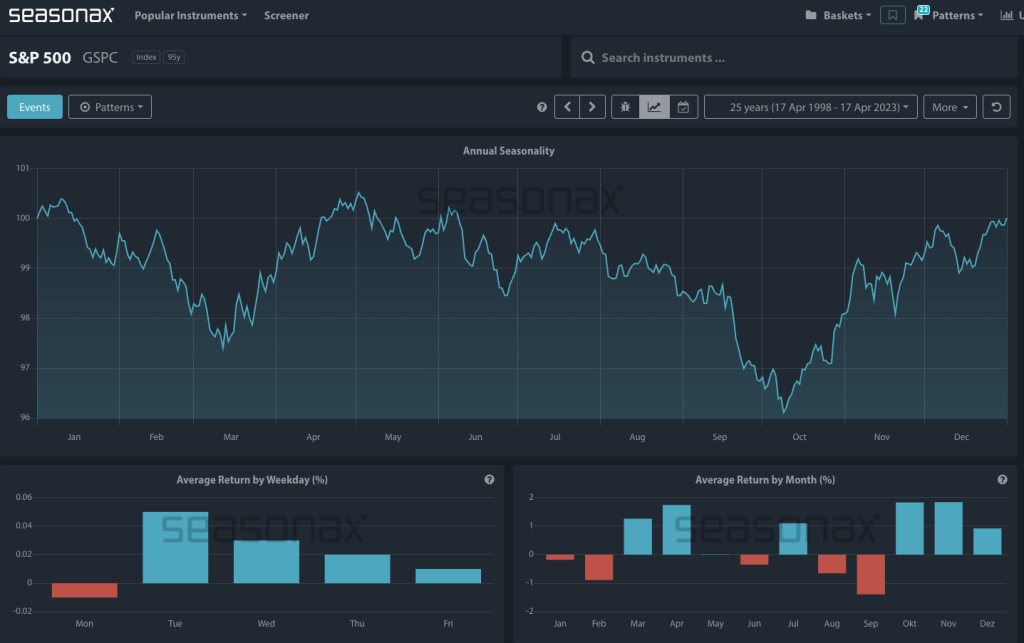

From a seasonal perspective stocks tend to do well in April. Over the last 25 years April has been the strongest month for the DAX, and the FTSE, as well as one of the strongest months of the year for the S&P500. So, April tends to be a great month for stocks. See the seasonal strength in the charts below from Seasonax’s excellent seasonal charts.

The DAX

The FTSE

The S&P500

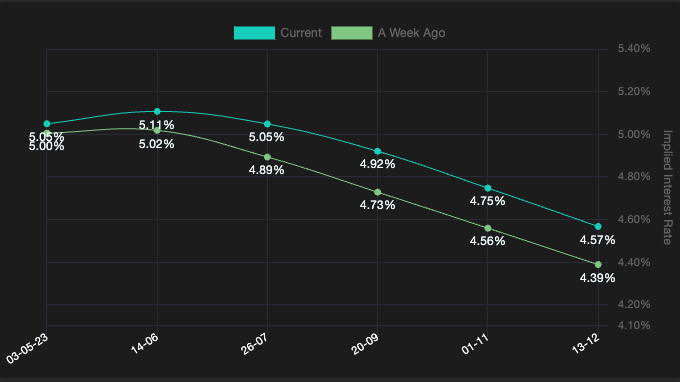

This seasonal bias has been seen this month as stocks have been helped by expectations of rate cuts from the Fed in the second half of this year. The Silicon Valley Bank prompted banking crisis added to hopes of rate cuts coming to ease financial conditions. However, this narrative will once again be tested around the Fed’s meeting on May 03. The rate expectations are that the fed will hike one more time (88% chance) in May before pausing. From there the STIR markets see two rate cuts into year end. See the interest rate probability tracker tool from Financial Source:

Sell in May and go away?

Stocks typically see a weaker summer period and that is timing with the Fed announcement on May 03. The risk is that the Fed set up a hawkish meeting in May that sends stocks lower on higher rate expectations. Remember the short term interest rate pricing has not been confirmed by the Federal Reserve. The Fed are not communicating rate cuts this year at all. Also, most analysts are worried about a bearish period for stocks ahead. Bank of America’s April Global Fund Manager survey is the most bearish of 2023 on credit crunch woes. A credit crunch and hawkish central banks are seen as the largest tail risk.

Frequent players from Australia can join the VIP Club, which features 15 progressive levels. Game contribution rates vary, and some games may be restricted. A 20 AUD deposit earns you 20 spins; 50 AUD unlocks 50 spins; and 100 AUD gives you the full 100 free spins to use on selected pokies. To cash out the winnings, players need to meet a 40x wagering requirement. In addition to newcomer promotions, National Casino treats its regular Aussie players to more perks. National Casino provides an extensive variety of bonuses for all users.

For players who enjoy gaming on the go, National Casino offers a fully optimized mobile app that allows access to all the platform’s games and features directly from your smartphone or tablet. National Casino also offers ongoing promotions for existing players, including reload bonuses, free spins, and special offers tied to specific games or events. For players who seek a more authentic casino experience, National Casino offers a comprehensive selection of live dealer games.

References:

https://blackcoin.co/ufo9-casino-your-place-to-play-your-way/

online casino accepts paypal us

References:

https://classihub.in

paypal casino

References:

hellos.link

online american casinos that accept paypal

References:

play123.co.kr

casino online paypal

References:

https://jobscart.in/employer/online-casinos-australia-best-aussie-casino-sites-of-2025/

Es liegt in Ihrer Verantwortung, Ihre lokalen Bestimmungen zu prüfen, bevor Sie online spielen. Wir empfehlen Ihnen, nur in Casinos zu spielen, die von einer offiziellen Regulierungsbehörde lizenziert sind (Malta, Gibraltar, Curaçao, UK, etc.). In einem Casino Online spielen um Echtgeld – dies ist umso spannender, wenn ein Live-Casino vorhanden ist. Mit seinem einfachen Gameplay und spannenden Wettoptionen bietet Baccarat sowohl Anfängern als auch erfahrenen Glücksspielern ein aufregendes Erlebnis in Casinos. In einem Casino Online spielen mit Echtgeld ist besonders spannend, wenn Pokerversionen wie Texas Hold’em und das nicht minder beliebte Casino Hold’em vorhanden sind.

Für zusätzliches Kapital im Zuge deiner ersten Einzahlung sorgt der Willkommensbonus. Hierzulande kannst du im Casino mit Echtgeld an mehr als 450 Spielautomaten dein Glück herausfordern. Du kannst aus mehr als 500 Titeln wählen und findest zum Beispiel neben klassischen Spieautomaten viele beliebte Megaways-Slots.

References:

https://s3.amazonaws.com/onlinegamblingcasino/casino%20im%20park%20kamp%20lintfort.html

Für die Gewinne aus Freispielen gilt in Deutschland ein 30-facher Umsatz. Der maximale Auszahlungsbetrag aus Freispielen und Boni ist oft auf das 5-fache des Bonusbetrags gedeckelt. Hier finden Spieler alles, von klassischen Fruchtslots bis hin zu modernen Video-Slots mit komplexen Features.

Sichern Sie sich Ihren exklusiven Registrierungsbonus, indem Sie sich einfach auf unserer Website anmelden! Die erste Variante sind 50 Freispiele für die Slot Big Bass Splash. Sollten Sie die entsprechende Website über unseren Link aufrufen, so könnten wir eine Provision erhalten. Immer mehr Spielotheken hingegen haben die Mindesteinzahlung bereits auf 20 € angehoben. Mit diesem Betrag haben Sie auch bereits Anrecht auf den Willkommensbonus. In dieser Spielothek trifft man auf eine sehr faire Mindesteinzahlung. Dennoch bietet das Hit N Spin Casino eine gute Mischung aus allem.

References:

https://s3.amazonaws.com/onlinegamblingcasino/casino%20%C3%B6ffnungszeiten.html

Es gibt verschiedene Zahlungsarten mit unterschiedlichen Vor- und Nachteilen in deutschen Online Casinos. Spieler können sich auf spannende und abwechslungsreiche Aktionen freuen, die regelmäßig stattfinden. Der erste erfolgreiche Einzahler bei bestimmten Aktionen erhält 111 Freispiele, während die restlichen Gewinner 100 Freespins erhalten. Am Donnerstag gibt es den Tag der 1.000 Freispiele, bei dem Quizfragen gestellt werden, um Freispiele zu gewinnen. Diese Programme verbessern die Spielerfahrung und bieten den Spielern ein Gefühl von Exklusivität und Wertschätzung. VIP-Clubs bieten noch exklusivere Vorteile, wie maßgeschneiderte Boni, persönliche Betreuung und Einladungen zu exklusiven Veranstaltungen.

Für Spieler in deutschen Online Casinos sind schnelle Auszahlungen genauso wichtig wie Einzahlungen. Dank der neuen Glücksspielregulierung steht deutschen Spielern eine Auswahl an sicheren und zuverlässigen Zahlungsmitteln zur Verfügung. Immer wenn ich eine Frage habe schreibe ich ihn an und die freundlichen Mitarbeiter helfen mir sofort. Aus diesem Grund finden Sie auf unseren Seiten auch nur deutsche Online Casinos mit Whitelist Eintrag. Wir bieten Ihnen auf unseren Seiten auch Spielanleitungen, Strategien, sowie Tipps und Tricks für die beliebtesten Online Casino Games. Unsere Experten haben nicht nur die besten deutschen Online Casinos im Vergleich. Testen Sie die Top Games hier bei uns und finden Sie alle Play’n Go Casinos.

References:

https://s3.amazonaws.com/onlinegamblingcasino/groupe%20casino.html

References:

Female anavar before after

References:

https://hedge.fachschaft.informatik.uni-kl.de/s/_R9fC1MOw

References:

Maryland live casino

References:

https://etuitionking.net/forums/users/campvise61/

Actually, I needed antibiotics quickly and discovered Antibiotics Express. They let you order meds no script legally. For treating strep throat, try here. Fast shipping available. Go here: https://antibioticsexpress.xyz/#. Good luck.

Lately, I had to find antibiotics urgently and found this amazing site. They let you get treatment fast legally. In case of sinusitis, I recommend this site. Overnight shipping to USA. More info: antibioticsexpress.com. Hope you feel better.

Hello! I found a useful resource for those who need prescriptions securely. Pharmiexpress has express shipping on all meds. If you want to save, visit here: [url=https://pharmiexpress.xyz/#]check availability[/url]. Cheers.

Hey there! Check out this resource to order pills at a discount. This store provides reliable delivery on health products. For fast service, highly recommended: [url=https://pharmiexpress.com/#]pharmacy online[/url]. Hope this helps.

References:

Dubuque iowa casino

References:

http://ezproxy.cityu.edu.hk/login?url=https://wd40casino.blackcoin.co

References:

Argosy casino

References:

https://ondashboard.win/story.php?title=play-wd-40-casino-online-real-money

References:

High 5 casino games

References:

https://algowiki.win/wiki/Post:New_NoDeposit_Bonuses_List_January_11_2026

Hər vaxtınız xeyir, əgər siz yaxşı kazino axtarırsınızsa, məsləhətdir ki, Pin Up saytını yoxlayasınız. Yüksək əmsallar və sürətli ödənişlər burada mövcuddur. Qeydiyyatdan keçin və ilk depozit bonusunu götürün. Sayta keçmək üçün link: [url=https://pinupaz.jp.net/#]ətraflı məlumat[/url] uğurlar hər kəsə!

Yeni Pin Up giriş ünvanını axtarırsınızsa, bura baxa bilərsiniz. İşlək link vasitəsilə qeydiyyat olun və qazanmağa başlayın. Xoş gəldin bonusu sizi gözləyir. Keçid: [url=https://pinupaz.jp.net/#]Pin Up online[/url] hamıya bol şans.

Salam dostlar, siz də keyfiyyətli kazino axtarırsınızsa, məsləhətdir ki, Pin Up saytını yoxlayasınız. Ən yaxşı slotlar və sürətli ödənişlər burada mövcuddur. Qeydiyyatdan keçin və ilk depozit bonusunu götürün. Oynamaq üçün link: [url=https://pinupaz.jp.net/#]Pin Up Azerbaijan[/url] uğurlar hər kəsə!

Info slot gacor malam ini: mainkan Gate of Olympus atau Mahjong Ways di Bonaslot. Website ini anti rungkad dan resmi. Bonus new member menanti anda. Akses link: п»ї[url=https://bonaslotind.us.com/#]situs slot resmi[/url] raih kemanangan.

Selamlar, güvenilir casino siteleri arıyorsanız, hazırladığımız listeye kesinlikle göz atın. Lisanslı firmaları ve bonusları sizin için inceledik. Dolandırılmamak için doğru adres: https://cassiteleri.us.org/# cassiteleri.us.org iyi kazançlar.

Pin-Up AZ ölkəmizdə ən populyar kazino saytıdır. Burada minlərlə oyun və canlı dilerlər var. Pulu kartınıza tez köçürürlər. Proqramı də var, telefondan oynamaq çox rahatdır. Rəsmi sayt https://pinupaz.jp.net/# sayta keçid baxın.

Pin Up Casino ölkəmizdə ən populyar platformadır. Saytda çoxlu slotlar və canlı dilerlər var. Pulu kartınıza anında köçürürlər. Proqramı də var, telefondan oynamaq çox rahatdır. Rəsmi sayt [url=https://pinupaz.jp.net/#]Pin Up AZ[/url] baxın.

Yeni Pin Up giriş ünvanını axtarırsınızsa, bura baxa bilərsiniz. İşlək link vasitəsilə qeydiyyat olun və oynamağa başlayın. Pulsuz fırlanmalar sizi gözləyir. Keçid: https://pinupaz.jp.net/# Pin Up AZ qazancınız bol olsun.

Salam dostlar, əgər siz etibarlı kazino axtarırsınızsa, mütləq Pin Up saytını yoxlayasınız. Yüksək əmsallar və rahat pul çıxarışı burada mövcuddur. Qeydiyyatdan keçin və ilk depozit bonusunu götürün. Daxil olmaq üçün link: Pin Up rəsmi sayt uğurlar hər kəsə!

Canlı casino oynamak isteyenler için rehber niteliğinde bir site: [url=https://cassiteleri.us.org/#]casino siteleri[/url] Hangi site güvenilir diye düşünmeyin. Onaylı bahis siteleri listesi ile sorunsuz oynayın. Tüm liste linkte.

Pin-Up AZ ölkəmizdə ən populyar kazino saytıdır. Burada çoxlu slotlar və Aviator var. Qazancı kartınıza tez köçürürlər. Proqramı də var, telefondan oynamaq çox rahatdır. Rəsmi sayt sayta keçid yoxlayın.

Aktual Pin Up giriş ünvanını axtaranlar, bura baxa bilərsiniz. İşlək link vasitəsilə qeydiyyat olun və qazanmağa başlayın. Xoş gəldin bonusu sizi gözləyir. Keçid: https://pinupaz.jp.net/# burada uğurlar.

2026 yılında popüler olan casino siteleri hangileri? Detaylı liste web sitemizde mevcuttur. Deneme bonusu veren siteleri ve yeni adres linklerini paylaşıyoruz. İncelemek için https://cassiteleri.us.org/# kaçak bahis siteleri fırsatı kaçırmayın.

Info slot gacor hari ini: mainkan Gate of Olympus atau Mahjong Ways di Bonaslot. Website ini anti rungkad dan resmi. Promo menarik menanti anda. Kunjungi: [url=https://bonaslotind.us.com/#]klik disini[/url] raih kemanangan.

Situs Bonaslot adalah bandar judi slot online terpercaya di Indonesia. Banyak member sudah mendapatkan Maxwin sensasional disini. Transaksi super cepat hanya hitungan menit. Situs resmi п»їhttps://bonaslotind.us.com/# daftar situs judi slot gas sekarang bosku.

Merhaba arkadaşlar, sağlam casino siteleri arıyorsanız, hazırladığımız listeye kesinlikle göz atın. Lisanslı firmaları ve bonusları sizin için listeledik. Dolandırılmamak için doğru adres: [url=https://cassiteleri.us.org/#]siteyi incele[/url] iyi kazançlar.

Situs Bonaslot adalah agen judi slot online terpercaya di Indonesia. Ribuan member sudah mendapatkan Maxwin sensasional disini. Proses depo WD super cepat hanya hitungan menit. Link alternatif https://bonaslotind.us.com/# Bonaslot rtp jangan sampai ketinggalan.

Bocoran slot gacor malam ini: mainkan Gate of Olympus atau Mahjong Ways di Bonaslot. Website ini anti rungkad dan resmi. Bonus new member menanti anda. Akses link: п»їhttps://bonaslotind.us.com/# Bonaslot dan menangkan.

2026 yılında en çok kazandıran casino siteleri hangileri? Cevabı platformumuzda mevcuttur. Bedava bahis veren siteleri ve yeni adres linklerini paylaşıyoruz. Hemen tıklayın güvenilir casino siteleri fırsatı kaçırmayın.

Bu sene popüler olan casino siteleri hangileri? Detaylı liste platformumuzda mevcuttur. Bedava bahis veren siteleri ve yeni adres linklerini paylaşıyoruz. Hemen tıklayın https://cassiteleri.us.org/# en iyi casino siteleri kazanmaya başlayın.

Info slot gacor malam ini: mainkan Gate of Olympus atau Mahjong Ways di Bonaslot. Situs ini gampang menang dan aman. Promo menarik menanti anda. Akses link: п»ї[url=https://bonaslotind.us.com/#]login sekarang[/url] raih kemanangan.

Yeni Pin Up giriş ünvanını axtarırsınızsa, bura baxa bilərsiniz. Bloklanmayan link vasitəsilə qeydiyyat olun və qazanmağa başlayın. Pulsuz fırlanmalar sizi gözləyir. Keçid: Pin Up giriş hamıya bol şans.

Bu sene popüler olan casino siteleri hangileri? Detaylı liste platformumuzda mevcuttur. Deneme bonusu veren siteleri ve yeni adres linklerini paylaşıyoruz. İncelemek için https://cassiteleri.us.org/# canlı casino siteleri kazanmaya başlayın.

2026 yılında en çok kazandıran casino siteleri hangileri? Cevabı web sitemizde mevcuttur. Bedava bahis veren siteleri ve güncel giriş linklerini paylaşıyoruz. Hemen tıklayın [url=https://cassiteleri.us.org/#]en iyi casino siteleri[/url] fırsatı kaçırmayın.

Pin Up Casino ölkəmizdə ən populyar platformadır. Saytda çoxlu slotlar və canlı dilerlər var. Pulu kartınıza anında köçürürlər. Mobil tətbiqi də var, telefondan oynamaq çox rahatdır. Rəsmi sayt [url=https://pinupaz.jp.net/#]bura daxil olun[/url] yoxlayın.

Pin-Up AZ Azərbaycanda ən populyar platformadır. Burada çoxlu slotlar və Aviator var. Pulu kartınıza anında köçürürlər. Proqramı də var, telefondan oynamaq çox rahatdır. Rəsmi sayt [url=https://pinupaz.jp.net/#]sayta keçid[/url] yoxlayın.

Salamlar, siz də etibarlı kazino axtarırsınızsa, mütləq Pin Up saytını yoxlayasınız. Ən yaxşı slotlar və sürətli ödənişlər burada mövcuddur. Qeydiyyatdan keçin və ilk depozit bonusunu götürün. Sayta keçmək üçün link: Pin Up giriş uğurlar hər kəsə!

Selamlar, ödeme yapan casino siteleri arıyorsanız, hazırladığımız listeye mutlaka göz atın. Lisanslı firmaları ve bonusları sizin için inceledik. Dolandırılmamak için doğru adres: listeyi gör bol şanslar.

Salam dostlar, əgər siz etibarlı kazino axtarırsınızsa, mütləq Pin Up saytını yoxlayasınız. Yüksək əmsallar və sürətli ödənişlər burada mövcuddur. İndi qoşulun və bonus qazanın. Oynamaq üçün link: https://pinupaz.jp.net/# pinupaz.jp.net uğurlar hər kəsə!

Canlı casino oynamak isteyenler için kılavuz niteliğinde bir site: [url=https://cassiteleri.us.org/#]canlı casino siteleri[/url] Nerede oynanır diye düşünmeyin. Editörlerimizin seçtiği bahis siteleri listesi ile sorunsuz oynayın. Tüm liste linkte.

Salamlar, əgər siz yaxşı kazino axtarırsınızsa, mütləq Pin Up saytını yoxlayasınız. Ən yaxşı slotlar və sürətli ödənişlər burada mövcuddur. İndi qoşulun və ilk depozit bonusunu götürün. Daxil olmaq üçün link: Pin Up AZ uğurlar hər kəsə!

Merhaba arkadaşlar, ödeme yapan casino siteleri bulmak istiyorsanız, hazırladığımız listeye mutlaka göz atın. Lisanslı firmaları ve fırsatları sizin için listeledik. Güvenli oyun için doğru adres: https://cassiteleri.us.org/# mobil ödeme bahis bol şanslar.

п»їHalo Bosku, cari situs slot yang gacor? Rekomendasi kami adalah Bonaslot. RTP Live tertinggi hari ini dan pasti bayar. Deposit bisa pakai Pulsa tanpa potongan. Login disini: п»ї[url=https://bonaslotind.us.com/#]login sekarang[/url] semoga maxwin.

Salam Gacor, cari situs slot yang mudah menang? Rekomendasi kami adalah Bonaslot. RTP Live tertinggi hari ini dan terbukti membayar. Isi saldo bisa pakai Dana tanpa potongan. Daftar sekarang: Bonaslot login salam jackpot.

Salam dostlar, əgər siz yaxşı kazino axtarırsınızsa, məsləhətdir ki, Pin Up saytını yoxlayasınız. Ən yaxşı slotlar və sürətli ödənişlər burada mövcuddur. Qeydiyyatdan keçin və bonus qazanın. Oynamaq üçün link: https://pinupaz.jp.net/# Pin Up kazino uğurlar hər kəsə!

Aktual Pin Up giriş ünvanını axtaranlar, bura baxa bilərsiniz. Bloklanmayan link vasitəsilə qeydiyyat olun və oynamağa başlayın. Xoş gəldin bonusu sizi gözləyir. Keçid: https://pinupaz.jp.net/# ətraflı məlumat hamıya bol şans.

Yeni Pin Up giriş ünvanını axtarırsınızsa, bura baxa bilərsiniz. Bloklanmayan link vasitəsilə qeydiyyat olun və qazanmağa başlayın. Xoş gəldin bonusu sizi gözləyir. Keçid: [url=https://pinupaz.jp.net/#]Pin Up AZ[/url] qazancınız bol olsun.

Bu sene popüler olan casino siteleri hangileri? Detaylı liste platformumuzda mevcuttur. Bedava bahis veren siteleri ve güncel giriş linklerini paylaşıyoruz. Hemen tıklayın [url=https://cassiteleri.us.org/#]listeyi gör[/url] kazanmaya başlayın.

Merhaba arkadaşlar, güvenilir casino siteleri bulmak istiyorsanız, bu siteye mutlaka göz atın. En iyi firmaları ve bonusları sizin için listeledik. Güvenli oyun için doğru adres: [url=https://cassiteleri.us.org/#]mobil ödeme bahis[/url] bol şanslar.

Info slot gacor hari ini: mainkan Gate of Olympus atau Mahjong Ways di Bonaslot. Website ini anti rungkad dan aman. Promo menarik menanti anda. Akses link: п»ї[url=https://bonaslotind.us.com/#]daftar situs judi slot[/url] raih kemanangan.

Halo Bosku, lagi nyari situs slot yang mudah menang? Rekomendasi kami adalah Bonaslot. RTP Live tertinggi hari ini dan pasti bayar. Deposit bisa pakai Dana tanpa potongan. Daftar sekarang: slot gacor hari ini salam jackpot.

Pin-Up AZ Azərbaycanda ən populyar kazino saytıdır. Burada çoxlu slotlar və Aviator var. Qazancı kartınıza anında köçürürlər. Mobil tətbiqi də var, telefondan oynamaq çox rahatdır. Giriş linki [url=https://pinupaz.jp.net/#]burada[/url] yoxlayın.

2026 yılında popüler olan casino siteleri hangileri? Detaylı liste platformumuzda mevcuttur. Deneme bonusu veren siteleri ve yeni adres linklerini paylaşıyoruz. İncelemek için listeyi gör kazanmaya başlayın.

Bocoran slot gacor hari ini: mainkan Gate of Olympus atau Mahjong Ways di Bonaslot. Situs ini anti rungkad dan resmi. Bonus new member menanti anda. Akses link: klik disini raih kemanangan.

Merhaba arkadaşlar, sağlam casino siteleri bulmak istiyorsanız, hazırladığımız listeye mutlaka göz atın. En iyi firmaları ve fırsatları sizin için inceledik. Güvenli oyun için doğru adres: casino siteleri 2026 bol şanslar.

synthetic hormone definition

References:

https://justpin.date/story.php?title=testosterone-therapy-potential-benefits-and-risks-as-you-age

Online slot oynamak isteyenler için kılavuz niteliğinde bir site: https://cassiteleri.us.org/# güvenilir casino siteleri Hangi site güvenilir diye düşünmeyin. Editörlerimizin seçtiği casino siteleri listesi ile rahatça oynayın. Detaylar linkte.

Bu sene popüler olan casino siteleri hangileri? Detaylı liste web sitemizde mevcuttur. Deneme bonusu veren siteleri ve yeni adres linklerini paylaşıyoruz. Hemen tıklayın [url=https://cassiteleri.us.org/#]mobil ödeme bahis[/url] fırsatı kaçırmayın.

Bu sene popüler olan casino siteleri hangileri? Cevabı web sitemizde mevcuttur. Bedava bahis veren siteleri ve yeni adres linklerini paylaşıyoruz. İncelemek için [url=https://cassiteleri.us.org/#]siteyi incele[/url] fırsatı kaçırmayın.

Pin-Up AZ ölkəmizdə ən populyar platformadır. Burada minlərlə oyun və canlı dilerlər var. Qazancı kartınıza tez köçürürlər. Proqramı də var, telefondan oynamaq çox rahatdır. Rəsmi sayt [url=https://pinupaz.jp.net/#]Pin Up online[/url] tövsiyə edirəm.

Canlı casino oynamak isteyenler için kılavuz niteliğinde bir site: https://cassiteleri.us.org/# kaçak bahis siteleri Hangi site güvenilir diye düşünmeyin. Editörlerimizin seçtiği bahis siteleri listesi ile sorunsuz oynayın. Tüm liste linkte.

Pin-Up AZ ölkəmizdə ən populyar platformadır. Burada çoxlu slotlar və canlı dilerlər var. Qazancı kartınıza tez köçürürlər. Proqramı də var, telefondan oynamaq çox rahatdır. Rəsmi sayt Pin Up rəsmi sayt baxın.

Hər vaxtınız xeyir, əgər siz etibarlı kazino axtarırsınızsa, məsləhətdir ki, Pin Up saytını yoxlayasınız. Yüksək əmsallar və sürətli ödənişlər burada mövcuddur. Qeydiyyatdan keçin və bonus qazanın. Daxil olmaq üçün link: https://pinupaz.jp.net/# Pin Up uğurlar hər kəsə!

Pin Up Casino ölkəmizdə ən populyar kazino saytıdır. Saytda çoxlu slotlar və canlı dilerlər var. Pulu kartınıza anında köçürürlər. Mobil tətbiqi də var, telefondan oynamaq çox rahatdır. Rəsmi sayt https://pinupaz.jp.net/# pinupaz.jp.net tövsiyə edirəm.

Pin Up Casino Azərbaycanda ən populyar kazino saytıdır. Saytda minlərlə oyun və Aviator var. Pulu kartınıza anında köçürürlər. Proqramı də var, telefondan oynamaq çox rahatdır. Giriş linki https://pinupaz.jp.net/# burada baxın.

Bonaslot adalah agen judi slot online nomor 1 di Indonesia. Banyak member sudah mendapatkan Maxwin sensasional disini. Transaksi super cepat hanya hitungan menit. Link alternatif bonaslotind.us.com jangan sampai ketinggalan.

Pin Up Casino ölkəmizdə ən populyar kazino saytıdır. Burada minlərlə oyun və canlı dilerlər var. Qazancı kartınıza anında köçürürlər. Proqramı də var, telefondan oynamaq çox rahatdır. Giriş linki rəsmi sayt baxın.

Hey there, Just now ran into a trusted website for affordable pills. If you are tired of high prices and want cheap antibiotics, this site is worth checking out. Great prices plus it is safe. Take a look: https://pharm.mex.com/#. Have a nice day.

Hey everyone, I just found an excellent website to order medications hassle-free. For those who need safe pharmacy delivery, this site is very good. They ship globally and no script needed. Visit here: visit website. Thank you.

Hi all, Just now found an amazing source from India for cheap meds. If you want to buy cheap antibiotics without prescription, this store is highly recommended. It has secure delivery guaranteed. Check it out: check availability. Best regards.

Greetings, I just found an excellent online drugstore to order medications securely. If you are looking for cheap meds, this site is very good. Great prices and no script needed. Visit here: online pharmacy usa. Have a good one.

Hi guys, I recently found an awesome resource for affordable pills. If you are tired of high prices and need generic drugs, this store is worth checking out. No prescription needed plus it is safe. Visit here: [url=https://pharm.mex.com/#]visit website[/url]. All the best.

Greetings, I wanted to share an excellent online drugstore for purchasing prescription drugs online. If you need cheap meds, OnlinePharm is highly recommended. They ship globally plus it is very affordable. Visit here: online pharmacy no prescription. Hope this helps!

Greetings, I recently came across a useful Indian pharmacy for cheap meds. If you need generic pills without prescription, this store is very reliable. It has wholesale rates worldwide. Check it out: check availability. Cheers.

Hello, To be honest, I found a useful source for meds where you can buy pills online. If you are looking for cheap meds, OnlinePharm is very good. Great prices plus huge selection. Check it out: [url=https://onlinepharm.jp.net/#]Online Pharm Store[/url]. Best wishes.

To be honest, I recently discovered a useful website for cheap meds. If you want to buy ED meds cheaply, IndiaPharm is worth checking. It has wholesale rates worldwide. More info here: [url=https://indiapharm.in.net/#]indian pharmacy[/url]. Good luck.

Hello, To be honest, I found a useful online drugstore for purchasing pills securely. If you need safe pharmacy delivery, this store is worth a look. Fast delivery plus huge selection. Visit here: https://onlinepharm.jp.net/#. Good luck!

To be honest, Lately discovered the best Indian pharmacy for cheap meds. If you want to buy ED meds without prescription, IndiaPharm is worth checking. It has lowest prices to USA. Check it out: visit website. Best regards.

Hey there, I recently ran into an awesome online source to buy medication. If you are tired of high prices and need meds from Mexico, this store is the best option. No prescription needed and secure. Take a look: https://pharm.mex.com/#. Kind regards.

Hey there, I just found a reliable source for meds for purchasing prescription drugs online. For those who need antibiotics, this site is worth a look. Secure shipping plus huge selection. Check it out: click here. Hope it helps.

Hi all, I just stumbled upon an amazing website for cheap meds. If you want to buy medicines from India without prescription, this site is the best place. You get lowest prices guaranteed. Take a look: https://indiapharm.in.net/#. Hope it helps.

Greetings, To be honest, I found a great international pharmacy for purchasing pills cheaply. If you need safe pharmacy delivery, this store is very good. Great prices and it is very affordable. Link here: [url=https://onlinepharm.jp.net/#]this site[/url]. Regards.

To be honest, I just discovered a great Mexican pharmacy to save on Rx. For those seeking and want generic drugs, Pharm Mex is a game changer. Great prices and it is safe. Link is here: https://pharm.mex.com/#. All the best.

Hey there, I wanted to share a great source for meds for purchasing pills online. For those who need safe pharmacy delivery, OnlinePharm is the best choice. Secure shipping and huge selection. See for yourself: Online Pharm Store. Thank you.

Greetings, I just found an amazing online drugstore to buy generics. For those looking for cheap antibiotics without prescription, this store is the best place. You get wholesale rates worldwide. Visit here: indian pharmacy online. Good luck.

oral dianabol for sale

References:

https://postheaven.net/toothbugle35/11-best-natural-supplements-for-testosterone-support

Hey everyone, I recently discovered a great international pharmacy for purchasing pills hassle-free. If you are looking for safe pharmacy delivery, this store is highly recommended. Secure shipping and it is very affordable. Visit here: [url=https://onlinepharm.jp.net/#]international pharmacy online[/url]. Stay safe.

Hey there, I recently came across a reliable website to save on Rx. For those seeking and want cheap antibiotics, Pharm Mex is the best option. Fast shipping and secure. Link is here: [url=https://pharm.mex.com/#]buy meds from mexico[/url]. Take care.

Hey there, To be honest, I found an excellent website for purchasing generics online. For those who need antibiotics, this site is the best choice. They ship globally plus huge selection. Link here: https://onlinepharm.jp.net/#. Have a nice day.

Hi guys, Just now came across a trusted Mexican pharmacy for cheap meds. If you want to save money and want generic drugs, this store is the best option. Fast shipping and very reliable. Visit here: [url=https://pharm.mex.com/#]check availability[/url]. Have a nice day.

Hey there, I wanted to share a reliable international pharmacy to order generics securely. For those who need safe pharmacy delivery, this store is the best choice. Great prices plus no script needed. Check it out: [url=https://onlinepharm.jp.net/#]online pharmacy no prescription[/url]. Hope this was useful.

To be honest, Lately ran into a trusted website to save on Rx. For those seeking and want meds from Mexico, Pharm Mex is the best option. Great prices plus it is safe. Check it out: [url=https://pharm.mex.com/#]this site[/url]. Sincerely.

Greetings, Just now found the best source from India to buy generics. For those looking for medicines from India cheaply, this store is the best place. You get wholesale rates guaranteed. More info here: indian pharmacy online. Hope it helps.

Hello, To be honest, I found an excellent online drugstore to order generics securely. For those who need cheap meds, this store is the best choice. They ship globally and huge selection. See for yourself: read more. Thx.

References:

Test enanthate and anavar cycle before and after

References:

https://nephila.org/members/queenbottom16/activity/1126327/

References:

Anavar dosage for women before and after pics

References:

https://aryba.kg/user/jumpgrill0/

Hey guys, Lately discovered a useful website to buy generics. If you need medicines from India safely, this store is very reliable. You get lowest prices to USA. Take a look: [url=https://indiapharm.in.net/#]read more[/url]. Cheers.

Greetings, I wanted to share a reliable international pharmacy to order generics securely. If you need safe pharmacy delivery, this site is the best choice. Great prices plus no script needed. Visit here: https://onlinepharm.jp.net/#. Thank you.

To be honest, Lately came across a great Mexican pharmacy to save on Rx. For those seeking and want generic drugs, this store is worth checking out. No prescription needed and very reliable. Link is here: cheap antibiotics mexico. Stay healthy.

Hello, I recently discovered a useful website to order generics securely. For those who need safe pharmacy delivery, OnlinePharm is highly recommended. Fast delivery plus no script needed. Visit here: [url=https://onlinepharm.jp.net/#]onlinepharm.jp.net[/url]. Warmly.

Hi, I recently discovered an excellent website where you can buy generics cheaply. If you need safe pharmacy delivery, OnlinePharm is the best choice. Fast delivery plus it is very affordable. Link here: online pharmacy no prescription. Warmly.

Hello everyone, Just now found a great Mexican pharmacy for cheap meds. If you want to save money and want affordable prescriptions, this store is the best option. Great prices plus very reliable. Take a look: [url=https://pharm.mex.com/#]read more[/url]. Best regards.

Hello, To be honest, I found an excellent website for purchasing pills hassle-free. If you are looking for antibiotics, this site is the best choice. Secure shipping plus it is very affordable. Check it out: https://onlinepharm.jp.net/#. Thank you.

To be honest, I recently stumbled upon an amazing online drugstore to save on Rx. If you want to buy cheap antibiotics cheaply, IndiaPharm is highly recommended. You get wholesale rates to USA. Take a look: [url=https://indiapharm.in.net/#]buy meds from india[/url]. Hope it helps.

Hey there, I just found an excellent online drugstore where you can buy prescription drugs securely. If you are looking for no prescription drugs, this store is worth a look. Great prices plus huge selection. Link here: https://onlinepharm.jp.net/#. Many thanks.

Hey guys, Just now found a useful website for affordable pills. If you need cheap antibiotics at factory prices, this site is the best place. You get wholesale rates guaranteed. More info here: https://indiapharm.in.net/#. Best regards.

Hey everyone, To be honest, I found an excellent source for meds where you can buy pills online. If you need no prescription drugs, this store is worth a look. Fast delivery plus no script needed. Check it out: [url=https://onlinepharm.jp.net/#]Trust Pharmacy online[/url]. Best regards.

Greetings, I just ran into a reliable resource for affordable pills. For those seeking and want generic drugs, this site is a game changer. No prescription needed and it is safe. Check it out: https://pharm.mex.com/#. Sincerely.

Hey there, I recently discovered an awesome Mexican pharmacy for cheap meds. If you are tired of high prices and need meds from Mexico, this site is the best option. No prescription needed plus very reliable. Check it out: Pharm Mex. Stay healthy.

Greetings, I just found a useful website for purchasing generics securely. For those who need cheap meds, this site is worth a look. Secure shipping and no script needed. Link here: https://onlinepharm.jp.net/#. Hope this was useful.

References:

Before and after anavar cycle pics

References:

https://saveyoursite.date/story.php?title=anavar-cycle-guide-safe-dosage-best-results-2025

References:

Should i take anavar before or after workout

References:

https://dumpmurphy.us/members/fridayhelp3/activity/5773/

Hey guys, Just now found a great Indian pharmacy to buy generics. If you need ED meds at factory prices, this store is worth checking. They offer secure delivery guaranteed. Visit here: click here. Cheers.

Greetings, I just found a reliable source for meds where you can buy generics hassle-free. If you need cheap meds, OnlinePharm is very good. Secure shipping plus huge selection. Visit here: click here. I hope you find what you need.

To be honest, I recently stumbled upon a useful Indian pharmacy to save on Rx. If you want to buy generic pills without prescription, this store is highly recommended. You get wholesale rates worldwide. Take a look: https://indiapharm.in.net/#. Good luck.

safest steroids for bulking

References:

https://bookmarking.win/story.php?title=los-mejores-quemagrasas-que-realmente-funcionan

Hello, I just found a great Indian pharmacy to buy generics. If you need medicines from India at factory prices, IndiaPharm is the best place. They offer secure delivery worldwide. More info here: click here. Cheers.

Greetings, I recently came across an awesome resource for cheap meds. If you are tired of high prices and want generic drugs, Pharm Mex is worth checking out. They ship to USA plus secure. Take a look: click here. Many thanks.

steroids for weight lifting

References:

https://output.jsbin.com/vijahobope/

Hello everyone, I recently ran into a trusted resource for cheap meds. For those seeking and want affordable prescriptions, Pharm Mex is highly recommended. No prescription needed plus very reliable. Visit here: click here. Best regards.

buy legal steriods

References:

https://googlino.com/members/coughcat0/activity/535305/

Hi all, Lately stumbled upon a great source from India to save on Rx. If you want to buy generic pills cheaply, IndiaPharm is highly recommended. It has fast shipping guaranteed. Take a look: [url=https://indiapharm.in.net/#]indian pharmacy[/url]. Hope it helps.

Greetings, Just now ran into an awesome online source to save on Rx. For those seeking and need meds from Mexico, Pharm Mex is highly recommended. They ship to USA and very reliable. Visit here: Pharm Mex Store. Best wishes.

Hello everyone, Lately found a reliable Mexican pharmacy for affordable pills. If you want to save money and want generic drugs, Pharm Mex is the best option. Fast shipping and it is safe. Link is here: [url=https://pharm.mex.com/#]click here[/url]. Thanks!

Hey guys, Lately stumbled upon the best source from India to save on Rx. For those looking for generic pills safely, this site is the best place. It has secure delivery worldwide. Take a look: https://indiapharm.in.net/#. Good luck.

Hello everyone, I just discovered a great resource to buy medication. If you are tired of high prices and want meds from Mexico, this site is a game changer. No prescription needed and secure. Visit here: Pharm Mex Store. Best wishes.

Hello, I recently found the best online drugstore to save on Rx. For those looking for ED meds without prescription, this store is highly recommended. It has secure delivery worldwide. Visit here: [url=https://indiapharm.in.net/#]check availability[/url]. Hope it helps.

Hi all, I recently found the best source from India for cheap meds. For those looking for medicines from India safely, IndiaPharm is highly recommended. You get fast shipping worldwide. More info here: [url=https://indiapharm.in.net/#]indian pharmacy online[/url]. Hope it helps.

Hello, I recently discovered a useful online drugstore for affordable pills. If you want to buy ED meds safely, this site is highly recommended. You get fast shipping guaranteed. Check it out: read more. Good luck.

Hey there, I recently ran into a reliable Mexican pharmacy to save on Rx. For those seeking and need cheap antibiotics, this site is worth checking out. Great prices and secure. Visit here: mexican pharmacy online. Best regards.

Herkese selam, Casibom sitesi üyeleri için önemli bir duyuru paylaşıyorum. Bildiğiniz gibi bahis platformu giriş linkini BTK engeli yüzünden tekrar güncelledi. Giriş hatası çekenler için çözüm burada. Güncel Casibom giriş linki artık burada Casibom Giriş Paylaştığım bağlantı üzerinden doğrudan siteye bağlanabilirsiniz. Ayrıca yeni üyelere verilen yatırım bonusu fırsatlarını mutlaka kaçırmayın. Güvenilir bahis keyfi sürdürmek için Casibom doğru adres. Herkese bol kazançlar dilerim.

Bahis severler selam, bu populer site uyeleri ad?na k?sa bir paylas?m paylas?yorum. Bildiginiz gibi Casibom domain adresini erisim k?s?tlamas? nedeniyle tekrar guncelledi. Siteye ulas?m hatas? varsa cozum burada. Cal?san Casibom giris baglant?s? su an burada [url=https://casibom.mex.com/#]Casibom Apk[/url] Bu link uzerinden vpn kullanmadan hesab?n?za erisebilirsiniz. Ek olarak yeni uyelere verilen hosgeldin bonusu f?rsatlar?n? da kac?rmay?n. Lisansl? bahis keyfi surdurmek icin Casibom dogru adres. Tum forum uyelerine bol sans dilerim.

Grandpasha guncel linki laz?msa dogru yerdesiniz. Sorunsuz giris yapmak icin Grandpashabet Sorunsuz Giris Yuksek oranlar burada.

Gençler, Grandpashabet son linki açıklandı. Adresi bulamayanlar buradan devam edebilir Grandpashabet Giriş

Grandpasha güncel linki arıyorsanız doğru yerdesiniz. Sorunsuz erişim için tıkla Grandpashabet Apk Yüksek oranlar bu sitede.

Grandpasha guncel linki laz?msa iste burada. H?zl? erisim icin [url=https://grandpashabet.in.net/#]Resmi Site[/url] Deneme bonusu burada.

Matbet TV giriş linki arıyorsanız doğru yerdesiniz. Maç izlemek için: https://matbet.jp.net/# Canlı maçlar burada. Arkadaşlar, Matbet son linki açıklandı.

Bahis severler selam, Casibom kullan?c?lar? ad?na k?sa bir bilgilendirme paylas?yorum. Herkesin bildigi uzere site adresini erisim k?s?tlamas? nedeniyle surekli degistirdi. Giris problemi yas?yorsan?z dogru yerdesiniz. Resmi Casibom giris baglant?s? su an asag?dad?r [url=https://casibom.mex.com/#]Casibom 2026[/url] Bu link uzerinden vpn kullanmadan hesab?n?za baglanabilirsiniz. Ayr?ca yeni uyelere sunulan yat?r?m bonusu kampanyalar?n? mutlaka kac?rmay?n. Lisansl? bahis deneyimi surdurmek icin Casibom tercih edebilirsiniz. Tum forum uyelerine bol kazanclar dilerim.

Matbet TV giris adresi laz?msa dogru yerdesiniz. Mac izlemek icin t?kla: Siteye Git Yuksek oranlar burada. Gencler, Matbet bahis yeni adresi belli oldu.

Herkese selam, Casibom kullanıcıları için önemli bir bilgilendirme yapmak istiyorum. Bildiğiniz gibi site domain adresini erişim kısıtlaması nedeniyle sürekli güncelledi. Siteye ulaşım sorunu varsa çözüm burada. Resmi Casibom güncel giriş linki artık burada [url=https://casibom.mex.com/#]Casibom Twitter[/url] Paylaştığım bağlantı üzerinden direkt siteye erişebilirsiniz. Ayrıca kayıt olanlara sunulan yatırım bonusu kampanyalarını mutlaka inceleyin. Lisanslı casino deneyimi için Casibom doğru adres. Tüm forum üyelerine bol kazançlar dilerim.

Arkadaşlar selam, Vay Casino oyuncuları adına önemli bir duyuru paylaşıyorum. Bildiğiniz gibi site adresini tekrar güncelledi. Giriş sorunu yaşıyorsanız endişe etmeyin. Çalışan siteye erişim linki şu an aşağıdadır: Vay Casino Güvenilir mi Bu link üzerinden direkt siteye erişebilirsiniz. Lisanslı bahis keyfi sürdürmek için Vay Casino doğru adres. Tüm forum üyelerine bol kazançlar dilerim.

Arkadaslar selam, bu populer site uyeleri ad?na k?sa bir duyuru paylas?yorum. Bildiginiz gibi Casibom giris linkini BTK engeli yuzunden surekli tas?d?. Giris problemi cekenler icin link asag?da. Son siteye erisim adresi art?k asag?dad?r Casibom Bonus Bu link uzerinden dogrudan hesab?n?za erisebilirsiniz. Ek olarak yeni uyelere verilen yat?r?m bonusu f?rsatlar?n? da inceleyin. Lisansl? slot deneyimi icin Casibom dogru adres. Herkese bol sans dilerim.

Grandpashabet guncel linki ar?yorsan?z dogru yerdesiniz. H?zl? erisim icin t?kla [url=https://grandpashabet.in.net/#]Grandpashabet 2026[/url] Yuksek oranlar burada.

Grandpashabet giriş adresi lazımsa işte burada. Sorunsuz erişim için tıkla [url=https://grandpashabet.in.net/#]Grandpashabet Bonus[/url] Yüksek oranlar burada.

Matbet TV giris adresi laz?msa dogru yerdesiniz. Mac izlemek icin t?kla: https://matbet.jp.net/# Yuksek oranlar burada. Arkadaslar, Matbet bahis yeni adresi ac?kland?.

Gençler, Grandpashabet son linki açıklandı. Adresi bulamayanlar şu linkten giriş yapabilir Grandpashabet Bonus

Matbet giris adresi ar?yorsan?z iste burada. H?zl? icin t?kla: T?kla Git Canl? maclar burada. Gencler, Matbet son linki ac?kland?.

Arkadaslar, Grandpashabet Casino son linki belli oldu. Adresi bulamayanlar buradan giris yapabilir [url=https://grandpashabet.in.net/#]Grandpashabet Indir[/url]

Herkese selam, Casibom sitesi kullanıcıları adına önemli bir bilgilendirme yapmak istiyorum. Herkesin bildiği üzere bahis platformu giriş linkini BTK engeli yüzünden yine güncelledi. Giriş hatası çekenler için link aşağıda. Yeni siteye erişim adresi şu an paylaşıyorum https://casibom.mex.com/# Bu link üzerinden vpn kullanmadan siteye girebilirsiniz. Ek olarak yeni üyelere verilen freespin kampanyalarını da inceleyin. En iyi bahis deneyimi sürdürmek için Casibom doğru adres. Tüm forum üyelerine bol şans dilerim.

Herkese selam, Vay Casino oyuncular? ad?na k?sa bir duyuru paylas?yorum. Malum platform adresini tekrar guncelledi. Erisim hatas? varsa panik yapmay?n. Son siteye erisim adresi su an burada: https://vaycasino.us.com/# Paylast?g?m baglant? ile vpn kullanmadan hesab?n?za erisebilirsiniz. Guvenilir bahis keyfi surdurmek icin Vay Casino tercih edebilirsiniz. Herkese bol sans temenni ederim.

References:

Casino duisburg permanenzen

References:

http://lideritv.ge/user/bronzebrow9/

Dostlar selam, Vay Casino kullanıcıları adına önemli bir duyuru paylaşıyorum. Malum platform adresini yine değiştirdi. Erişim sorunu yaşıyorsanız panik yapmayın. Son Vay Casino giriş linki artık burada: Vaycasino Üyelik Bu link ile vpn kullanmadan hesabınıza girebilirsiniz. Güvenilir bahis deneyimi için Vay Casino doğru adres. Tüm forum üyelerine bol şans dilerim.

References:

Grand falls casino

References:

http://okprint.kz/user/maskroom5/

Herkese selam, Vay Casino kullan?c?lar? icin k?sa bir duyuru yapmak istiyorum. Bildiginiz gibi platform adresini yine guncelledi. Erisim sorunu yas?yorsan?z panik yapmay?n. Son siteye erisim adresi su an burada: https://vaycasino.us.com/# Bu link ile vpn kullanmadan siteye girebilirsiniz. Guvenilir casino deneyimi surdurmek icin Vay Casino dogru adres. Herkese bol kazanclar temenni ederim.

References:

Slots games download

References:

http://mozillabd.science/index.php?title=sampanedge8

Grandpashabet güncel adresi arıyorsanız doğru yerdesiniz. Hızlı erişim için [url=https://grandpashabet.in.net/#]Grandpashabet Kayıt[/url] Deneme bonusu burada.

References:

Mount airy casino

References:

https://u.to/JEtzIg

Herkese merhaba, Vay Casino oyuncular? icin k?sa bir duyuru yapmak istiyorum. Malum site adresini tekrar guncelledi. Erisim sorunu yas?yorsan?z panik yapmay?n. Cal?san Vaycasino giris adresi art?k burada: Vaycasino Bonus Paylast?g?m baglant? uzerinden vpn kullanmadan siteye girebilirsiniz. Guvenilir casino keyfi surdurmek icin Vay Casino tercih edebilirsiniz. Tum forum uyelerine bol sans temenni ederim.

References:

Slot machine download

References:

https://imoodle.win/wiki/Candy96_Casino_20_Free_Spins_No_Deposit_Online_Engagement_for_Australia

Herkese merhaba, bu site oyuncular? ad?na onemli bir duyuru paylas?yorum. Bildiginiz gibi Vaycasino giris linkini tekrar degistirdi. Giris sorunu yas?yorsan?z endise etmeyin. Yeni siteye erisim linki su an burada: Vay Casino Bu link ile direkt hesab?n?za girebilirsiniz. Guvenilir casino keyfi surdurmek icin Vay Casino tercih edebilirsiniz. Herkese bol sans temenni ederim.

References:

Fairmont le manoir richelieu

References:

http://downarchive.org/user/stockbelt7/

Grandpashabet giriş linki lazımsa işte burada. Sorunsuz giriş yapmak için tıkla Grandpashabet Kayıt Deneme bonusu bu sitede.

Arkadaslar, Grandpashabet Casino yeni adresi belli oldu. Giremeyenler su linkten devam edebilir Grandpashabet

References:

Play online blackjack

References:

https://molchanovonews.ru/user/eastyard71/

References:

Prairie band casino

References:

https://www.divephotoguide.com/user/nylonthing4

References:

Roulette layout

References:

https://mozillabd.science/wiki/Descarga_el_APK_en_Uptodown

Gençler, Grandpashabet Casino son linki belli oldu. Adresi bulamayanlar şu linkten giriş yapabilir [url=https://grandpashabet.in.net/#]Grandpashabet 2026[/url]

Grandpashabet giris adresi laz?msa iste burada. H?zl? giris yapmak icin t?kla https://grandpashabet.in.net/# Yuksek oranlar bu sitede.

References:

Casino online

References:

https://md.ctdo.de/s/1tJFk-2xeI

best tren cycle for bulking

References:

https://historydb.date/wiki/N1_Appetitzgler_Kapseln_forte_apotal_de_Ihre_Versandapotheke

%random_anchor_text%

References:

https://justbookmark.win/story.php?title=how-to-buy-medicines-safely-from-an-online-pharmacy

online roids.com

References:

https://roberson-rosendahl-3.mdwrite.net/10-best-natural-testosterone-boosters-for-men-science-backed-supplements-and-lifestyle-changes

%random_anchor_text%

References:

https://farmsolutionsja.com/members/jutefifth18/activity/21041/

Grandpashabet guncel adresi laz?msa iste burada. H?zl? erisim icin t?kla Grandpashabet Uyelik Deneme bonusu bu sitede.

ibuysteroids

References:

https://pad.geolab.space/s/4ySRl_dNYq

xtreme muscle pro reviews

References:

https://ai-db.science/wiki/Testosteron_mit_Medikamenten_steigern

how do steroids affect your body

References:

https://livebookmark.stream/story.php?title=testosteron-kaufen-so-geht-es-ohne-rezept

steroid effects on females

References:

https://bookmarkspot.win/story.php?title=lll-abnehmpillen-schlankheitsmittel-im-test-und-vergleich

Hello m?i ngu?i, ngu?i anh em nao c?n nha cai uy tin d? gi?i tri Game bai thi tham kh?o con hang nay. Dang co khuy?n mai: https://homemaker.org.in/#. Chi?n th?ng nhe.

steroids before after

References:

https://hack.allmende.io/s/0MuQL-VaE

Hi cac bac, ai dang tim nha cai uy tin d? cay cu?c Game bai thi xem th? ch? nay. N?p rut 1-1: [url=https://gramodayalawcollege.org.in/#]Dola789 dang nh?p[/url]. Chuc cac bac r?c r?.

References:

Roxy palace mobile

References:

https://hikvisiondb.webcam/wiki/Live_Dealer_Casino_Games_at_Candy96_RealTime_Blackjack_Roulette_More

References:

Craps online

References:

https://bandori.party/user/384369/sugarafrica6/

References:

Sky vegas slots

References:

https://hack.allmende.io/s/2nyNvL8G2

References:

Casino la toja

References:

https://md.swk-web.com/s/hq4wAolqR

Hi cac bac, ngu?i anh em nao c?n san choi d?ng c?p d? cay cu?c Game bai thi xem th? trang nay nhe. Dang co khuy?n mai: Nha cai Dola789. Chi?n th?ng nhe.

References:

Brantford casino poker

References:

https://fakenews.win/wiki/Candy_Casino_Review_Expert_Player_Ratings_2026

References:

Play roulette for fun

References:

https://hangoutshelp.net/user/cymbalground3

Chao anh em, n?u anh em dang ki?m san choi d?ng c?p d? g? g?c Game bai thi tham kh?o con hang nay. Uy tin luon: Dola789. V? b? thanh cong.

Chào anh em, người anh em nào cần cổng game không bị chặn để gỡ gạc Tài Xỉu thì vào ngay trang này nhé. Không lo lừa đảo: [url=https://gramodayalawcollege.org.in/#]Dola789[/url]. Chúc các bác rực rỡ.

built mass phase 2 prohormone

References:

https://www.bandsworksconcerts.info:443/index.php?bearnic22

extreme steroids

References:

http://king-wifi.win//index.php?title=hussainthaysen4870

Chào cả nhà, bác nào muốn tìm nhà cái uy tín để chơi Casino thì vào ngay trang này nhé. Uy tín luôn: https://homemaker.org.in/#. Húp lộc đầy nhà.

Xin chao 500 anh em, n?u anh em dang ki?m trang choi xanh chin d? g? g?c Tai X?u thi xem th? ch? nay. T?c d? ban th?: Nha cai Dola789. Chi?n th?ng nhe.

top rated pre workout 2016

References:

https://arcatalanternfloatingceremony.org/members/alloyuncle78/activity/241164/

test and tren cycle

References:

https://botdb.win/wiki/7_modi_per_aumentare_il_testosterone_naturalmente

Hi các bác, bác nào muốn tìm chỗ nạp rút nhanh để gỡ gạc Đá Gà thì tham khảo địa chỉ này. Tốc độ bàn thờ: Link vào BJ88. Về bờ thành công.

where to get clomid price: fertility pct guide – fertility pct guide

fertility pct guide [url=https://fertilitypctguide.us.com/#]how to get clomid without rx[/url] generic clomid without dr prescription

stromectol order: Iver Protocols Guide – stromectol 3mg

Iver Protocols Guide: ivermectin australia – buy stromectol uk

fertility pct guide [url=https://fertilitypctguide.us.com/#]fertility pct guide[/url] can you buy cheap clomid now

fertility pct guide: fertility pct guide – fertility pct guide

https://amitrip.us.com/# AmiTrip Relief Store

Iver Protocols Guide: Iver Protocols Guide – ivermectin lotion price

https://follicle.us.com/# order propecia pills

References:

Grand casino coushatta

References:

http://gojourney.xsrv.jp/index.php?spidershears3

where to get cheap clomid prices: fertility pct guide – fertility pct guide

buying cheap propecia without prescription [url=https://follicle.us.com/#]get propecia without dr prescription[/url] Follicle Insight

https://iver.us.com/# Iver Protocols Guide

fertility pct guide: where to buy cheap clomid without dr prescription – buy clomid

propecia without dr prescription: propecia order – cost of propecia without rx

https://iver.us.com/# ivermectin cost uk

https://amitrip.us.com/# AmiTrip Relief Store

Follicle Insight: Follicle Insight – Follicle Insight

Follicle Insight: buy cheap propecia for sale – Follicle Insight

https://fertilitypctguide.us.com/# how to get cheap clomid for sale

ivermectin 2mg [url=https://iver.us.com/#]stromectol 6 mg tablet[/url] ivermectin purchase

Iver Protocols Guide: Iver Protocols Guide – Iver Protocols Guide

https://iver.us.com/# Iver Protocols Guide

References:

Diamond jo casino northwood

References:

https://pattern-wiki.win/wiki/AdmiralBet_Online_Casino_Erfahrungen_und_Test

References:

Plenty jackpots

References:

https://www.blurb.com/user/enemyplace5

https://amitrip.us.com/# buy Elavil

Iver Protocols Guide: Iver Protocols Guide – buy ivermectin nz

Iver Protocols Guide: Iver Protocols Guide – Iver Protocols Guide

https://fertilitypctguide.us.com/# cost of clomid for sale

Amitriptyline: AmiTrip – AmiTrip Relief Store

https://fertilitypctguide.us.com/# fertility pct guide

fertility pct guide: fertility pct guide – how can i get clomid prices

buying cheap propecia [url=https://follicle.us.com/#]cost propecia without rx[/url] cost of cheap propecia now

References:

Calgary casinos

References:

https://rasch-boone-2.mdwrite.net/die-top-10-mobile-casino-apps-mit-echtgeld-spielen-2026

https://amitrip.us.com/# AmiTrip

Amitriptyline: buy Elavil – AmiTrip Relief Store

Follicle Insight: Follicle Insight – order cheap propecia tablets

https://amitrip.us.com/# Generic Elavil

https://iver.us.com/# Iver Protocols Guide

buy ivermectin for humans uk: stromectol tablets uk – Iver Protocols Guide

order cheap propecia pills: cheap propecia pills – cost generic propecia without dr prescription

fertility pct guide [url=https://fertilitypctguide.us.com/#]cost of clomid pills[/url] fertility pct guide

References:

Sky ute casino

References:

https://www.udrpsearch.com/user/rabbidesire8

https://iver.us.com/# stromectol 15 mg

https://iver.us.com/# buy stromectol canada

cost cheap propecia without dr prescription: Follicle Insight – Follicle Insight

Elavil: buy Elavil – buy Elavil

https://amitrip.us.com/# Generic Elavil

stromectol 3 mg dosage: Iver Protocols Guide – Iver Protocols Guide

fertility pct guide: fertility pct guide – where to get generic clomid without prescription

References:

Leprechaun games

References:

https://blogfreely.net/persondesire3/online-casinos-mit-5-euro-mindesteinzahlung-fur-deutsche-spieler

https://iver.us.com/# stromectol 3 mg tablets price

https://iver.us.com/# Iver Protocols Guide

Follicle Insight [url=https://follicle.us.com/#]order propecia without rx[/url] get generic propecia prices

fertility pct guide: where can i get cheap clomid for sale – buy cheap clomid price

Elavil: AmiTrip – AmiTrip Relief Store

Greetings, anyone searching for a reliable online pharmacy to buy health products cheaply. I found this pharmacy: meclizine. Selling high quality drugs and huge discounts. Cheers.

Hey everyone, if anyone needs dosage instructions about prescription drugs, I recommend this health wiki. It explains safety protocols clearly. Reference: https://magmaxhealth.com/Methotrexate. Good info.

Hi, anyone searching for a great source for meds to buy medicines cheaply. I found MagMaxHealth: allopurinol. Selling generic tablets at the best prices. Thanks.

Hello, if you are looking for dosage instructions regarding prescription drugs, take a look at this medical reference. It covers safety protocols in detail. See details: https://magmaxhealth.com/Clomid. Hope it helps.

regarding the medical specifications, please review the official information page at: https://magmaxhealth.com/clarinex.html to ensure correct administration.

To start saving, I recommend this reliable site here to order now. Get your meds today hassle-free.

Hey everyone, if you need an affordable health store to buy medicines hassle-free. Take a look at MagMaxHealth: MagMaxHealth. Selling a wide range of meds and huge discounts. Good luck.

Hey everyone, if anyone needs detailed information on common medicines, take a look at this medical reference. You can read about drug interactions in detail. Read more here: https://magmaxhealth.com/Naltrexone. Very informative.

Hi, I recently found side effects info on prescription drugs, I recommend this medical reference. You can read about usage and risks very well. See details: https://magmaxhealth.com/Meclizine. Good info.

For a trusted source, visit this service canadian pharmacy meds review for the best prices. Stop overpaying hassle-free.

For a complete overview of side effects and interactions, data is available at the medical directory at: https://magmaxhealth.com/naltrexone.html to ensure correct administration.

References:

Casino louisiana

References:

https://fakenews.win/wiki/Royal_Reels_20_Fast_Crypto_Withdrawals_PayID_Pokies

Hello, if you are looking for a useful article regarding common medicines, check out this online directory. You can read about safety protocols clearly. Reference: https://magmaxhealth.com/Prilosec. Very informative.

References:

Casinos by state

References:

https://may22.ru/user/cloudwave89/

Hey everyone, I wanted to share a trusted drugstore to buy pills securely. Take a look at MagMaxHealth: lipitor. Selling generic tablets with fast shipping. Best regards.

Hi all, if anyone needs a useful article regarding various medications, I found this useful resource. It covers drug interactions in detail. Source: https://magmaxhealth.com/Lipitor. Hope this is useful.

regarding the side effects and interactions, you can consult the detailed guide on: https://magmaxhealth.com/flonase.html for correct administration.

Greetings, if anyone needs side effects info regarding prescription drugs, take a look at this useful resource. You can read about usage and risks in detail. See details: https://magmaxhealth.com/Clarinex. Thanks.

For a complete overview of proper usage instructions, please review this resource: https://magmaxhealth.com/methotrexate.html for clinical details.

Greetings, if you are looking for a medical guide about various medications, check out this online directory. It explains how to take meds clearly. Read more here: https://magmaxhealth.com/Lipitor. Good info.

Hi guys, if you need a great drugstore to order prescription drugs cheaply. Take a look at this pharmacy: methotrexate. Selling high quality drugs with fast shipping. Best regards.

Greetings, for those searching for a useful article regarding health treatments, check out this useful resource. It covers drug interactions clearly. See details: https://magmaxhealth.com/Protonix. Very informative.

Gastro Health Monitor: prilosec dosage – omeprazole otc

Gastro Health Monitor [url=https://gastrohealthmonitor.shop/#]omeprazole brand name[/url] omeprazole over the counter

http://nauseacareus.com/# buy zofran

Gastro Health Monitor: prilosec omeprazole – buy prilosec

prilosec medication: prilosec generic – Gastro Health Monitor

zofran over the counter: Nausea Care US – buy zofran online

zofran generic: Nausea Care US – Nausea Care US

https://spasmreliefprotocols.com/# robaxin generic

https://spasmreliefprotocols.shop/# tizanidine hydrochloride

tizanidine generic: robaxin – antispasmodic medication

Gastro Health Monitor: Gastro Health Monitor – prilosec medication

tizanidine generic: Spasm Relief Protocols – muscle relaxers for back pain

Nausea Care US: Nausea Care US – Nausea Care US

https://nauseacareus.com/# generic for zofran

omeprazole brand name: omeprazole – omeprazole

buy methocarbamol [url=http://spasmreliefprotocols.com/#]buy methocarbamol without prescription[/url] п»їbest muscle relaxer

Nausea Care US: zofran over the counter – generic for zofran

Nausea Care US: zofran otc – Nausea Care US

http://nauseacareus.com/# generic for zofran

tizanidine zanaflex: methocarbamol dosing – buy methocarbamol

tizanidine muscle relaxer: Spasm Relief Protocols – buy tizanidine without prescription

ondansetron: Nausea Care US – Nausea Care US

References:

Roxy palace mobile

References:

https://doherty-key-4.technetbloggers.de/a-league-tips

zofran side effects: Nausea Care US – Nausea Care US

https://gastrohealthmonitor.shop/# omeprazole

zofran side effects: Nausea Care US – zofran dosage

buy prilosec: omeprazole over the counter – Gastro Health Monitor

buy prilosec: prilosec generic – prilosec side effects

zofran medication: buy zofran – Nausea Care US

http://nauseacareus.com/# Nausea Care US

tizanidine medication: over the counter muscle relaxers that work – buy methocarbamol

ondansetron otc: Nausea Care US – Nausea Care US

п»їbest muscle relaxer: Spasm Relief Protocols – zanaflex medication

omeprazole generic: buy prilosec – Gastro Health Monitor

robaxin generic: robaxin medication – muscle relaxant drugs

https://spasmreliefprotocols.shop/# muscle relaxers over the counter

Nausea Care US: zofran otc – Nausea Care US

Nausea Care US: zofran dosage – Nausea Care US

muscle relaxers for back pain: Spasm Relief Protocols – robaxin medication

buy zofran online: Nausea Care US – Nausea Care US

https://gastrohealthmonitor.shop/# Gastro Health Monitor

https://nauseacareus.shop/# Nausea Care US

otc muscle relaxer: muscle relaxant drugs – buy tizanidine without prescription

http://gastrohealthmonitor.com/# Gastro Health Monitor

generic zofran: Nausea Care US – ondansetron zofran

http://spasmreliefprotocols.com/# otc muscle relaxer

methocarbamol medication: methocarbamol dosing – muscle relaxer tizanidine

anabolic steroid articles

References:

https://timeoftheworld.date/wiki/Raiz_De_Tejocote_Root_Reviews_2026_Scam_or_Legit_Alert

https://gastrohealthmonitor.com/# prilosec side effects

Gastro Health Monitor: prilosec medication – prilosec medication

https://spasmreliefprotocols.com/# buy methocarbamol

http://spasmreliefprotocols.com/# methocarbamol dosing

methocarbamol dosing: Spasm Relief Protocols – methocarbamol dosing

http://gastrohealthmonitor.com/# Gastro Health Monitor

https://indogenericexport.shop/# muscle relaxers over the counter

mexican online pharmacy wegovy: BajaMed Direct – mexican pharmacies

https://usmedsoutlet.shop/# US Meds Outlet

https://usmedsoutlet.shop/# US Meds Outlet

online pharmacy india: Indo-Generic Export – buy medicines online in india

https://indogenericexport.com/# reputable indian pharmacies

http://usmedsoutlet.com/# US Meds Outlet

canada drugs online review: US Meds Outlet – indian pharmacy

http://indogenericexport.com/# best india pharmacy

http://bajameddirect.com/# order meds from mexico

Потолки в Архангельске — быстро,качественно,с гарантией.

Осуществляем проффессиональный монтаж в ванную, на кухню, в комнату, в коридор;

Подберем стильный дизайн натяжных потолков по вашему желанию;

Выполняем работы любой сложности, предлагаем большой выбор сатиновых полотен.

Приедем на замер — напишите!

Потолочные решения в ванной — любая расцветка. в Архангельском регионе — с консультацией специалиста-

[url=https://29-potolok.ru/]натяжные потолки глянцевые в архангельске высота[/url]

натяжные потолки на кухню в архангельске высота – [url=https://www.29-potolok.ru/]https://www.29-potolok.ru[/url]

[url=https://cse.google.bg/url?sa=t&url=https://29-potolok.ru/]https://www.google.co.th/url?sa=t&url=https://29-potolok.ru/[/url]

[url=http://pocherparts.de/cgi-bin/gast4.cgi/t.me/prodazha-akkauntov-ploshadka.ru/www.arus-diplom4.ru/www.zaimy-23.ru/market.html]Профессиональная установка натяжных потолков в Архангельске: быстро, качественно, с гарантией[/url] 1e4aed8

tizanidine zanaflex: muscle relaxer medication – buy tizanidine without prescription

BajaMed Direct: mexico online pharmacy – BajaMed Direct

https://bajameddirect.shop/# medicine from mexico

pharmacy website india: Indo-Generic Export – reputable indian pharmacies

https://indogenericexport.shop/# robaxin generic

how to get anavar

References:

https://ai-db.science/wiki/12_Natural_Foods_to_Boost_Testosterone

https://bajameddirect.shop/# pharmacy mexico online

BajaMed Direct: can i buy meds from mexico online – best mexican online pharmacy

US Meds Outlet: US Meds Outlet – US Meds Outlet

http://usmedsoutlet.com/# US Meds Outlet

mexico pharmacies: farmacia mexicana en chicago – mexico pet pharmacy

legitimate online pharmacies india: india pharmacy mail order – top 10 online pharmacy in india

https://usmedsoutlet.com/# canada rx pharmacy

buy prescription drugs from india: online shopping pharmacy india – indianpharmacy com

https://usmedsoutlet.com/# US Meds Outlet

top online pharmacy india: cheapest online pharmacy india – cheapest online pharmacy india

mexico pharmacy online: medication from mexico – BajaMed Direct

https://usmedsoutlet.shop/# US Meds Outlet

online pharmacy india: online pharmacy india – india online pharmacy

reputable mexican pharmacy: BajaMed Direct – BajaMed Direct

References:

Casino times

References:

https://mmcon.sakura.ne.jp:443/mmwiki/index.php?bluewriter15

US Meds Outlet: US Meds Outlet – US Meds Outlet

BajaMed Direct: farmacia online usa – BajaMed Direct

п»їlegitimate online pharmacies india: Indo-Generic Export – best online pharmacy india

https://usmedsoutlet.com/# pharmacy online

US Meds Outlet: US Meds Outlet – canadian pharmacy

https://bajameddirect.shop/# BajaMed Direct

online shopping pharmacy india: Indo-Generic Export – indianpharmacy com

mexico medicine: BajaMed Direct – BajaMed Direct

https://bajameddirect.shop/# mexico prescription online

buy medicines online in india: top online pharmacy india – reputable indian pharmacies

http://indogenericexport.com/# reputable indian pharmacies

pharmacys in mexico: BajaMed Direct – reputable mexican pharmacy

indian trail pharmacy: US Meds Outlet – the peoples pharmacy

https://indogenericexport.shop/# indian pharmacy paypal

best no prescription pharmacy: discount pharmacy – US Meds Outlet

indian pharmacy: best india pharmacy – buy prescription drugs from india

https://indogenericexport.com/# top 10 pharmacies in india

Online medicine order: Online medicine home delivery – india pharmacy

http://bajameddirect.com/# mexico online farmacia

buy medicines online in india: Indo-Generic Export – best india pharmacy

anavar water retention

References:

http://karayaz.ru/user/francelibra5/

US Meds Outlet: canadian pharmacy 365 – US Meds Outlet

https://usmedsoutlet.com/# US Meds Outlet

US Meds Outlet: list of online pharmacies – canadianpharmacymeds

mail order pharmacy india: indian pharmacy paypal – top 10 pharmacies in india

http://bajameddirect.com/# BajaMed Direct

Neuro Relief USA: Neuro Relief USA – Neuro Relief USA

https://sertralineusa.com/# generic for zoloft

neurontin 100mg cost: neurontin buy from canada – neurontin for sale online

http://ivertherapeutics.com/# Iver Therapeutics

steroid benefits

References:

https://yogaasanas.science/wiki/Low_Testosterone_In_Women_Causes_Symptoms_Treatment

https://neuroreliefusa.shop/# neurontin buy online

Neuro Relief USA: Neuro Relief USA – cheap neurontin

muscle builder supplements gnc

References:

https://securityholes.science/wiki/Buy_Dianabol_Methandienone_Online_Lab_Tested_99_Purity

http://ivertherapeutics.com/# Iver Therapeutics

Neuro Relief USA: Neuro Relief USA – Neuro Relief USA

what are the disadvantages and side effects of cortisone injections

References:

https://freebookmarkstore.win/story.php?title=buy-injectable-stanozolol-50mg

https://neuroreliefusa.com/# medicine neurontin capsules

zoloft generic: zoloft generic – zoloft without rx

https://neuroreliefusa.shop/# Neuro Relief USA

Iver Therapeutics: Iver Therapeutics – Iver Therapeutics

http://ivertherapeutics.com/# ivermectin syrup

zoloft no prescription: generic zoloft – zoloft buy

https://sertralineusa.com/# zoloft cheap

no script pharmacy: Smart GenRx USA – online canadian pharmacy coupon

https://smartgenrxusa.com/# Smart GenRx USA

zoloft without dr prescription [url=https://sertralineusa.com/#]order zoloft[/url] zoloft no prescription

generic for zoloft: zoloft medication – order zoloft

http://ivertherapeutics.com/# Iver Therapeutics

«Инсис» в Екатеринбурге предлагают:

• пакет из 150+ ТВ каналов;

• бесплатный монтаж оборудования;

• Подбор оптимального сочетания интернета и ТВ под ваши задачи;

• Проверку инфраструктуры по вашему адресу.

[url=https://insis-internet-podkluchit.ru/]тарифы инсис для компьютерного интернета[/url]

insis интернет проверить адрес – [url=http://www.insis-internet-podkluchit.ru]https://www.insis-internet-podkluchit.ru[/url]

[url=https://toolbarqueries.google.gp/url?q=https://insis-internet-podkluchit.ru/]http://alt1.toolbarqueries.google.kz/url?q=https://insis-internet-podkluchit.ru/[/url]

[url=http://www2.saganet.ne.jp/cgi-bin/hatto/board/wwwboard.pl/www.pelsh.forum24.ru/www.rf-lifting-moskva.ru]Домашний интернет и ТВ от «Инсис» в Екатеринбурге[/url] c94f6_a

purchase neurontin online: neurontin 300 mg coupon – neurontin 100 mg cost

https://ivertherapeutics.shop/# price of ivermectin

generic neurontin 600 mg: Neuro Relief USA – neurontin from canada

side effects of anabolic steroids

References:

https://socialbookmark.stream/story.php?title=comprehensive-guide-to-safely-purchasing-and-using-winstrol-stanozolol-8

ivermectin pills human [url=https://ivertherapeutics.shop/#]Iver Therapeutics[/url] ivermectin rx

«СибСети» в Красноярске предлагают:

• пакет из 150+ ТВ каналов;

• Комплексный анализ скорости соединения в вашем доме

• Определение оптимального пакета услуг под ваши задачи

• Проверку возможности подключения по вашему адресу

• Профессиональную установку оборудования

• Фиксированные тарифы на весь срок обслуживания

[url=internet-sibirskie-seti.ru/krasnoyarsk]сибсети интернет[/url]

сибирские сети интернет плюс тв – [url=https://www.internet-sibirskie-seti.ru]http://internet-sibirskie-seti.ru/krasnoyarsk[/url]

[url=http://maps.google.com.tw/url?sa=t&url=https://internet-sibirskie-seti.ru/krasnoyarsk]https://clients1.google.ac/url?q=https://internet-sibirskie-seti.ru/krasnoyarsk[/url]

[url=http://nick263.la.coocan.jp/TeamCaffeine/wwwboard.cgi/kraken2trfqodidvlh4a37cpzfrhdlfldhve5nf7njhumwr7instad.info]Домашний интернет и ТВ от «СибСети» в вашем доме[/url] d813774

«Field Fit» предоставляет:

• футболки из быстросохнущей ткани;

• привлекательные цены и скидки до 50-60%;

• Определение оптимального набора под ваш клуб и бюджет;

• Проверку ассортимента в нужной категории.

[url=https://futbolnaya-forma-fieldfit.ru/]футбольная форма[/url]

футбольная форма клубов – [url=https://www.futbolnaya-forma-fieldfit.ru]http://www.futbolnaya-forma-fieldfit.ru/[/url]

[url=https://images.google.mv/url?sa=t&url=https://futbolnaya-forma-fieldfit.ru/]http://images.google.mw/url?q=https://futbolnaya-forma-fieldfit.ru/[/url]

[url=https://andangfoundation.org/bbs/board.php?bo_table=qa&wr_id=888757]Спортивная экипиров[/url] e1e4aed

ivermectin tablets: Iver Therapeutics – ivermectin 2%

https://smartgenrxusa.com/# canadian pharmacy viagra 100mg

generic for zoloft: order zoloft – zoloft cheap

https://neuroreliefusa.shop/# Neuro Relief USA

order zoloft [url=https://sertralineusa.com/#]zoloft no prescription[/url] order zoloft

Iver Therapeutics: ivermectin 6 mg tablets – Iver Therapeutics

https://sertralineusa.com/# order zoloft

buy anavar online

References:

https://wikimapia.org/external_link?url=https://ironmaiden.es/cuentaatras/pages/?como_aumentar_la_testosterona_1.html

zoloft cheap: zoloft buy – zoloft buy

https://ivertherapeutics.com/# Iver Therapeutics

order zoloft: sertraline zoloft – zoloft medication

Smart GenRx USA [url=https://smartgenrxusa.shop/#]Smart GenRx USA[/url] Smart GenRx USA

purchasing anabolic steroids online

References:

https://avery-goodwin-2.mdwrite.net/is-human-growth-hormone-dangerous-or-should-we-all-take-it

https://ivertherapeutics.shop/# Iver Therapeutics

order stromectol: Iver Therapeutics – ivermectin oral

http://sertralineusa.com/# zoloft cheap

«Зелёная точка» в Ставрополе предлагают:

• интерактивное ТВ;

• поддержки 24/7;

• Подбор оптимального пакета услуг под ваши задачи;

• Анализ технической доступности по вашему адресу.

[url=]домашний интернет зеленая точка подключен ли дом[/url]

зеленая точка подключить интернет – [url=https://zelenaya-tochka-podkluchit.ru]http://www.zelenaya-tochka-podkluchit.ru[/url]

[url=http://cse.google.cd/url?sa=i&url=https://zelenaya-tochka-podkluchit.ru]https://images.google.com.iq/url?q=https://zelenaya-tochka-podkluchit.ru[/url]

[url=http://www2.saganet.ne.jp/cgi-bin/hatto/board/wwwboard.pl/www.guryevsk.forum24.ru/www.mostbet-download-app-apk.com/www.arus-diplom21.ru/www.karniz-elektroprivodom.ru/www.1xbet-13.com]Высокоскоростной интернет и ТВ от «Зелёная точка» в вашем доме[/url] 137741f

stromectol pill: buy ivermectin pills – ivermectin 4 tablets price

«TUT-SPORT» предлагает:

• широкий выбор форм топ-клуба Арсенал;

• доставку по всей России;

• Определение оптимального комплекта экипировки под ваш клуб и бюджет;

• Анализ доступности товара по акции.

[url=https://tut-sport.ru/tovary/kluby/arsenal]футбольная форма клуба Арсенал[/url]

купить футбольную атрибутику Арсенал – [url=http://www.tut-sport.ru/tovary/kluby/arsenal]https://www.tut-sport.ru/tovary/kluby/arsenal[/url]

[url=https://clients1.google.ht/url?q=https://tut-sport.ru/tovary/kluby/arsenal]https://maps.google.be/url?q=https://tut-sport.ru/tovary/kluby/arsenal[/url]

[url=http://www2.saganet.ne.jp/cgi-bin/hatto/board/wwwboard.pl/www.chop-ohrana.com/czeny-na-uslugi-ohrany/www.superogorod.ucoz.org/forum/www.candy-casino-9.com/k.krakenwork.cc/www.frei-diplom6.ru/www.prognozy-na-futbol-10.ru/www.narkologicheskaya-klinika-28.ru/www.luchshie-digital-agencstva.ru/www.google.cg/maps.google.kg/index.html,[],[],200,65,0,1126,0,4,6,0,0,https://www.internet-sibirskie-seti.ru/,%D0%BF%D1%97%D0%85%D0%BF%D1%97%D0%85%D0%BF%D1%97%D0%85y%D0%BF%D1%97%D0%85q%D0%BF%D1%97%D0%85%D0%BF%D1%97%D0%85%D0%BF%D1%97%D0%85u%D0%BF%D1%97%D0%85%D0%BF%D1%97%D0%85%D0%BF%D1%97%D0%85y%5DОфициальная футбольная форма и аксессуары для болельщиков от «TUT-SPORT» в вашем городе[/url] aed8137

«TUT-SPORT» предоставляет:

• широкий выбор форм топ-клуба Айнтрахт;

• доставку по всей России;

• Подбор оптимального комплекта экипировки под ваш клуб и бюджет;

• Проверку наличия размеров.

[url=https://tut-sport.ru/tovary/kluby/eintracht]футбольная форма Айнтрахт купить интернет магазин[/url]

футбольная атрибутика Айнтрахт – [url=http://www.tut-sport.ru/tovary/kluby/eintracht]https://www.tut-sport.ru/tovary/kluby/eintracht[/url]

[url=http://www.google.com.do/url?q=https://tut-sport.ru/tovary/kluby/eintracht]https://www.google.com.gh/url?q=https://tut-sport.ru/tovary/kluby/eintracht[/url]

[url=http://www2.saganet.ne.jp/cgi-bin/hatto/board/wwwboard.pl/www.chop-ohrana.com/czeny-na-uslugi-ohrany/www.superogorod.ucoz.org/forum/www.candy-casino-9.com/k.krakenwork.cc/www.1xbet-16.com/www.1xbet-12.com/cse.google.com.af/index.html,[],[],200,65,0,1126,0,5,8,0,0,http://www.internet-sibirskie-seti.ru/,%D0%BF%D1%97%D0%85t%D0%BF%D1%97%D0%85%D0%BF%D1%97%D0%85%D0%BF%D1%97%D0%85%7D%D0%BF%D1%97%D0%85p%D0%BF%D1%97%D0%85%D0%BF%D1%97%D0%85%D0%BF%D1%97%D0%85%7E%D0%BF%D1%97%D0%85y%D0%BF%D1%97%D0%85z%5DОфициальная футбольная форма и футбольные сувениры от «TUT-SPORT» в вашем городе[/url] e723eda

indianpharmacy com [url=http://smartgenrxusa.com/#]best canadian pharmacy to buy from[/url] onlinepharmaciescanada com

«Орион» в Красноярске предлагают:

• высокоскоростной интернет до 500 Мбит/с;

• быстрое подключение за 1 день;

• Определение оптимального пакета услуг под ваши задачи;

• Проверку технической доступности по вашему адресу.

[url=https://orion-inetrnet-podkluchit.ru]орион подключить домашний интернет и телевидение[/url]

орион подключить интернет и телевидение цена – [url=http://www.orion-inetrnet-podkluchit.ru]https://www.orion-inetrnet-podkluchit.ru[/url]

[url=https://toolbarqueries.google.mu/url?q=https://orion-inetrnet-podkluchit.ru]https://www.google.rs/url?q=https://orion-inetrnet-podkluchit.ru[/url]

[url=http://kkochi7.co.kr/bbs/board.php?bo_table=board_custom&wr_id=15197]Домашний интернет и[/url] 8_c41a9

https://neuroreliefusa.com/# neurontin 800 mg pill

Iver Therapeutics: ivermectin 1 cream generic – Iver Therapeutics

«TUT-SPORT» предлагает:

• футболки из быстросохнущей ткани клуба Аталанта;

• доставку по всей России;

• Подбор оптимального комплекта экипировки под ваш клуб и бюджет;

• Анализ доступности товара по акции.

[url=https://tut-sport.ru/tovary/kluby/atalanta]футбольная форма Аталанта купить интернет магазин москва[/url]

магазин футбольной атрибутики Аталанта в москве – [url=http://www.tut-sport.ru/tovary/kluby/atalanta]https://tut-sport.ru/tovary/kluby/atalanta[/url]

[url=https://images.google.co.im/url?q=https://tut-sport.ru/tovary/kluby/atalanta]https://www.google.com.kw/url?sa=t&url=https://tut-sport.ru/tovary/kluby/atalanta[/url]

[url=http://www2.saganet.ne.jp/cgi-bin/hatto/board/wwwboard.pl/25kat.ru/music/www.zakazat-onlayn-translyaciyu5.ru/www.r-diploma17.ru]Клубная атрибутика и подарки для фанатов от «TUT-SPORT» в вашем городе[/url] e723eda

«Инсис» в Екатеринбурге предлагают:

• пакет из 150+ ТВ каналов;

• быстрое подключение за 1 день;

• Определение оптимального сочетания интернета и ТВ под ваши задачи;

• Проверку технической доступности по вашему адресу.

[url=https://insis-internet-podkluchit.ru/]интернет инсис подключить домой[/url]

инсис домашний интернет проверить подключен ли дом – [url=https://www.insis-internet-podkluchit.ru /]http://insis-internet-podkluchit.ru /[/url]

[url=https://clients1.google.cl/url?q=https://insis-internet-podkluchit.ru/]https://images.google.dj/url?sa=t&url=https://insis-internet-podkluchit.ru/[/url]

[url=http://www2.saganet.ne.jp/cgi-bin/hatto/board/wwwboard.pl/www.iskusstvennaya-kozha-dlya-mebeli-kupit.ru/www.rulonnye-shtory-s-elektroprivodom11.ru/www.blog-o-marketinge.ru/www.r-diploma12.ru]Интернет и ТВ от «Инсис» в вашем доме[/url] 3edac94

http://ivertherapeutics.com/# Iver Therapeutics

stromectol tablets: stromectol tablet 3 mg – ivermectin purchase

https://neuroreliefusa.shop/# Neuro Relief USA

neurontin prescription cost: Neuro Relief USA – Neuro Relief USA

ivermectin tablets order [url=http://ivertherapeutics.com/#]ivermectin 1 cream 45gm[/url] Iver Therapeutics

neurontin 200 mg price: buying neurontin online – buy brand neurontin

http://ivertherapeutics.com/# ivermectin lice oral