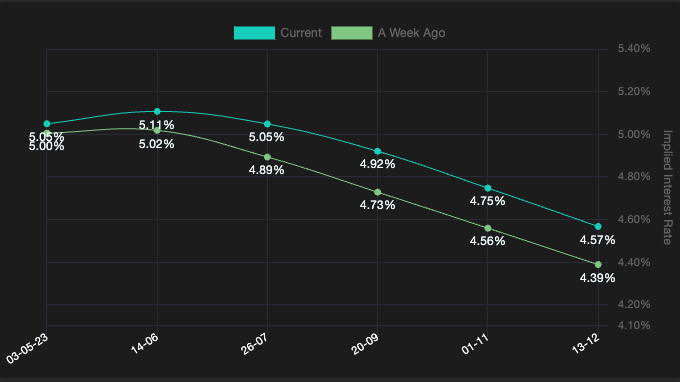

FOMC Minutes: Fed keeps options open

With all the talks and drama surrounding the US debt ceiling it is easy to lose sight of what’s going on in terms of US rates. The latest STIR market pricing has a 66% chance that the Fed will be on hold in June. Powell has recently hinted at the possibility of a June hold, … Read more