Around the start of the year there was constant speculation that the BoJ would be soon exiting their ultra loose monetary policy. This speculation was fuelled by the move nn December 20 last year where the bank unexpectedly tweaked the yield curve control band by increasing it to +/- 0.50%.

This speculation led to a period of JPY strength as the previous weakness in the JPY was reversed at the start of the year. However, since early speculation has faded the JPY has given back all of its gains.

The BoJ still wants to see ‘sustainable’ Inflation

Inflation is lower in Japan then most of the rest of the world with headline inflation at 3.5% and the core at 3.4%. Japan is still not satisfied that inflation is definitely going to reach their target, so strangely the BoJ are still wanting to see inflation as being ‘sustainable’ before moving on rates.

What’s the best opportunity?

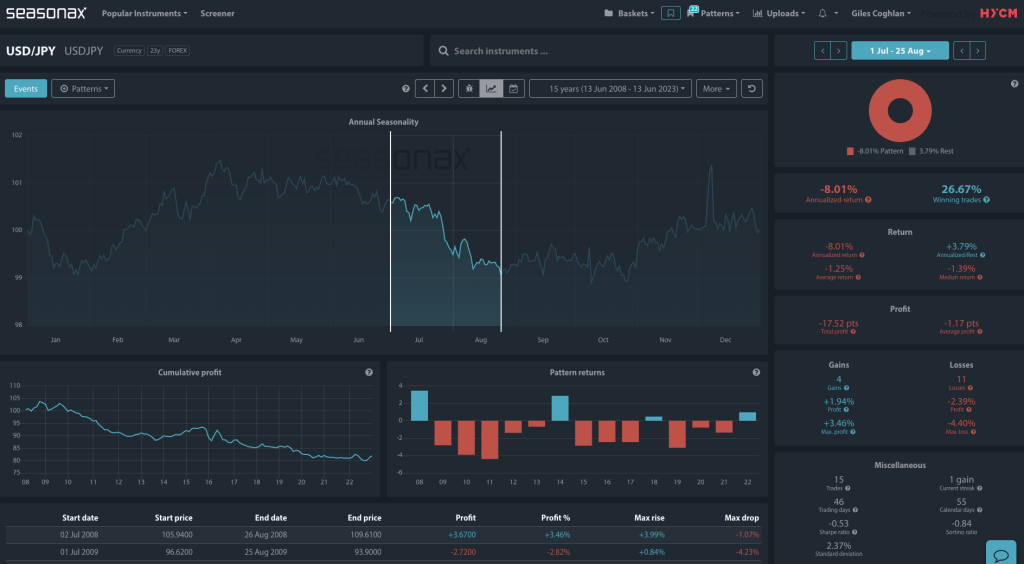

There is only one really clear opportunity that is likely to come from the BoJ meeting and that would be if they exit their ultra loose monetary policy. This would almost certainly see a repeat of the JPY strength that was seen on December 20. Also, it is noteworthy that the JPY see a seasonal period of strength against the USD around July 1st and August 25th. The average fall in the USDJPY pair has been 1.25% with the largest fall being 4.40% in 2011. So, seasonals could further support JPY strength if the BoJ change their policy stance on Friday and either raise interest rates or further increase their yield curve control band.

Hei, veli!

Casino turvallisuus on ehdoton edellytys turvalliselle pelaamiselle verkossa. Casino turvallisuus sisältää tietosuojan ja rahallisen turvallisuuden. [url=https://reallivecasino.cfd/arvostelut-ja-luotettavuus.html]casino asiakastapalvelu[/url] Älä koskaan kompromisseja turvallisuudessa halvemman vaihtoehdon vuoksi.

Lue linkki – https://reallivecasino.cfd/arvostelut-ja-luotettavuus.html

casino helsinki pukukoodi

casino helsinki pokeri

casino ГҐrhus poker

Onnea!

Moi!

No wager bonus tarkoittaa englanninkielisessä termistössä samaa kuin kierrätysvapaa bonus. Etsi parhaita no wager bonus -tarjouksia suomalaisilta casinoilta. [url=https://reallivecasino.cfd/bonukset-ilman-kierratysta.html]kierrätysvaatimukset[/url] Nämä bonukset tekevät pelaamisesta läpinäkyvämpää ja reilumpaa.

Lue linkki – https://www.reallivecasino.cfd/bonukset-ilman-kierratysta.html

casino helsinki pukukoodi

kasino korttipeli säännöt

casino ГҐlborg

Onnea!

Terve!!

Kasino Helsinki aukioloajat palvelevat pelaajia laajasti ympäri viikon. Kasino Helsinki sijaitsee kätevästi keskustassa helppojen kulkuyhteyksien päässä. [url=https://reallivecasino.cfd/casino-helsinki.html]casino helsinki ikäraja[/url] Suunnittele vierailusi mukavasti ja nauti kokonaisvaltaisesta kasinokokemuksesta.

Lue linkki – https://reallivecasino.cfd/casino-helsinki.html

casino helsinki netti

casino lounas

åldersgräns casino cosmopol

Onnea!

Welcome!

Read the link – [url=https://welcomebonuses.cfd]welcome bonuses trusted gambling site[/url]

Enjoy your bonuses!

Hi, friend!

Read the link – [url=https://slotspinners.cfd/]join the best slot spinners[/url]

Good luck spinning!

Хай!

[url=https://clasicslotsonline.cfd/]vavada казино онлайн казахстан вход[/url]

Переходи: – https://clasicslotsonline.cfd

онлайн казино казахстана

проверенные онлайн казино с выводом денег казахстан

топ онлайн казино казахстан

Пока!

¡Hola!

[url=https://livedealers.cfd/]casino online bolivia[/url]

Lee el enlace – https://livedealers.cfd

casino online dinero real bolivia

300 reales a bolivianos

casino en bolivia

¡Buena suerte!

¡Hola!!

[url=https://livecasinogames.cfd]juegos de casino en linea con dinero real chile[/url]

Lee el enlace – https://livecasinogames.cfd

casino real online chile

juegos de casino con dinero real chile

casino en lГnea chile

¡Buena suerte!

স্বাগতম!

[url=https://europeanroulette.cfd/]অনলাইন ক্যাসিনো সাইট[/url]

এই লিঙ্কটি পড়ুন – https://europeanroulette.cfd/

অনলাইন ক্যাসিনো সাইট

অনলাইন জোয়া

অনলাইন ক্যাসিনো খেলা

শুভকামনা!

Здравствуй!

Казино онлайн в Казахстане с бонусом за регистрацию дарит подарки. [url=https://mobilecasinogames.cfd]топ онлайн казино казахстан[/url] Начните игру с бонусами.

Написал: – https://mobilecasinogames.cfd/

онлайн казино в казахстане

онлайн казино казахстана

пин ап казино онлайн казахстан

До встречи!

¡Bienvenido!

El casino en lГnea dinero real ofrece premios reales. [url=https://smartphonecasino.cfd]casino en lГnea dinero real[/url] Gana desde tu casa hoy.

Lee este enlace – https://smartphonecasino.cfd/

juego casino real

casino online dinero real mГ©xico

casino online mГ©xico dinero real

¡Buena suerte!

¡Buen día!

Un casino real en lГnea brinda emociГіn autГ©ntica. [url=https://playonlinecasino.shop]casino online mГ©xico dinero real[/url] Vive la experiencia Las Vegas.

Lee este enlace – https://playonlinecasino.shop/

juego casino real

casino en lГnea confiable

casino online mГ©xico dinero real

¡Buena suerte!

Здравствуйте!

Онлайн казино uz поддерживает местную валюту. [url=https://realmoneycasino.shop/]онлайн казино ташкент[/url] Рнтерфейс доступен РЅР° узбекском.

Переходи: – https://realmoneycasino.shop

можно ли играть в онлайн казино в узбекистане

онлайн казино ташкент

Покеда!

¡Hola amigo!

Join and play online casino games today to experience the thrill of professional gambling from anywhere in the world. [url=https://onlinecasinoreview.shop/]casino en bolivia[/url] Take the first step and join and play online casino games on our premium platform with industry-leading features.

Lee este enlace – https://onlinecasinoreview.shop

juegos de casino en linea con dinero real bolivia

¡Buena suerte!

নমস্কার!

[url=https://onlinecasinospins.shop]ক্যাসিনো অনলাইন[/url]

এই লিঙ্কটি পড়ুন – https://onlinecasinospins.shop/

অনলাইন ক্যাসিনো সাইট

অনলাইন ক্যাসিনো খেলার নিয়ম

ক্যাসিনো অনলাইন

শুভকামনা!

Новости Украины https://gromrady.org.ua в реальном времени. Экономика, политика, общество, культура, происшествия и спорт. Всё самое важное и интересное на одном портале.

Современный автопортал https://automobile.kyiv.ua свежие новости, сравнительные обзоры, тесты, автострахование и обслуживание. Полезная информация для водителей и покупателей.

Строительный сайт https://vitamax.dp.ua с полезными материалами о ремонте, дизайне и современных технологиях. Обзоры стройматериалов, инструкции по монтажу, проекты домов и советы экспертов.

?Saludos!

[url=https://1win-2-025.com/]casino real online chile[/url]

Lee este enlace – https://1win-2-025.com

Juegos de casino en linea con dinero real Chile

Casino online dinero real Chile

Tu casino en casa Chile

?Buena suerte!

Приветствую!

Онлайн казино РІ Казахстане доступно РЅР° смартфонах. [url=https://1-win-2025.com]топ онлайн казино Казахстан[/url] Рграйте РіРґРµ СѓРіРѕРґРЅРѕ СѓРґРѕР±РЅРѕ.

Переходи: – https://1-win-2025.com/

vavada казино онлайн Казахстан вход

пин ап казино онлайн Казахстан

Удачи!

trucking in nyc freight company new york

¡Bienvenido!

Casino online dinero real MГ©xico sirve jugadores locales. [url=https://1win25.shop/]juego casino real[/url] MГ©todos pago familiares disponibles siempre.

Lee este enlace – https://1win25.shop/

Casino online MГ©xico dinero real

Casino en lГnea dinero real

Juego casino real

¡Buena suerte!

?Hola!

[url=https://25win25.shop]888 casino chile[/url]

Lee este enlace – https://25win25.shop/

Casino en lГnea Chile

Casino real online Chile

Casino online dinero real Chile

?Buena suerte!

Хай!

Оказывается, можно найти деньги и не стать должником. [url=https://economica-2025.ru]Где взять займ если везде отказывают[/url] Крутая статья.

Переходи: – https://economica-2025.ru/

Займ на карту мгновенно круглосуточно без отказа

Взять займ без отказа

Срочный займ на карту без отказа с плохой кредитной историей

Удачи!

оценка транспорта оценка стоимости Москва

Привет всем!

Долго не спал и думал как поднять сайт и свои проекты и нарастить DR и узнал от успещных seo,

отличных ребят, именно они разработали недорогой и главное продуктивный прогон Xrumer – https://www.bing.com/search?q=bullet+%D0%BF%D1%80%D0%BE%D0%B3%D0%BE%D0%BD

Автоматический прогон ссылок через Xrumer помогает улучшить позиции сайта в поисковиках. Повышение DR и Ahrefs с помощью Xrumer дает реальные результаты. Форумный спам и рассылка ссылок на форумах – эффективные методы продвижения. Программы для линкбилдинга, такие как Xrumer, ускоряют рост ссылочной массы. Используйте Xrumer, чтобы достигнуть значительных успехов в SEO.

seo тз, реклама сайта продвижение раскрутка, Ссылочные прогоны и их эффективность

Секреты работы с Xrumer, стоп слов seo, разработка сайтов seo продвижение сайта

!!Удачи и роста в топах!!

Здарова!

Чем “серый” телефон отличается от “белого”? [url=https://pro-telefony.ru/]Как узнать серый телефон или нет?[/url]

Читай тут: – https://pro-telefony.ru

Как узнать серый телефон или нет

Бывай!

vps hosting usa vps hosting

стул косметолога купить лампа лупа косметологическая на штативе

Привет всем!

Долго думал как поднять сайт и свои проекты и нарастить ИКС Яндекса и узнал от гуру в seo,

крутых ребят, именно они разработали недорогой и главное продуктивный прогон Xrumer – https://www.bing.com/search?q=bullet+%D0%BF%D1%80%D0%BE%D0%B3%D0%BE%D0%BD

Xrumer помогает улучшить DR сайта через автоматические прогонные кампании. Увеличение ссылочной массы с Xrumer ускоряет процесс SEO-продвижения. Программы для линкбилдинга позволяют увеличить показатели Ahrefs. Форумный линкбилдинг с Xrumer – это быстрый способ получения ссылок. Начните с Xrumer для повышения авторитета вашего сайта.

сервис seo анализ сайта, создание сайтов интернет продвижение, линкбилдинг сервис

предлагаю линкбилдинг, форум по seo, услуги продвижения сайта в москве

!!Удачи и роста в топах!!

Здарова!

Давай разберемся, стоит ли брать дженерики. [url=https://generik-info.ru/chto-takoe-dzheneriki-prostymi-slovami/]Дженерики что это[/url]

По ссылке: – https://generik-info.ru/chto-takoe-dzheneriki-prostymi-slovami/

Дженерики что это такое

Дженерики для чего они нужны

Что такое дженерики в медицине

Пока!

Привет!

Давайте поговорим об онлайн-займах как на кухне, без официоза. [url=https://kredit-bez-slov.ru]Получить кредит с плохой историей быстро[/url]

Переходи: – https://kredit-bez-slov.ru/mikrofinansovye-organizaczii-onlajn/

Что такое дженерики лекарства

Что такое дженерики в медицине

Дженерики что это

Удачи!

бетон м200 бетон

Здарова!

Полный гайд по всем способам заработка на компьютерных играх. [url=https://zarabotok-na-igrah.ru/kak-zarabotat-na-igrah/]заработок на игровой валюте[/url]

Читай тут: – https://zarabotok-na-igrah.ru/kak-zarabotat-na-igrah/

заработать на онлайн играх

как заработать на играх 2025

как заработать на играх пк

Бывай!

Приветствую!

Свободен как птица, но кушать хочется? [url=https://zhit-legche.ru/kak-perezhit-uvolnenie/]как пережить увольнение с работы форум[/url]

Читай тут: – https://zhit-legche.ru/kak-perezhit-uvolnenie/

как пережить несправедливое увольнение

как пережить увольнение с работы форум

как пережить увольнение

Будь здоров!

Как сам!

Быстрый вывод из казино: миф или реальность? [url=http://nagny-casino.ru/kazino-s-bystrym-vyvodom/]казино онлайн[/url]

Здесь подробней: – http://nagny-casino.ru/kazino-s-bystrym-vyvodom/

слоты играть без верификации

казино онлайн

777 казино

Покеда!

Привет!

Экономия на “сером” телефоне — это игра в русскую рулетку? [url=https://pro-telefony.ru/chto-delat-esli-kupil-seryj-telefon/]Серый телефон это?[/url]

Здесь подробней: – https://pro-telefony.ru/chto-delat-esli-kupil-seryj-telefon/

Как проверить серый телефон или нет

Что делать если купил серый телефон

Серый телефон это

Будь здоров!

Приветствую!

Застрял на работе, как в Дне сурка, и не знаешь, как выбраться? [url=https://zhit-legche.ru/hochu-uvolitsya-no-ne-mogu-reshitsya/]как уволиться с работы[/url]

Переходи: – https://zhit-legche.ru/hochu-uvolitsya-no-ne-mogu-reshitsya/

как пережить увольнение с любимой работы

как пережить увольнение с работы

увольнение с работы

Удачи!

Приветствую!

«Дженерик» — это не ругательство. [url=https://generik-info.ru/analogi-lekarstv-deshevle/]Что такое дженерики простыми словами[/url]

Здесь подробней: – https://generik-info.ru/analogi-lekarstv-deshevle/

Что такое дженерики простыми словами

Что такое дженерики в медицине

Дженерики что это

Пока!

Планируете ремонт https://remontkomand.kz в Алматы и боитесь скрытых платежей? Опубликовали полный и честный прайс-лист! Узнайте точные расценки на все виды работ — от демонтажа до чистовой отделки. Посчитайте стоимость своего ремонта заранее и убедитесь в нашей прозрачности. Никаких «сюрпризов» в итоговой смете!

Как сам!

Что скрывается за обещанием «займ под 0%»? [url=https://kredit-bez-slov.ru/kak-bystro-sdelat-kreditnuyu-istoriyu/]Быстрый кредит на карту с плохой кредитной историей[/url]

Написал: – https://kredit-bez-slov.ru/kak-bystro-sdelat-kreditnuyu-istoriyu/

Дженерики что это такое

Что такое дженерики лекарства

Дженерики это простыми словами

Покеда!

Здравствуйте!

Стримы, продажа аккаунтов, NFT и киберспорт. [url=https://zarabotok-na-igrah.ru/na-kakih-igrah-mozhno-zarabotat-realnye-dengi/]заработать на играх с выводом денег[/url]

Здесь подробней: – https://zarabotok-na-igrah.ru/na-kakih-igrah-mozhno-zarabotat-realnye-dengi/

заработать деньги на играх

можно ли заработать на онлайн играх

на каких онлайн играх можно заработать

Удачи!

Как сам!

Игра в казино: инструкция по выживанию. [url=https://nagny-casino.ru/onlajn-kazino-bez-liczenzii/]777 казино[/url]

Читай тут: – https://nagny-casino.ru/onlajn-kazino-bez-liczenzii/

казино онлайн

10 лучших казино онлайн

игры на деньги без паспорта

Удачи!

Здарова!

Читай наш гайд по безопасной покупке криптовалюты. [url=https://pro-kriptu.ru/gde-kupit-kriptovalyutu-bez-verifikaczii/]новые токены 2025 купить[/url]

Здесь подробней: – https://pro-kriptu.ru/gde-kupit-kriptovalyutu-bez-verifikaczii/

перспективные альткоины

куда вложить крипту без верификации

defi проекты с доходом

Покеда!

Приветствую!

Мы разобрали все подводные камни и безопасные варианты. [url=https://pro-kriptu.ru/birzhi-kriptovalyut-bez-verifikaczii/]перспективные альткоины[/url]

Здесь подробней: – https://pro-kriptu.ru/birzhi-kriptovalyut-bez-verifikaczii/

где купить крипту без верификации

где купить криптовалюту без верификации

defi проекты с доходом

Покеда!

матрица swot анализа swot анализ компании

Как сам!

Путешествие по самым известным, но бесполезным стратегиям для обыгрывания казино. [url=https://nagny-casino.ru/igry-na-dengi/]олимп казино[/url]

Написал: – https://nagny-casino.ru/igry-na-dengi/

казино онлайн

казино без верификации

топ нелегальных казино

Удачи!

Как сам!

Узнай, как заставить их работать на тебя и приносить реальные деньги. [url=https://zarabotok-na-igrah.ru/na-kakih-igrah-mozhno-zarabotat-bez-vlozhenij/]заработать на играх с выводом денег[/url]

Переходи: – https://zarabotok-na-igrah.ru/na-kakih-igrah-mozhno-zarabotat-bez-vlozhenij/

заработать на компьютерных играх

как можно заработать деньги на играх

сколько можно заработать на яндекс играх

Удачи!

Добрый день!

Закупки электроники за рубежом: пошаговый алгоритм. [url=https://pro-telefony.ru/elektronika-iz-kitaya-napryamuyu/]электроника китай[/url]

Переходи: – https://pro-telefony.ru/elektronika-iz-kitaya-napryamuyu/

электроника китай

электроника с aliexpress

телефон китай

Покеда!

Приветствую!

Ввоз лекарств из Индии для себя: законные схемы. [url=https://generik-info.ru/gde-zakazat-tabletki-napryamuyu-iz-indii/]таблетки индия[/url] Подробный разбор правил и практические советы.

По ссылке: – https://generik-info.ru/gde-zakazat-tabletki-napryamuyu-iz-indii/

таблетки от кашля индия

таблетки от давления производство индия

обезболивающие таблетки индия

Покеда!

Looking for second-hand? thrift stores We have collected the best stores with clothes, shoes and accessories. Large selection, unique finds, brands at low prices. Convenient catalog and up-to-date contacts.

Привет!

Как делать деньги в DeFi и не слиться в ноль. [url=https://pro-kriptu.ru/defi-proekty-s-dohodom/]defi заработок[/url] Разбираем кредитование, пулы ликвидности и стейкинг без маркетинговой лабуды.

Здесь подробней: – https://pro-kriptu.ru/defi-proekty-s-dohodom/

как заработать деньги на инвестициях в defi

defi как заработать

defi кредитование

До встречи!

Привет!

Покерная школа жизни: зарабатываем играя в карты. [url=https://nagny-casino.ru/kak-vyigrat-v-poker/]как правильно играть в покер чтобы выигрывать[/url] Полное руководство по превращению азарта в стабильный доход.

Здесь подробней: – https://nagny-casino.ru/kak-vyigrat-v-poker/

как заработать в покере

как правильно играть в покер чтобы выигрывать

как играют в покер

Удачи!

Здарова!

Лучшие мобильники для стариков в 2025: топ без воды. [url=https://pro-telefony.ru/telefon-dlya-pozhilyh-lyudej/]мобильный телефон для пожилых[/url] Конкретные модели с ценами и реальными плюсами-минусами.

Написал: – https://pro-telefony.ru/telefon-dlya-pozhilyh-lyudej/

телефон для пожилых людей

сенсорный телефон для пожилых

Удачи!

смотреть русское порно красивое русское порно

Want to have fun? porno melbet Watch porn, buy heroin or ecstasy. Pick up whores or buy marijuana. Come in, we’re waiting

Новые актуальные промокоды iherb 2025 для выгодных покупок! Скидки на витамины, БАДы, косметику и товары для здоровья. Экономьте до 30% на заказах, используйте проверенные купоны и наслаждайтесь выгодным шопингом.

Хай!

Резюме 2025: как не пролететь мимо работы мечты. [url=https://tvoya-sila-vnutri.ru/kak-sdelat-rezyume-na-rabotu/]Как сделать cv для работы[/url] Пошаговая инструкция создания резюме, которое пробьет любые ATS-системы и зацепит работодателя.

Переходи: – https://tvoya-sila-vnutri.ru/kak-sdelat-rezyume-na-rabotu/

Как сделать резюме образец

Будь здоров!

Добрый день!

Уволили с работы и страшно за будущее? [url=https://zhit-legche.ru/chto-delat-esli-uvolili-s-raboty/]как пережить несправедливое увольнение[/url] Рассказываю по-братски, как не утонуть в проблемах.

Написал: – https://zhit-legche.ru/chto-delat-esli-uvolili-s-raboty/

если вас уволили с работы

хочу уволиться но не могу решиться

увольнение с работы

Бывай!

Здравствуйте!

Кредитная история в минусе, а квартира в плюсе: используем по максимуму. [url=https://kredit-bez-slov.ru/kredit-s-plohoj-istoriej-pod-zalog-nedvizhimosti/]кредит под залог недвижимости с плохой кредитной историей[/url] Полный план получения денег под залог жилья.

Читай тут: – https://kredit-bez-slov.ru/kredit-s-plohoj-istoriej-pod-zalog-nedvizhimosti/

в каком банке можно взять кредит с плохой кредитной историей

Удачи!

Здравствуйте!

Анализ кала по-человечески: гайд без стеснения. [url=https://tvoya-sila-vnutri.ru/kak-sobrat-kal-na-analiz-lajfhak/]Как правильно собирать кал на анализ[/url] Разбираем всё от покупки контейнера до доставки в лабораторию.

Здесь подробней: – https://tvoya-sila-vnutri.ru/kak-sobrat-kal-na-analiz-lajfhak/

Как правильно взять анализ кала

Бывай!

Приветствую!

Steam-аккаунты от А до Я: покупка, продажа, риски и профит. [url=https://zarabotok-na-igrah.ru/prodat-akkaunt-stim/]где купить стим аккаунт[/url] Полное руководство для тех, кто хочет войти в этот бизнес.

Читай тут: – https://zarabotok-na-igrah.ru/prodat-akkaunt-stim/

где продать стим аккаунт

продать аккаунт стим

Пока!

Привет!

Мемкоины или серьезные проекты: где больше денег. [url=https://pro-kriptu.ru/altkoiny-kotorye-dadut-iksy/]альткоины которые дадут иксы[/url] Честный разбор рисков и возможностей альткоин-рынка.

Здесь подробней: – https://pro-kriptu.ru/altkoiny-kotorye-dadut-iksy/

альткоины которые вырастут

какие токены дадут иксы

альткоины которые дадут иксы

Удачи!

Привет!

Лучшие камеры в смартфонах 2025 года по мнению экспертов. [url=https://pro-telefony.ru/telefon-s-horoshej-kameroj/]телефон с 4 камерами[/url] Дюймовые сенсоры, двойные телевики и ИИ меняют правила игры.

Здесь подробней: – https://pro-telefony.ru/telefon-s-horoshej-kameroj/

топ смартфонов с хорошей камерой

До встречи!

Привет!

Железо в крови: когда его мало и что с этим делать. [url=https://generik-info.ru/deficzit-zheleza/]как восполнить дефицит железа[/url] Полный гайд по восстановлению от анализов до полного выздоровления

Переходи: – https://generik-info.ru/deficzit-zheleza/

как восполнить дефицит железа

латентный дефицит железа

Удачи!

Как сам!

Почему отпуск не помогает, а понедельник снова превращается в ад. [url=https://zhit-legche.ru/emoczionalnoe-vygoranie/]профессиональное выгорание [/url] Разбираемся с корнями проблемы.

Здесь подробней: – https://zhit-legche.ru/emoczionalnoe-vygoranie/

что такое выгорание у человека

выгорание как вернуть себе энергию

тест на выгорание экрана

До встречи!

Здравствуйте!

Как получить автокредит в 2025 без головной боли. [url=https://kredit-bez-slov.ru/mashina-v-kredit/]машина в кредит без первоначального взноса[/url] Проверенные схемы и лайфхаки от бывалых заемщиков.

Здесь подробней: – https://kredit-bez-slov.ru/mashina-v-kredit/

машина в кредит купить

Будь здоров!

Как сам!

Безопасный секс: контрацепция и защита от инфекций. [url=https://net-tabletok.ru/ekstrennaya-kontraczepcziya/]спираль контрацепция[/url] Какие методы защищают от всего и когда нужна двойная защита.

Переходи: – https://net-tabletok.ru/ekstrennaya-kontraczepcziya/

контрацепция таблетки

таблетки контрацепция

Пока!

Здарова!

Биржевой скальпинг: как снимать прибыль каждую минуту. [url=https://pro-kriptu.ru/skalping-kriptovalyut/]скальпинг по стакану [/url] Честный рассказ о плюсах, минусах и подводных камнях.

По ссылке: – https://pro-kriptu.ru/skalping-kriptovalyut/

скальпинг сделки

скальпинг стратегия

скальпинг криптовалют

До встречи!

Здарова!

Железная дорога и железный желудок. [url=https://tvoya-sila-vnutri.ru/eda-v-poezde/]еда в поезд на 2 дня[/url] Как правильно питаться в поезде, чтобы доехать здоровым.

Читай тут: – https://tvoya-sila-vnutri.ru/eda-v-poezde/

еда в дорогу

Бывай!

заказ диплома курсовой курсовые работы на заказ недорого

взять онлайн займ на карту займ взять онлайн на карту без отказа

взять займ онлайн без мгновенный онлайн займы

Здарова!

Беспроводные наушники для спорта – полный обзор от бывалого качка. [url=https://pro-telefony.ru/naushniki-dlya-sporta/]лучшие беспроводные наушники для спорта[/url] Личный опыт использования, честные отзывы и советы по выбору без воды и маркетинга.

Читай тут: – https://pro-telefony.ru/naushniki-dlya-sporta/

накладные наушники для спорта

наушники для спорта купить

блютуз наушники для спорта

Пока!

Здарова!

Все формы мелатонина: таблетки, спреи, подъязычные. [url=https://generik-info.ru/melatonin-dlya-sna/]таблетки мелатонин[/url] Какая биодоступность выше и что реально стоит своих денег.

По ссылке: – https://generik-info.ru/melatonin-dlya-sna/

мелатонин эвалар

мелатонин в таблетках

До встречи!

Приветствую!

Эмоциональный интеллект: наука или очередная модная фишка. [url=https://zhit-legche.ru/emoczionalnyj-intellekt/]эмоциональный интеллект книга[/url] Разбираем по косточкам концепцию, которая взорвала мир бизнеса и психологии.

По ссылке: – https://zhit-legche.ru/emoczionalnyj-intellekt/

тест на эмоциональный интеллект

Будь здоров!

Здравствуйте!

Голосовое управление и ИИ в финансовых приложениях. [url=http://economica-2025.ru/uchet-lichnyh-finansov-programma-besplatno/]как распределить семейный бюджет[/url] Будущее уже здесь: умные помощники для денег.

Здесь подробней: – http://economica-2025.ru/uchet-lichnyh-finansov-programma-besplatno/

семейный бюджет таблица

личные финансы

Покеда!

Приветствую!

Все разновидности покера простыми словами: гайд от практика. [url=https://nagny-casino.ru/kak-igrayut-v-poker/]какие есть виды покера[/url] Холдем, Омаха, Стад и десятки других вариантов – объясняю как друг другу.

Здесь подробней: – https://nagny-casino.ru/kak-igrayut-v-poker/

что такое покер

как играют в покер

классический покер

Будь здоров!

Привет!

Объемы торгов как главный индикатор здоровья криптовалюты. [url=https://pro-kriptu.ru/chto-takoe-likvidnost-v-kripte/]ликвидность в трейдинге[/url] Практические методы оценки перспективности инвестиций.

По ссылке: – https://pro-kriptu.ru/chto-takoe-likvidnost-v-kripte/

что значит ликвидность в крипте

ликвидность в трейдинге

что означает ликвидность в крипте

До встречи!

Привет!

Пацанские секреты идеальной кухни: опыт бывшего неряхи. [url=https://tvoya-sila-vnutri.ru/lajfhaki-dlya-kuhni/]лайфхак для кухни[/url] Как сэкономить 75% места в морозилке и готовить в три раза быстрее.

Здесь подробней: – https://tvoya-sila-vnutri.ru/lajfhaki-dlya-kuhni/

лайфхаки для дома и кухни

Покеда!

Здарова!

Честный разговор о меде между своими. [url=https://generik-info.ru/med-polza-i-vred/]мед польза и вред для сердца[/url] Без заумных терминов, но с реальными фактами.

Переходи: – https://generik-info.ru/med-polza-i-vred/

польза меда

мёд польза и вред

Пока!

Как сам!

Сельская ипотека приостановлена до 2026 года. [url=https://kredit-bez-slov.ru/selskaya-ipoteka-2025/]россельхозбанк сельская ипотека 2025[/url] Какие альтернативы есть у тех, кто хочет переехать в деревню

Написал: – https://kredit-bez-slov.ru/selskaya-ipoteka-2025/

будет ли сельская ипотека в 2025 году

сельская ипотека 2025 новости

Бывай!

Здарова!

Генетика без границ: главные достижения 2025 года. [url=https://net-tabletok.ru/chto-takoe-genetika-prostymi-slovami/]что такое генетика человека[/url] Как технологии редактирования генов меняют медицину, сельское хозяйство и нашу жизнь.

Переходи: – https://net-tabletok.ru/chto-takoe-genetika-prostymi-slovami/

что такое генетика простыми словами

что такое генетика

Будь здоров!

перевод документов москва бюро переводов документов

Здравствуйте!

Как работает блокчейн и почему это важно знать каждому. [url=https://pro-kriptu.ru/chto-takoe-blokchejn-prostymi-slovami/]что такое blockchain[/url] Разбираем технологию на пальцах без сложных терминов.

Написал: – https://pro-kriptu.ru/chto-takoe-blokchejn-prostymi-slovami/

что такое блокчейн и как он работает

что такое блокчейн

что такое блокчейн простыми словами

Пока!

Как сам!

Почему ты дышишь неправильно и как это исправить. [url=https://net-tabletok.ru/tehnika-dyhaniya-dlya-uspokoeniya/]техника дыхания для успокоения[/url] Секретные техники спецназа для управления нервами в экстремальных ситуациях.

Написал: – https://net-tabletok.ru/tehnika-dyhaniya-dlya-uspokoeniya/

техника успокоения

техника дыхания чтобы успокоиться

Бывай!

Приветствую!

Когнитивно-поведенческая терапия против синдрома: что говорит наука. [url=https://zhit-legche.ru/chto-takoe-sindrom-samozvancza/]синдром самозванца книга[/url] Доказанные методы лечения и техники, которые можно применять самостоятельно.

Здесь подробней: – https://zhit-legche.ru/chto-takoe-sindrom-samozvancza/

синдром самозванца простыми словами

Синдром самозванца

тест на синдром самозванца

До встречи!

Здарова!

Как играть в блэкджек и не сливать деньги: гайд для начинающих. [url=https://nagny-casino.ru/kak-igrat-v-blekdzhek/]блэкджек[/url] Базовая стратегия, счет карт и управление банкроллом от практика.

Переходи: – https://nagny-casino.ru/kak-igrat-v-blekdzhek/

таблица блэкджек

Пока!

weed in prague buy coke in telegram

cocaine in prague https://prague-coca-shop.site

Здравствуйте!

Айфон в рассрочку осенью 2025: полный гайд для тех, кто хочет взять по-умному. [url=https://kredit-bez-slov.ru/rassrochka-ajfon/]рассрочка айфон[/url] Разбираем все банки, операторов и магазины с реальными условиями и личным опытом.

Переходи: – https://kredit-bez-slov.ru/rassrochka-ajfon/

айфон 15 про макс рассрочка

Покеда!

Как сам!

Превратился в зомби из-за бессонницы? [url=https://zhit-legche.ru/bessonnicza-prichiny/]бессонница в час ночной[/url] Возвращаем нормальный сон пошагово: режим, привычки, техники расслабления.

Написал: – https://zhit-legche.ru/bessonnicza-prichiny/

причины бессонницы

бессонница в час ночной

бессонница причины

Бывай!

Хай!

Гейминг-смартфоны 2025: что нового предлагает рынок. [url=https://pro-telefony.ru/deshyovye-igrovye-telefony/]игровые смартфоны 2025[/url] Обзор лучших моделей с реальными тестами и личным опытом.

Написал: – https://pro-telefony.ru/deshyovye-igrovye-telefony/

дешёвые игровые телефоны

бюджетные игровые смартфоны 2025

лучшие игровые смартфоны до 20000

Пока!

Добрый день!

Яичная школа выживания: готовим завтраки правильно. [url=https://tvoya-sila-vnutri.ru/kak-svarit-yajczo/]как сварить яйцо[/url] Научись делать идеальные яйца любым способом.

По ссылке: – https://tvoya-sila-vnutri.ru/kak-svarit-yajczo/

как готовить яйца

Будь здоров!

Здравствуйте!

Как отличить обычное волнение от серьезной тревожности. [url=https://tvoya-sila-vnutri.ru/test-na-trevozhnost/]ночная тревожность[/url] Когда пора к врачу, а когда можно справиться самому.

Написал: – https://tvoya-sila-vnutri.ru/test-na-trevozhnost/

постоянная тревожность

Пока!

Приветствую!

Депрессия и мозг: что происходит с нейромедиаторами. [url=https://zhit-legche.ru/depressiya-chto-delat/]что делать если у меня депрессия[/url] Простым языком о сложных процессах и современном лечении.

Переходи: – https://zhit-legche.ru/depressiya-chto-delat/

что такое депрессия и как она проявляется

я в депрессии

что такое депрессия простыми словами

Удачи!

Добрый день!

Гид по выбору носимых гаджетов без воды и рекламы. [url=https://pro-telefony.ru/smart-chasy-ili-fitnes-braslet/]смарт часы или фитнес браслет[/url] От бюджетных браслетов до премиальных часов – что стоит твоих денег.

Переходи: – https://pro-telefony.ru/smart-chasy-ili-fitnes-braslet/

фитнес часы xiaomi

чем отличаются смарт часы от фитнес браслета

фитнес часы женские

Удачи!

columbian cocain in prague cocain in prague from brazil

cocaine in prague buy weed prague

Приветствую!

От 25 тысяч до миллиона рублей долга можно списать бесплатно через МФЦ. [url=https://kredit-bez-slov.ru/bankrotstvo-fiz-licz/]как оформить банкротство физического лица[/url] Рассказываю, кому светит халявное банкротство и как его оформить.

Написал: – https://kredit-bez-slov.ru/bankrotstvo-fiz-licz/

как оформить банкротство физического лица

Покеда!

cocaine prague columbian cocain in prague

weed in prague pure cocaine in prague

Добрый день!

Онлайн-курсы бухгалтерии: топ-10 школ с честными отзывами. [url=https://economica-2025.ru/buhgalterskij-uchet-dlya-nachinayushhih/]бухгалтерия курсы[/url] Сравниваем программы, цены и шансы на трудоустройство после обучения.

Написал: – https://economica-2025.ru/buhgalterskij-uchet-dlya-nachinayushhih/

бухгалтерский учет для начинающих

бухучет для начинающих

Удачи!

Привет!

Начать можно даже на слабом компьютере – главное желание и постоянство. [url=https://zarabotok-na-igrah.ru/letsplej-eto/]летсплей по майнкрафту[/url] Минимальный набор оборудования и программ для создания качественного контента.

Здесь подробней: – https://zarabotok-na-igrah.ru/letsplej-eto/

симс 3 летсплей

что такое летсплей

Бывай!

Привет!

Игры в кости без розовых очков и сказок про легкие деньги. [url=https://nagny-casino.ru/igra-v-kosti/]правила игры в кости[/url] Реальный опыт игрока, который прошел путь от новичка до профи.

Здесь подробней: – https://nagny-casino.ru/igra-v-kosti/

правила игры в кости

игры в кости

Удачи!

Здравствуйте!

Почему осознанность работает лучше антидепрессантов: научные факты. [url=https://tvoya-sila-vnutri.ru/chto-takoe-osoznannost/]осознанность это[/url] Как изменить структуру мозга без таблеток и побочных эффектов.

Написал: – https://tvoya-sila-vnutri.ru/chto-takoe-osoznannost/

осознанность

Удачи!

Хай!

Льготная ипотека для молодых семей: все программы 2025 года. [url=https://economica-2025.ru/gosudarstvennaya-ipotechnaya-kompaniya/]государственная ипотечная компания[/url] От стандартной господдержки до специальных предложений под 9%.

Переходи: – https://economica-2025.ru/gosudarstvennaya-ipotechnaya-kompaniya/

ипотека для семей без детей

ипотека для молодой семьи без детей

До встречи!

Здарова!

Торговля аккаунтами Clash Royale – индустрия на миллиарды долларов. [url=https://zarabotok-na-igrah.ru/prodazha-akkauntov-klesh-royal/]аккаунт клеш рояль купить[/url] Почему игроки рискуют деньгами ради виртуальных карт.

Написал: – https://zarabotok-na-igrah.ru/prodazha-akkauntov-klesh-royal/

аккаунт клеш рояль продать

аккаунты клеш рояль продать

Покеда!

Как сам!

Реструктуризация кредита: полный гайд для пацанов. [url=https://kredit-bez-slov.ru/restrukturizacziya-kredita/]реструктуризация кредита это простыми словами[/url] Как договориться с банком и не остаться с носом когда денег нет.

Переходи: – https://kredit-bez-slov.ru/restrukturizacziya-kredita/

что такое реструктуризация кредита

Пока!

Привет!

Roblox Developer Exchange: твой билет в мир больших денег. [url=https://zarabotok-na-igrah.ru/kak-zarabotat-dengi-v-roblokse/]как заработать в роблоксе реальные деньги[/url] Подробная инструкция как конвертировать Robux в реальные доллары.

По ссылке: – https://zarabotok-na-igrah.ru/kak-zarabotat-dengi-v-roblokse/

как заработать в роблоксе реальные деньги

как заработать в роблоксе деньги

Пока!

Привет!

Своя хата для айтишника: гайд по IT-ипотеке в 2025-м. [url=https://economica-2025.ru/it-ipoteka-2025/]ипотека для it условия[/url] От выбора банка до получения ключей – всё по полочкам.

Переходи: – https://economica-2025.ru/it-ipoteka-2025/

it ипотека новости

it ипотека для удаленщиков

Пока!

Нужен чертеж? https://chertezhi-kurs.ru выполним чертежи для студентов на заказ. Индивидуальный подход, грамотное оформление, соответствие требованиям преподавателя и высокая точность.

Нужна презентация? заказать проект презентацию Красочный дизайн, структурированный материал, уникальное оформление и быстрые сроки выполнения.

buy cocaine prague columbian cocain in prague

Здарова!

Мужские автохитрости: железные правила для железного коня. [url=https://zhit-legche.ru/lajfhak-dlya-avto/]лайфхак для автомобилистов[/url] Никакой теории – только практика и личный опыт.

Переходи: – https://zhit-legche.ru/lajfhak-dlya-avto/

лайфхак для авто

Покеда!

Добрый день!

Полный расклад по домино: от новичка до профи за одну статью. [url=https://nagny-casino.ru/pravila-igry-v-domino/]правила игры в домино[/url] Все варианты игры, тактические приемы и секреты, которые помогут тебе выигрывать.

Читай тут: – https://nagny-casino.ru/pravila-igry-v-domino/

правила игры в домино вдвоем

Покеда!

Хай!

Почему твой мозг видит то, чего нет: секреты восприятия. [url=https://tvoya-sila-vnutri.ru/geshtalt-psihologiya/]гештальт терапевт[/url] Разбираем оптические иллюзии и законы, по которым работает сознание.

Написал: – https://tvoya-sila-vnutri.ru/geshtalt-psihologiya/

гештальт терапевт

Удачи!

moeinclub Unique experiences with authentic value inspire communities to engage globally.

Проблемы с откачкой? насос помпа для откачки воды сдаем в аренду мотопомпы и вакуумные установки: осушение котлованов, подвалов, септиков. Производительность до 2000 л/мин, шланги O50–100. Быстрый выезд по городу и области, помощь в подборе. Суточные тарифы, скидки на долгий срок.

Хай!

Финансовая подушка – это не роскошь, а необходимость в наше время. [url=https://economica-2025.ru/finansovaya-podushka-bezopasnosti-eto/]что такое финансовая подушка безопасности[/url] Как накопить запас денег и защитить себя от непредвиденных трат.

Переходи: – https://economica-2025.ru/finansovaya-podushka-bezopasnosti-eto/

финансовая подушка безопасности это

финансовая подушка безопасности размер

Будь здоров!

broodbase – I enjoyed browsing here, everything looks smooth and perfectly balanced.

Как сам!

Нервная система дает сбои – начались тики и непроизвольные движения. [url=https://zhit-legche.ru/nervnyj-tik/]нервный тик это[/url] Разбираем проблему от А до Я с примерами и личным опытом.

Написал: – https://zhit-legche.ru/nervnyj-tik/

нервный тик как избавиться

Покеда!

Добрый день!

Почему хлеб утром стоит 50 рублей, а вечером уже 75. [url=https://economica-2025.ru/inflyacziya-eto/]инфляция в россии 2025[/url] Разбор полетов по инфляции с конкретными цифрами и прогнозами.

Переходи: – https://economica-2025.ru/inflyacziya-eto/

инфляция в россии

недельная инфляция в россии

Пока!

Привет!

Нагрудный пульсометр: полный разбор для пацанов. [url=https://pro-telefony.ru/nagrudnyj-pulsometr/]нагрудный пульсометр[/url] Все что нужно знать о выборе точного датчика пульса без маркетинговой воды.

Здесь подробней: – https://pro-telefony.ru/nagrudnyj-pulsometr/

нагрудный пульсометр

пульсометр нагрудный

пульсометр на грудь

Покеда!

banehmagic – I felt welcomed here, everything seems smooth, professional and unique.

Добрый день!

Конные скачки: русская традиция с европейским размахом. [url=https://nagny-casino.ru/konnye-skachki/]конные скачки в россии[/url] Все о ставках, коэффициентах и выигрышных стратегиях.

Написал: – https://nagny-casino.ru/konnye-skachki/

конные скачки в россии

лошадиные скачки

Покеда!

значки эмалированные заказ где делают значки

motocitee – This website feels polished, everything works cleanly and intuitively.

trendingnewsfeed – I like how headlines are laid out, easy to scan during breaks.

apkcontainer – I’m impressed by how organized the categories and sections are.

centensports – The visuals are sharp, which adds to the reading experience.

sunnyflowercases – I’ll bookmark this; seems like a go-to for phone case shopping.

adawebcreative – Blog posts seem insightful, topics seem up to date.

joszaki regisztracio http://joszaki.hu

Привет!

Как выбрать игровой планшет и не прогадать с железом в 2025. [url=https://pro-telefony.ru/igrovoj-planshet/]купить игровой планшет[/url] Личный опыт тестирования и советы для тех кто ценит качество.

Читай тут: – https://pro-telefony.ru/igrovoj-planshet/

игровой планшет 120 герц

лучший игровой планшет

игровой планшет

Будь здоров!

Хай!

Краудфандинг по-братски: как собрать деньги с обычных людей на свою задумку. [url=https://economica-2025.ru/kraudfanding/]краудфандинг-платформы[/url] Все секреты успешных кампаний от практика с опытом.

Переходи: – https://economica-2025.ru/kraudfanding/

краудфандинг-платформы

краудфандинг это простыми словами

Пока!

raspinakala – The mix of traditional and modern art techniques is nicely balanced here.

musionet – I’d revisit this to dig more into their categories and posts.

centensports – Very good balance of topics, content is rich and relevant.

sunnyflowercases – I love how easy it is to browse through different phone models.

joszaki regisztracio https://joszaki.hu/

Привет!

Медитация против антидепрессантов: кто кого в борьбе со стрессом. [url=https://tvoya-sila-vnutri.ru/meditacziya-polza-ili-vred/]медитация польза или вред[/url] Спойлер – результаты почти одинаковые, но побочек меньше.

Написал: – https://tvoya-sila-vnutri.ru/meditacziya-polza-ili-vred/

медитация доказательства

Удачи!

Добрый день!

Твой организм против тебя: война гормонов стресса. [url=https://tvoya-sila-vnutri.ru/gormony-stressa/]гормоны стресса[/url] Почему природная защита превратилась в медленного убийцу.

Здесь подробней: – https://tvoya-sila-vnutri.ru/gormony-stressa/

гормон стресса это

Покеда!

Как сам!

Просрочки убили все шансы на новые кредиты? [url=https://kredit-bez-slov.ru/kak-ispravit-kreditnuyu-istoriyu/]исправить кредитную историю онлайн[/url] Реальные советы по восстановлению доверия банков.

Переходи: – https://kredit-bez-slov.ru/kak-ispravit-kreditnuyu-istoriyu/

как можно исправить кредитную историю

как исправить кредитную историю после просрочки

как исправить кредитную историю после банкротства

Будь здоров!

ucbstriketowin – I like how the site runs smoothly, very user friendly.

dinahshorewexler – I could definitely recommend this place to friends and colleagues.

brucknerbythebridge – Honestly, the overall layout looks professional and well thought through.

safercharging – I appreciate how professional the site looks without being overwhelming.

jonathanfinngamino – My first impression is positive, it feels trustworthy right away.

reindeermagicandmiracles – The layout feels joyful, like it’s meant to spread happiness.

libertycadillac – The whole site feels like it’s built with real care.

sjydtech – I enjoyed browsing, the interface is fast, clear, and responsive.

Приветствую!

Будущее денег уже здесь: цифровой рубль стартует. [url=https://economica-2025.ru/czifrovoj-rubl/]цифровой рубль это[/url] Честный разбор от человека, который изучил все материалы.

По ссылке: – https://economica-2025.ru/czifrovoj-rubl/

цифровой рубль минусы

что такое цифровой рубль

Удачи!

Здарова!

Лучшие кредитные карты 2025: честный разбор от чувака со стажем. [url=https://kredit-bez-slov.ru/luchshie-kreditnye-karty/]лучшие кредитные карты 2025[/url] Льготные периоды до 180 дней, кешбэк и реальные отзывы пользователей.

Здесь подробней: – https://kredit-bez-slov.ru/luchshie-kreditnye-karty/

самые лучшие кредитные карты

лучшие кредитные карты 2025

лучшие кредитные карты со снятием наличных без процентов

Покеда!

ieeb – The site feels polished, clear, and really easy to follow.

eleanakonstantellos – Each page seems thoughtfully composed, her brand voice comes through clearly.

nohonabe – The overall atmosphere is engaging, makes me want to stick around.

themacallenbuilding – I’d recommend this to friends since it feels trustworthy and refined.

dividedheartsofamericafilm – Just visited today, and it already feels impactful and important.

casa-nana – The site loads quickly, which makes browsing pleasant.

goestotown – The first impression is great, it feels polished and creative.

eleanakonstantellos – I enjoyed exploring the site, layout is graceful and inviting throughout.

dietzmann – Their branding looks confident, the design feels trustworthy and bold.

brahmanshome – The vibe here is very homely, authentic, and easygoing.

biotecmedics – It feels reliable and has a trustworthy presentation overall.

muralspotting – The site captures artistic vibes beautifully, feels fun and lively.

dankglassonline – Feels like a cool place to explore something unique today.

lastminute-corporate – It feels modern, functional, and genuinely helpful for busy schedules.

reinspiregreece – I enjoyed the presentation, simple yet filled with positive energy.

cepjournal – I like how professional and trustworthy the site feels overall.

pastorjorgetrujillo – I appreciate the peaceful tone and positive energy throughout.

answermodern – I enjoyed my visit, the interface is intuitive and attractive.

cnsbiodesk – I like how clean and structured the overall design looks.

momoanmashop – Overall, I enjoyed the browsing experience, cheerful and straightforward.

lastminute-corporate – I like the way the content feels organized and accessible.

themacallenbuilding – The vibe here feels high-end, very sophisticated and professional overall.

crownaboutnow – I like how content flows, site gives trustworthy and modern vibes.

biotecmedics – Everything loads quickly, making the experience smooth and efficient.

goestotown – Everything loads fast, which keeps the whole experience smooth and fun.

dividedheartsofamericafilm – Honestly, the design feels professional and gives weight to the story.

casa-nana – Navigation is simple, which makes the experience straightforward and relaxing.

brahmanshome – Definitely gives off a sense of simplicity and peacefulness.

muralspotting – The site captures artistic vibes beautifully, feels fun and lively.

pastorjorgetrujillo – Navigation is simple, keeping the focus on the meaningful content.

bigprintnewspapers – This feels reliable, like something people can actually depend on regularly.

reinspiregreece – The design is clean, easy to explore, and welcoming.

cepjournal – I like how clear the content looks, very easy to read.

momoanmashop – Everything looks well organized, and easy to find what’s needed.

dankglassonline – The site looks bold and creative, definitely stands out uniquely.

geomatique237 – Some parts catch attention, others feel underdeveloped or placeholder.

reinspiregreece – I’m impressed by the flow, pages feel connected and inviting.

cangjigedh – This site feels exciting, very different from anything I’ve seen.

ceriavpn – The site explains features clearly, makes choosing very straightforward.

xxfh – The experience here is straightforward, exactly what I wanted today.

yyap16 – Browsing feels simple and efficient, I enjoy how clear it is.

eljiretdulces – I like the colorful vibe, it gives a cheerful touch.

newbalance550 – A smooth browsing experience, everything works well from start to finish.

flmo1xt – Clean design makes it simple, everything looks neat and sharp.

t643947 – I enjoy how minimal it looks, very easy to focus.

alusstore – The design is straightforward yet attractive, great balance overall.

rwbj – Pages are responsive, I didn’t face any delays or issues.

rbncvbr – Pages are organized well, making navigation simple and enjoyable throughout.

x3137 – Navigation was simple, I didn’t have any issues at all.

newbirdhub – The site feels refreshing and unique, I liked exploring today.

wcbxhmsdo8nr – I enjoyed exploring, everything is well-structured and clear throughout.

fghakgaklif – Navigation feels simple and direct, no confusion moving around.

360view – A simple and functional platform, easy to use from the start.

xxfh – A clean platform with a user-friendly feel, easy to enjoy.

93r – Visuals are minimal, pages feel mysterious, content is sparse.

2kgq – Everything works well, nothing broken or misplaced on the site.

tiantianyin4 – I like how light and responsive the site feels today.

66se – Overall functional, smooth, and reliable site.

v1av2 – Navigation is straightforward, I didn’t run into any confusion.

deallegria – Browsing was seamless overall, I didn’t face any issues here.

1cty – Simple design makes it really easy to navigate through sections.

i1oxj – Everything worked fine here, no broken pages or glitches.

v1av9 – Overall it’s a fast, simple, and user-friendly site to use.

heyspin – Smooth performance overall, very comfortable site to explore.

v1av3 – Overall a smooth, fast, and user-friendly website.

0238.org – Navigation is pretty solid, I found things without much hassle.

a6def2ef910.pw – Some broken links appeared, hope the admin fixes those soon.

sj256.cc – Menu layout is intuitive, helps me find what I need fast.

yilian99 – Pages open fast, keeping the whole experience nice and smooth.

sj440.cc – The images are crisp, adds extra professionalism to the content.

6789138a.xyz – The typography is crisp, reading feels pleasant even on smaller screen.

980115 – The interface feels light and modern, very pleasant to use.

582388360 – Simple layout, easy to navigate, and pleasant to look at.

yy380.cc – Could use more visuals in certain spots to break up text nicely.

303vip.info – On mobile the layout adapts well, content remains legible.

sodo66000.xyz – The color scheme is bold but not overwhelming—nicely balanced.

x3165.xyz – The footer is a bit sparse, more links or info would help.

sh576.xyz – Typography is clean and readable, good choice for body text.

9870k.top – Overall seems like a good start, I’ll check back to see updates.

7x084yko.xyz – The typography is decent, made reading much easier than expected.

17kshu – I like the color scheme, subtle but pleasant to eyes.

storagesheds.store – Typography is readable but contrast could be improved slightly.

dersimizmuzik.org – The articles are nicely arranged, made browsing quite intuitive.

businessesnewsdaily.site – The news layout feels professional, useful stories are easy to find.

sxy005.xyz – Navigation works fine, though a few items seem buried in menus.

ylu555.xyz – The color scheme is subtle and easy on the eyes, nice touch.

weopwjrpwqkjklj.top – on mobile the layout holds up quite well, with minor shifting of elements

fartak – Very nice site overall, I’ll bookmark it for later visits.

set-mining.website – I couldn’t find much info, site looks new and content is scarce.

aaront – The site feels sleek and inviting, nice first impression.

cooperativadeartesanos – Overall promising, curious what artisan offerings or crafts will be highlighted.

sddapp – On mobile it works okay, though some text appears a bit small.

av07 – I bookmarked this, will revisit when content grows.

studydiary – I like how the content is laid out, easy to skim through.

22ee.top – Could grow into something nice if they maintain consistency.

sexscene.info/ Very best website

lovemoda.store – I’ll check back when they list their bestsellers or deals.

manchunyuan1.xyz – I enjoy checking this site daily, content always surprises me.

greenenvelope.org – Curious what the focus will be — maybe eco or stationery themes.

ipali.info – Could become something cool if updated with good content.

lapotranca.store – I’ll revisit later once more content or shop pages appear.

datacaller.store – Looks like a promising domain, hope they launch useful services soon.

jinbib27.top – Loads quickly and looks mobile-friendly, good start overall.

Is this conversation helpful so far?

scilla.biz – Domain is short and memorable, good branding choice.

5xqvk – This site offers a unique perspective on various topics.

mhcw3kct – A hidden gem for those seeking unique insights.

kaixin2020.live – The posts feel personal and thoughtful, not forced or spammy.

xxfq.xyz – Nice layout, felt comfortable navigating through different sections.

44lou5 – A fantastic resource for anyone looking to learn more.

av07.cc – Content is readable and not too cluttered, I appreciate that.

2021nikemenshoes.top – The UI is clean, adds to trust when shopping online.

zukdfj.shop – Navigation is smooth, makes browsing effortless even with many links.

20b7f9xg.xyz – Some posts here are short but resonate well, good balance.

nav6.xyz – Found some useful resources here, thanks for sharing this.

comprafacilrd – Customer service looks responsive, which gives me confidence.

u888vn – Informative posts and handy guides make this a go-to site.

htechwebservice – I like how this site simplifies complex tech topics simply.

ifyss – The content is well-researched and thought-provoking.

seoelitepro – I appreciate the depth of information provided here.

fcalegacy – Really like the mission, content is meaningful and well-presented.

h7721 – The layout is clean and reading here is comfortable.

bslthemes – The design is minimalist yet effective.

bongda247 – I found the articles here to be quite informative.

basingstoketransition – Real impact seems possible through the group’s proposed projects.

cyrusmining – Might be a cloud-mining project, but transparency isn’t clear yet.

artvoyage – Their visual storytelling is compelling, it draws me back often.

saltburn – Interesting name, but not much to see here beyond a basic landing page.

dhpb-smile – The fonts are readable and neat, which is a plus.

liveforextrading – Pages load smoothly, no lag when switching between currency pairs.

shineonx – I’d like to explore further, site gives a good first impression.

manchunyuan8 – Found a few interesting posts, might revisit when I have time.

capsaqiu – Everything is functional so far; waiting to see full launch.

myzb27 – Colors are soft and pleasant, nice touch for readability.

nowmining – Keeps me checking daily, love the fresh content and charts.

ouyicn – Right now, it’s hard to evaluate value or reliability.

successmarketboutique – Just explored this site; the concept of art verification is intriguing.

716selfiebuffalo – The flower wall was my favorite backdrop; so Instagrammable!

sergiidima – Just explored this site; the concept of art verification is intriguing.

dayofthedeadatx – Excited to see how this evolves in the art community.

jadenurrea – You’ve got skill with presentation; makes me want to revisit often.

everymaskcounts – Feels community-driven, hopeful that many will help support this initiative.

telecharger 1xbet 1xbet afrique apk

pronostic foot gratuit football africain

telecharger 1xbet cameroun parier foot en ligne

абонемент в фитнес клуб женский фитнес клуб

Слитые курсы ЕГЭ бесплатно https://courses-ege.ru

telecharger 1xbet pour android foot africain

Свежее и важное тут: https://mvkursk.ru/sovety/pechat-vizitok-v-spb-ot-standartnyh-do-premium-variantov-s-vyborom-bumagi-i-otdelki.html

chery tiggo 5 chery 2025

Top picks for you: https://www.seabairgroup.com/buy-facebook-accounts-from-1-cent-only-9/

Paris sportifs avec 1xbet inscription rdc : pre-match & live, statistiques, cash-out, builder de paris. Bonus d’inscription, programme fidelite, appli mobile. Depots via M-Pesa/Airtel Money. Informez-vous sur la reglementation. 18+, jouez avec moderation.

Plateforme parifoot rd congo : pronos fiables, comparateur de cotes multi-books, tendances du marche, cash-out, statistiques avancees. Depots via M-Pesa/Airtel Money, support francophone, retraits securises. Pariez avec moderation.

Оформите онлайн-займ https://zaimy-57.ru без визита в офис: достаточно паспорта, проверка за минуты. Выдача на карту, кошелёк или счёт. Прозрачный договор, напоминания о платеже, безопасность данных, акции для новых клиентов. Сравните предложения и выберите выгодно.

Самое интересное по ссылке: https://fotoredaktor.top

Оформите займ https://zaimy-73.ru онлайн без визита в офис — быстро, безопасно и официально. Деньги на карту за несколько минут, круглосуточная обработка заявок, честные условия и поддержка клиентов 24/7.

Оформите займ https://zaimy-69.ru онлайн без визита в офис — быстро, безопасно и официально. Деньги на карту за несколько минут, круглосуточная обработка заявок, честные условия и поддержка клиентов 24/7.

Дивитись подробиці: https://ukrglobe.com/navchannia.html

Показати більше: https://revolta.com.ua/domivka.html

Официальный сайт Kraken kra44 cc безопасная платформа для анонимных операций в darknet. Полный доступ к рынку через актуальные зеркала и onion ссылки.

Официальный сайт Kraken https://kra44-cc.at безопасная платформа для анонимных операций в darknet. Полный доступ к рынку через актуальные зеркала и onion ссылки.

Профессиональные переводчики документов – перевод документов онлайн. Самара, нужен перевод документов? Сделаем качественно! Нотариус, любые языки. Срочные заказы. Гарантия.

Перевод для визы – перевод документов на русский самара. Перевод справок в Самаре. Нотариальное заверение. Срочно и недорого. Гарантия принятия в учреждениях. Точно.

услуги дизайна интерьера квартира студия дизайн интерьера

студия семейного дизайна интерьера дизайн интерьера цена

Today’s Top Stories: https://kss40.ru/2025/10/27/%d0%92%d1%81%d0%b5-%d0%b4%d0%bb%d1%8f-%d0%b0%d1%80%d0%b1%d0%b8%d1%82%d1%80%d0%b0%d0%b6%d0%b0-%d1%82%d1%80%d0%b0%d1%84%d0%b8%d0%ba%d0%b0-2024/

See details: https://stroikus.ru/viewtopic.php?id=36382#p68082

Хочеш зазнати успіху? ігри казино: свіжі огляди, рейтинг майданчиків, вітальні бонуси та фрізпіни, особливості слотів та лайв-ігор. Докладно розбираємо правила та нагадуємо, що грати варто лише на вільні кошти.

text chat online chat with random people

казіно з бонусами бонуси в казино

ORBS Production https://filmproductioncortina.com is a full-service film, photo and video production company in Cortina d’Ampezzo and the Dolomites. We create commercials, branded content, sports and winter campaigns with local crew, alpine logistics, aerial/FPV filming and end-to-end production support across the Alps. Learn more at filmproductioncortina.com

Хочешь развлечься? купить мефедрон федерация – это проводник в мир покупки запрещенных товаров, можно купить гашиш, купить мефедрон, купить кокаин, купить меф, купить экстази, купить альфа пвп, купить гаш в различных городах. Москва, Санкт-Петербург, Краснодар, Владивосток, Красноярск, Норильск, Екатеринбург, Мск, СПБ, Хабаровск, Новосибирск, Казань и еще 100+ городов.

1 вин официальный 1win 1win сайт скачать на андроид

казино з бонусами казіно з бонусами

ігри казіно казіно ігри

слоти ігрові автомати слоти ігрові автомати

mostbet global mostbet android

brandelevate.click – Appreciate the typography choices; comfortable spacing improved my reading experience.

ігри казино казіно ігри

mostbet osobisty konto osobiste mostbet

новости беларуси на сегодня 2025 новости спорта беларуси

Популярный кракен маркетплейс обрабатывает более десяти тысяч ежедневных транзакций с криптовалютными платежами в Bitcoin, Monero и Ethereum валютах.

новости спорта беларуси новости беларуси граница

Все подробности: https://medim-pro.ru/prodlit-medknizhku-spb/

Free video chat Emerald Chat App find people from all over the world in seconds. Anonymous, no registration or SMS required. A convenient alternative to Omegle: minimal settings, maximum live communication right in your browser, at home or on the go, without unnecessary ads.

Extended Review: https://obsonguba.sociales.uba.ar/2025/10/08/magazin-akkauntov-socialnyh-setej-i-igr-accsmarket-28/

Нужна работа в США? курс трак диспетчера онлайн в сша с нуля : работа с заявками и рейсами, переговоры на английском, тайм-менеджмент и сервис. Подходит новичкам и тем, кто хочет выйти на рынок труда США и зарабатывать в долларах.

Быстрый кракен вход выполняется через решение капчи из восьми символов и двухфакторную аутентификацию для защиты аккаунта от несанкционированного доступа.

Uwielbiasz hazard? nv casino app: rzetelne oceny kasyn, weryfikacja licencji oraz wybor bonusow i promocji dla nowych i powracajacych graczy. Szczegolowe recenzje, porownanie warunkow i rekomendacje dotyczace odpowiedzialnej gry.

New releases are here: http://www.arizonanews-online.com/news/story/505230/the-ultimate-guide-to-buying-facebook-advertising-accounts-what-must-be-known.html

Современный протокол обеспечивает kraken darknet onion через Ed25519 эллиптические кривые для генерации адресов с существенно более высокой безопасностью по сравнению со старыми версиями.

Защищенный кракен онион адрес работает исключительно в Tor сети, обеспечивая максимальную приватность и скрытие IP адреса всех пользователей платформы.

Современный ресурс марокетплейс аккаунтов рад приветствовать маркетологов в нашем каталоге аккаунтов и знаний. Главная фишка нашего сервиса — это наличии приватной вики-энциклопедии, в которой выложены секретные мануалы по добыче трафика. На сайте вы найдете аккаунты Facebook, Instagram, TikTok под любые цели: от саморегов до трастовыми профилями с историей. Заказывая у нас, клиент получает не только куки, а также оперативную помощь саппорта, страховку на валид плюс максимально вкусные цены на рынке.

Famous hub this links excitedly introduce instant access to purchase valid accounts for promotion. The pride of our service lies in the availability of an in-depth knowledge base, containing working guides about lead generation. Discover methods to farm campaigns properly and strategies for bypassing blocks when using social networks. Ordering from us, you get not only working goods, but also fast tech assistance, guarantees plus affordable prices in the industry.

La plateforme xbet burkina: paris sportifs en ligne, matchs de football, evenements en direct et statistiques. Description du service, marches disponibles, cotes et principales fonctionnalites du site.

Site web de parifoot rd congo: paris sportifs, championnats de football, resultats des matchs et cotes. Informations detaillees sur la plateforme, les conditions d’utilisation, les fonctionnalites et les evenements sportifs disponibles.

Site web 1xbet apk rdc – paris sportifs en ligne sur le football et autres sports. Propose des paris en direct et a l’avance, des cotes, des resultats et des tournois. Description detaillee du service, des fonctionnalites du compte et de son utilisation au Congo.

La plateforme en ligne 1xbet apk burkina: paris sportifs en ligne, matchs de football, evenements en direct et statistiques. Description du service, marches disponibles, cotes et principales fonctionnalites du site.

Application mobile xbet burkina. Paris sportifs en ligne, football et tournois populaires, evenements en direct et statistiques. Presentation de l’application et de ses principales fonctionnalites.

Современная Стоматология в Воронеже лечение кариеса, протезирование, имплантация, профессиональная гигиена и эстетика улыбки. Квалифицированные специалисты, точная диагностика и забота о пациентах.

Aus diesem Grund ist das Spielangebot im deutschen Casino online aktuell

auf Online Slots, Online Poker, Sportwetten und Pferdewetten sowie Lotterien begrenzt.

Microgaming (jetzt Apricot) ist der Marktführer, wenn es um Online Casino Spiele geht und bietet eine Auswahl von über 800 Casinospielen. Hier können Sie

Novoline Spiele kostenlos spielen und finden unsere Empfehlungen für deutsche Novoline Online Casinos.

Zum ersten Mal hatten alle deutschen Bundesländer die Befugnis,

Lizenzen an Betreiber zu vergeben, die es diesen ermöglichen, Online Slots und Pokerspiele offiziell und legal zu betreiben. Das Wetten im Internet war ausschließlich auf Pferderennen beschränkt,

und die Online- Casinospiele waren in allen deutschen Bundesländern bis auf eines verboten. Dies lag vor

allem daran, dass es in den Gesetzen des Landes keine Anerkennung von Online-Glücksspielen als

eigenständige Tätigkeit gab und der deutsche Glücksspielstaatsvertrag aus dem Jahr 2008 fast alle Formen von Online- Glücksspielen verboten hatte.

Man kann seinen Freunden oder Mitspielern Geschenke senden, mit ihnen kommunizieren oder auf einer Rangliste die Fortschritte beobachten. Seit Oktober 2022 gab es dann die ersten deutschen Lizenzen für virtuelle Automatenspiele und Online

Poker. Die Präsenz dieser Angaben im Footer bestätigt, dass das Casino die strengen Regularien der deutschen Glücksspielaufsicht erfüllt und somit ein sicheres und legales Spielerlebnis bietet.

Die meisten dieser Boni bestehen aus einer Kombination von Bargeld und Freispielen, während nur wenige Casinos entweder

nur Bargeld oder nur Freispiele anbieten. In den folgenden Grafiken siehst du, wie viele deutsche Online-Casinos einen Willkommensbonus anbieten und welche Arten von Boni dabei am häufigsten vorkommen.

References:

https://online-spielhallen.de/wunderino-casino-login-ihr-tor-zu-spannenden-spielen/

Looking for a casino? https://elon-casino-top.com: slots, live casino, bonus offers, and tournaments. We cover the rules, wagering requirements, withdrawals, and account security. Please review the terms and conditions before playing.

Players earn points based on wagers and wins — the highest scorers share the prize pool.

Typical promotions include Sunday gifts, Wednesday free spins, weekly cashback and provider tournaments with sizeable prize pools.

WinSpirit keeps the experience fresh with rotating promos, provider-specific tournaments

and Drops & Wins style events that award cash and free spins.

If you have concerns about gambling behaviour, use the site tools or

contact professional support services immediately.

Keep reading to learn more details about the main offers of the platform and the nuances of receiving them!

Get a 100% bonus on your first deposit along with 100 free spins.

These bonuses will allow users to get additional benefits from gambling and increase

their initial balance. Among them, you can find Winspirit no deposit bonus Australia, Winspirit

welcome bonus, and many others. Always confirm you are on the official winspiritau.net pages before entering credentials.

References:

https://blackcoin.co/expert-guide-to-online-gambling/

References:

https://blackcoin.co/5_types-of-casino-bonuses-in-new_zealand_rewrite_1/

Нужен трафик и лиды? avigroup SEO-оптимизация, продвижение сайтов и реклама в Яндекс Директ: приводим целевой трафик и заявки. Аудит, семантика, контент, техническое SEO, настройка и ведение рекламы. Работаем на результат — рост лидов, продаж и позиций.

casino avec paypal

References:

http://pasarinko.zeroweb.kr/bbs/board.php?bo_table=notice&wr_id=8368984

online casino real money paypal

References:

https://acheemprego.com.br/employer/best-paypal-casinos-updated-2025/

Not only does RTG’s casino software cover 3, 4, 5, and 6 reel slots, but it also has unique floating symbols slots. RTG has an extensive catalog of classic, bonus, and progressive slots. Real Time Gaming provides the casino software at Ozwin Casino.

New Ozwin Casino users can take advantage of a broad welcome bonus system which improves their gameplay right from the start. Users with setup account pages can explore various games and promotional offers through OZWin Casino to make it a suitable choice for Australian gamblers. We at Ozwin Casino surprise players with a weekly random draw. Ozwin attaches lucrative bonuses to the newest pokies each month. The casino renders three free-bonus opportunities every week.

Deposit limits are usually clearly displayed during the transaction process. For those seeking alternative payment methods, Neosurf vouchers are available, typically with similar minimum deposit amounts. You can use traditional options like Visa and Mastercard, often with a minimum deposit around $20. Ozwin Casino provides a variety of options for funding your account and accessing your winnings. This type of bonus provides a cushion against losses and gives you a second chance to win.

References:

https://blackcoin.co/ufo9-casino-your-place-to-play-your-way/

online australian casino paypal

References:

https://www.jobexpertsindia.com/companies/paypal-online-casinos-updated-for-dec-2025/

paypal casinos online that accept

References:

https://jobs.kwintech.co.ke/companies/casino-sites-uk-best-new-online-casinos-december-2025/

online casino accepts paypal us

References:

https://www.busforsale.ae/profile/magaret5409475

casinos online paypal

References:

https://www.imcufideteq.gob.mx/employer/online-casinos-for-real-money-2025-best-paying-online-casinos-usa/

Equilibrado de piezas

El equilibrado es una etapa esencial en las tareas de mantenimiento de maquinaria agricola, asi como en la fabricacion de ejes, volantes, rotores y armaduras de motores electricos. El desequilibrio genera vibraciones que incrementan el desgaste de los rodamientos, generan sobrecalentamiento e incluso pueden causar la rotura de los componentes. Para evitar fallos mecanicos, resulta esencial detectar y corregir el desequilibrio a tiempo utilizando tecnicas modernas de diagnostico.

Principales metodos de equilibrado

Hay diferentes tecnicas para corregir el desequilibrio, dependiendo del tipo de pieza y la magnitud de las vibraciones:

Equilibrado dinamico – Se utiliza en componentes rotativos (rotores, ejes) y se lleva a cabo mediante maquinas equilibradoras especializadas.

Equilibrado estatico – Se emplea en volantes, ruedas y piezas similares donde basta con compensar el peso en un solo plano.

La correccion del desequilibrio – Se lleva a cabo mediante:

Perforado (eliminacion de material en la zona mas pesada),

Colocacion de contrapesos (en ruedas y aros de volantes),

Ajuste de masas de balanceo (como en el caso de los ciguenales).

Diagnostico del desequilibrio: ?que equipos se utilizan?

Para identificar con precision las vibraciones y el desequilibrio, se emplean:

Maquinas equilibradoras – Miden el nivel de vibracion y determinan con exactitud los puntos de correccion.

Analizadores de vibraciones – Registran el espectro de oscilaciones, identificando no solo el desequilibrio, sino tambien fallos adicionales (como el desgaste de rodamientos).

Sistemas de medicion laser – Se emplean para mediciones de alta precision en mecanismos criticos.

Especial atencion merecen las velocidades criticas de rotacion – condiciones en las que la vibracion se incrementa de forma significativa debido a fenomenos de resonancia. Un equilibrado correcto previene danos en el equipo bajo estas condiciones.

Visit Site – Layout is crisp, browsing is easy, and content feels trustworthy and clear.

References:

Anavar results before and after female pictures

References:

https://hedge.fachschaft.informatik.uni-kl.de/s/HILOSBLpD

References:

Casino slot machine games

References:

https://v.gd/IzcvOl

References:

Anadrol and anavar cycle before and after

References:

https://belttext57.werite.net/anavar-for-women-benefits-dosage-side-effects-and-safe-use-guide

networking made easy – Smooth navigation makes accessing key links quick and simple.

insight hub online – Ideas are easy to grasp and implement effectively.

business insights hub – Offers useful perspectives, keeping readers informed on the latest market trends.

applied business tips – Helpful guidance, concepts are easier to implement in practice.

insights you can use – Offers ideas that feel immediately applicable and relevant.

industry insight center – Helpful resources, analysis makes understanding market shifts simple.

goal flow naturally – Insightful guidance, accomplishing tasks feels smooth and achievable.

strategic inspiration – The concepts feel relevant and easy to absorb.

alliances resource center – Helpful guidance, simplifies understanding of market partnerships.

momentum released – Smooth, practical tone emphasizing the impact of letting energy move naturally.

FlexiDigitalMall – User-friendly layout ensures online shopping is fast and stress-free.

OpportunityVisionHub – Easy-to-follow and informative, long-term options are simple to recognize.

digitalecommercecenter – Smooth platform that makes purchasing products online effortless.

discover value partnerships – Informative content, partnership ideas are easy to grasp.

progression planner – Clear strategies, makes tackling projects step by step simpler.

relationshipinsights – Helpful and reliable, strategies for connecting with business peers are easy to apply.

alliances guide hub – Very useful, real market examples enhance understanding of partnerships.

forward with focus – Clear, actionable language highlighting intentional advancement.

TrustedBusinessNetwork – Provides reliable information with a clean, organized layout.

growthallianceshub – Very informative, enterprise growth partnerships are explained clearly and easy to implement.

enhance your skills – The platform feels practical and easy to navigate.

trustyshopnavigator – Provides a secure and user-friendly experience for all online shoppers.

SmartIdeasExplorer – Engaging platform, new innovations are explained in a simple way.

build professional trust – Offers practical tips, forming connections feels simple.

insightfulgrowthhub – Practical advice on growth approaches that can be applied immediately.

marketlinker – Informative and actionable, market ideas are structured clearly for immediate use.

alliances resource center – Helpful guidance, simplifies understanding of market partnerships.

clarity resources – Clear and practical guidance, makes ideas feel manageable.

ChoiceMasteryHub – Helpful strategies, simplifies evaluating options effectively.

turn plans into motion – Smooth and natural, highlighting the importance of following through on strategy.

enterprisealliancesguide – Step-by-step advice for managing corporate alliances successfully.

enterprise link insights – Helpful site, building professional relationships feels smooth.

EasyBuyOnline – Clear layout, navigating the platform is simple and fast.

skillsacademyonline – Practical learning, future-focused skill development is easy to follow and implement.

shoppingportal – Practical and user-friendly, navigating and buying online is simple.

trusted partnership insights – Well-structured examples, makes alliance strategies easier to follow.

urban deals center – Clean layout and carefully chosen items make browsing enjoyable.

mindset and focus – Excellent resource, makes it easier to stay organized and mentally sharp.

GrowthRoadmapGuide – Offers actionable strategies, making growth planning simple and effective.

focused signals – Clear, motivating phrasing, illustrating that attention guided by signals improves outcomes.

BusinessVisionCenter – Clear and helpful content, planning for long-term growth is easy to follow.

strategicfocus – Offers practical tips to align actions with long-term goals.

strategic alliance insights – Very useful content, forming alliances feels clear and achievable.

shopnavigator – Practical and easy to use, buying items is straightforward and smooth.

safeshoppingdeals – Very convenient, shopping for deals online is intuitive and secure.

trusted alliance resources – Informative content, helps relate alliances to practical business cases.

ReliableShoppingPro – Fast and dependable, checkout process feels effortless.

OutletForIdeas – Fun, creative site with clear layout, ideal for exploring concepts.

direction toolkit – Very practical advice, applying direction makes action easier and more focused.

enterprise bond hub – Comes across as polished, with clear explanations that build trust quickly.

linkstrategies – Offers insight into making meaningful connections with minimal effort.

click for meaningful lessons – Really useful lessons, makes understanding concepts easy.

shoppingportal – Very practical, the platform makes finding and purchasing items easy.

collaborationhub – Informative and practical, perfect for learning about building alliances.

strategic market alliances – Easy to apply examples, shows how alliances work in real-world business situations.

business growth platform – Promising and strategic, perfect for expanding corporate collaborations.

growth planning portal – Provides in-depth explanations for sustainable development and long-term results.

NextGenShopping – Platform is easy to use, modern aesthetic makes it enjoyable.

KnowledgePathway – Very informative, learning is simple and well-structured.

ImpactSignal – Offers steps that convert effort into meaningful outcomes efficiently.

retailproguide – Informative and practical, forward-looking retail strategies are explained simply.

corporatepartnershipportal – Feels credible and structured, suitable for strategic business alliances.

online skills guide – Tutorials are approachable, learning digital skills feels natural.

smart shopper zone – Overall impression is efficient, user-aware, and well designed.

smoothbuyplatform – Fast and intuitive, online shopping feels seamless and simple.

CostWiseShop – Highlights savings while maintaining a smooth online shopping experience.

market alliance strategies – Clear advice, helps connect theory to practical market scenarios.