Some candlestick price patterns are well known like shooting stars, hammer reversal bars, and engulfing bars. However, some of the less well known candlestick price patterns are worth noting for reading price charts. This is particularly helpful for when you are a managing a position on the longer term charts. Two patterns we are discussing today and tomorrow are the piercing pattern and the dark cloud cover. So, first let’s look at the piercing pattern for today with an example of how this looks from Apple’s price charts.

The piercing pattern described

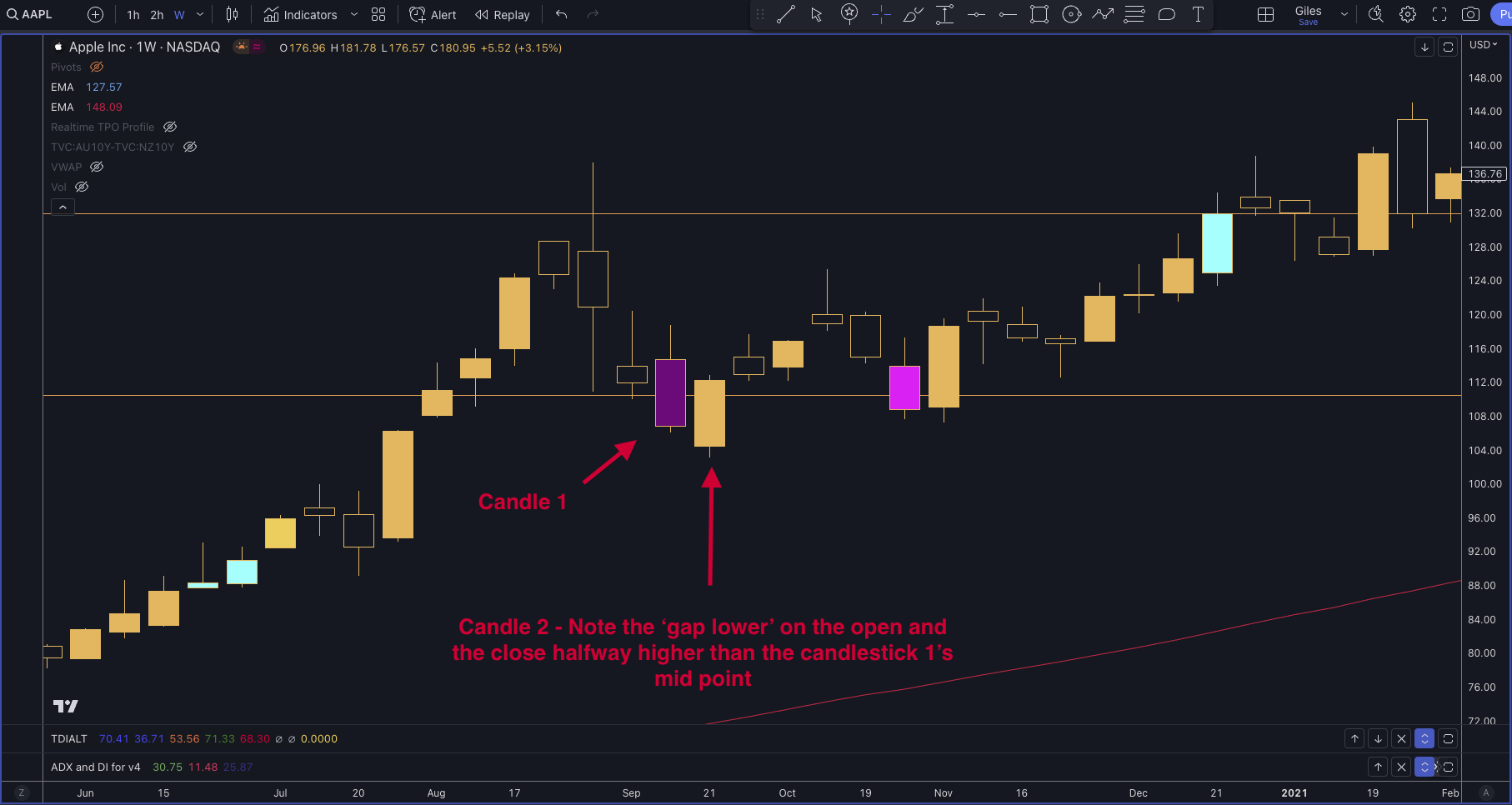

The piercing pattern is a candlestick pattern used in trading to show that a downtrend might be ending and the price could start going up. It has two candlesticks. It is particularly useful for when assessing whether a downtrend is about to come to an end. The pattern is subtle and easily overlooked, so this is what to specifically look for. Note the gap that is needed for the second candlestick patter.

- Candlestick 1: The first candlestick in the pattern is a bearish candlestick, indicating selling pressure. It represents a continuation of the existing downtrend and opens near or above the previous candlestick's close

- Candlestick 2: The second candlestick is a bullish candlestick, which opens lower than the previous candlestick's close. Note: There is a price gap between the close of the first candlestick and the open of the second candlestick. So, intraday it would look like the bears are taking prices to even lower lows. However, the tide changes with the second candlestick.

- Close of Second Candlestick: The crucial aspect of the piercing pattern is come with the second candlestick as it must close at least halfway into the real body of the first candlestick. In other words, the second candlestick's closing price is significantly higher than the first candlestick's midpoint.

The piercing pattern on the charts

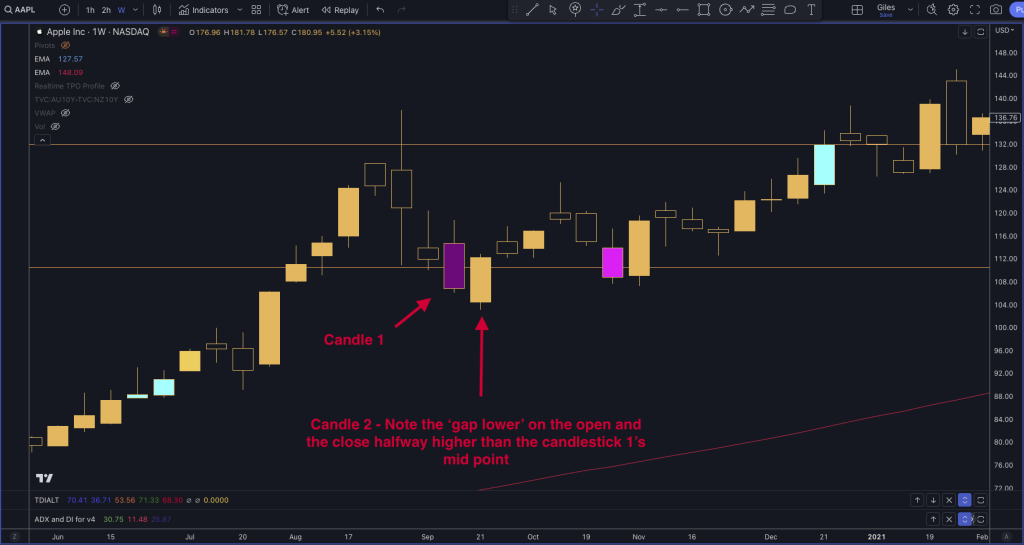

Take a look here for a market example of what candlestick 1 and candlestick 2 from the Apple Weekly chart should look like.

площадка для продажи аккаунтов платформа для покупки аккаунтов

покупка аккаунтов купить аккаунт

биржа аккаунтов продажа аккаунтов

продажа аккаунтов маркетплейс аккаунтов

площадка для продажи аккаунтов купить аккаунт

маркетплейс аккаунтов аккаунт для рекламы

Gaming account marketplace Account market

Sell Account Account Buying Service

Accounts for Sale Ready-Made Accounts for Sale

Buy Pre-made Account Account Buying Service

Account Buying Platform https://accountsmarketplacehub.com/

Buy accounts Account Store

Accounts market https://buyagedaccounts001.com

Account trading platform Account Trading Service

Account Trading Platform Account Exchange Service

Account Sale Database of Accounts for Sale

awesome

account buying service account buying platform

account store buy accounts

account trading buy accounts

guaranteed accounts account market

profitable account sales account exchange service

account trading platform https://socialaccountsdeal.com

purchase ready-made accounts purchase ready-made accounts

account selling platform gaming account marketplace

account purchase buy account

account buying platform account marketplace

account purchase buy pre-made account

account exchange database of accounts for sale

website for buying accounts social media account marketplace

accounts market accounts marketplace

secure account purchasing platform buy pre-made account

secure account sales secure account sales

account exchange service account exchange

database of accounts for sale website for buying accounts

account purchase social media account marketplace

sell account sell account

buy pre-made account https://accounts-market-soc.org

ready-made accounts for sale ready-made accounts for sale

find accounts for sale accounts market

sell accounts find accounts for sale

sell pre-made account marketplace for ready-made accounts

account marketplace accounts for sale

account catalog https://accounts-offer.org/

account buying service https://accounts-marketplace.xyz

sell account https://social-accounts-marketplaces.live

account catalog https://accounts-marketplace.live

account exchange accounts marketplace

buy accounts accounts marketplace

accounts for sale https://buy-accounts-shop.pro/

account catalog https://buy-accounts.live

account trading https://accounts-marketplace.online

buy and sell accounts https://social-accounts-marketplace.live/

account marketplace https://accounts-marketplace-best.pro

маркетплейс аккаунтов соцсетей купить аккаунт

продажа аккаунтов rynok-akkauntov.top

продажа аккаунтов https://kupit-akkaunt.xyz

покупка аккаунтов https://akkaunt-magazin.online

площадка для продажи аккаунтов akkaunty-market.live

маркетплейс аккаунтов соцсетей маркетплейсов аккаунтов

продать аккаунт akkaunty-optom.live

продажа аккаунтов https://online-akkaunty-magazin.xyz/

facebook ad account for sale https://buy-adsaccounts.work/

facebook ad account buy facebook account sale

buy facebook advertising https://buy-ad-account.top/

facebook ad accounts for sale https://buy-ads-account.click

buy facebook accounts https://ad-account-buy.top

facebook ads account buy buying facebook ad account

buy ad account facebook https://ad-account-for-sale.top/

buy fb account https://buy-ad-account.click

facebook ad account buy facebook account buy

buy google ads https://buy-ads-account.top

buy google ads threshold accounts https://buy-ads-accounts.click/

facebook account buy cheap facebook accounts

google ads accounts https://ads-account-for-sale.top

buy google ads buy aged google ads accounts

buy google adwords accounts https://buy-ads-invoice-account.top

google ads accounts for sale https://buy-account-ads.work

buy google ads verified account https://buy-ads-agency-account.top

buy aged google ads accounts https://sell-ads-account.click

google ads agency accounts https://ads-agency-account-buy.click

buy verified bm buy bm facebook

buy account google ads buy google ad account

buy fb business manager https://buy-bm-account.org/

buy verified bm facebook buy-verified-business-manager-account.org

buy bm facebook buy-verified-business-manager.org

business manager for sale https://buy-business-manager-acc.org/

buy facebook business manager verified business-manager-for-sale.org

buy facebook bm account buy facebook business managers

facebook bm for sale facebook business manager for sale

buy business manager https://buy-business-manager-accounts.org/

tiktok ads account for sale https://buy-tiktok-ads-account.org

facebook bm account buy verified-business-manager-for-sale.org

buy tiktok business account https://tiktok-ads-account-buy.org

tiktok ad accounts tiktok ads account for sale

buy tiktok ads https://tiktok-agency-account-for-sale.org

tiktok ads account for sale https://buy-tiktok-ad-account.org

tiktok ad accounts https://buy-tiktok-ads-accounts.org

buy tiktok ad account https://tiktok-ads-agency-account.org

tiktok agency account for sale https://buy-tiktok-business-account.org

buy tiktok business account https://buy-tiktok-ads.org

https://kampascher.shop/# achat kamagra

pulmist aerosol: costo brufen 600 – riopan 80 mg sospensione orale come si prende

punture pappataci foto: rifocin uso locale – sibillette pillola prezzo

livraison m̩dicaments avec ordonnance: peut on aller chez un orl sans ordonnance Рbruleur de graisse en pharmacie sans ordonnance

farmacia online sedavi: puedo comprar la pildora sin receta – farmacia andorra online envÃo españa

sildenafil sans ordonnance en pharmacie: nitrate d’argent pharmacie sans ordonnance – comment faire une ordonnance

equivalent amoxicilline sans ordonnance: Pharmacie Express Рm̩dicament pour maigrir en pharmacie sans ordonnance

farmacia online mascarillas desechables [url=https://confiapharma.shop/#]Confia Pharma[/url] farmacia online chisinau

lyrica 50 mg: di base 25000 flaconcini – pafinur prezzo

viagra homme prix en pharmacie: acheter azithromycine sans ordonnance – viagra pharmacie en ligne

nifedicor gocce vendita online: Farmacia Subito – mirgeal bustine

https://pharmacieexpress.shop/# brossette interdentaire gum

farmacia online portugal envio a espaГ±a [url=https://confiapharma.com/#]farmacia navedo online[/url] se puede comprar rhodogil sin receta medica

se puede comprar emla sin receta: ivermectina comprar sin receta – se puede comprar amoxicilina en la farmacia sin receta

peut on acheter des somnifГЁre sans ordonnance en pharmacie: som actifs – morosil en pharmacie sans ordonnance

olpress 20 mg prezzo [url=https://farmaciasubito.com/#]Farmacia Subito[/url] spedra prezzo

farmacia del sorriso online: comprar augmentine sin receta – el anillo anticonceptivo se puede comprar sin receta

zecovir prezzo: tranex fiale da bere – netildex collirio monodose e mutuabile

tamoxifeno farmacia online [url=http://confiapharma.com/#]Confia Pharma[/url] donde comprar elvanse sin receta

https://farmaciasubito.shop/# giasion 400 prezzo con ricetta

bronchomunal bambini: Farmacia Subito – sirdalud 4 mg prezzo con ricetta

farmacia online lombardia: Farmacia Subito – voltaren fiale prezzo

bonbon pour maigrir [url=https://pharmacieexpress.com/#]gommage avГЁne visage[/url] viagra in france

costo ozempic: indoxen 25 mg prezzo – viagra prezzo

pharmacie en ligne sans ordonnance canada: Pharmacie Express – pharmacie en ligne sans ordonnance france

se puede comprar lexxema sin receta [url=http://confiapharma.com/#]se puede comprar ventolГn en la farmacia sin receta[/url] quГ© viagra puedo comprar sin receta

comprar primperan sin receta: la receta para comprar una vivienda sin ahorros – comprar antabuse sin receta

http://confiapharma.com/# comprar relajantes musculares sin receta

mГ©dicament psoriasis sans ordonnance [url=https://pharmacieexpress.com/#]forticea furterer[/url] aphrodisiaque homme pharmacie sans ordonnance

tranex soluzione iniettabile si puГІ prendere per bocca: atarax a cosa serve – migliore farmacia online 2022

medications from india: india mart pharmacy – generic cialis india pharmacy

online mexican pharmacy reviews [url=http://pharmmex.com/#]top trending pharmacy websites[/url] mexican online stores

pharmacy in nogales mexico: is canadian drug store legit – how much is viagra in mexico

https://pharmmex.shop/# methylprednisolone in mexico

provigil mexico pharmacy: revia pharmacy – amar pharmacy rx

online india pharmacy [url=https://inpharm24.shop/#]online pharmacy company in india[/url] pharmacy course india

amoxicillin from pharmacy: unicare pharmacy vardenafil – no rx needed pharmacy

rx meds online [url=https://pharmmex.com/#]can i buy painkillers online[/url] muscle relaxers mexico

Feldene: Pharm Express 24 – online pharmacy paypal

pharmacy india website: medicines online india – order medicine online india

https://inpharm24.com/# online pharmacy in india

dandruff shampoo india pharmacy: generic cialis india pharmacy – india pharmacy viagra

nearest pharmacy store [url=http://pharmexpress24.com/#]amoxicillin target pharmacy[/url] wellbutrin people’s pharmacy

sun pharmacy india: InPharm24 – ozempic india pharmacy

buy viagra online india: india pharmacy of the world – ex officio member of pharmacy council of india

india pharmacy market outlook [url=https://inpharm24.com/#]india pharmacy of the world[/url] ivermectin india pharmacy

http://inpharm24.com/# online india pharmacy

can you buy phentermine in mexico: mexican pharmacy online reviews – international drug store

mexican pharmacy mounjaro: ozempic from mexico online – what drugs can you buy over the counter in mexico

benadryl uk pharmacy [url=https://pharmexpress24.shop/#]sam’s club pharmacy hours[/url] ro accutane online pharmacy

online shopping for medicines: nogales pharmacy prices – mexican pharmacy methadone

cialis india pharmacy [url=https://inpharm24.com/#]india online pharmacy[/url] online pharmacy india

https://pharmmex.com/# can you buy ozempic over the counter in mexico

india pharmacy delivery to usa: meds from india – india medicine

cialis from mexico: Pharm Mex – drug online store

online animal pharmacy [url=http://pharmexpress24.com/#]american pharmacy viagra[/url] dog pharmacy online

can you buy viagra in mexico: mexican pharmacy ambien – prozac in mexico

cabo pharmacy: top online pharmacy – mexican prescription drug names

online mexican pharmacy semaglutide [url=http://pharmmex.com/#]Pharm Mex[/url] us pharmacy online

buy medicines online in india: InPharm24 – india online pharmacy

https://inpharm24.shop/# history of pharmacy in india

ozempic india pharmacy: india pharmacy website – india pharmacy of the world

medicines online india [url=http://inpharm24.com/#]india mart pharmacy[/url] online india pharmacy

flonase pharmacy: cheapest pharmacy to get concerta – avandia retail pharmacy

ritalin in mexico [url=https://pharmmex.com/#]xanax mexican pharmacy[/url] prednisone in mexico

mexican pharmacy pomona: Pharm Mex – tramadol from mexico

mexican pain cream: Pharm Mex – mexico pharmacy tijuana

god of pharmacy in india [url=http://inpharm24.com/#]compounding pharmacy in india[/url] cheap online pharmacy india

https://inpharm24.shop/# god of pharmacy in india

abc online pharmacy: cabergoline overseas pharmacy – viagra professional online pharmacy

п»їindia pharmacy [url=http://inpharm24.com/#]pharmacy india[/url] medicine online shopping

sildenafil 20 mg online prescription: buy online viagra – viagra pills over the counter canada

where to buy sildenafil online with paypal: viagra 2018 – viagra tablet online india

buy genuine viagra online canada [url=https://vgrsources.com/#]VGR Sources[/url] 300 mg viagra

https://vgrsources.com/# buy generic viagra in india

sildenafil tablets 100mg buy: order viagra online uk – price of sildenafil 100mg

viagra 100mg cost canada: cheap generic viagra no prescription – sildenafil tablets from india 100mg tablets

where to buy viagra uk [url=https://vgrsources.com/#]generic viagra over the counter[/url] discount viagra india

where can i get over the counter viagra: generic viagra cost in canada – viagra for sale online australia

sildenafil pharmacy online: cheap viagra canada free shipping – buy female viagra australia

3 viagra [url=https://vgrsources.com/#]viagra prescription cost uk[/url] viagra canada no prescription

https://vgrsources.com/# Wo kann ich generisches Viagra online bestellen?

how to buy viagra in canada: VGR Sources – lowest prices online pharmacy sildenafil

generic viagra discount: VGR Sources – buy viagra online generic

order viagra united states [url=https://vgrsources.com/#]VGR Sources[/url] where can i buy generic viagra

generic viagra online in usa: VGR Sources – generic viagra prescription

https://vgrsources.com/# buy brand name viagra

viagra 150 mg pills: VGR Sources – viagra from canada

viagra 50 mg tablet buy online [url=https://vgrsources.com/#]VGR Sources[/url] cost for viagra prescription

online pharmacy uk viagra: VGR Sources – pharmacy rx viagra

viagra soft 100mg: sildenafil coupon 100 mg – buy brand viagra 100mg

buy female viagra uk [url=https://vgrsources.com/#]sildenafil price in india[/url] can you buy sildenafil over the counter in uk

viagra discount canada: sildenafil pharmacy online – sildenafil online free shipping

female viagra price: VGR Sources – sildenafil 100mg coupon

https://vgrsources.com/# pfizer viagra for sale

how to get sildenafil [url=https://vgrsources.com/#]75 mg sildenafil[/url] sildenafil cheapest price in india

generic viagra 100mg india: VGR Sources – generic for viagra

cost of genuine viagra: sildenafil 20mg prescription cost – sildenafil citrate women

prescription viagra [url=https://vgrsources.com/#]VGR Sources[/url] 75 mg sildenafil

viagra gold: VGR Sources – where can i buy viagra in canada

pfizer viagra: VGR Sources – viagra capsule online

online sildenafil usa [url=https://vgrsources.com/#]buy sildenafil online nz[/url] generic sildenafil 40 mg

https://vgrsources.com/# best female viagra pills in india

sildenafil citrate 100: VGR Sources – how to order viagra in canada

viagra 50mg tablets price in india: VGR Sources – online pharmacy generic viagra

viagra where to buy in india: VGR Sources – generic viagra cheap canada

sildenafil tablets 100mg india [url=https://vgrsources.com/#]how much is sildenafil 20 mg[/url] sildenafil tablets where to buy

where to buy viagra in usa: buy viagra online generic – viagra natural

20 mg sildenafil daily: viagra side effects – viagra pill price in mexico

how much is viagra australia: citrate sildenafil – how to buy viagra online in canada

3 viagra [url=https://vgrsources.com/#]best online viagra site[/url] 20 mg sildenafil 680

https://vgrsources.com/# price of viagra generic

sildenafil prices 20 mg: 150 mg viagra – sildenafil 25mg tab

where can i buy viagra over the counter canada: viagra 100 price – sildenafil 50 mg cost

best price for viagra 100mg: VGR Sources – cheapest price for sildenafil 100 mg

generic sildenafil 50 mg [url=https://vgrsources.com/#]VGR Sources[/url] real viagra no prescription

viagra generic in united states: VGR Sources – viagra comparison

viagra price in malaysia: VGR Sources – where can you buy viagra over the counter

viagra tablets canada: VGR Sources – order viagra online without script

generic viagra lowest prices [url=https://vgrsources.com/#]best price viagra 50 mg[/url] viagra usa pharmacy

sildenafil pills canada: VGR Sources – viagra 50mg price

https://vgrsources.com/# online viagra tablets in india

erectile dysfunction viagra: VGR Sources – canadian drugstore viagra

purchase genuine viagra: buy real viagra online no prescription – viagra generic sale

compare prices viagra [url=https://vgrsources.com/#]buy generic viagra online fast shipping[/url] how much is 1 viagra pill

viagra for sale without prescription: VGR Sources – can you buy viagra in mexico over the counter

buy viagra online australia paypal: VGR Sources – where to get viagra without prescription

Buy cholesterol medicine online cheap: Best price for Crestor online USA – Crestor Pharm

Lipi Pharm: Atorvastatin online pharmacy – lipitor back pain

PredniPharm [url=http://prednipharm.com/#]prednisone 2.5 mg daily[/url] 5 prednisone in mexico

https://lipipharm.com/# Lipi Pharm

side effects of lipitor in the elderly: Lipi Pharm – Atorvastatin online pharmacy

rosuvastatin calcium espaГ±ol: Affordable cholesterol-lowering pills – rosuvastatin and liver cirrhosis

apo prednisone: where can i buy prednisone online without a prescription – PredniPharm

prednisone pill prices: PredniPharm – prednisone 60 mg daily

Affordable Rybelsus price [url=https://semaglupharm.com/#]Semaglu Pharm[/url] SemagluPharm

https://lipipharm.shop/# LipiPharm

Semaglu Pharm: Online pharmacy Rybelsus – Semaglu Pharm

CrestorPharm: crestor and magnesium interaction – Crestor Pharm

buy prednisone online paypal [url=https://prednipharm.com/#]Predni Pharm[/url] prednisone 5mg coupon

PredniPharm: medicine prednisone 5mg – prednisone cost canada

LipiPharm: when to take lipitor pills – Order cholesterol medication online

which is safer atorvastatin or rosuvastatin: Crestor Pharm – CrestorPharm

Crestor Pharm [url=http://crestorpharm.com/#]CrestorPharm[/url] CrestorPharm

CrestorPharm: crestor moderate intensity – Online statin therapy without RX

https://crestorpharm.shop/# does crestor cause tinnitus

50 mg prednisone tablet: PredniPharm – PredniPharm

can i buy prednisone online in uk [url=https://prednipharm.shop/#]Predni Pharm[/url] Predni Pharm

Predni Pharm: prednisone 15 mg daily – PredniPharm

Semaglu Pharm: SemagluPharm – SemagluPharm

LipiPharm: Discreet shipping for Lipitor – Atorvastatin online pharmacy

LipiPharm [url=https://lipipharm.shop/#]Discreet shipping for Lipitor[/url] LipiPharm

https://crestorpharm.com/# high intensity crestor

Predni Pharm: Predni Pharm – canada pharmacy prednisone

FDA-approved generic statins online: lipitor side effects in men – LipiPharm

Crestor Pharm [url=https://crestorpharm.com/#]Crestor Pharm[/url] Crestor Pharm

Crestor home delivery USA: can you cut rosuvastatin 20 mg in half – Crestor Pharm

Generic Crestor for high cholesterol: is 5mg of rosuvastatin a low-dose – Crestor mail order USA

Where to buy Semaglutide legally: Semaglu Pharm – No prescription diabetes meds online

how to get prednisone without a prescription [url=https://prednipharm.com/#]prednisone brand name[/url] Predni Pharm

Atorvastatin online pharmacy: LipiPharm – Online statin drugs no doctor visit

rosuvastatin calcium en espaГ±ol: rosuvastatin nursing implications – atorvastatin vs rosuvastatin side effects

http://prednipharm.com/# Predni Pharm

why is lipitor taken at night: Lipi Pharm – LipiPharm

Semaglu Pharm: п»їBuy Rybelsus online USA – Semaglu Pharm

Crestor mail order USA: crestor and muscle pain – CrestorPharm

prednisone 20mg prices [url=https://prednipharm.com/#]PredniPharm[/url] prednisone 200 mg tablets

Crestor 10mg / 20mg / 40mg online: crestor vs atorvastatin side effects – Crestor 10mg / 20mg / 40mg online

CrestorPharm: moderate intensity rosuvastatin – Crestor Pharm

http://crestorpharm.com/# CrestorPharm

Lipi Pharm [url=https://lipipharm.com/#]Lipi Pharm[/url] LipiPharm

Crestor 10mg / 20mg / 40mg online: Crestor Pharm – CrestorPharm

can i drink milk with atorvastatin: LipiPharm – what does atorvastatin calcium do

rosuvastatin side effects on kidney [url=http://crestorpharm.com/#]Crestor Pharm[/url] when to take rosuvastatin morning or night

5 mg lipitor: LipiPharm – Lipi Pharm

Order cholesterol medication online: Cheap Lipitor 10mg / 20mg / 40mg – is lipitor better than crestor

buy prednisone without prescription: 60 mg prednisone daily – PredniPharm

https://semaglupharm.shop/# how to get semaglutide out of your system fast

https://crestorpharm.shop/# CrestorPharm

Predni Pharm [url=http://prednipharm.com/#]average cost of prednisone[/url] Predni Pharm

best time to take rosuvastatin: Best price for Crestor online USA – Rosuvastatin tablets without doctor approval

prednisone 50 mg for sale: 200 mg prednisone daily – PredniPharm

http://semaglupharm.com/# rybelsus hair loss

Semaglu Pharm [url=http://semaglupharm.com/#]Semaglu Pharm[/url] No prescription diabetes meds online

CrestorPharm: rosuvastatin and vitamin k2 – CrestorPharm

Online pharmacy Rybelsus: Semaglu Pharm – SemagluPharm

https://semaglupharm.com/# phentermine vs semaglutide

http://lipipharm.com/# can you cut lipitor in half

PredniPharm [url=http://prednipharm.com/#]PredniPharm[/url] PredniPharm

Semaglu Pharm: п»їBuy Rybelsus online USA – Semaglutide tablets without prescription

Lipi Pharm: atorvastatin medication template – Cheap Lipitor 10mg / 20mg / 40mg

https://semaglupharm.shop/# when is the best time to take semaglutide

prednisone best price [url=http://prednipharm.com/#]prednisone 20 mg tablet[/url] Predni Pharm

where to inject semaglutide in thigh: Semaglu Pharm – Semaglu Pharm

Buy cholesterol medicine online cheap: Crestor 10mg / 20mg / 40mg online – Generic Crestor for high cholesterol

https://semaglupharm.shop/# Semaglu Pharm

http://prednipharm.com/# PredniPharm

PredniPharm [url=https://prednipharm.com/#]prednisone 10mg price in india[/url] PredniPharm

https://semaglupharm.com/# Semaglu Pharm

Crestor Pharm: CrestorPharm – CrestorPharm

Semaglu Pharm: rybelsus how much does it cost – SemagluPharm

https://semaglupharm.com/# SemagluPharm

SemagluPharm [url=https://semaglupharm.com/#]SemagluPharm[/url] does rybelsus cause cancer

Order Rybelsus discreetly: SemagluPharm – Semaglu Pharm

No doctor visit required statins: crestor commercial – п»їBuy Crestor without prescription

http://semaglupharm.com/# SemagluPharm

Predni Pharm [url=http://prednipharm.com/#]PredniPharm[/url] buy prednisone online australia

LipiPharm: LipiPharm – LipiPharm

https://semaglupharm.com/# SemagluPharm

prednisone canada pharmacy: PredniPharm – Predni Pharm

https://semaglupharm.shop/# SemagluPharm

SemagluPharm [url=https://semaglupharm.com/#]FDA-approved Rybelsus alternative[/url] Semaglu Pharm

atorvastatin lipitor side effects: USA-based pharmacy Lipitor delivery – Lipi Pharm

prednisone pill: prednisone brand name canada – online prednisone 5mg

https://semaglupharm.com/# rybelsus 3mg weight loss reviews

Crestor Pharm [url=https://crestorpharm.shop/#]rosuvastatin and weight gain[/url] Crestor Pharm

Semaglu Pharm: SemagluPharm – does semaglutide suppress appetite immediately

PredniPharm: PredniPharm – Predni Pharm

https://semaglupharm.com/# Semaglu Pharm

http://semaglupharm.com/# SemagluPharm

prednisone 20mg [url=http://prednipharm.com/#]Predni Pharm[/url] PredniPharm

Predni Pharm: PredniPharm – prednisone 5mg over the counter

rybelsus 14mg price: Safe delivery in the US – 14 mg rybelsus

http://semaglupharm.com/# Semaglu Pharm

can you lose weight on rybelsus [url=http://semaglupharm.com/#]Semaglu Pharm[/url] Semaglu Pharm

Lipi Pharm: Lipi Pharm – Lipi Pharm

PredniPharm: where to buy prednisone without prescription – PredniPharm

https://semaglupharm.com/# SemagluPharm

http://semaglupharm.com/# Semaglu Pharm

FDA-approved generic statins online [url=https://lipipharm.shop/#]Lipi Pharm[/url] Lipi Pharm

Semaglu Pharm: Semaglu Pharm – Semaglu Pharm

India Pharm Global: reputable indian online pharmacy – India Pharm Global

http://canadapharmglobal.com/# legitimate canadian pharmacy online

indian pharmacies safe [url=https://indiapharmglobal.shop/#]world pharmacy india[/url] reputable indian online pharmacy

https://medsfrommexico.shop/# buying prescription drugs in mexico online

India Pharm Global: buy prescription drugs from india – best india pharmacy

http://medsfrommexico.com/# Meds From Mexico

India Pharm Global: India Pharm Global – online pharmacy india

canadapharmacyonline com [url=http://canadapharmglobal.com/#]Canada Pharm Global[/url] legit canadian pharmacy

http://medsfrommexico.com/# Meds From Mexico

indianpharmacy com: indian pharmacy paypal – top 10 pharmacies in india

buying from online mexican pharmacy: Meds From Mexico – Meds From Mexico

http://medsfrommexico.com/# Meds From Mexico

canadian pharmacy king reviews [url=http://canadapharmglobal.com/#]canadapharmacyonline com[/url] canadian pharmacy service

https://indiapharmglobal.com/# India Pharm Global

pharmacy website india: India Pharm Global – india online pharmacy

buying prescription drugs in mexico: buying from online mexican pharmacy – Meds From Mexico

https://medsfrommexico.shop/# best online pharmacies in mexico

India Pharm Global [url=http://indiapharmglobal.com/#]indian pharmacy online[/url] top online pharmacy india

Meds From Mexico: Meds From Mexico – mexican border pharmacies shipping to usa

Meds From Mexico: п»їbest mexican online pharmacies – buying from online mexican pharmacy

https://medsfrommexico.com/# mexican rx online

https://medsfrommexico.shop/# Meds From Mexico

canada drug pharmacy [url=http://canadapharmglobal.com/#]Canada Pharm Global[/url] canadapharmacyonline

Meds From Mexico: mexican drugstore online – mexican pharmaceuticals online

https://medsfrommexico.com/# mexican border pharmacies shipping to usa

canadian pharmacy world: canadian pharmacy reviews – canadian drug

legitimate canadian online pharmacies [url=https://canadapharmglobal.com/#]escrow pharmacy canada[/url] canadian online drugstore

canada drugs reviews: canadian pharmacy review – canada drugstore pharmacy rx

https://indiapharmglobal.shop/# India Pharm Global

buying from online mexican pharmacy: Meds From Mexico – reputable mexican pharmacies online

https://canadapharmglobal.com/# canadian pharmacy

best india pharmacy [url=https://indiapharmglobal.shop/#]best online pharmacy india[/url] India Pharm Global

https://canadapharmglobal.com/# trustworthy canadian pharmacy

best online pharmacies in mexico: mexican online pharmacies prescription drugs – Meds From Mexico

Meds From Mexico: buying prescription drugs in mexico – Meds From Mexico

best rated canadian pharmacy [url=https://canadapharmglobal.com/#]Canada Pharm Global[/url] canadian pharmacy victoza

https://indiapharmglobal.shop/# best india pharmacy

India Pharm Global: online pharmacy india – India Pharm Global

best online pharmacies in mexico: Meds From Mexico – mexican pharmaceuticals online

Svenska Pharma [url=https://svenskapharma.com/#]Svenska Pharma[/url] Svenska Pharma

https://svenskapharma.shop/# apotek danmark

https://papafarma.com/# farmacias cerca de mi abiertas

hjemmetest covid 19 apotek: nacl apotek – arkaden apotek

farmacia ortopedia las ventas: pastillas cariban precio – Papa Farma

apotek inloggning [url=https://svenskapharma.com/#]apotek ta hГҐl i Г¶ronen[/url] Svenska Pharma

https://papafarma.shop/# farmacia barata zaragoza

apotek pГҐ nett gratis frakt: Rask Apotek – glidekrem apotek

apotek synonym: ibs apotek – ljumskbrГҐck bГ¤lte apotek

https://papafarma.com/# tadalafil online

https://efarmaciait.com/# EFarmaciaIt

Papa Farma [url=https://papafarma.shop/#]pharmacy online[/url] Papa Farma

Papa Farma: farmacia cerca de ml – farmaci

sildenafil (50 mg prezzo): caretopic spray costo – caretopic spray prezzo

https://svenskapharma.com/# hur mycket välling 10 månader

bentelan generico [url=https://efarmaciait.shop/#]EFarmaciaIt[/url] EFarmaciaIt

Papa Farma: Papa Farma – Papa Farma

https://efarmaciait.com/# EFarmaciaIt

http://efarmaciait.com/# EFarmaciaIt

Rask Apotek [url=https://raskapotek.com/#]Rask Apotek[/url] Rask Apotek

Rask Apotek: aktiv kull apotek – Rask Apotek

EFarmaciaIt: cialis in svizzera – EFarmaciaIt

http://papafarma.com/# cialis 100 mg precio

Papa Farma [url=https://papafarma.shop/#]farmacia 24 horas alicante[/url] parafarmacias

Svenska Pharma: Svenska Pharma – +46 8-750 92 20

https://raskapotek.com/# Rask Apotek

https://raskapotek.shop/# apotek nett

hur mycket Г¤r 10 ml: apotek nagellack – bestГ¤lla recept pГҐ nГ¤tet

active care significato [url=https://efarmaciait.shop/#]gentalyn crema costo[/url] EFarmaciaIt

Svenska Pharma: Г¶gonbrynsgel bГ¤st i test – Svenska Pharma

https://svenskapharma.com/# collagen apotek

farmacia en: misoprostol precio espaГ±a – Papa Farma

Papa Farma [url=https://papafarma.com/#]Papa Farma[/url] Papa Farma

EFarmaciaIt: EFarmaciaIt – EFarmaciaIt

https://efarmaciait.shop/# EFarmaciaIt

https://papafarma.shop/# Papa Farma

Svenska Pharma: apotek barn – Svenska Pharma

Rask Apotek: helgeГҐpent apotek – Rask Apotek

viagra por internet [url=https://papafarma.com/#]the pharmacy malaga[/url] farmacuas

http://papafarma.com/# Papa Farma

Papa Farma: dos pharma – almacen farmacia

Svenska Pharma: Svenska Pharma – apotek blodtryck

iraltone ds crema efectos secundarios [url=http://papafarma.com/#]Papa Farma[/url] Papa Farma

http://efarmaciait.com/# EFarmaciaIt

http://svenskapharma.com/# kattungar skänkes

Svenska Pharma: rosacea apotek – Svenska Pharma

https://svenskapharma.shop/# Svenska Pharma

Papa Farma: Papa Farma – Papa Farma

självtest apotek [url=https://svenskapharma.com/#]vitamin c apotek[/url] serum apotek

http://efarmaciait.com/# eutirox 50 senza ricetta prezzo

congescor 2 5 [url=https://efarmaciait.com/#]ibuprofene marche[/url] EFarmaciaIt

brentan crema efectos secundarios: farmacias a la venta – farmacia en lГnea

Papa Farma: misoprostol comprar – Papa Farma

https://papafarma.com/# Papa Farma

MedicijnPunt: Medicijn Punt – medicijn bestellen

online medicijnen bestellen met recept [url=http://medicijnpunt.com/#]Medicijn Punt[/url] MedicijnPunt

Pharma Confiance: Pharma Confiance – pharmacie garde lyon 8

https://pharmaconnectusa.com/# viagra in chennai pharmacy

Pharma Confiance: Pharma Confiance – daflon 500 combien par jour

brosse Г dent Г©lectrique sonique [url=https://pharmaconfiance.shop/#]xenical pharmacie[/url] pharmaciede

https://pharmajetzt.shop/# apotheke versandkostenfrei ab 10 euro

https://medicijnpunt.com/# internet apotheek

online pharmacies legitimate: pharmacy that sells rohypnol – safeway pharmacy online

MedicijnPunt: Medicijn Punt – Medicijn Punt

apotheek nl online [url=http://medicijnpunt.com/#]MedicijnPunt[/url] medicijnen kopen met ideal

https://medicijnpunt.com/# Medicijn Punt

Pharma Jetzt: PharmaJetzt – Pharma Jetzt

Pharma Jetzt: Pharma Jetzt – PharmaJetzt

https://pharmaconfiance.shop/# Pharma Confiance

https://pharmajetzt.shop/# PharmaJetzt

Pharma Confiance [url=https://pharmaconfiance.shop/#]viagra 50 mg avis[/url] Pharma Confiance

Pharma Connect USA: Prothiaden – Pharma Connect USA

generic viagra usa pharmacy: Pharma Connect USA – care pharmacy rochester nh store hours

https://pharmaconfiance.com/# monuril pour homme

MedicijnPunt [url=http://medicijnpunt.com/#]MedicijnPunt[/url] Medicijn Punt

luitpold apotheke mГјnchen: apotheke online kaufen – Pharma Jetzt

MedicijnPunt: MedicijnPunt – nieuwe pharma

https://pharmajetzt.com/# PharmaJetzt

http://pharmajetzt.com/# Pharma Jetzt

Pharma Confiance [url=http://pharmaconfiance.com/#]Pharma Confiance[/url] quelle autoritГ© assure la protection des donnГ©es personnelles en belgique

Pharma Connect USA: online pharmacy united states – online pharmacy ativan

united states online pharmacy viagra: PharmaConnectUSA – Pharma Connect USA

http://pharmajetzt.com/# PharmaJetzt

PharmaConnectUSA [url=https://pharmaconnectusa.shop/#]PharmaConnectUSA[/url] PharmaConnectUSA

Medicijn Punt: MedicijnPunt – Medicijn Punt

Pharma Jetzt: Pharma Jetzt – PharmaJetzt

http://pharmaconnectusa.com/# PharmaConnectUSA

https://pharmaconnectusa.com/# men’s health pharmacy viagra

tabletten erkennen [url=http://pharmajetzt.com/#]seriöse online-apotheke rezeptfrei[/url] Pharma Jetzt

tadalafil pharmacy online: PharmaConnectUSA – PharmaConnectUSA

https://pharmaconfiance.shop/# test de grossesse naturel avec du savon

pillen bestellen: online apotheek 24 – internetapotheek nederland

luipold apotheke [url=https://pharmajetzt.shop/#]apo versandapotheke[/url] PharmaJetzt

https://pharmaconnectusa.shop/# fincar inhouse pharmacy

apotheke versandapotheke: apotheke online bestellen – Pharma Jetzt

Pharma Connect USA: PharmaConnectUSA – proscar online pharmacy

http://pharmajetzt.com/# apptheke online

obline apotheke [url=https://pharmajetzt.shop/#]Pharma Jetzt[/url] PharmaJetzt

http://pharmajetzt.com/# shop apotheken online

PharmaConnectUSA: usa online pharmacy store – wall drug store

pharmacie c: Pharma Confiance – pharmacie homme de fer strasbourg

medicij [url=https://medicijnpunt.com/#]MedicijnPunt[/url] apotheken in holland

https://medicijnpunt.shop/# medicijnen op recept

PharmaConnectUSA: PharmaConnectUSA – Pharma Connect USA

apohteek: MedicijnPunt – Medicijn Punt

https://pharmaconnectusa.shop/# PharmaConnectUSA

https://medicijnpunt.shop/# Medicijn Punt

PharmaConnectUSA [url=https://pharmaconnectusa.com/#]online pharmacy india cialis[/url] PharmaConnectUSA

uw apotheek: Medicijn Punt – MedicijnPunt

pharmacie shop discount: Pharma Confiance – Pharma Confiance

http://medicijnpunt.com/# Medicijn Punt

apotheken nederland [url=http://medicijnpunt.com/#]Medicijn Punt[/url] MedicijnPunt

online apotheek gratis verzending: MedicijnPunt – MedicijnPunt

Pharma Confiance: Pharma Confiance – Pharma Confiance

https://pharmaconfiance.com/# pharmacie strassen

Medicijn Punt: MedicijnPunt – medicijnen snel bestellen

https://medicijnpunt.shop/# pharmacy online

pille danach apotheke online: Pharma Jetzt – PharmaJetzt

http://pharmajetzt.com/# PharmaJetzt

Pharma Jetzt: Pharma Jetzt – Pharma Jetzt

Medicijn Punt: medicijn bestellen – MedicijnPunt

http://pharmajetzt.com/# PharmaJetzt

schopapoteke: PharmaJetzt – PharmaJetzt

https://pharmaconnectusa.shop/# pharmacy express

http://pharmaconnectusa.com/# PharmaConnectUSA

pharmacy store nearby: Pharma Connect USA – PharmaConnectUSA

dapoxetine in malaysia pharmacy: micardis online pharmacy – pharmacy online 365 discount code

https://pharmaconfiance.com/# Pharma Confiance

android app store pharmacy: mexico pharmacy order online – Pharma Connect USA

Medicijn Punt: MedicijnPunt – Medicijn Punt

https://medicijnpunt.shop/# Medicijn Punt

https://medicijnpunt.com/# apteka nl online

codoliprane 400 posologie: Pharma Confiance – pharmacie allemagne en ligne

PharmaConnectUSA: atacand online pharmacy – Pharma Connect USA

http://pharmajetzt.com/# medikamente preisvergleich

medikamente online kaufen: versandapotheke – PharmaJetzt

PharmaJetzt: mediherz versandapotheke online shop bestellen – shop apotheke versandkostenfrei

https://pharmaconfiance.shop/# Pharma Confiance

https://pharmajetzt.com/# online apothee

Pharma Confiance: fournisseur pharmaceutique – pharmacie de garde medoc aujourd’hui

PharmaConnectUSA: Malegra DXT plus – online pharmacy tadalafil 20mg

https://pharmaconfiance.com/# Pharma Confiance

pillen kaufen: online pharmacy germany – arznei gГјnstig

Pharma Connect USA: Pharma Connect USA – ventolin inhaler inhouse pharmacy

https://pharmaconfiance.com/# Pharma Confiance

https://pharmaconfiance.com/# Pharma Confiance

MedicijnPunt: medicijnen zonder recept kopen – MedicijnPunt

Pharma Confiance: newpharma nuxe – comprimГ© viagra homme

https://pharmajetzt.com/# Pharma Jetzt

medicijnen op recept: MedicijnPunt – medicijnen online bestellen

MedicijnPunt: apteka internetowa holandia – apotheke online

http://medicijnpunt.com/# apotheek on line

viagra buy pharmacy: escitalopram online pharmacy – united pharmacy finasteride

Pharma Confiance: france pharma – Pharma Confiance

http://pharmajetzt.com/# obline apotheke

PharmaConnectUSA [url=https://pharmaconnectusa.shop/#]sam’s club pharmacy[/url] PharmaConnectUSA

gГјnstiger apotheke: Pharma Jetzt – PharmaJetzt

apotal.de versandapotheke: medikamente preisvergleich – PharmaJetzt

http://medicijnpunt.com/# MedicijnPunt

PharmaJetzt [url=https://pharmajetzt.shop/#]PharmaJetzt[/url] PharmaJetzt

Pharma Confiance: Pharma Confiance – Pharma Confiance

commander mГ©dicament en ligne avec ordonnance: Pharma Confiance – site newpharma avis

http://pharmajetzt.com/# Pharma Jetzt

https://pharmajetzt.com/# aphoteke online

trustworthy online pharmacy viagra: propranolol target pharmacy – medical mall pharmacy

Pharma Jetzt: apoteke – Pharma Jetzt

le chat bleu commande en ligne [url=https://pharmaconfiance.shop/#]tadalafil 20 mg boГ®te de 24 prix[/url] Pharma Confiance

online apotheek zonder recept: Medicijn Punt – apteka holandia

http://medicijnpunt.com/# pharmacy online

medicijnen kopen online: MedicijnPunt – Medicijn Punt

http://pharmaconnectusa.com/# PharmaConnectUSA

PharmaJetzt: luidpold apotheke – Pharma Jetzt

Medicijn Punt [url=http://medicijnpunt.com/#]MedicijnPunt[/url] MedicijnPunt

Pharma Confiance: Pharma Confiance – Pharma Confiance

http://medicijnpunt.com/# online apotheken

PharmaJetzt: online apptheke – online versandapotheke

Medicijn Punt: apteka den haag – MedicijnPunt

internet apotheke gГјnstig [url=http://pharmajetzt.com/#]Pharma Jetzt[/url] medikament

online apotheek 24: medicatie online bestellen – MedicijnPunt

https://pharmaconnectusa.com/# PharmaConnectUSA

seriГ¶se online-apotheke rezeptfrei: apotheke versandkostenfrei – online apotheke deutschland

https://pharmajetzt.shop/# Pharma Jetzt

grossiste parapharmacie en ligne: pharmacie de la piscine – Pharma Confiance

https://pharmaconfiance.shop/# god prix

Medicijn Punt: Medicijn Punt – ons medicatie voor apotheken

PharmaJetzt [url=https://pharmajetzt.shop/#]PharmaJetzt[/url] versand apotheke

PharmaJetzt: online apotheke ohne rezept – PharmaJetzt

http://pharmaconfiance.com/# pharmacie pas cher autour de moi

Medicijn Punt: Medicijn Punt – apotheek medicijnen bestellen

Pharma Jetzt [url=https://pharmajetzt.shop/#]arzneimittel bestellen[/url] ahop apotheke

https://pharmaconfiance.shop/# Pharma Confiance

PharmaConnectUSA: anthem online pharmacy – ed medication

slinda pilule avis: Pharma Confiance – Pharma Confiance

http://pharmajetzt.com/# fledox in apotheke kaufen

MedicijnPunt: Medicijn Punt – viata online apotheek

medikament online [url=http://pharmajetzt.com/#]PharmaJetzt[/url] PharmaJetzt

apotheken online shop: Pharma Jetzt – shop apotheje

https://pharmajetzt.com/# Pharma Jetzt

PharmaConnectUSA: Pharma Connect USA – PharmaConnectUSA

https://pharmajetzt.com/# shop apotheke versandkosten

PharmaConnectUSA: pharmacy loratadine – Pharma Connect USA

canadian pharmacy mall [url=https://canrxdirect.shop/#]canadian pharmacies online[/url] best canadian pharmacy to order from

Online medicine order: Online medicine home delivery – top 10 pharmacies in india

https://indimedsdirect.com/# IndiMeds Direct

TijuanaMeds: medicine in mexico pharmacies – mexico drug stores pharmacies

TijuanaMeds [url=https://tijuanameds.com/#]buying prescription drugs in mexico[/url] mexican pharmaceuticals online

https://tijuanameds.com/# TijuanaMeds

https://canrxdirect.shop/# canada drugs reviews

top 10 pharmacies in india: top 10 pharmacies in india – pharmacy website india

IndiMeds Direct: reputable indian pharmacies – top 10 pharmacies in india

legit canadian pharmacy [url=https://canrxdirect.com/#]CanRx Direct[/url] canadian medications

https://tijuanameds.com/# medication from mexico pharmacy

certified canadian pharmacy: canadian pharmacy india – reputable canadian online pharmacy

https://www.cagesideseats.com/users/via2025

https://corps.humaniste.info/Utilisateur:FloridaQuinlivan

http://polyamory.wiki/index.php?title=User:LilyChisholm238

https://wiki.vwsl.me/index.php/User:VincentScrivener

https://cs.transy.edu/wiki/index.php?title=User:BeatrizVrooman1

https://kmportal.nha.gov.ph/index.php/User:NiamhEhret

http://canrxdirect.com/# northwest canadian pharmacy

https://nogami-nohken.jp/BTDB/?⑴뵪??EsperanzaZms

https://indimedsdirect.shop/# IndiMeds Direct

canadian pharmacy ed medications [url=https://canrxdirect.shop/#]CanRx Direct[/url] canadian mail order pharmacy

https://www.draysbay.com/users/via2025

https://mediawiki.laisvlaanderen.ehb.be/index.php/User:LeopoldoXbz

best online canadian pharmacy: CanRx Direct – 77 canadian pharmacy

https://yjspic.top/space-uid-75884.html

https://docs.brdocsdigitais.com/index.php/User:JereCausey6

https://www.wikidelta.org/index.php/User:ShawnaCarothers

http://tijuanameds.com/# TijuanaMeds

https://wiki.infinitemc.net/index.php?title=User:JasmineBard643

canadian pharmacy uk delivery [url=https://canrxdirect.com/#]canadian compounding pharmacy[/url] ed meds online canada

https://www.blessyouboys.com/users/via2025

http://polyamory.wiki/index.php?title=User:ShayneDalgety6

п»їlegitimate online pharmacies india: Online medicine order – top 10 pharmacies in india

http://www.xiangtoushu.com/space-uid-100467.html

https://en.encyclopedia.kz/index.php/User:OliviaPlt452268

https://indimedsdirect.shop/# IndiMeds Direct

http://bbs.yongrenqianyou.com/home.php?mod=space&uid=4250171&do=profile&from=space

http://www.isexsex.com/space-uid-2970119.html

https://www.southsidesox.com/users/via2025

https://wikis.ece.iastate.edu/cpre488/index.php?title=User:EdwinaSanches06

https://wikibuilding.org/index.php?title=User:CharlaHunter3

https://meta.xuniverse.wiki/w/User:JeannineVega02

northern pharmacy canada [url=https://canrxdirect.shop/#]pharmacy in canada[/url] canada drugs online reviews

https://americanspeedways.net/index.php/User:NellieBrassell4

http://xn--00tp5e735a.xn--cksr0a.life/home.php?mod=space&uid=295210&do=profile&from=space

mexican border pharmacies shipping to usa: TijuanaMeds – mexican border pharmacies shipping to usa

https://online-learning-initiative.org/wiki/index.php/User:CorinneIverson

https://wiki.lovettcreations.org/index.php/User:LaraBurrowes7

http://tijuanameds.com/# TijuanaMeds

https://indimedsdirect.com/# top online pharmacy india

http://projectingpower.org/w/index.php/User:DarlaUbc4822

https://avdb.wiki/index.php/User:BrunoByles11

cheap canadian pharmacy: canadian pharmacy meds – canadian pharmacy online reviews

https://blackdiamond.baka-sama.de/index.php?title=User:CarolynOlin7

https://trevorjd.com/index.php/User:GradyBaddeley

https://oscar-footballer.com/d981d984d98ad983-d8a7d984d8aad8bad98ad98ad8b1d8a7d8aa-d8b5d8b9d8a8d8aa-d8a7d984d8a3d985d988d8b1-d988d8a3d8afd8b1d986d8a7-d8a7d984d8af/

https://wiki.ots76.org/wiki/U%C5%BCytkownik:FredrickTyas

https://apk.tw/space-uid-7146671.html?do=profile

canadian pharmacy ratings [url=https://canrxdirect.com/#]CanRx Direct[/url] best canadian pharmacy to buy from

IndiMeds Direct: IndiMeds Direct – IndiMeds Direct

https://higgledy-piggledy.xyz/index.php/User:ClarkYav30

https://paintingsofdecay.net/index.php/User:AlisaPettey738

https://wiki.tgt.eu.com/index.php?title=User:CaitlynMota

https://wiki.fuzokudb.com/fdb/%E5%88%A9%E7%94%A8%E8%80%85:DanieleForehand

https://wiki.ots76.org/wiki/U%C5%BCytkownik:FredrickTyas

https://canrxdirect.com/# is canadian pharmacy legit

https://hav2h1t2.com/cpi-das-apostas-pede-indiciamento-de-tio-de-paqueta/

https://parentingliteracy.com/wiki/index.php/User:TorstenLayh4

https://dobrowin88.com/contato/

https://thebitcoinproject.club/wiki/index.php/User:NathanielValadez

https://plamosoku.com/enjyo/index.php?title=%E5%88%A9%E7%94%A8%E8%80%85:SheltonChamplin

https://community.hodinkee.com/members/via2025

https://l0fjf5lh.2q7q78.com

What’s Happening i am new to this, I stumbled upon this I have found It positively

useful and it has helped me out loads. I’m hoping to contribute & aid different users like its aided me.

Great job.

https://8qqd.yx5523.com

I’ve been exploring for a little for any high quality articles

or weblog posts in this sort of area . Exploring in Yahoo

I eventually stumbled upon this site. Studying this information So i

am happy to convey that I’ve an incredibly good uncanny feeling

I came upon just what I needed. I so much for sure will make certain to do not overlook this site and give it a look regularly.

https://bookslibrary.wiki/content/User:BenedictCherry8

https://2eax.u0uyy.com

Hi there, I think your blog could be having browser compatibility

problems. Whenever I take a look at your site in Safari, it looks fine however, if opening in I.E., it’s got some overlapping

issues. I merely wanted to give you a quick heads up!

Apart from that, fantastic site!

http://wiki.rumpold.li/index.php?title=Benutzer:WaldoQuillen41

http://wiki.thedragons.cloud/index.php?title=User:RichieLithgow84

top online pharmacy india: top 10 online pharmacy in india – top 10 pharmacies in india

https://bbc-football-eg.com/d988d8b9d8af-d981d8a3d988d981d989-d8b3d98ad986d8a7d8b1d98ad988-d985d8afd8b1d98ad8afd98a-d988d98ad8af-d8a3d981d8b1d98ad982d98ad8a9-d98a/

http://christozzi.com/lhwiki/index.php/User:OnaPrichard1

safe canadian pharmacy [url=https://canrxdirect.shop/#]pet meds without vet prescription canada[/url] canadian drug stores

mexican mail order pharmacies: TijuanaMeds – mexico pharmacies prescription drugs

https://mvni84oo.com/quem-esta-com-pneumonia-pode-ser-identificado-com-raio-x/

https://thepostersparadise.wiki/index.php?title=User:SonjaBernhardt7

https://pokeronline-br.com/apostas-emocionantes-descubra-o-poker-online/

https://tijuanameds.shop/# mexican border pharmacies shipping to usa

https://thepostersparadise.wiki/index.php?title=User:EmelySweat18

http://buch.christophgerber.ch/index.php?title=Benutzer:DorineRock

https://wiki.fuzokudb.com/fdb/%E5%88%A9%E7%94%A8%E8%80%85:MelindaMcCann01

https://www.wattpad.com/user/widmarmorita900

http://www.sapijaszko.net/index.php/User:TandyYagan20069

https://speakerdeck.com/via2025

https://wikis.ece.iastate.edu/cpre488/index.php?title=User:LetaHaire29301

https://national-in.com/national-bet-f09fa7a7-crush-the-competition-tried-and-tested-tactics-for-dominating-national-bet-13-06-2024/

canadian pharmacy review: certified canadian international pharmacy – safe canadian pharmacies

https://rxfreemeds.shop/# viagra in pharmacy uk

https://lqq3865.com/???%20?????%20??%20??-5785/84a54899367/

I always used to study piece of writing in news papers but now as I am

a user of web therefore from now I am using net for posts, thanks to web.

https://yalla-shoot-eg.com/d984d8a7d8b9d8a8-d8b3d98ad984d8aad8a7-d981d98ad8acd988-d985d986d8aad982d8afd98bd8a7-d8a7d984d8aad8add983d98ad985-d8a5d98ad986d98ad8ac/

Farmacia Asequible: Farmacia Asequible – farmacia mayor 13 reseГ±as

https://hk5272.com/2025-06-16/35d43399531/

Hello there! Do you use Twitter? I’d like to follow you if

that would be ok. I’m definitely enjoying your blog and look forward to new updates.

https://a9t8dl74.com/camisa-10-do-santos-de-neymar-vira-febre-na-vila-belmiro-mesmo-com-preco-elevado/

https://rxfreemeds.com/# provigil india pharmacy

Farmacia Asequible [url=https://farmaciaasequible.com/#]farmacis[/url] promociГіn braun 100 euros

https://bet77-br.com/compreendendo-as-estrategias-de-aposta-na-bet77/

https://e-football-pes.com/d985d988d8b9d8af-d988d8a7d984d982d986d8a7d8a9-d8a7d984d986d8a7d982d984d8a9-d984d985d8a8d8a7d8b1d8a7d8a9-d8b1d98ad8a7d984-d985d8afd8b1/

https://6p15i7ni.com/google-desativara-comentarios-sobre-escolas-em-seu-aplicativo-maps/

https://hy1rwqvz.com/onde-assistir-atletico-mg-x-criciuma/

enclomiphene for men: enclomiphene testosterone – enclomiphene online

RxFree Meds: RxFree Meds – RxFree Meds

http://rxfreemeds.com/# viagra online us pharmacy no prescription

https://enclomiphenebestprice.shop/# enclomiphene buy

Farmacia Asequible [url=https://farmaciaasequible.com/#]Farmacia Asequible[/url] farmacia e

https://esportesdasorte-br.com/

https://hpudi3xi.com/voce-pode-fazer-raio-x-mesmo-com-implante-dentario/

My family always say that I am killing my time here at net,

however I know I am getting knowledge everyday by reading thes good articles or

reviews.

https://0duz0kzu.com/onde-assistir-ao-jogo-entre-bala-town-e-caernarfon-town-fc/

There is definately a lot to learn about this topic.

I like all of the points you’ve made.

https://7lk38tsi.com/mayke-exalta-intensidade-do-palmeiras-e-projeta-final-do-paulista-vamos-para-fazer-historia/

What i do not understood is in fact how you’re now not actually a lot

more smartly-appreciated than you might be now. You’re so intelligent.

You recognize therefore considerably relating to this subject, made me personally believe it from numerous varied angles.

Its like men and women aren’t involved until it’s something to

do with Girl gaga! Your personal stuffs great. At all times deal with

it up!

https://kora-live-eg.com/d981d98ad8afd98ad988-d8afd98ad983d984d8a7d986-d8b1d8a7d98ad8b3-d98ad8b3d8acd984-d987d8afd981-d8a2d8b1d8b3d986d8a7d984-d8a7d984d8abd8a7/

https://bowri857.com/quem-garantiu-vaga-na-semifinal-da-copa-do-brasil/

Hey there! I know this is kind of off topic but I was wondering which blog platform are you using for this site?

I’m getting tired of WordPress because I’ve had issues

with hackers and I’m looking at options for another platform.

I would be great if you could point me in the direction of a good platform.

https://in37lg0p.com/

cialis 20 mg precio farmacia: Farmacia Asequible – movicol precio farmacia

enclomiphene online: enclomiphene citrate – enclomiphene

https://tqtvu7qx.com/gerard-pique-marca-presenca-no-aniversario-de-irma-de-neymar-rafaella-santos/

https://9rg5jmtb.com/

https://tvbet-br.com/descubra-todas-as-caracteristicas-emocionantes-da-tvbet/

https://8f5j9kzp.com/eduardo-camavinga-do-real-madrid-sofre-lesao-e-pode-ficar-fora-por-tres-semanas/

https://fantasy-football-eg.com/d981d98ad8afd98ad988-d8a7d984d8aad8b9d8a7d8afd984-d98ad8add8b3d985-d985d8a8d8a7d8b1d8a7d8a9-d8a8d8a7d98ad8b1d986-d985d98ad988d986d8ae/

https://enclomiphenebestprice.com/# enclomiphene citrate

https://footballer-eg.com/d8a7d984d8b2d985d8a7d984d983-d98ad983d8b4d981-d984d980d8a8d8b7d988d984d8a7d8aa-d8b3d8a8d8a8-d981d8b3d8ae-d985d8afd8b1d8a8-d8ad/

pharmacy no prescription required [url=http://rxfreemeds.com/#]RxFree Meds[/url] RxFree Meds

https://ujds42lw.com/nao-tenho-essa-informacao-mas-posso-te-ajudar-a-transformar-o-titulo-em-uma-pergunta-o-titulo-que-voce-enviou-foi-corinthians-campeao-da-copa-do-brasil-a-versao-em-forma-de-pergunta-seriacorinth/

enclomiphene citrate: enclomiphene testosterone – enclomiphene best price

https://xstqjw05.com/onde-assistir-ao-jogo-do-corinthians-na-copa-do-brasil/

https://yalla-shoot-today-eg.com/d8aad8b7d988d8b1d8a7d8aa-d8a8d8b4d8a3d986-d8add8a7d984d8a9-d985d8a8d8a7d8a8d98a-d982d8a8d984-d986d987d8a7d8a6d98a-d983d8a3d8b3-d8a7d984/

RxFree Meds: RxFree Meds – navarro pharmacy miami

https://hy1rwqvz.com/onde-assistir-palmeiras-x-mirassol-na-tv/

https://2cjzo372.com/

https://e-football-eg.com/d8a7d984d8b2d985d8a7d984d983-d98ad983d8b4d981-d8add982d98ad982d8a9-d8b3d8b1d982d8a9-d8aed8b2d98ad986d8a9-d8a7d984d986d8a7d8afd98a/

https://escala-gaming-ph.com/

https://premierbet-br.com/maximizando-suas-apostas-na-premier-bet/

https://10aba2m6.com/para-resolver-a-expressao-10-10-x-10-10-2-precisamos-seguir-a-ordem-das-operacoes-matematicas-conhecida-como-pemdas-parenteses-exponenciacao-multiplicacao-e-divisao-adicao-e-subtracao-va/

https://argentina-football.com/d985d988d8a7d8b9d98ad8af-d985d8a8d8a7d8b1d98ad8a7d8aa-d986d8b5d981-d986d987d8a7d8a6d98a-d8afd988d8b1d98a-d8a3d8a8d8b7d8a7d984-d8a5d981/

enclomiphene for sale [url=http://enclomiphenebestprice.com/#]enclomiphene online[/url] enclomiphene buy

http://rxfreemeds.com/# best online pharmacy usa

https://s7lyvjt2.com/apos-frustracao-com-claudinho-palmeiras-mira-vitor-roque/

https://rxfreemeds.com/# adipex online pharmacy diet pills

https://5kl22kpi.com/

https://yalla-shoot-english-eg.com/d987d8a7d8b1d98a-d983d98ad986-d98ad8a8d8b9d8af-d8b5d981d982d8aad98ad986-d8abd982d98ad984d8aad98ad986-d8b9d986-d8a8d8a7d98ad8b1d986-d985/

enclomiphene citrate: enclomiphene best price – buy enclomiphene online

https://2m6n72dr.com/quanto-voce-pode-ganhar-com-a-copa-do-brasil/

enclomiphene testosterone: enclomiphene testosterone – enclomiphene

https://yalla-shoot-today-eg.com/d8b3d8a7d8b9d8a9-d8b0d987d8a8d98ad8a9-d8aad985d986d8ad-d8b1d98ad8a7d984-d985d8afd8b1d98ad8af-d8a3d985d984-d8a5d8b3d982d8a7d8b7-d8a8d8b1/

https://kora-live-tv-eg.com/d983d988d984d986-d8aad985d8afd8af-d8a7d8b3d8aad8b6d8a7d981d8a9-d986d987d8a7d8a6d98a-d983d8a3d8b3-d8a3d984d985d8a7d986d98ad8a7-d984d984/

https://www.allwin568-br.com/contato/

enclomiphene for men [url=http://enclomiphenebestprice.com/#]enclomiphene best price[/url] enclomiphene best price

http://enclomiphenebestprice.com/# enclomiphene testosterone

https://esportebet-br.com/

https://msc14vz6.com/quem-o-sao-paulo-enfrenta-na-copa-do-brasil/

Amazing blog! Do you have any suggestions for aspiring writers?

I’m planning to start my own website soon but I’m a little lost on everything.

Would you advise starting with a free platform like WordPress or go for a paid option?

There are so many choices out there that I’m completely confused ..

Any recommendations? Kudos!

https://khp1pp4f.com/onde-assistir-dallas-x-golden-state/

I have been browsing on-line greater than 3 hours nowadays, but I by no means found any attention-grabbing article

like yours. It is lovely value sufficient for me. In my opinion, if all web owners and bloggers made good content

as you probably did, the net will probably be much more useful than ever before.

https://jp3nej09.com/qual-e-o-melhor-lugar-para-assistir-aos-jogos-de-hoje-da-copa-do-brasil/

It’s very straightforward to find out any matter on web as

compared to books, as I found this post at this site.

https://t1djsh47.com/onde-assistir-flamengo-x-palmeiras-na-copa-do-brasil/

Having read this I thought it was extremely informative.

I appreciate you finding the time and energy to put this short article together.

I once again find myself spending a lot of time both reading and posting

comments. But so what, it was still worth it!

https://bahrain-football-eg.com/d8acd985d8a7d987d98ad8b1-d985d8a7d986d8b4d8b3d8aad8b1-d8b3d98ad8aad98a-d8b9d986-d985d8a8d8a7d8b1d8a7d8a9-d8a8d984d98ad985d988d8ab-d981/

https://the-football-news.com/d8a7d984d8a3d987d984d98a-d988d8a7d984d8b2d985d8a7d984d983-d8a7d984d8a8d8afd8a7d98ad8a9-d8aad8b7d8a8d98ad982-d8a7d984d981d8a7d8b1-d981/

https://football-ball-eg.com/d8b5d988d8b1-d985d8b1d8a7d986-d985d986d8aad8aed8a8-d985d8b5d8b1-d8a7d986d8b6d985d8a7d985-d984d8a7d8b9d8a8d98a-d8a7d984d8a3d987d984/

https://baji-in.com/baji-bet-f09fa7a7-maximizing-your-winnings-the-ultimate-guide-to-conquering-baji-bet-and-achieving-success-13-06-2024/

enclomiphene online: buy enclomiphene online – enclomiphene testosterone

https://24bet-in.com/tips-to-enhance-your-winning-odds-in-rummy-star-how-can-i-improve-my-chances-18-06-2024/

https://ajga4706.com/

https://tjk80nw9.com/onde-assistir-flamengo-x-vasco-da-gama/

Hi there, just became aware of your blog through Google, and found that it

is really informative. I am gonna watch out for brussels.

I will be grateful if you continue this in future.

A lot of people will be benefited from your writing.

Cheers!

https://xdmlayb7.com/

It’s going to be ending of mine day, however before finish

I am reading this impressive post to increase my know-how.

https://football-pitch-eg.com/d984d98ad983d8b1d8b2-d98ad8b3d8aad8b9d8af-d984d8a5d8b9d8a7d8afd8a9-d8a7d984d8a8d986d8a7d8a1-d8a8d8b9d8af-d8a7d984d8aed8b1d988d8ac-d8a7/

https://yalla-shoot-english-eg.com/d8afd98a-d8a8d8b1d988d98ad986-d981d8b1d98ad982d98a-d8a7d984d8acd8afd98ad8af-d982d8af-d98ad8add8b1d985d986d98a-d985d986-d985d988d986d8af/

https://wv3heffq.com/leila-pereira-diz-nao-temer-reacao-da-conmebol-apos-criticas-tenho-coragem/

Hello, after reading this awesome article i am too delighted to share my knowledge here with friends.

https://phl63-8.com/phl63-about/

https://uagbobz8.com/botafogo-anuncia-retorno-de-claudio-cacapa-como-treinador-interino/

excellent issues altogether, you simply received a logo

new reader. What could you recommend in regards to your post

that you simply made some days ago? Any certain?

https://fkvrco4b.com/onde-assistir-eintracht-x-bayern/

https://vck2ws73.com/onde-assistir-santos-x-novorizontino/

I absolutely love your blog.. Excellent colors & theme. Did you create this website yourself?

Please reply back as I’m looking to create my very own website and would like to know where you got this from or just what

the theme is named. Many thanks!

https://tqtvu7qx.com/romero-e-memphis-decidem-contra-o-sao-bernardo-e-garantem-corinthians-nas-quartas-do-paulistao/

I every time used to study article in news papers but now

as I am a user of web therefore from now I am using net for posts, thanks to web.

https://premierbet-br.com/maximizando-suas-apostas-na-premier-bet/

https://gvxtv90t.com/category/competicoes/

https://gzuc2px5.com/onde-assistir-sinner-x-medvedev/

https://ubet95-8.com/ubet95-bouns/

https://rxfreemeds.shop/# worldwide pharmacy online

https://real-football-eg.com/d985d988d986d8afd988-d8afd98ad8a8d988d8b1d8aad98ad981d988-d8a8d8b1d8b4d984d988d986d8a9-d98ad8aad8b1d8a7d8acd8b9-d8b9d986-d8aad985d8af/

enclomiphene price [url=https://enclomiphenebestprice.com/#]enclomiphene online[/url] enclomiphene

See what’s new https://yyr.7ov1aa.com

https://farmaciaasequible.com/# farma 10

Don’t miss out, click here https://ds7553.com/vivjf-75954

Want more info? Click here https://546wqa.com/btgrmpfyewysldoxqcnljrxzohktizkszi-9988291769121232136736447263652594514526626638/9988291769121232136736447263652594514526626638/

RxFree Meds: RxFree Meds – RxFree Meds

Discover new info here https://bx6536.com/o0/87a831191601/

Visit this page https://zs3728.com/terms

Look at this article https://valmiera-fc-16-06-2025.wd9339.com

Explore the features https://twz4l35n.com/yslua/

https://enclomiphenebestprice.shop/# enclomiphene for men

Check out the latest update https://xy7596.com/2025-06-16/32b346396504/

See more here https://2025-06-16-hfcnlzptiawfggihbpph.dog004.com

pfizer viagra online pharmacy [url=https://rxfreemeds.shop/#]RxFree Meds[/url] RxFree Meds

Take a tour here https://al6855.com?casino=ilghi

Follow this link https://dx8565.com/qlqn3-7

See how it works https://qq5531.com/hofzpjigbsakxpfymoho-77258968865226566/77258968865226566/

Take a closer look https://at1353.com/06-2025/7263187963543932/

Go to this page https://zs5816.com/l/44d13899817/

Visit our website https://olltcv.l2uxf.com

enclomiphene citrate: enclomiphene buy – enclomiphene citrate

Read the full review here https://botafogo-fc.wz3826.com

Browse this page https://ks6676.com?slot=k

Explore this website https://wh14gz.com?cassino=pb

https://enclomiphenebestprice.com/# enclomiphene best price

Have a glance here https://zc3677.com/?? 2-62/12f08099907/

Visit to learn more https://ds57852.com/item/?brand_id=35571&type_category_id=138

Go here https://tk8802.com?slot=hfxp

Check out our latest post https://ywqi.qw6679.com

Discover the details https://932vxw.com/2025-06-16/317485969944858736681391969794852371/

Click here https://mpwzjnqljmissuvzg.zs3738.com

enclomiphene for sale [url=https://enclomiphenebestprice.com/#]enclomiphene best price[/url] enclomiphene for men

Click to read https://noxpaon.iaea2e.com

Find out how to do it https://fu9936.com/ebonjyxxyjtbiqzmwhqumfshpztgrymndkqreasnjslwqguv-924678915571738/50c00299947/

Check out what’s new https://tk5729.com/rec/35e02499940/

Discover how it works https://kajxiatlyxodnmll.yx2098.com

http://enclomiphenebestprice.com/# buy enclomiphene online

See for yourself https://tk9272.com/???? ??? ??-5/40e780592154/

Learn more at this site https://tmp.ww1616.com

Take a tour here https://wh14gz.com?cassino=skcc

Click to find out more https://hr0077.com/zwjumfvfiqcnkvctuh-2025-06-16/48664438426344391335/

Click to explore https://sk7683.com/277535175734164281698896264536793684144629165457997162452521172-2025-06mbongcoklr-list.html

Explore new content https://tt7365.com/zlbv-06-2025/814528727/

enclomiphene testosterone: enclomiphene best price – enclomiphene citrate

Go ahead and click here https://cjimwbcgcobnbpgypg.wd8252.com

Click here https://koraae.com/2025-06-16/254917948446426254852654925141952174993391141/

prozac indian pharmacy [url=https://rxfreemeds.com/#]longs drug store[/url] renova cream online pharmacy

Have a quick look https://cs9528.com?slot=snuy

Explore now https://zg5737.com/??? ???-23/11b891691072/

Click here https://dx8225.com/deposit-5-get-bonus-slots-2025-06-16

Go ahead and click here https://qt5733.com/????? ??-3/8a89899093/

Explore more https://du7356.com?cassino=ci

See what we’ve got https://zwuy.xh8828.com

View this article https://sj5233.com/channel_753jadwalpersib-list.html

Read all about it https://rwo9uq0k.4lougx.com

Go ahead and click here https://al-ittihad-fc.gd25666.com

RxFree Meds [url=http://rxfreemeds.com/#]doctor prescription[/url] RxFree Meds

Farmacia Asequible: mounjaro precio espaГ±a – casenlax niГ±os opiniones

https://enclomiphenebestprice.shop/# enclomiphene best price

View this article https://news-836.ws5277.com

Check out more info https://68hp53fwjybeheot4eva.ds3675.com

Take a closer look https://aa8023.com/9191352531725682178647617385781856745825532554478-jxnyxgpxiqbeftvzmpplnavwigtoppqfmynyoinzvwvgpg/

Read all about it https://uzbekistan-fc.gd57999.com

Visit this page https://tk6275.com?slot=iqe

Check out the latest update https://brondby-fc.cc9525.com

Click to find out more https://tp57277.com?cassino=uor

Read the full post https://tx7656.com/?? ??? ??? ???-8/83c15899758/

swiss pharmacy finpecia [url=https://rxfreemeds.shop/#]diltiazem online pharmacy[/url] flonase online pharmacy

Want more details? Visit here https://pkapcrnw.cm4gkx.com

Check the facts here https://lqq7535.com/vwq/97b79799105/

Want to know more? Click here https://zjjy66.com/simp/topics/9jdjgk1w8jvsc-list.html

Read all about it https://kx5252.com/2025-06-16/14b411495871/

Get started now https://qf3628.com/gxgxbn-16-06-2025/765/

Get more info here http://cc9522.com/

Get more details https://nimnsgq.xh8828.com

Visit to learn more https://qf3628.com/366931792212573912211967958347496478997731241744/

Go on, click here https://xs6976.com?cassino=pso

See what we’re offering https://1329.ww1826.com

Check the info here https://kzys.v71en.com

Check out more content here https://cd7237.com?cassino=ie

enclomiphene best price: enclomiphene for men – enclomiphene

Check out the details https://tk9352.com/simp/topics/js7hy0f2j1eredivisieleaguetable-list.html

Read the full post https://hu7632.com/kay-921437271765125496956664859616357457487452238356/921437271765125496956664859616357457487452238356/

Explore the features https://zt6375.com/博多 駅 イベント ライブ-2025-06-16/63c092699010/

See more about it https://fu9935.com/qbuzisbuiwwfhikhxqcqmzlzdkjgbxndyxjpdlqe-2/9e49299498/

Go on, click here https://alianza-fc.ks2108.com

flomax online pharmacy [url=https://rxfreemeds.shop/#]pharmacy rx by crystal zamudio[/url] RxFree Meds

Check out this link https://35.my9596.com

Try this page https://td5227.com/6o30/79f61699304/

Get the full story https://xy5820.com/kbxltrbdwkakfvihfqkcczdkfavorzgzyf-06-2025/

https://cs9536.com/sitemap.xml

Your means of describing the whole thing in this paragraph is truly fastidious,

all can effortlessly understand it, Thanks a lot.

https://rxfreemeds.shop/# RxFree Meds

diazepam online pharmacy [url=https://rxfreemeds.com/#]RxFree Meds[/url] RxFree Meds

RxFree Meds: RxFree Meds – RxFree Meds

https://wiki.112schade.nl/index.php/Gebruiker:LaurenHoss02811

https://indigenouspedia.com/index.php?title=User:JarredBaumgardne

https://xn--kgbec7hm.my/index.php/User:ZenaidaMcSharry

https://www.guerzhoy.a2hosted.com/index.php/User:EarnestineP93

https://adsintro.com/index.php?page=user&action=pub_profile&id=495331

https://wiki.vwsl.me/index.php/User:Therese8608

RxFree Meds [url=http://rxfreemeds.com/#]RxFree Meds[/url] RxFree Meds

https://www.truenorthis.com.au/mediawiki/index.php/User:GWJAnne26152

https://rxfreemeds.com/# RxFree Meds

http://43.199.183.204/wiki/User:JermaineWood67

http://projectingpower.org:80/w/index.php/User:BellFilson541

enclomiphene for sale [url=http://enclomiphenebestprice.com/#]enclomiphene for men[/url] enclomiphene price

Farmacia Asequible: farmacia serca de mi – comprar tobrex

http://torrdan.net:80/index.php?title=Benutzer:CathleenWhitmore

https://wiki.morx.in/index.php/User:BerylCoombes604

https://troonindex.com/index.php/User:AlphonsoGillingh

la botica sevilla este [url=https://farmaciaasequible.shop/#]citrafleet para que sirve[/url] ozempic tenerife

https://online-learning-initiative.org/wiki/index.php/User:MalissaLovejoy8

Motilium: pharmacy online no prescription – RxFree Meds

https://enclomiphenebestprice.shop/# enclomiphene for men

enclomiphene [url=https://enclomiphenebestprice.com/#]enclomiphene for men[/url] enclomiphene price

http://lhtalent.free.fr/modules.php?name=Your_Account&op=userinfo&username=SimonAlba

http://genome-tech.ucsd.edu/LabNotes/index.php?title=User:WinnieMonaco

https://wiki.algabre.ch/index.php?title=Benutzer:TammieHammond7

https://freekoreatravel.com/index.php/User:AlizaBlankenship

http://taxwiki.us/index.php/User:DelorisMaddox

http://xn--cksr0ar36ezxo.com/home.php?mod=space&uid=327487&do=profile&from=space

https://wiki.infinitemc.net/index.php?title=User_talk:MelvaDrum84

https://oeclub.org/index.php/User:JanLake697551

https://www.jieyamima.top/space-uid-3510.html

https://yjspic.top/space-uid-75417.html

casenlax que es [url=https://farmaciaasequible.shop/#]Farmacia Asequible[/url] Farmacia Asequible

Farmacia Asequible: Farmacia Asequible – mycostatin canarios

https://enclomiphenebestprice.shop/# enclomiphene citrate

enclomiphene for men [url=https://enclomiphenebestprice.com/#]enclomiphene for sale[/url] enclomiphene for sale

enclomiphene online [url=https://enclomiphenebestprice.com/#]enclomiphene online[/url] enclomiphene buy

enclomiphene price: enclomiphene testosterone – buy enclomiphene online

https://enclomiphenebestprice.com/# enclomiphene for sale

Farmacia Asequible [url=https://farmaciaasequible.shop/#]precio medicamentos[/url] codigo farmacia barata

Farmacia Asequible: Farmacia Asequible – Farmacia Asequible

enclomiphene for sale [url=https://enclomiphenebestprice.com/#]buy enclomiphene online[/url] enclomiphene

amoxil generic – buy amoxicillin pills for sale cheap amoxil without prescription

buy enclomiphene online [url=https://enclomiphenebestprice.shop/#]enclomiphene price[/url] enclomiphene for sale

RxFree Meds: RxFree Meds – metoprolol people’s pharmacy

http://enclomiphenebestprice.com/# enclomiphene citrate

montelukast online pharmacy [url=https://rxfreemeds.shop/#]RxFree Meds[/url] magellan rx pharmacy

farmacia a domicilio barcelona: Farmacia Asequible – Farmacia Asequible

fred meyer pharmacy hours: buying ambien online pharmacy – RxFree Meds

viagra online us pharmacy [url=http://rxfreemeds.com/#]mexico viagra pharmacy[/url] dextroamphetamine online pharmacy

https://enclomiphenebestprice.com/# enclomiphene price

tesco pharmacy viagra price: RxFree Meds – RxFree Meds

enclomiphene for sale: buy enclomiphene online – enclomiphene for men

Farmacia Asequible [url=http://farmaciaasequible.com/#]Farmacia Asequible[/url] Farmacia Asequible

http://enclomiphenebestprice.com/# enclomiphene

cialis 40 mg precio: Farmacia Asequible – movicol liquido

http://enclomiphenebestprice.com/# enclomiphene

mas parafarmacia opiniones [url=https://farmaciaasequible.shop/#]Farmacia Asequible[/url] Farmacia Asequible

enclomiphene citrate: buy enclomiphene online – enclomiphene buy

Farmacia Asequible: Farmacia Asequible – Farmacia Asequible

https://enclomiphenebestprice.shop/# enclomiphene

https://medismartpharmacy.shop/# prozac overseas pharmacy

top 10 online pharmacy in india: indian pharmacy online – buy medicines online in india

IndoMeds USA [url=https://indomedsusa.com/#]buy medicines online in india[/url] reputable indian pharmacies

certified canadian international pharmacy: propecia pharmacy direct – northwest canadian pharmacy

https://meximedsexpress.shop/# MexiMeds Express

best online pharmacies in mexico: pharmacies in mexico that ship to usa – MexiMeds Express

mexican pharmaceuticals online [url=https://meximedsexpress.shop/#]mexico drug stores pharmacies[/url] pharmacies in mexico that ship to usa

https://medismartpharmacy.com/# losartan pharmacy

MexiMeds Express: pharmacies in mexico that ship to usa – MexiMeds Express

http://indomedsusa.com/# best online pharmacy india

MexiMeds Express: MexiMeds Express – MexiMeds Express

indian pharmacy paypal [url=https://indomedsusa.com/#]top 10 online pharmacy in india[/url] IndoMeds USA

canadianpharmacy com: search rx pharmacy discount card – canadian pharmacy com

https://indomedsusa.com/# IndoMeds USA

MexiMeds Express: MexiMeds Express – MexiMeds Express

https://medismartpharmacy.com/# best ed medication

buying from online mexican pharmacy [url=http://meximedsexpress.com/#]MexiMeds Express[/url] MexiMeds Express

IndoMeds USA: pharmacy website india – cheapest online pharmacy india

https://medismartpharmacy.com/# best online pharmacy ativan

can you buy viagra at the pharmacy: MediSmart Pharmacy – pharmacy rx symbol

india pharmacy mail order [url=http://indomedsusa.com/#]top 10 pharmacies in india[/url] indian pharmacy

mexican pharmaceuticals online: pharmacies in mexico that ship to usa – mexican pharmaceuticals online

http://indomedsusa.com/# IndoMeds USA

IndoMeds USA: IndoMeds USA – IndoMeds USA

https://indomedsusa.shop/# IndoMeds USA

https://meximedsexpress.shop/# mexican online pharmacies prescription drugs

reputable mexican pharmacies online: reputable mexican pharmacies online – mexican border pharmacies shipping to usa

IndoMeds USA: india pharmacy – IndoMeds USA

pharmacy selling viagra in dubai [url=https://medismartpharmacy.com/#]MediSmart Pharmacy[/url] no prescription required pharmacy

http://meximedsexpress.com/# MexiMeds Express

canadian pharmacy king: MediSmart Pharmacy – canadian pharmacy meds review

IndoMeds USA: IndoMeds USA – IndoMeds USA

Полезно видеть, что статья предоставляет информацию без скрытой агенды или однозначных выводов.

https://medismartpharmacy.com/# Cialis Soft Tabs

reputable mexican pharmacies online [url=https://meximedsexpress.com/#]mexican pharmaceuticals online[/url] mexican online pharmacies prescription drugs

https://indomedsusa.shop/# IndoMeds USA

latisse online pharmacy: MediSmart Pharmacy – legitimate online pharmacy usa

legitimate canadian pharmacy online: maryland board of pharmacy – canadian pharmacy ltd

http://meximedsexpress.com/# mexico drug stores pharmacies

best india pharmacy [url=https://indomedsusa.com/#]world pharmacy india[/url] IndoMeds USA

buy viagra tesco pharmacy: MediSmart Pharmacy – permethrin cream online pharmacy

online canadian pharmacy review: MediSmart Pharmacy – canadian pharmacy phone number

http://indomedsusa.com/# IndoMeds USA

http://indomedsusa.com/# IndoMeds USA

mexican pharmacy online [url=http://medismartpharmacy.com/#]MediSmart Pharmacy[/url] wall drug store

domperidone pharmacy online: pharmacy class online – priligy johor pharmacy

MexiMeds Express: mexico drug stores pharmacies – mexico pharmacies prescription drugs

http://meximedsexpress.com/# MexiMeds Express

rite aid pharmacy store hours [url=http://medismartpharmacy.com/#]no prescription pharmacy valtrex[/url] lamictal pharmacy assistance

MexiMeds Express: mexican online pharmacies prescription drugs – MexiMeds Express

IndoMeds USA: IndoMeds USA – IndoMeds USA

https://medismartpharmacy.com/# rx logo pharmacy

http://medismartpharmacy.com/# magellan rx pharmacy network

mexican drugstore online [url=https://meximedsexpress.com/#]mexican rx online[/url] reputable mexican pharmacies online

IndoMeds USA: online pharmacy india – IndoMeds USA

buy facebook accounts account trading service sell account

http://medismartpharmacy.com/# advair pharmacy coupons

Автор статьи представляет разнообразные точки зрения и аргументы, оставляя решение оценки информации читателям.

indian pharmacy online [url=https://indomedsusa.shop/#]IndoMeds USA[/url] indian pharmacy paypal

IndoMeds USA: IndoMeds USA – indian pharmacy

https://indomedsusa.com/# legitimate online pharmacies india

MexiMeds Express [url=https://meximedsexpress.shop/#]medicine in mexico pharmacies[/url] mexican rx online

reputable mexican pharmacies online: mexican rx online – MexiMeds Express

https://indomedsusa.shop/# IndoMeds USA

https://medismartpharmacy.com/# pharmacy selling viagra in dubai

meijer online pharmacy [url=https://medismartpharmacy.com/#]best rogue online pharmacy[/url] topamax online pharmacy