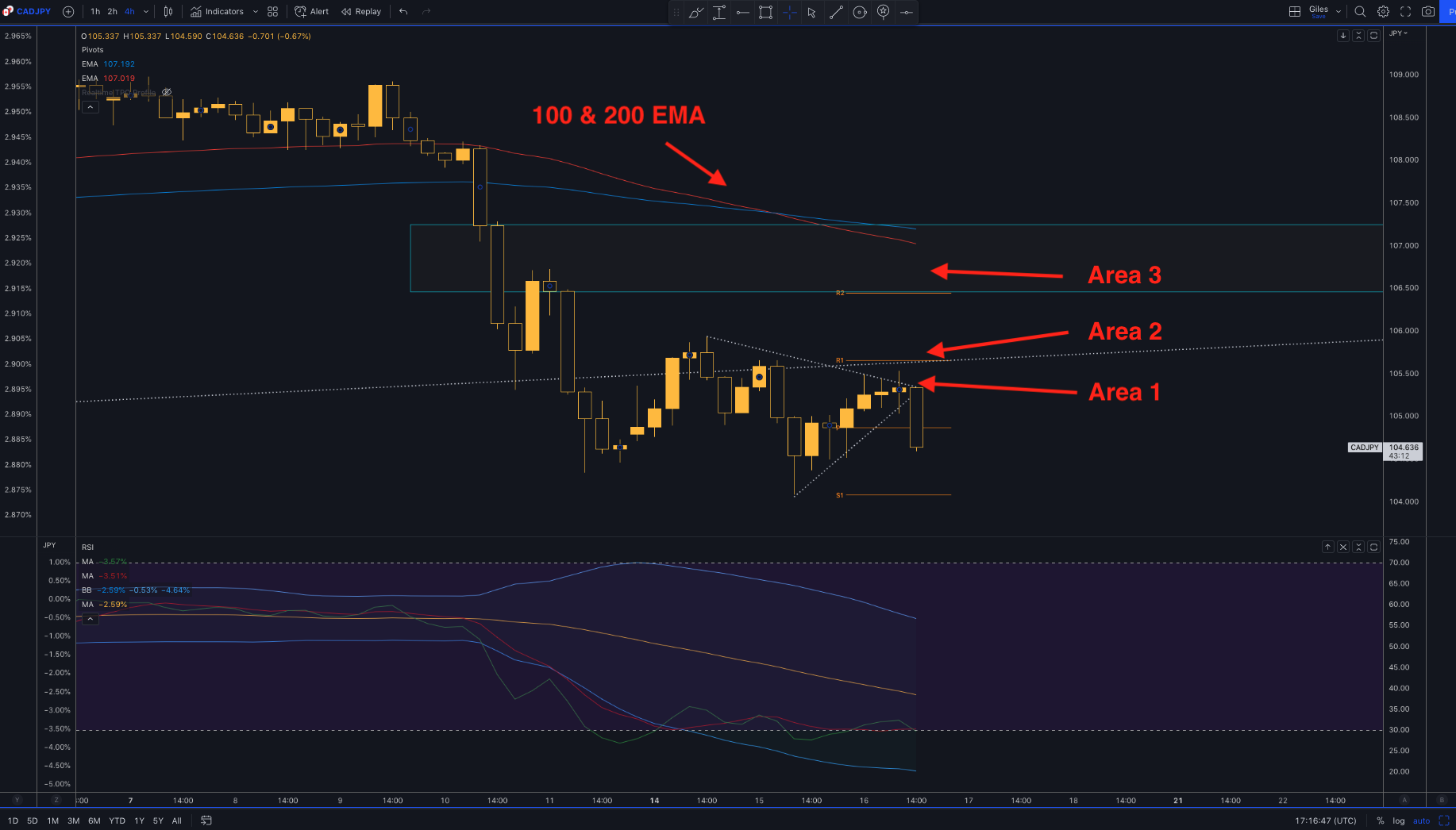

How to trade the BoJ meeting

The Bank of Japan have a problem. That problem is the weakness in the JPY. You can see from the index chart below that JPY weakness has been pronounced this year. The JPY being weak is great for Japan’s export economy. A weak domestic currency means that the countries exports are better value abroad. However, … Read more

Trading Gold, Stocks, & USD over the Fed meeting

The Fed are widely expected to hike interest rates by 75bps this Wednesday. Short Term Interest Rate markets are seeing it as a 100% probability and the same markets have a 79% chance of a larger 100bps hike. The expectations for larger hikes have increased after last Tuesday’s US CPI print where the headline and … Read more

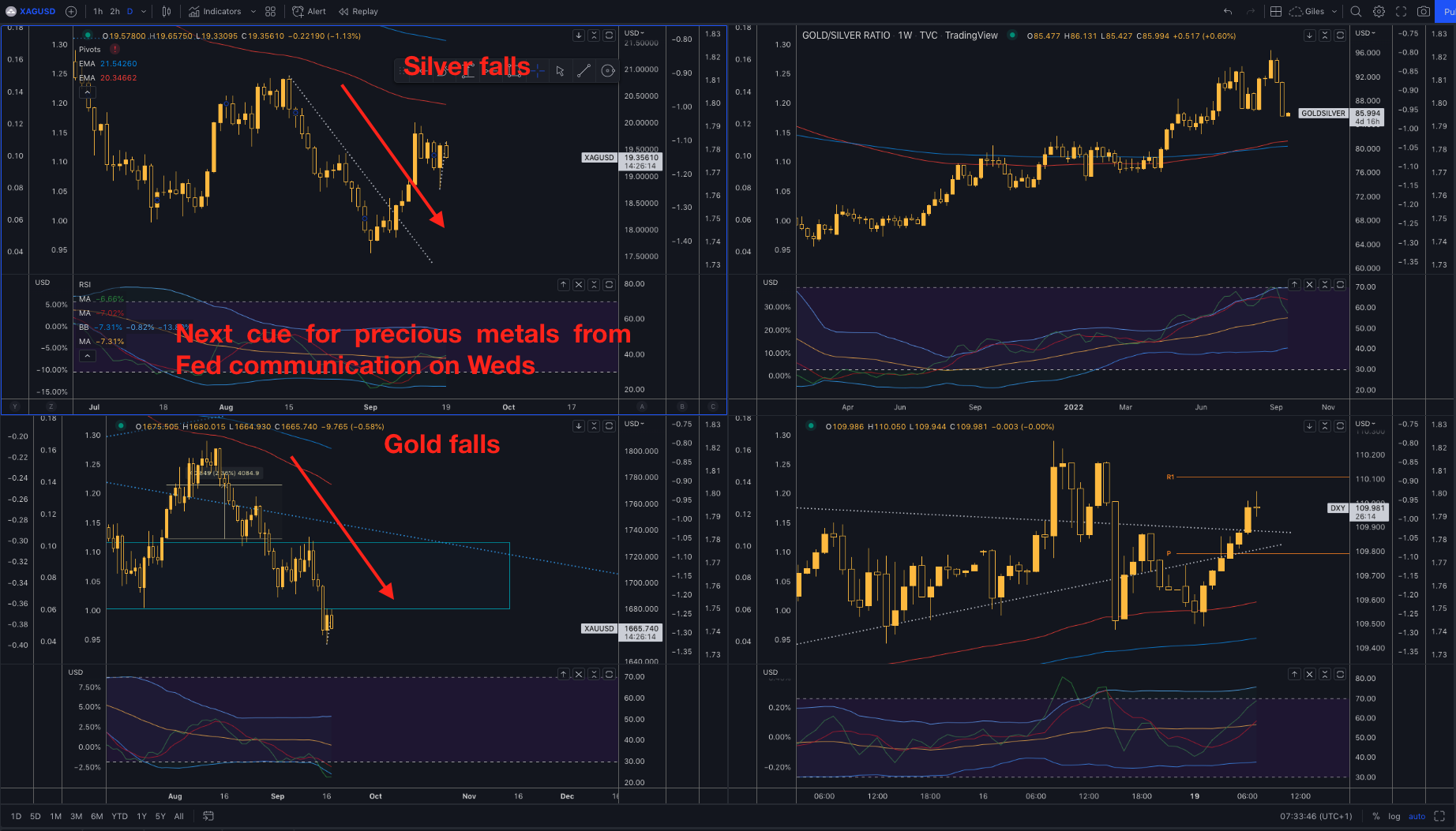

Gold & Silver selling into next week?

Gold and silver markets have both been pressured over the last few weeks on expectations of aggressive Fed hikes. On Tuesday this week both headline and core inflation printed at the high end of expectations. The reaction in the market was predictable and offered good opportunities to astute traders. Stocks, bonds, precious metals all sold … Read more

Trading the flag pattern

The high and tight flag pattern is one of the most reliable technical patterns. Dp you know how to recognise it?

Trading the US Consumer Confidence Print

The US consumer confidence is likely to offer another intraday trading opportunity as US consumer confidence is released on Friday at 1500 UK time