On November 1 New Zealand house prices showed the first sign of strain with their first annual fall in more than 11 years. Prices fell 0.6% from the prior year and values fell for a 7th consecutive month. This is due to the affordability challenge for buyers either getting new or applying for extensions to their mortgages. According to Bloomberg, some economists are projecting a 13% fall in house prices this year with further falls in 2023 and a peak to trough slump of 18-20%. The impact of higher interest rates are being felt.

So, will this slow down the RBNZ?

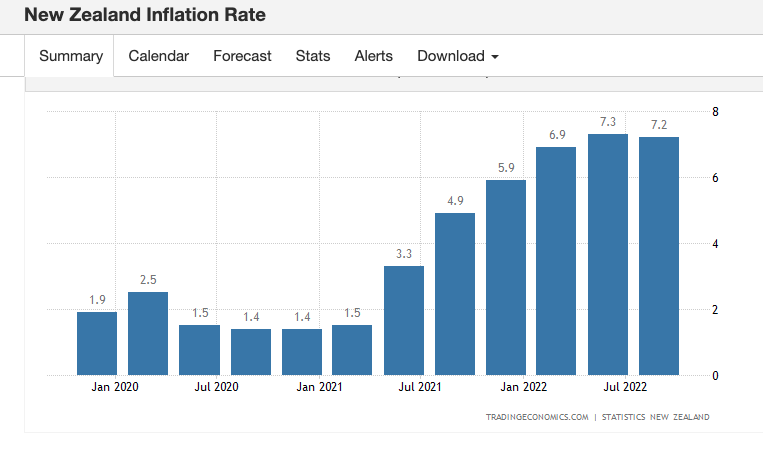

The last meeting saw an RBNZ resolute on hiking rates. The RBNZ took a definite hawkish stance as reported on here and high inflation was flagged as a concern. Headline inflation remains at 7.2% y/y .

Core inflation continues to rise with June’s print continuing the upward trend

Governor Orr stated on November 02 that the RBNZ are determined to bring inflation down to 2%. So, the RBNZ are faced with inflation that they need to reduce.

What’s expected from the RBNZ on Wednesday?

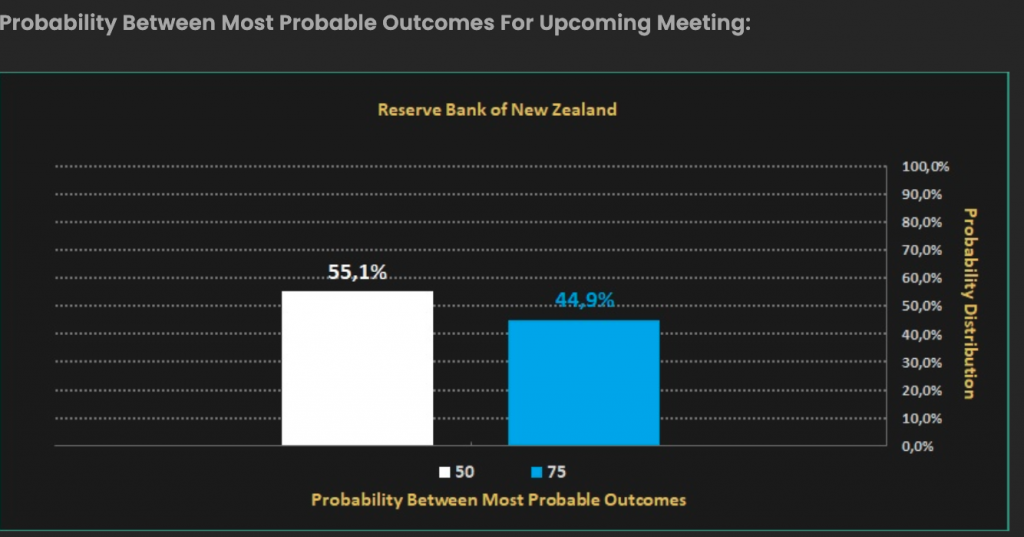

The current expectations are all follows. The majority(15/23) of economists surveyed by Reuters expect a 75 bps rate hike to 4.25%. The remaining 8 expect a 50bps rate hike. The Short Term Interest Rate markets expect (as of the end of last week) a near 50/50 split on a 75bps or 50bps rate hike. So, there are options here either way for a surprise. See here the probability options from Financial Source.

However, the best opportunity would likely come from a 50bps hike and more dovish communication that might focus on the slowing housing sector. So, it would be reasonable to expect that to weaken the NZD out of the meeting.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

amoxicillin tablets – order amoxicillin online cheap amoxicillin pills

fluconazole 200mg us – on this site purchase diflucan for sale

order lexapro 10mg pills – https://escitapro.com/ order escitalopram pill

cenforce ca – order cenforce sale cenforce 100mg over the counter

sanofi cialis – this cialis tadalafil cheapest online

how well does cialis work – https://strongtadafl.com/# ordering tadalafil online

buy viagra in dubai – https://strongvpls.com/ generic viagra 100 mg

More posts like this would force the blogosphere more useful. https://buyfastonl.com/isotretinoin.html

More posts like this would bring about the blogosphere more useful. amoxil capsulas 500 mg dosis

The thoroughness in this piece is noteworthy. https://prohnrg.com/product/get-allopurinol-pills/

More content pieces like this would urge the интернет better. https://ursxdol.com/cenforce-100-200-mg-ed/

I am in fact happy to gleam at this blog posts which consists of tons of worthwhile facts, thanks towards providing such data. https://aranitidine.com/fr/lasix_en_ligne_achat/

With thanks. Loads of expertise! https://ondactone.com/simvastatin/

Facts blog you be undergoing here.. It’s severely to assign elevated quality script like yours these days. I truly respect individuals like you! Take guardianship!!

https://proisotrepl.com/product/clopidogrel/

With thanks. Loads of conception! http://furiouslyeclectic.com/forum/member.php?action=profile&uid=24631

Новости Украины https://gromrady.org.ua в реальном времени. Экономика, политика, общество, культура, происшествия и спорт. Всё самое важное и интересное на одном портале.

delivery nyc delivery new york

салон красоты приморская https://beauty-salon-spb.ru

оценка ООО Москва оценочная компания официальный сайт

order generic dapagliflozin 10 mg – https://janozin.com/# order dapagliflozin 10mg online

cheap vps hosting vps best hosting

стул косметолога купить тумба для педикюра с уф лампой

сколько стоит куб бетона стоимость бетона

xenical online order – this orlistat online order

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article. https://www.binance.info/ur/register?ref=WTOZ531Y

Планируете ремонт https://remontkomand.kz в Алматы и боитесь скрытых платежей? Опубликовали полный и честный прайс-лист! Узнайте точные расценки на все виды работ — от демонтажа до чистовой отделки. Посчитайте стоимость своего ремонта заранее и убедитесь в нашей прозрачности. Никаких «сюрпризов» в итоговой смете!

This is the type of advise I recoup helpful. http://3ak.cn/home.php?mod=space&uid=230356

swot анализ проблемы https://swot-analiz1.ru

Looking for second-hand? second hand We have collected the best stores with clothes, shoes and accessories. Large selection, unique finds, brands at low prices. Convenient catalog and up-to-date contacts.

порно русские мамки русское порно сиськи

Want to have fun? porno bangladesh melbet Watch porn, buy heroin or ecstasy. Pick up whores or buy marijuana. Come in, we’re waiting

Новые актуальные промокод iherb для первого заказа для выгодных покупок! Скидки на витамины, БАДы, косметику и товары для здоровья. Экономьте до 30% на заказах, используйте проверенные купоны и наслаждайтесь выгодным шопингом.

сколько стоит курсовик помощь в написании курсовых

займы онлайн без процентов займы на карту онлайн мгновенно без отказа

взять онлайн займ на карту займ онлайн на карту срочно

нотариальный перевод документов бюро переводов срочно

prague plug buy weed prague

buy coke in prague plug in prague

Hello, friend!

gilescoghlanfx.com, Thanks for the time and heart you put into posting and moderating.

I recently published my ebooks and training videos on

https://www.hotelreceptionisttraining.com/

They feel like a rare find for anyone interested in hospitality management studies. These ebooks and videos have already been welcomed and found very useful by students in Russia, the USA, France, the UK, Australia, Spain, and Vietnam—helping learners and professionals strengthen their real hotel reception skills. I believe visitors and readers here might also find them practical and inspiring.

Unlike many resources that stay only on theory, this ebook and training video set is closely connected to today’s hotel business. It comes with full step-by-step training videos that guide learners through real front desk guest service situations—showing exactly how to welcome, assist, and serve hotel guests in a professional way. That’s what makes these materials special: they combine academic knowledge with real practice.

With respect to the owners of gilescoghlanfx.com who keep this platform alive, I kindly ask to share this small contribution. For readers and visitors, these skills and interview tips can truly help anyone interested in becoming a hotel receptionist prepare with confidence and secure a good job at hotels and resorts worldwide. If found suitable, I’d be grateful for it to remain here so it can reach those who need it.

Why These Ebooks and Training Videos Are Special

They uniquely combine academic pathways such as a bachelor’s degree in hospitality management or a master’s degree in hospitality management with very practical guidance on the hotel front desk job duties. They also cover the hotel front desk receptionist job description, and detailed hotel front desk tasks.

The materials go further by explaining the hotel reservation process, hotel check-in, check-out flow, guest relations, and dealing with guest complaints—covering nearly every situation that arises in the daily business of hotel reception.

Beyond theory, my ebooks and training videos connect the academic side of resort management with the real-life practice of hotel front desk duties.

– For students and readers: they bridge classroom study with career preparation, showing how hotel management certificate programs link directly to front desk skills.

– For professionals and community visitors: they support career growth through questions for receptionist, with step-by-step interview questions for receptionist with answers. There’s also guidance on writing a strong receptionist job description for resume.

As someone who has taught resort management for nearly 30 years, I rarely see materials that balance the academic foundation with the day-to-day hotel front desk job responsibilities so effectively. This training not only teaches but also simulates real hotel reception challenges—making it as close to on-the-job learning as possible, while still providing structured guidance.

I hope the owners of gilescoghlanfx.com, and the readers/visitors of gilescoghlanfx.com, will support my ebooks and training videos so more people can access the information and gain the essential skills needed to become a professional hotel receptionist in any hotel or resort worldwide.

Appreciate you and your community.

buy weed prague buy mdma prague

high quality cocaine in prague columbian cocain in prague

buy drugs in prague cocaine in prague

buy coke in prague buy weed prague

Нужна лабораторная? https://lab-ucheb.ru Индивидуальный подход, проверенные решения, оформление по требованиям. Доступные цены и быстрая помощь.

Нужен чертеж? чертежи на заказ цена выполним чертежи для студентов на заказ. Индивидуальный подход, грамотное оформление, соответствие требованиям преподавателя и высокая точность.

Нужна презентация? заказать презентацию в повер поинт Красочный дизайн, структурированный материал, уникальное оформление и быстрые сроки выполнения.

buy coke in prague vhq cocaine in prague

rasecurities These platforms showcase reliability, innovation, and genuine dedication to success.

Нужна презентация? презентация через нейросеть бесплатно Создавайте убедительные презентации за минуты. Умный генератор формирует структуру, дизайн и иллюстрации из вашего текста. Библиотека шаблонов, фирстиль, графики, экспорт PPTX/PDF, совместная работа и комментарии — всё в одном сервисе.

Проблемы с откачкой? помпа бензиновая для откачки воды сдаем в аренду мотопомпы и вакуумные установки: осушение котлованов, подвалов, септиков. Производительность до 2000 л/мин, шланги O50–100. Быстрый выезд по городу и области, помощь в подборе. Суточные тарифы, скидки на долгий срок.

Нужна презентация? нейросеть презентация онлайн Создавайте убедительные презентации за минуты. Умный генератор формирует структуру, дизайн и иллюстрации из вашего текста. Библиотека шаблонов, фирстиль, графики, экспорт PPTX/PDF, совместная работа и комментарии — всё в одном сервисе.

broodbase – Unique creativity here makes this website stand apart very clearly.

banehmagic – I felt welcomed here, everything seems smooth, professional and unique.

знаки на заказ железные значки на заказ

значки с логотипом металл изготовление металлических значков на заказ

значок на пиджак изготовление заказ значков из металла со своим дизайном москва

печать значков москва металлические значки на заказ москва

печать значков москва металлические значки

значки эмаль на заказ производство металлических значков

catherinewburton – Strong sense of style here, she presents content with real elegance.

motocitee – Very compelling presentation, the tone feels modern and trustworthy.

trendingnewsfeed – I bookmarked this, seems like a solid go-to news source now.

apkcontainer – I found exactly what I needed here faster than on many others.

goldmetalshop – The site layout is smooth, made browsing feel effortless tonight.

centensports – Navigation is clean, I found what I wanted quickly and easily.

sunnyflowercases – I appreciated seeing customer reviews, gives more confidence to buy.

adawebcreative – The site is responsive; it worked great on mobile just now.

joszaki regisztracio http://joszaki.hu

raspinakala – The color palette and fonts give a strong, cohesive aesthetic feel.

celtickitchen – Navigating between recipes is smooth, no cluttered menus here.

centensports – Articles flow well, visuals support the text in a nice way.

raspinakala – Their content feels meaningful, design touches give it a refined identity.

sunnyflowercases – Overall, cute designs, good UX, definitely worth exploring.

joszaki regisztracio joszaki.hu

joszaki regisztracio joszaki.hu/

masquepourvous – Such a unique brand name, it sticks in my memory quickly.

ucbstriketowin – I enjoy how simple but engaging the navigation feels here.

geteventclipboard – Honestly, the overall design feels modern, clean, and very professional.

dinahshorewexler – The name instantly feels personal, like it carries a real story.

brucknerbythebridge – I appreciate how everything loads quickly without any hiccups at all.

safercharging – Just found this today, and the concept feels very useful.

jonathanfinngamino – Navigation works smoothly, I didn’t run into any confusing spots.

reindeermagicandmiracles – My first impression is that this brand feels warm and genuine.

saveaustinneighborhoods – The site design feels straightforward, letting the message shine through.

libertycadillac – The name feels bold, instantly reminds me of style and class.

sjydtech – Users will trust this site, it gives a polished tech presence.

skibumart – Great mix of artistic style and user experience here.

ieeb – Just visited today, and it feels trustworthy right from the start.

nohonabe – Just found this today, and honestly the vibe feels authentic.

themacallenbuilding – The vibe here feels high-end, very sophisticated and professional overall.

dividedheartsofamericafilm – I like how the site feels serious, clear, and well presented.

casa-nana – The site loads quickly, which makes browsing pleasant.

goestotown – Honestly, the presentation feels modern, simple, and very user friendly.

eleanakonstantellos – Clean typography and soft imagery give this site a calm, polished vibe.

bigprintnewspapers – The idea feels unique and the site looks straightforward.

dietzmann – Strong identity here, every section conveys power and purpose.

brahmanshome – The design seems minimal yet it communicates everything clearly.

biotecmedics – Looks like a trustworthy resource for people looking into this field.

muralspotting – It really highlights art in such an exciting and dynamic way.

dankglassonline – The design gives off a fresh, modern, and stylish feel.

lastminute-corporate – Very efficient vibe, looks like it saves a lot of time.

reinspiregreece – Browsing was smooth, everything loads quickly and feels well-organized.

cepjournal – I like how clear the content looks, very easy to read.

pastorjorgetrujillo – The site feels calming, filled with thoughtful and meaningful content.

answermodern – Their voice comes through clearly, design supports the message well.

momoanmashop – The site feels colorful, fun, and full of positive energy.

lastminute-corporate – I like the way the content feels organized and accessible.

crownaboutnow – The overall feel is polished, brand identity is clear and strong.

biotecmedics – Overall, a positive and professional platform with useful information.

goestotown – I enjoyed the atmosphere here, feels lighthearted and entertaining.

casa-nana – Overall, it feels friendly, cozy, and very pleasant to visit.

muralspotting – Very cool concept, I could spend time exploring different pages.

pastorjorgetrujillo – The vibe is genuine, heartfelt, and encouraging throughout.

bigprintnewspapers – This feels reliable, like something people can actually depend on regularly.

reinspiregreece – The theme feels meaningful, definitely conveys hope and creativity.

momoanmashop – Browsing was smooth, everything loads quickly without any issues.

cepjournal – It feels useful, clear, and full of valuable information.

haskdhaskdjaslkds – I see images but context is missing, feels like a placeholder site.

bigprintnewspapers – I’d revisit this brand, its presentation leaves a firm impression.

geomatique237 – The domain name is unique, the site feels experimental and intriguing.

reinspiregreece – I’m impressed by the flow, pages feel connected and inviting.

cangjigedh – The design stands out instantly, it has a bold style.

ceriavpn – Easy to use interface, even beginners will feel comfortable instantly.

xxfh – The layout is simple yet effective, nothing feels overwhelming here.

yyap16 – The site feels smooth, everything loads quickly without delays today.

eljiretdulces – Everything loads fast, which makes browsing really enjoyable overall.

newbalance550 – I enjoyed scrolling, very user-friendly and visually appealing overall.

local-website – Everything looks organized and neat, makes finding info really straightforward.

flmo1xt – Great overall experience, I’d definitely return again for another visit.

t643947 – Everything about this feels neat, organized, and user-friendly overall.

alusstore – Pages load quickly, making the shopping experience smooth and enjoyable.

rwbj – Browsing here feels quick and effortless, I really enjoyed it.

x3137 – The site loads super fast, giving a smooth browsing experience.

rbncvbr – The vibe is sleek and functional, easy to spend time here.

newbirdhub – The site feels refreshing and unique, I liked exploring today.

wcbxhmsdo8nr – A very reliable platform, fast and pleasant experience today.

nnvfy – Pages load quickly without unnecessary clutter.

v1av2 – Overall a fast, functional, and pleasant site experience today.

v1av7 – Works perfectly on mobile, responsive and easy to use there.

jekflix – Overall browsing felt seamless, everything worked just as expected here.

worldloans – Works well on mobile too, responsive and easy to read.

fhkaslfjlas – Overall the site works well, pleasant and easy to navigate.

1cty – The browsing flow was smooth and comfortable, nothing confusing here.

8886611tz – Overall it’s a simple, fast, and pleasant website experience.

v1av9 – The site loaded instantly and worked without any problems today.

v1av3 – Performance stayed stable across multiple page loads.

other2.club – I stumbled on this site, seems pretty interesting and fun to browse.

196v5e63 – Everything functions properly, giving a really nice user experience.

sj256.cc – The color scheme works well, not too loud but still engaging.

yilian99 – Works perfectly fine on mobile without any scaling issues.

sj440.cc – The homepage looked sharp, got me curious to dig deeper right away.

6789138a.xyz – A few broken images here and there, hopefully they’ll be fixed.

diwangdh77 – Mobile version is responsive and works perfectly on smaller screens.

980115 – I like the simple layout, it’s easy to navigate around.

5918222q.xyz – Navigation is okay, could improve clarity on menu items.

yy380.cc – The menu is intuitive, helps me find things without confusion.

303vip.info – The page loads smoothly, didn’t experience frustrating lag.

sodo66000.xyz – The color scheme is bold but not overwhelming—nicely balanced.

sh576.xyz – Navigation feels intuitive, didn’t struggle to find pages.

9870k.top – Interesting site, the layout feels fresh and easy to explore.

51p31.xyz – A couple of images didn’t load, hope they fix those asset links.

storagesheds.store – The color palette is subtle, works well for a minimal design.

businessesnewsdaily.site – Found a few broken images in posts, hope they patch those soon.

sxy005.xyz – Overall it’s promising — I’ll revisit later to see improvements.

ylu555.xyz – The color scheme is subtle and easy on the eyes, nice touch.

weopwjrpwqkjklj.top – the color scheme is simple and doesn’t feel overwhelming, good choice overall

formasecoarquitectonicas – Would help to see an about-page with mission and team info soon.

axjaognr – Interesting domain name, makes me curious what they sell behind it.

aaront – Bookmarking this to watch how the site evolves over time.

hhproduction – I’m curious about their service pricing, hope they share more soon.

cooperativadeartesanos – The layout feels fresh though some pages seem a bit sparse presently.

fortressystemnig – The color scheme is pleasant, works well for readability.

sddapp – Navigation is light, but sometimes feels uncertain where to go next.

av07 – Hope they add blog/news or updates to keep things lively.

A reliable partner https://terionbot.com in the world of investment. Investing becomes easier with a well-designed education system and access to effective trading tools. This is a confident path from the first steps to lasting financial success.

studydiary – I like how the content is laid out, easy to skim through.

22ee.top – Could grow into something nice if they maintain consistency.

sexscene.info/ Thanks for content

zkjcnm.top – Interesting domain name, I wonder what content will show up.

ipali.info – Site loads okay, maybe still in development or maintenance mode.

lapotranca.store – I like the domain, it’s catchy and fairly easy to remember.

camomh.site – I like the minimal style, looks like a clean design approach.

datacaller.store – Looks like a promising domain, hope they launch useful services soon.

niubi1.xyz – Navigation seems basic, but that’s good for clarity.

90dprr.top – The layout is simple yet effective — not overwhelming.

kaixin2020.live – Overall impression is positive, I’ll visit again for new content.

av07.cc – The tone is casual and friendly, which makes reading relaxing.

675kk.top – The tone feels casual and approachable, I’m liking it so far.

2021nikemenshoes.top – Seeing good reviews on the site itself, seems legit so far.

warmm1.cc – I’ll revisit often — there’s promise in what I saw.

20b7f9xg.xyz – The tone is casual yet informative, makes reading enjoyable.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

seostream – The content is diverse and engaging.

htechwebservice – I will definitely return to check new content regularly.

683tz084 – Great resource for those interested in niche subjects.

seoelitepro – I found the articles here to be quite informative.

fcalegacy – I find the resources extremely helpful and well organized.

h7721 – I found this site informative and quite useful overall.

bslthemes – I enjoy the fresh perspective this site offers.

bongda247 – The layout is clean and easy to navigate.

basingstoketransition – Informative articles and initiatives, great resource for locals.

newstoday – Layout is clean, images and text balanced nicely throughout.

live-sex-cam – Really interesting platform, love how everything loads fast and smooth.

saltburn – Bookmarking it to revisit—curious what the full version could look like.

liveforextrading – Great resource, charts are clear and the tools feel well made.

googlerankmaster – Hope to see great content here, design certainly helps.

crowltheselinks – This site name is unusual, makes me curious what’s behind it.

shineonx – Just discovered this, hoping to find interesting content ahead.

manchunyuan8 – Images load well, and overall experience is pleasant so far.

capsaqiu – Found some placeholders, seems work in progress—but promising.

Seo аудит сайта онлайн бесплатно https://seo-audit-sajta.ru

Need TRON Energy? rent tron energy instantly and save on TRX transaction fees. Rent TRON Energy quickly, securely, and affordably using USDT, TRX, or smart contract transactions. No hidden fees—maximize the efficiency of your blockchain.

nowmining – Smooth interface and clear info, exactly what I was searching.

bbc2y – The load times were okay, though some parts seemed bare.

ouyicn – The domain seems tied to affiliate or campaign links rather than rich content.

Need porn videos or photos? create ai porn online – create erotic content based on text descriptions. Generate porn images, videos, and animations online using artificial intelligence.

IPTV форум http://vip-tv.org.ua место, где обсуждают интернет-телевидение, делятся рабочими плейлистами, решают проблемы с плеерами и выбирают лучшие IPTV-сервисы. Присоединяйтесь к сообществу интернет-ТВ!

wexfordliteraryartsfestival – It’s refreshing to see innovation in the art world like this.

whollywoodhalloween – My friends and I loved the decoration tips from your blog.

ukrainianvictoryisthebestaward – Might attract attention globally, especially with strong storytelling.

716selfiebuffalo – Great value for the price; unlimited time to snap pics.

dayofthedeadatx – This could really streamline the process of art authentication.

everymaskcounts – Just checked this out, the site is clean and message really resonant.

Всё о металлообработке j-metall.ru и металлах: технологии, оборудование, сплавы и производство. Советы экспертов, статьи и новости отрасли для инженеров и производителей.

You can shelter yourself and your ancestors by being cautious when buying medicine online. Some pharmaceutics websites function legally and put forward convenience, privacy, cost savings and safeguards as a replacement for purchasing medicines. buy in TerbinaPharmacy https://terbinafines.com/product/keppra.html keppra

Есть металлолом? прием чермета мы предлагаем полный цикл услуг по приему металлолома в Санкт-Петербурге, включая оперативную транспортировку материалов непосредственно на перерабатывающий завод. Особое внимание мы уделяем удобству наших клиентов. Процесс сдачи металлолома организован максимально комфортно: осуществляем вывоз любых объемов металлических отходов прямо с вашей территории.

Хочешь сдать металл? скупка металлолома наша компания специализируется на профессиональном приёме металлолома уже на протяжении многих лет. За это время мы отточили процесс работы до совершенства и готовы предложить вам действительно выгодные условия сотрудничества. Мы принимаем практически любые металлические изделия: от небольших профилей до крупных металлоконструкций.

Путешествуйте по Крыму https://м-драйв.рф на джипах! Ай-Петри, Ялта и другие живописные маршруты. Безопасно, интересно и с профессиональными водителями. Настоящий отдых с приключением!

The thoroughness in this draft is noteworthy. TerbinaPharmacy

Нужна карта? карта Visa без комиссии ATM за границей как оформить зарубежную банковскую карту Visa или MasterCard для россиян в 2025 году. Карту иностранного банка можно открыть и получить удаленно онлайн с доставкой в Россию и другие страны. Зарубежные карты Visa и MasterCard подходят для оплаты за границей. Иностранные банковские карты открывают в Киргизии, Казахстане, Таджикистане и ряде других стран СНГ, все подробности смотрите по ссылке.

Портал о стройке https://mr.org.ua всё о строительстве, ремонте и дизайне. Статьи, советы экспертов, современные технологии и обзоры материалов. Полезная информация для мастеров, инженеров и владельцев домов.

Строительный портал https://repair-house.kiev.ua всё о строительстве, ремонте и архитектуре. Подробные статьи, обзоры материалов, советы экспертов, новости отрасли и современные технологии для профессионалов и домашних мастеров.

Металлообработка и металлы j-metall.ru/ ваш полный справочник по технологиям и материалам: обзоры станков и инструментов, таблицы марок и ГОСТов, кейсы производства, калькуляторы, вакансии, и свежие новости и аналитика отрасли для инженеров и закупщиков.

Строительный портал https://intellectronics.com.ua источник актуальной информации о строительстве, ремонте и архитектуре. Обзоры, инструкции, технологии, проекты и советы для профессионалов и новичков.

Актуальный портал https://sinergibumn.com о стройке и ремонте. Современные технологии, материалы, решения для дома и бизнеса. Полезные статьи, инструкции и рекомендации экспертов.

Онлайн женский портал https://replyua.net.ua секреты красоты, стиль, любовь, карьера и семья. Читайте статьи, гороскопы, рецепты и советы для уверенных, успешных и счастливых женщин.

Современный женский https://novaya.com.ua портал о жизни, моде и гармонии. Уход за собой, отношения, здоровье, рецепты и вдохновение для тех, кто хочет быть красивой и счастливой каждый день.

Женский портал https://prins.kiev.ua всё о красоте, моде, отношениях, здоровье и саморазвитии. Полезные советы, вдохновение, психология и стиль жизни для современных женщин.

Интересный женский https://muz-hoz.com.ua портал о моде, психологии, любви и красоте. Полезные статьи, тренды, рецепты и лайфхаки. Живи ярко, будь собой и вдохновляйся каждый день!

Женский портал https://z-b-r.org ваш источник идей и вдохновения. Советы по красоте, стилю, отношениям, карьере и дому. Всё, что важно знать современной женщине.

Онлайн авто портал https://retell.info всё для автолюбителей! Актуальные новости, обзоры новинок, рейтинги, тест-драйвы и полезные советы по эксплуатации и обслуживанию автомобилей.

Автомобильный портал https://autoguide.kyiv.ua для водителей и поклонников авто. Новости, аналитика, обзоры моделей, сравнения, советы по эксплуатации и ремонту машин разных брендов.

Авто портал https://psncodegeneratormiu.org мир машин в одном месте. Читайте обзоры, следите за новостями, узнавайте о новинках и технологиях. Полезный ресурс для автолюбителей и экспертов.

Авто портал https://bestsport.com.ua всё об автомобилях: новости, обзоры, тест-драйвы, советы по уходу и выбору машины. Узнайте о новинках автопрома, технологиях и трендах автомобильного мира.

Современный авто портал https://necin.com.ua мир автомобилей в одном месте. Тест-драйвы, сравнения, новости автопрома и советы экспертов. Будь в курсе последних тенденций автоиндустрии

dreamgrid.click – Typography okay but spacing between sections feels tight, a bit cramped.

Портал про стройку https://dcsms.uzhgorod.ua всё о строительстве, ремонте и дизайне. Полезные советы, статьи, технологии, материалы и оборудование. Узнайте о современных решениях для дома и бизнеса.

Портал про стройку https://keravin.com.ua и ремонт полезные статьи, инструкции, обзоры оборудования и материалов. Всё о строительстве домов, дизайне и инженерных решениях

Строительный портал https://msc.com.ua о ремонте, дизайне и технологиях. Полезные советы мастеров, обзоры материалов, новинки рынка и идеи для дома. Всё о стройке — от фундамента до отделки. Учись, строй и вдохновляйся вместе с нами!

Онлайн-портал про стройку https://donbass.org.ua и ремонт. Новости, проекты, инструкции, обзоры материалов и технологий. Всё, что нужно знать о современном строительстве и архитектуре.

Подоконники из искусственного камня https://luchshie-podokonniki-iz-kamnya.ru в Москве. Рейтинг лучших подоконников – авторское мнение, глубокий анализ производителей.

Советы по строительству https://vodocar.com.ua и ремонту своими руками. Пошаговые инструкции, современные технологии, идеи для дома и участка. Мы поможем сделать ремонт проще, а строительство — надёжнее!

Сайт о строительстве https://valkbolos.com и ремонте домов, квартир и дач. Полезные советы мастеров, подбор материалов, дизайн-идеи, инструкции и обзоры инструментов. Всё, что нужно для качественного ремонта и современного строительства!

Строительный сайт https://teplo.zt.ua для тех, кто создаёт дом своей мечты. Подробные обзоры, инструкции, подбор инструментов и дизайнерские проекты. Всё о ремонте и строительстве в одном месте.

Полезный сайт https://stroy-portal.kyiv.ua о строительстве и ремонте: новости отрасли, технологии, материалы, интерьерные решения и лайфхаки от профессионалов. Всё для тех, кто строит, ремонтирует и создаёт уют.

Информационный портал https://smallbusiness.dp.ua про строительство, ремонт и интерьер. Свежие новости отрасли, обзоры технологий и полезные лайфхаки. Всё, что нужно знать о стройке и благоустройстве жилья в одном месте!

Энциклопедия строительства https://kero.com.ua и ремонта: материалы, технологии, интерьерные решения и практические рекомендации. От фундамента до декора — всё, что нужно знать домовладельцу.

Строим и ремонтируем https://buildingtips.kyiv.ua своими руками! Инструкции, советы, видеоуроки и лайфхаки для дома и дачи. Узнай, как сделать ремонт качественно и сэкономить бюджет.

Новостной портал https://kiev-online.com.ua с проверенной информацией. Свежие события, аналитика, репортажи и интервью. Узнавайте новости первыми — достоверно, быстро и без лишнего шума.

Пошаговые советы https://tsentralnyi.volyn.ua по строительству и ремонту. Узнай, как выбрать материалы, рассчитать бюджет и избежать ошибок. Простые решения для сложных задач — строим и ремонтируем с уверенностью!

Главные новости дня https://sevsovet.com.ua эксклюзивные материалы, горячие темы и аналитика. Мы рассказываем то, что действительно важно. Будь в курсе вместе с нашим новостным порталом!

Строительный портал https://sitetime.kiev.ua для мастеров и подрядчиков. Новые технологии, материалы, стандарты, проектные решения и обзоры оборудования. Всё, что нужно специалистам стройиндустрии.

Строим и ремонтируем https://srk.kiev.ua грамотно! Инструкции, пошаговые советы, видеоуроки и экспертные рекомендации. Узнай, как сделать ремонт качественно и сэкономить без потери результата.

Сайт о стройке https://samozahist.org.ua и ремонте для всех, кто любит уют и порядок. Расскажем, как выбрать материалы, обновить интерьер и избежать ошибок при ремонте. Всё просто, полезно и по делу.

Как построить https://rus3edin.org.ua и отремонтировать своими руками? Пошаговые инструкции, простые советы и подбор инструментов. Делаем ремонт доступным и понятным для каждого!

Обустраивайте дом https://stroysam.kyiv.ua со вкусом! Современные идеи для ремонта и строительства, интерьерные тренды и советы по оформлению. Создайте стильное и уютное пространство своими руками.

Сайт для женщин https://oun-upa.org.ua которые ценят себя и жизнь. Мода, советы по уходу, любовь, семья, вдохновение и развитие. Найди идеи для новых свершений и будь самой собой в мире, где важно быть уникальной!

Портал для автомобилистов https://translit.com.ua от выбора машины до профессионального ремонта. Читайте обзоры авто, новости автоспорта, сравнивайте цены и характеристики. Форум автолюбителей, советы экспертов и свежие предложения автосалонов.

Мужской онлайн-журнал https://cruiser.com.ua о современных трендах, технологиях и саморазвитии. Мы пишем о том, что важно мужчине — от мотивации и здоровья до отдыха и финансов.

Ваш гид в мире https://nerjalivingspace.com автомобилей! Ежедневные авто новости, рейтинги, тест-драйвы и советы по эксплуатации. Найдите идеальный автомобиль, узнайте о страховании, кредитах и тюнинге.

Мужской сайт https://rkas.org.ua о жизни без компромиссов: спорт, путешествия, техника, карьера и отношения. Для тех, кто ценит свободу, силу и уверенность в себе.

Портал о дизайне https://sculptureproject.org.ua интерьеров и пространства. Идеи, тренды, проекты и вдохновение для дома, офиса и общественных мест. Советы дизайнеров и примеры стильных решений каждый день.

Строительный сайт https://okna-k.com.ua для профессионалов и новичков. Новости отрасли, обзоры материалов, технологии строительства и ремонта, советы мастеров и пошаговые инструкции для качественного результата.

Главный автопортал страны https://nmiu.org.ua всё об автомобилях в одном месте! Новости, обзоры, советы, автообъявления, страхование, ТО и сервис. Для водителей, механиков и просто любителей машин.

Сайт о металлах https://metalprotection.com.ua и металлообработке: виды металлов, сплавы, технологии обработки, оборудование и новости отрасли. Всё для специалистов и профессионалов металлургии.

Женский онлайн-журнал https://rosetti.com.ua о стиле, здоровье и семье. Новости моды, советы экспертов, тренды красоты и секреты счастья. Всё, что важно и интересно женщинам любого возраста.

This is the amicable of glad I take advantage of reading.

Студия ремонта https://anti-orange.com.ua квартир и домов. Выполняем ремонт под ключ, дизайн-проекты, отделочные и инженерные работы. Качество, сроки и индивидуальный подход к каждому клиенту.

Туристический портал https://feokurort.com.ua для любителей путешествий! Страны, маршруты, достопримечательности, советы и лайфхаки. Планируйте отдых, находите вдохновение и открывайте мир вместе с нами.

Студия дизайна https://bathen.rv.ua интерьеров и архитектурных решений. Создаём стильные, функциональные и гармоничные пространства. Индивидуальный подход, авторские проекты и внимание к деталям.

Ремонт и строительство https://fmsu.org.ua без лишних сложностей! Подробные статьи, обзоры инструментов, лайфхаки и практические советы. Мы поможем построить, отремонтировать и обустроить ваш дом.

foot africain football africain

parier foot en ligne pronostics du foot

parier foot en ligne telecharger 1xbet apk

pronostic foot gratuit info foot africain

football africain info foot africain

telecharger 1xbet apk 1xbet cameroun apk

Современная студия дизайна https://bconline.com.ua архитектура, интерьер, декор. Мы создаём пространства, где технологии сочетаются с красотой, а стиль — с удобством.

info foot africain parier foot en ligne

parier foot en ligne afrik foot pronostic

Создавайте дом https://it-cifra.com.ua своей мечты! Всё о строительстве, ремонте и дизайне интерьера. Идеи, проекты, фото и инструкции — вдохновляйтесь и воплощайте задуманное легко и с удовольствием.

parier foot en ligne foot africain

Мир архитектуры https://vineyardartdecor.com и дизайна в одном месте! Лучшие идеи, проекты и вдохновение для дома, офиса и города. Узнай, как создаются красивые и функциональные пространства.

Частный заем денег домашние деньги онлайн займ альтернатива банковскому кредиту. Быстро, безопасно и без бюрократии. Получите нужную сумму наличными или на карту за считанные минуты.

Все спортивные новости http://sportsat.ru в реальном времени. Итоги матчей, трансферы, рейтинги и обзоры. Следите за событиями мирового спорта и оставайтесь в курсе побед и рекордов!

Suchen Sie Immobilien? https://www.montenegro-immobilien-kaufen.com/ wohnungen, Villen und Grundstucke mit Meerblick. Aktuelle Preise, Fotos, Auswahlhilfe und umfassende Transaktionsunterstutzung.

новый фитнес клуб женский фитнес клуб в москве

фитнес клуб москва цены занятия в фитнес клубе

Заказ автобуса по городу https://povozkin.ru

фитнес клуб тренировка стоимость фитнес клуба

Нужна недвижимость? https://www.nedvizhimost-chernogorii-u-morya.ru/ лучшие объекты для жизни и инвестиций. Виллы, квартиры и дома у моря. Помощь в подборе, оформлении и сопровождении сделки на всех этапах.

Аутстаффинг персонала https://skillstaff2.ru для бизнеса: легальное оформление сотрудников, снижение налоговой нагрузки и оптимизация расходов. Работаем с компаниями любого масштаба и отрасли.

Строительный портал https://v-stroit.ru всё о строительстве, ремонте и архитектуре. Полезные советы, технологии, материалы, новости отрасли и практические инструкции для мастеров и новичков.

Риэлторская контора https://daber27.ru покупка, продажа и аренда недвижимости. Помогаем оформить сделки безопасно и выгодно. Опытные риэлторы, консультации, сопровождение и проверка документов.

Купольные дома https://kupol-doma.ru под ключ — энергоэффективные, надёжные и современные. Проектирование, строительство и отделка. Уникальная архитектура, комфорт и долговечность в каждом доме.

Информационный блог https://gidroekoproekt.ru для инженеров и проектировщиков. Всё об инженерных изысканиях, водохозяйственных объектах, гидротехническом строительстве и современных технологиях в отрасли.

Ваша Недвижимость https://rbn-khv.ru сайт о покупке, продаже и аренде жилья. Разбираем сделки, налоги, ипотеку и инвестиции. Полезная информация для владельцев и покупателей недвижимости.

Деревянные лестницы https://rosslestnica.ru под заказ в любом стиле. Прямые, винтовые, маршевые конструкции из массива. Замеры, 3D-проект, доставка и установка. Гарантия качества и точности исполнения.

Лестницы в Москве https://лестницы-в-москве.рф продажа и изготовление под заказ. Прямые, винтовые, модульные и чердачные конструкции. Качество, гарантия и монтаж по всем стандартам.

Long-term squad planning becomes achievable when you buy fifa coins from trusted sources offering seasonal discount programs. Fast delivery with real account verification and active support plus non drop warranties enable strategic multi-month investments.

Курсы подготовки ЕГЭ 11 класс https://courses-ege.ru

Новости спорта онлайн http://sportsat.ru футбол, хоккей, бокс, теннис, баскетбол и другие виды спорта. Результаты матчей, обзоры, интервью, аналитика и главные события дня в мире спорта.

Онлайн школы курсы ЕГЭ https://courses-ege.ru

pariez sur le foot telecharger 1xbet apk

Все о коттеджных посёлках https://cottagecommunity.ru/sosnovka/ фото, описание, стоимость участков и домов. Всё о покупке, строительстве и жизни за городом в одном месте. Полезная информация для покупателей и инвесторов.

melbet – paris sportif africain foot

chery комплектации chery tiggo 4

Полезное одним кликом: https://1newss.com/obshhestvo/bejdzhi-dlya-meropriyatij-i-ofisa-vidy-dizajn-i-sposoby-krepleniya.html

All the details at the link: https://diuwinngame.org/akkaunty-dlja-facebook-kupit-po-nizkoj-cene-v-2/

Plateforme parifoot rdc : pronos fiables, comparateur de cotes multi-books, tendances du marche, cash-out, statistiques avancees. Depots via M-Pesa/Airtel Money, support francophone, retraits securises. Pariez avec moderation.

Paris sportifs avec 1xbet rdc apk : pre-match & live, statistiques, cash-out, builder de paris. Bonus d’inscription, programme fidelite, appli mobile. Depots via M-Pesa/Airtel Money. Informez-vous sur la reglementation. 18+, jouez avec moderation.

Оформите онлайн-займ https://zaimy-65.ru без визита в офис: достаточно паспорта, проверка за минуты. Выдача на карту, кошелёк или счёт. Прозрачный договор, напоминания о платеже, безопасность данных, акции для новых клиентов. Сравните предложения и выберите выгодно.

Узнать больше здесь: https://fotoredaktor.top

Оформите займ https://zaimy-71.ru онлайн без визита в офис — быстро, безопасно и официально. Деньги на карту за несколько минут, круглосуточная обработка заявок, честные условия и поддержка клиентов 24/7.

Оформите займ https://zaimy-65.ru онлайн без визита в офис — быстро, безопасно и официально. Деньги на карту за несколько минут, круглосуточная обработка заявок, честные условия и поддержка клиентов 24/7.

Hi!

gilescoghlanfx.com, Thanks for keeping a thoughtful corner of the internet alive.

I recently published my ebooks and training videos on

https://www.hotelreceptionisttraining.com/

They feel like a hidden gem for anyone interested in hospitality management studies. These ebooks and videos have already been welcomed and found very useful by students in Russia, the USA, France, the UK, Australia, Spain, and Vietnam—helping learners and professionals strengthen their real hotel reception skills. I believe visitors and readers here might also find them practical and inspiring.

Unlike many resources that stay only on theory, this ebook and training video set is closely connected to today’s hotel business. It comes with full step-by-step training videos that guide learners through real front desk guest service situations—showing exactly how to welcome, assist, and serve hotel guests in a professional way. That’s what makes these materials special: they combine academic knowledge with real practice.

With respect to the owners of gilescoghlanfx.com who keep this platform alive, I kindly ask to share this small contribution. For readers and visitors, these skills and interview tips can truly help anyone interested in becoming a hotel receptionist prepare with confidence and secure a good job at hotels and resorts worldwide. If found suitable, I’d be grateful for it to remain here so it can reach those who need it.

Why These Ebooks and Training Videos Are Special

They uniquely combine academic pathways such as a bachelor’s degree in hospitality management or a advanced hotel management course with very practical guidance on the duties of a front desk agent. They also cover the hotel front desk receptionist job description, and detailed hotel front desk tasks.

The materials go further by explaining the hotel reservation process, check-in and check-out procedures, guest service handling, and practical guest service recovery—covering nearly every situation that arises in the daily business of a front office operation.

Beyond theory, my ebooks and training videos connect the academic side of hospitality management studies with the real-life practice of hotel front desk duties and responsibilities.

– For students and readers: they bridge classroom study with career preparation, showing how hotel management certificate programs link directly to front desk skills.

– For professionals and community visitors: they support career growth through interview tips for receptionist, with step-by-step questions to ask a receptionist in an interview. There’s also guidance on writing a strong receptionist description for resume.

As someone who has taught hospitality management programs for nearly 30 years, I rarely see materials that balance the academic foundation with the day-to-day job description of front desk receptionist in hotel so effectively. This training not only teaches but also simulates real hotel reception challenges—making it as close to on-the-job learning as possible, while still providing structured guidance.

I hope the owners of gilescoghlanfx.com, and the readers/visitors of gilescoghlanfx.com, will support my ebooks and training videos so more people can access the information and gain the essential skills needed to become a professional hotel receptionist in any hotel or resort worldwide.

Appreciate you and your community.

Найцікавіше: https://vechorka.com.ua/dity.html

Дивитись подробиці: https://press-express.com.ua/tekhnolohii.html

Официальный сайт Kraken https://kra44-cc.at безопасная платформа для анонимных операций в darknet. Полный доступ к рынку через актуальные зеркала и onion ссылки.

Официальный сайт Kraken kra44 at безопасная платформа для анонимных операций в darknet. Полный доступ к рынку через актуальные зеркала и onion ссылки.

У нас быстро – онлайн перевод документов на английский. Самарское бюро переводов. Документы, нотариус, срочно! Любые языки. Качество проверенное. Гарантия принятия.

Проверенные переводчики документов – нотариальный перевод документов со самара. Бюро переводов в Самаре. Документы, нотариальное заверение. Срочно и недорого. Гарантия качества. Опыт 10 лет.

дизайн проект интерьера студия дизайна интерьеров отзывы

дизайн интерьера спб недорого дизайн интерьера 3d

The best is right here: https://devinttusr.yomoblog.com/45537152/nppr-team-shop-the-ultimate-hub-for-social-media-marketing-mastery

Skip to details: https://vseuznaete.ru/2025/10/27/%d0%90%d0%b2%d1%82%d0%be%d1%80%d0%b5%d0%b3%d0%b8-%d0%a4%d0%b5%d0%b9%d1%81%d0%b1%d1%83%d0%ba-%d0%bf%d0%be-%d0%bd%d0%b8%d0%b7%d0%ba%d0%be%d0%b9-%d1%86%d0%b5%d0%bd%d0%b5/

brandelevate.click – Overall, professional vibe here; trustworthy, polished, and pleasantly minimal throughout.

brandelevate.click – Bookmarked this immediately, planning to revisit for updates and inspiration.

ігрові слоти онлайн слоти

ігри казино ігри казино онлайн

aplikacja mostbet aplikacja mostbet

Этот информативный материал предлагает содержательную информацию по множеству задач и вопросов. Мы призываем вас исследовать различные идеи и факты, обобщая их для более глубокого понимания. Наша цель — сделать обучение доступным и увлекательным.

Изучить вопрос глубже – https://vivod-iz-zapoya-1.ru/

новости беларуси свежие новости беларуси свежие

Стабильный kraken tor браузер позволяет работать с площадкой полностью анонимно благодаря многоуровневой маршрутизации трафика через распределенные узлы сети.

Полная статья здесь: https://medim-pro.ru/kupit-spravku-ot-pediatra/

Free video chat http://www.emerald-chat.app find people from all over the world in seconds. Anonymous, no registration or SMS required. A convenient alternative to Omegle: minimal settings, maximum live communication right in your browser, at home or on the go, without unnecessary ads.

New in the Category: https://digitalmarketingsalarytex89888.ja-blog.com/38786413/nppr-team-shop-the-ultimate-hub-for-social-media-marketing-mastery

Анонимная экосистема kraken даркнет функционирует с 2020 года без единого exit scam демонстрируя стабильность инфраструктуры и надежность технической реализации платформы.

Нужна работа в США? обучение диспетчера в америке по всему миру для начинающих : работа с заявками и рейсами, переговоры на английском, тайм-менеджмент и сервис. Подходит новичкам и тем, кто хочет выйти на рынок труда США и зарабатывать в долларах.

Uwielbiasz hazard? nv casino: rzetelne oceny kasyn, weryfikacja licencji oraz wybor bonusow i promocji dla nowych i powracajacych graczy. Szczegolowe recenzje, porownanie warunkow i rekomendacje dotyczace odpowiedzialnej gry.

More details One click: https://onyxtherapy.in/a-b-testing-made-easy-why-we-buy-facebook-fan-pages-for-every-new-client/

Telecharger 1xbet telecharger 1xbet pour android

1xbet Live telecharger 1xbet pour android

Machines a sous 1xbet 1xbet rdc telecharger

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

нужна заклепка? заклепка вытяжная из нержавеющей стали надёжный крепёж для прочных и долговечных соединений. Устойчива к коррозии, влаге и перепадам температур. Подходит для металла, строительства, машиностроения и наружных работ.

Проблемы с алкоголем? вызвать нарколога на дом анонимно Томск выезд врача-нарколога на дом и приём в клинике 24/7 (Томск и область) без ожидания. Осмотр, детоксикация, капельница, контроль давления и самочувствия. Анонимно, бережно, с рекомендациями на восстановление и поддержкой семьи.

Хочешь просить пить? нарколог на дом быстрое прибытие, медицинский осмотр, капельница для снятия интоксикации, контроль пульса и давления. Анонимная помощь взрослым, внимательное отношение, поддержка после процедуры и советы, как избежать срыва.

Есть зависимости? откапать от алкоголя Томск вывод из запоя и детоксикация под наблюдением врача. Приём и выезд на дом 24/7, индивидуальный подбор препаратов, контроль самочувствия, конфиденциальность. Помогаем стабилизировать состояние и организовать дальнейшее лечение.

Нужен юрист? услуги адвоката разберём ситуацию, оценим риски и предложим стратегию. Составим иск, претензию, договор, жалобу, защитим в суде. Для граждан и компаний. Первичная консультация онлайн/по телефону. Прозрачные условия.

Проблемы в авто? услуги автоэлектрика с выездом диагностика на месте, запуск двигателя, поиск короткого замыкания, ремонт проводки, замена предохранителей и реле, настройка сигнализации. Приедем быстро по городу и области. Честная цена, гарантия, без лишних работ.

Производственная компания отгружает https://www.sportprof.su/ по адекватным ценам в рассрочку. Перечень включает неразборные гантели, разминочные блины, велотренажеры. В продаже профессиональные силовые тренажеры и запчасти для реализации спортивных целей. Оформляйте с доставкой станок Смита, вертикальную тягу, парту Скотта, тренажер для плечей, станок Гаккеншмидта, наклонную скамью, римский стул для спины, а также сопутствующие снаряды.

Стоматология в Калуге https://albakaluga.ru Альбадент — имплантация и протезирование зубов с гарантией эстетики. Виниры, костная пластика и реставрация улыбки по индивидуальному плану лечения.

Show More: https://kenkyuukai.jp/event/event_detail_society.asp?id=52212&ref=calendar&rurl=https://minimalsudoku.com/

Центр охраны труда https://www.unitalm.ru “Юнитал-М” проводит обучение по охране труда более чем по 350-ти программам, в том числе по электробезопасности и пожарной безопасности. А также оказывает услуги освидетельствования и испытаний оборудования и аутсорсинга охраны труда.

Нужны заклепки? заклепки вытяжные нержавеющие 4х8 для прочного соединения листового металла и профиля. Стойкость к коррозии, аккуратная головка, надежная фиксация даже при вибрациях. Подбор размеров и типа борта, быстрая отгрузка и доставка.

Нужен эвакуатор? эвакуатор вызову цена быстрый выезд по Санкт-Петербургу и области. Аккуратно погрузим легковое авто, кроссовер, мотоцикл. Перевозка после ДТП и поломок, помощь с запуском/колесом. Прозрачная цена, без навязываний.

Расширенный обзор: Куда сдать фотоаппарат Minox быстро — официальная скупка в Москве

Geben Sie eine gültige E-Mail-Adresse ein und wählen Sie ein sicheres Passwort aus. Um einen Account bei BassBet Casino zu erstellen, klicken Sie einfach auf den Button “Registrieren” und folgen Sie den Anweisungen. Na dann los geht’s – dein großartiger Willkommensbonus wartet auf dich!

Die Plattform kombiniert klassische Casinoboni mit modernen Promotion-Formaten, die regelmäßig aktualisiert werden und an saisonale Ereignisse oder besondere Spielreihen angepasst sind. BassBet bietet deutschen Spielern ein abwechslungsreiches und vorteilhaftes Bonusprogramm, das sowohl neue Nutzer als auch treue Stammkunden anspricht. Sie bieten mehr Tiefe und Strategie, da du nicht nur auf das Endergebnis, sondern auf spezifische Faktoren eines Spiels setzt. Live-Wetten sind besonders beliebt bei Fußball und Tennis, wo sich das Geschehen schnell ändern kann. Diese Wettform bietet viele spontane Optionen und ermöglicht es, direkt auf Spielverlauf, Momentum und taktische Änderungen zu reagieren. Jede Wettform bietet eigene Vorteile, unterschiedliche Risikostufen und individuelle Gewinnchancen.

References:

https://online-spielhallen.de/lukki-casino-mobile-app-dein-ultimativer-leitfaden/

Нужен эвакуатор? эвакуатор цена за 1 км быстрый выезд по Санкт-Петербургу и области. Аккуратно погрузим легковое авто, кроссовер, мотоцикл. Перевозка после ДТП и поломок, помощь с запуском/колесом. Прозрачная цена, без навязываний.

Нужны заклепки? заклепки нержавеющие вытяжные 4.8 мм для прочного соединения листового металла и профиля. Стойкость к коррозии, аккуратная головка, надежная фиксация даже при вибрациях. Подбор размеров и типа борта, быстрая отгрузка и доставка.

Что изменилось: Продать телефон MAXVI за деньги — скупка рядом со мной выгодно

Хочешь продвинуть сайт? сео продвижение сайта наша компания предлагает профессиональные услуги по SEO?продвижению (Search Engine Optimization) — мы поможем вывести ресурс в топ?3 поисковых систем Google и Яндекс всего за месяц. Сотрудничество строится на прозрачной основе: все договорённости фиксируются в официальном договоре, что гарантирует чёткость взаимодействия и уверенность в достижении результата.

две шлюхи порно фото

Авто в ОАЭ https://auto.ae/showrooms/all/ под ключ: продажа новых и б/у автомобилей, диагностика перед покупкой, регистрация и страховка. Прокат на сутки и долгосрок, включая премиум. VIP номерные знаки — подбор вариантов, торг, оформление передачи и сопровождение на русском.

Центр охраны труда https://unitalm.ru “Юнитал-М” проводит обучение по охране труда более чем по 350-ти программам, в том числе по электробезопасности и пожарной безопасности. А также оказывает услуги освидетельствования и испытаний оборудования и аутсорсинга охраны труда.

Продаешь антиквариат? Скупка антиквариата в Москве — выгодно продать старинные вещи оценка и выкуп старинных вещей с понятными условиями. Принимаем фарфор, бронзу, серебро, иконы, монеты, часы, книги, мебель и предметы искусства. Возможен выезд и оценка по фото. Оплата сразу, конфиденциальность.

Нужен эвакуатор? вызвать эвакуатор в спб быстрый выезд по Санкт-Петербургу и области. Аккуратно погрузим легковое авто, кроссовер, мотоцикл. Перевозка после ДТП и поломок, помощь с запуском/колесом. Прозрачная цена, без навязываний.

Авто в ОАЭ https://auto.ae/rent/car/ под ключ: продажа новых и б/у автомобилей, диагностика перед покупкой, регистрация и страховка. Прокат на сутки и долгосрок, включая премиум. VIP номерные знаки — подбор вариантов, торг, оформление передачи и сопровождение на русском.

Любишь азарт? https://everumonline.ru игры от популярных провайдеров, live-казино, бонусы и турниры. Проверяйте лицензию и правила, лимиты и комиссии вывода перед игрой. Подбор способов оплаты, поддержка и обзоры условий.

Любишь азарт? https://riobetmobile.ru бонусы, слоты и live-игры, турниры, платежные методы, верификация, лимиты и правила. Даем вывод, кому подходит, и чек-лист, на что обратить внимание перед пополнением и игрой. Актуально на 2025.

Хочешь бонусы? https://casinobezdeposita.ru бонусы за регистрацию, фриспины, промокоды. Сравниваем условия отыгрыша, лимит вывода, сроки, верификацию и поддержку. Обновления и фильтры по методам оплаты.

ООО «ТрастСервис» https://www.trustsol.ru московская IT-компания с более чем 15-летним опытом в разработке, внедрении и сопровождении IT-систем для бизнеса. Компания предлагает комплексный IT-аутсорсинг, администрирование серверов и рабочих станций, безопасность, телефонию, облачные решения и разработку ПО. ТрастСервис обслуживает малые, средние и крупные организации, помогает оптимизировать инфраструктуру, снизить издержки и обеспечить стабильную работу IT-среды.

Experience Brainy https://askbrainy.com the free & open-source AI assistant. Get real-time web search, deep research, and voice message support directly on Telegram and the web. No subscriptions, just powerful answers.

Сдаешь экзамен? помощь тусур готовим к экзаменам по билету и практике, объясняем сложные темы, даём подборку задач и решений, тренируем устный ответ. Проверим конспекты, поможем оформить лабы и отчёты.

Учишься в вузе? написание работ для студентов Разберём методичку, составим план, поможем с введением, целями и выводами, оформим список литературы, проверим ошибки и оформление. Конфиденциально, быстро, по шагам.

FarbWood https://farbwood.by команда, включающая конструкторов, менеджеров и мастеров строительных специальностей. Каждый член нашего коллектива имеет за плечами собственный солидный опыт работы в своей сфере от 9 лет. Объединив общие знания и навыки, мы постарались создать компанию, которая сможет предоставить качественные услуги частным и корпоративным заказчикам.

Строительство и ремонт https://colorprofi.ru без сюрпризов: пошаговые инструкции, советы мастеров, сравнение материалов, схемы, частые ошибки и способы сэкономить. От фундамента и стен до плитки, пола, потолков и инженерки. Обновляемые статьи и ответы на вопросы.

Бесплатные программы https://soft-sng.ru для компьютера: офис, браузер, антивирус, архиватор, PDF, плееры, монтаж видео и фото, утилиты для системы. Скачивание с официальных сайтов, краткие обзоры, плюсы/минусы и аналоги. Подбор по Windows/macOS/Linux, подборки и инструкции.

Мировые новости https://lratvakan.com сегодня: свежая информация из разных стран, важные заявления, международная политика, рынки и тренды. Оперативные обновления, проверенные источники и понятные обзоры событий каждого дня.

Портал о строительстве https://strojdvor.ru ремонте и инженерных системах: от фундамента до отделки и коммуникаций. Пошаговые инструкции, сравнение материалов, расчёты, советы экспертов и типовые ошибки. Помогаем сделать надёжно и без переплат.

Новости Москвы https://moskva-news.com и Московской области: политика, экономика, общество, происшествия, транспорт, ЖКХ и погода. Оперативные репортажи, комментарии экспертов, официальные заявления и фото. Главное за день — быстро, точно, без лишнего.

Новости K-POP https://www.iloveasia.su из Кореи: айдол-группы, соло-артисты, камбэки, скандалы, концерты и шоу. Актуальные обновления, переводы корейских источников, фото и видео. Следите за любимыми артистами и трендами индустрии каждый день.

Полезные советы https://vashesamodelkino.ru для дома и быта: практичные идеи на каждый день — от уборки и готовки до хранения вещей и мелкого ремонта. Понятные инструкции, бытовые лайфхаки и решения, которые реально работают и упрощают жизнь.

Всё о ремонте https://svoimi-rukamy.net своими руками: понятные гайды, схемы, расчёты и лайфхаки для квартиры и дома. Черновые и чистовые работы, отделка, мелкий ремонт и обновление интерьера. Практично, доступно и без лишней теории.

Learn More: http://www.proagfarmers.com/markets/stocks.php?article=abnewswire-2025-12-4-the-ultimate-guide-to-buying-facebook-advertising-accounts-what-must-be-known

Нужна косметика? набор корейской косметики большой выбор оригинальных средств K-beauty. Уход для всех типов кожи, новинки и хиты продаж. Поможем подобрать продукты, выгодные цены, акции и оперативная доставка по Алматы.

Today’s Top Stories: https://nashfact.com/pages/the-evolution-of-online-gambling-in-canada-past-present-2025-trends.html

Товар дня – обзоры бытовой техники https://hotgoods.com.ua

Аренда автобуса посуточно https://gortransauto.ru

With a mix of local flavour, massive bonuses, and pokies that actually pay, it’s no surprise this casino is turning heads. As well as the standard mapping, you will find local MICHELIN Guide listed restaurants and real-time traffic. Our app includes Michelin maps and routes with real-time traffic info, GPS navigation with voice guidance and community alerts. ViaMichelin will help you to determine the best route based on various options and, by default, offer two to three routes with varying costs, distances and journey times.

This means the site follows all the rules for fair play, responsible gaming, and player protection — with regular audits to keep everything above board.🔐 Safe as a Bank VaultFrom SSL encryption to secure payment gateways, Lucky Ones uses the same tech trusted by global banks. That’s why Lucky Ones Casino is fully licensed and operates under strict international standards, so you can focus on the fun while your data and money stay safe.🎓 Licensed & LegitLucky Ones is officially licensed by Curacao eGaming, one of the most recognised authorities in the online casino world. When it comes to online gambling, security isn’t optional — it’s everything. From small deposits to big withdrawals, top pokies to fast payouts — Lucky Ones really puts the player first.Still curious? That’s double the playtime and a whole lot more chances to win — right from the start.📋 How to claim it?

However, for other common tools like setting deposit limits, session time limits, or time-outs, you’ll need to reach out to customer support. If you’re already dabbling in crypto, cashing out your casino winnings can be a seamless process. For Aussie players, embracing crypto can mean faster transactions and potentially lower fees compared to traditional banking methods. This isn’t uncommon for online casinos these days, especially with heftier payouts.

References:

https://blackcoin.co/stay-casino-login-australia-quick-access-to-your-account/

Try your luck at the freshly rebuilt casino, which has a total area of 65,000 square feet. With award-winning restaurants and five bars, there’s plenty to do.

With the redesigned private gaming rooms Sovereign and Oasis, the land based casino delivers the finest in premium gaming experiences. Mississippi stud poker, three card poker, Caribbean stud poker, and Texas Hold ’em bonus poker are among the poker games available on the casino floor. Only two poker tables are available in the poker room, with the majority of the games being Texas Hold ’em ($2/$3). After you’ve finished spinning the reels, walk over to the table games area to try your hand at your favorite table casino games. More information on premium membership access and advantages will be sent to eligible members.

Alternatively, you might relax in your 5-star hotel room and take in the beautiful scenery from your suite. Before you attend the latest stage play, meet up with friends and have a meal before the night begins, or taste from the incredible buffet. There are over six restaurants, and their website offers a handy online table reservation option. After hours, choose from outdoor bars, sports bars, or the neighborhood’s hotspot, The Atrium Bar. You may enjoy lush manicured grounds, an enviable location, and five-star comfort whether you stay at The Star Grand or The Darling. There are also spa services, an outdoor pool area, and private cabanas.

References:

https://blackcoin.co/casino-rocket-australia-your-next-favourite-online-spot/

дизайн проект квартиры дизайн квартир спб

Play at https://elon-casino-top.com online: slots from popular providers, live dealers, promotions, and tournaments. Learn about the bonus policy, wagering requirements, payment methods, and withdrawal times. Information for adult players. 18+. Gambling requires supervision.

Play online at casino elon: slots, live casino, and special offers. We explain the rules, limits, verification, and payments to avoid any surprises. This material is for informational purposes only.

online casino usa paypal

References:

https://sangrok.net/bbs/board.php?bo_table=free&wr_id=1283

online casinos that accept paypal

References:

https://www.woosungplating.com/bbs/board.php?bo_table=free&wr_id=48037

Нужен трафик и лиды? яндекс реклама казань SEO-оптимизация, продвижение сайтов и реклама в Яндекс Директ: приводим целевой трафик и заявки. Аудит, семантика, контент, техническое SEO, настройка и ведение рекламы. Работаем на результат — рост лидов, продаж и позиций.

best online casino usa paypal

References:

https://qalmsecurity.nl/employer/paypal-gambling-sites-where-its-accepted/

paypal casinos online that accept

References:

https://jobstaffs.com/employer/new-casinos-australia-new-casino-sites-online/

It includes full access to all games, bonuses and payments. Yes, live betting games like Bet on Poker, Bet on Dice, Bet on Baccarat add thrill to the gambling at Leon Casino. Visit leon.bet from any mobile browser for instant access to 12,000+ games.

Players can use Visa, Mastercard, bank transfers, and popular e-wallets for deposits and withdrawals. Details of each promotion, including wagering requirements and bonus terms, can be found in the Promotions section. After verification, you can log in and start playing.

References:

https://blackcoin.co/ufo9-casino-your-place-to-play-your-way/

actionfuelsmomentum.bond – Love the vibe here, everything loads fast and looks super clean.

actionfuelsmomentum.bond – Love the vibe here, everything loads fast and looks super clean.

directionenergizesgrowth.bond – Really helpful info, I’ll be coming back to read more soon.

growthnavigator – Simple design with clear objectives, making the purpose immediately evident.

clarityleadsmovement.bond – Nice layout and simple flow, made it easy to find what I needed.

Progress Experience – Everything flows nicely and the message is easy to grasp.

progressflowguide – Smooth layout supports quick comprehension of the main points.

forwardmotionactivatednow.bond – Great work on this site, feels polished and surprisingly easy to navigate.

Main Momentum Platform – The layout supports the content and keeps things understandable.

growthblueprint – Very engaging, the structure of growth concepts is clearly defined.

forwardfocusstream – Clear, practical tips encourage productivity and goal completion.

claritysetsdirection.bond – Pretty solid content, I enjoyed reading through the pages today.

Action Driven Program – Well-structured design that makes the mission clear right away.

clear thinking space – Nicely written, ideas are organized and understandable.

motionpath – Encouraging advice, concepts here make forward movement feel structured and doable.

forwardpathinsights – Helpful guidance, knowing the next steps makes moving forward easier.

online blackjack paypal

References:

https://realestate.kctech.com.np/profile/sheena50y13919

gamble online with paypal

References:

https://careers.tu-varna.bg/employer/paypal-casinos-uk-best-online-casino-sites-that-accept-paypal-2025/

thinkingforwardstream – Advice is practical, clear, and supports better planning.

directionshapesoutcomes.bond – Smooth experience overall, pages are organized and load without any lag.

strategicmovesonline – Visual hierarchy is strong, making browsing effortless.

purpose based growth – Strong message, growth ideas are easy to understand.

ideastart – Very practical advice, ideas here encourage smooth and steady progress.

focuspathway – Practical notes, keeping attention sharp makes direction simpler to follow.

forwardwithclarity – Nice advice, moving forward with clarity ensures tasks are completed effectively.

progressmotioncenter – Practical steps encourage forward momentum for the group.

goalflow – Very helpful, these points energize motion and improve productivity.

ideaimpulse – Great tips, interpreting signals properly keeps ideas progressing smoothly.

smartmoves – Taking thoughtful steps can simplify what you need to do today.

guided momentum – Useful takeaway, direction acts like a catalyst for progress.

Clarity Focused Resource – The layout feels intentional and easy on the eyes.

progressmovespurposefully.bond – Interesting site, the structure makes sense and keeps things straightforward.

progressbyaction – Very useful, consistent action helps make progress tangible and steady.

intentionalsteps – Great guidance, focusing on intentions simplifies the workflow.

clarityforwardstream – Guidance is structured logically and easy to act upon.

focuseddirection – Inspiring tips, clarity here simplifies figuring out priorities and direction.

thinkingengine – Helpful notes, keeps the mind energized for forward-focused strategies.

actioncompass – Using signals helps streamline work and reduce confusion.

clarityengine – Focused action generates better results and keeps work organized consistently.

conceptsignals – Very practical, signals here help convert concepts into forward movement efficiently.

brainwaveengine – Steady progress transforms ideas into meaningful achievements.

movement with focus – Nicely shared, focused thinking supports consistent action.

activategrowthstream – Easy-to-read layout with clear messaging that guides the user effectively.

growthinorder – Helpful tips, aligning steps properly allows progress to move forward smoothly.

poweredsignals – Very encouraging, signals guide decisions to enhance growth consistently.

progresspathwayguide – Practical steps keep efforts aligned and efficient.

claritycompass – Inspiring guidance, clarity here points the way for better choices.

movementinsights – Very helpful, these notes show how action fuels continuous movement.

productivitybeacon – Clear focus boosts results and ensures consistent workflow in projects.

focusedaction – Helpful tips, clear focus allows progress to happen without unnecessary delays.

collaborationleadershub – Great perspective, the hub highlights purposeful partnerships and credible connections.

projectbeacon – Knowing your next steps today creates stronger results tomorrow.

idea execution path – Clear direction, ideas are guided toward practical outcomes.

focusengine – Guidance from signals ensures motion stays steady and productive.

globalnetworking – Interesting concept, partnerships give a sense of worldwide credibility.

growthsignalflow – Content reads smoothly, and the structure enhances clarity.

collaborationcircle – Join trusted relationships that encourage teamwork and shared success.

progressmoveswithsignal – Very practical advice, progress moves feel structured and achievable today.

forwardinsights – Very encouraging, the unlocked guidance makes planning progress simpler and more effective.

focusdrivencenter – Suggestions keep priorities in order and make execution easier.

collaborationcircle – Encourages teamwork and strengthens professional alliances.

creativestreamcenter – Suggestions help translate ideas into meaningful actions.

growthtracker – Inspiring tips, following clear signals keeps growth flowing smoothly over time.

strategicthinking – Very insightful, forward thinking is presented clearly and understandably.

actionmovesforwardclean.bond – Good read, I found a couple sections that were genuinely useful.

actionbeacon – Practical insights, signals here create steady velocity and maintain smooth workflow across projects.

forwardorganically – Very useful, natural pacing ensures progress continues smoothly and predictably.

cohesivebusinesshub – Great advice, cohesion in the network ensures steady progress and clarity in operations.

planbeacon – Understanding forward movement helps structure my day better.

direction made simple – Easy to follow, focus keeps direction intentional.

movingforwardclearly – Helpful insights, clear direction accelerates progress without confusion.

confidenceinaction – Very motivating, consistent action builds personal confidence steadily.

focusdrivenmotion – Helpful reminders, staying driven with clear focus is key today.

Visit Growth Flows Forward – The site loads quickly and the information is easy to take in.

growthfocusplan – Great insights, consciously choosing growth paths ensures smoother forward movement.

relationshipallies – Trusted partnerships designed to enhance collaboration and results.

momentumbuilder – Helpful reminders, small actions steadily increase velocity in tasks.

motionplannerhub – Insights are helpful for prioritizing tasks effectively and staying on track.

workflowbeacon – Structured growth methods simplify progress and improve efficiency.

trustcircle – Build meaningful collaborations that deliver consistent results efficiently.

signalcreatesalignment.bond – Looks great on mobile too, everything feels quick and nicely put together.

actiondrivesgrowth – Helpful advice, taking action regularly clearly drives steady growth.

brainstormengine – Strategic ideas unlock growth and keep projects advancing.

trustedgrowthbond – Helpful, trust-driven approaches promote structured and balanced development.

dynamicflowaction – Great advice, momentum naturally builds when actions are applied steadily over time.

focused growth guide – Helpful explanation, growth concepts are laid out in a clean way.

acceleratedfocus – Inspiring advice, aligning focus and direction speeds up results noticeably.

signalsteppingstones – Very encouraging, clear signals guide actions in a focused way.

visionpartnershiphub – Very practical, vision-focused partnerships strengthen collaboration and outcomes.

actionenergyguide – Steps are easy to track and advice is presented clearly.

motionmaker – Helpful insights, active steps ensure projects keep moving consistently.

forwardflowideas – Excellent tips, growth ideas are laid out clearly for action.

Check This Platform – Clear direction throughout, with a confident and cohesive layout.

forwardmomentum – Great insights, steady application of ideas makes moving forward simple today.

trustedrelationshiphub – Useful, hub tools make fostering trust and reliability easier in business interactions.

tractionplannerhub – Guidance is structured and helps maintain momentum efficiently.

networkforsuccessfulalliances – Excellent, mutual guidance ensures balanced and sustainable progress.

partnershipzone – Collaborate with professionals to achieve consistent results and long-term value.

momentumengine – Proper guidance generates leverage, making project momentum easier to sustain.

powerdrive – Channeling energy forward helps projects move faster and smoother.

taskflowsignals – Great strategies, workflow directions are easy to implement.

goalbeacon – Helpful signals ensure projects progress smoothly and efficiently.

structuredprogress – Great tips, thoughtful planning helps ensure progress moves forward smoothly.

motionguide – Very practical, the article shows how motion can be applied effectively.

signalflowcenter – Useful insights make it easy to follow directions for progress.

actioncompass – Great tips, deliberate moves guide teams in the right direction naturally.

progressstream – Helpful notes, ideas here turn progress into clear, actionable steps.

clarityflows – Helpful advice, ideas are structured so they can be applied easily today.

sharedprosperitycircle – Great guidance, focusing on shared benefits helps growth feel authentic and long-lasting.

focusanchor – Anchoring attention in the right way makes tasks simpler.

flowbeacon – Very useful, signals here help create smooth workflow and keep momentum steady.

solidfoundationfund – Strong long-term strategies that foster dependable outcomes.

growthadvancescleanly – Really nice insights, the growth process feels clear and easy to follow.

targetedfocus – Great advice, concentrating on key steps accelerates progress effectively.

alliancehub – Connect with businesses for joint projects and successful collaborations.

clarityexecutionguide – Insights help translate ideas into actionable steps efficiently.

growthmoveswithfocus – Very useful, staying focused helps growth move forward efficiently today.

strategicaction – Inspiring guidance, smart moves consistently shape results and direction.

continuousgrowth – Helpful notes, steady progress builds confidence and momentum naturally.

valuetrustpartners – Practical tips, dependable values lead to stronger collaborative results.

strategybeacon – Insightful guidance keeps actions aligned with desired results.

goalpathway – Very practical, mapping a forward path helps transform plans into action efficiently.

progressivepartnersclub – Excellent, branding communicates growth, creativity, and strategic collaboration.