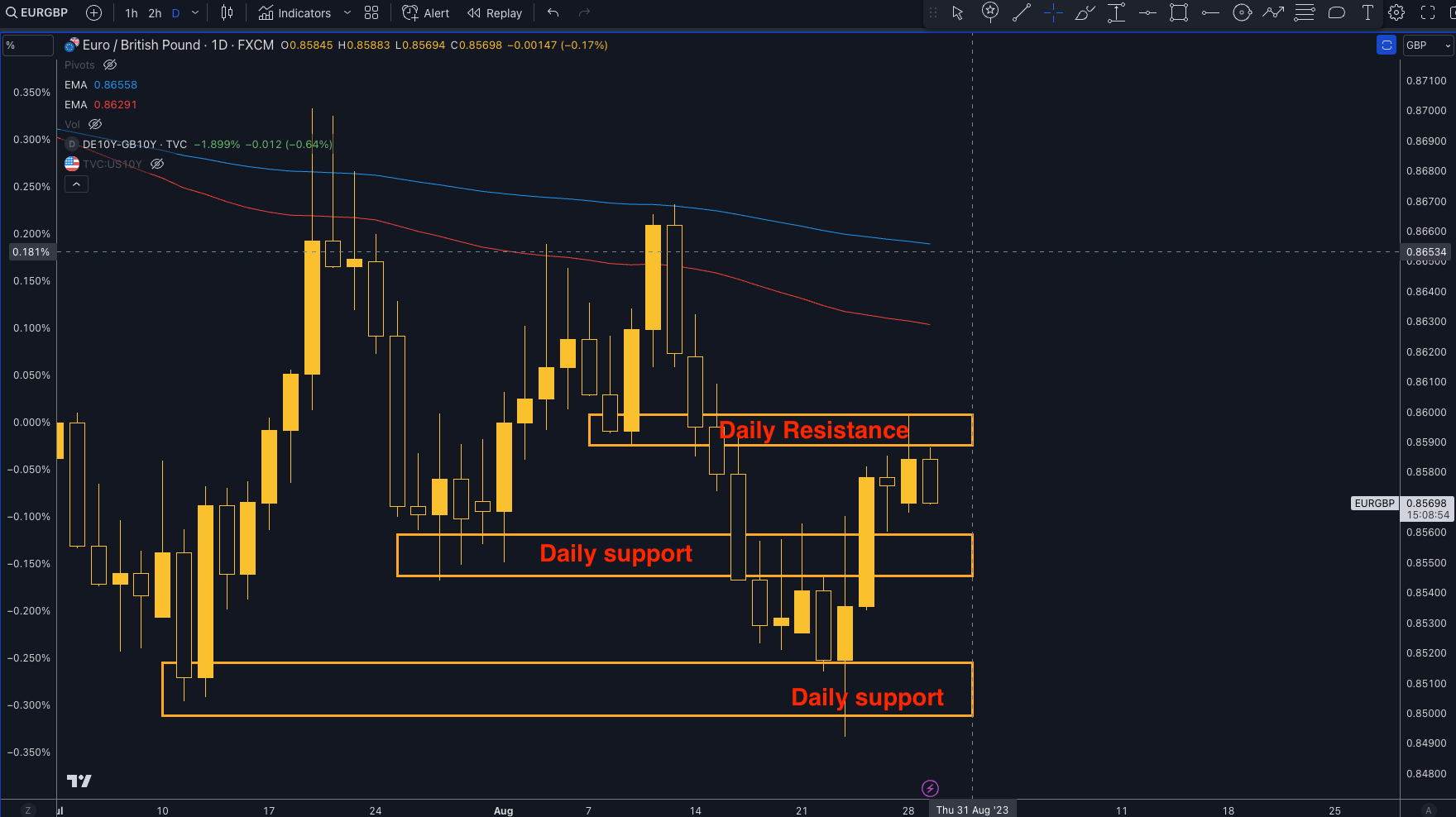

EURGBP buy bias on a strong Eurozone inflation print

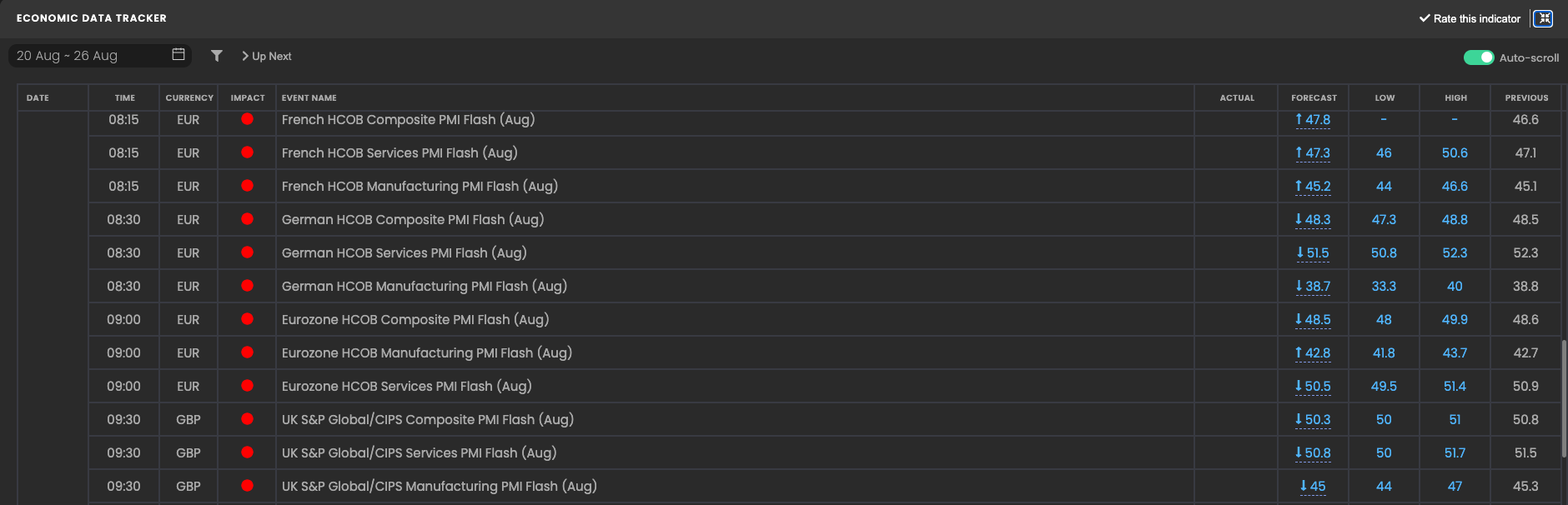

Over last weekend, at the Jackson Hall symposium, we heard from ECB’s head, Christine Lagarde, who reminded markets that the ECB remains on a meeting by meeting approach. The next significant data for the Eurozone is coming up in the form of the Flash HICP inflation readings for August, which is due out on the … Read more