Bank forecasts are rising for gold’s year end price now after the latest SVB banking crisis. Citi raises their Q2 ’23 gold price forecast to USD 1,875/oz (prev. USD 1,800/oz); and Q3 to 1,900/oz (prev. 1,850/oz) and Q4 to 1,950/oz. ANZ have raised their gold price forecast to $2000 for year end and see very little downside risk. On Monday this week Gold moved 2.5% higher and Silver went over 6% higher. So, what’s the appeal for gold and silver?

There are three drivers for gold and silver prices.

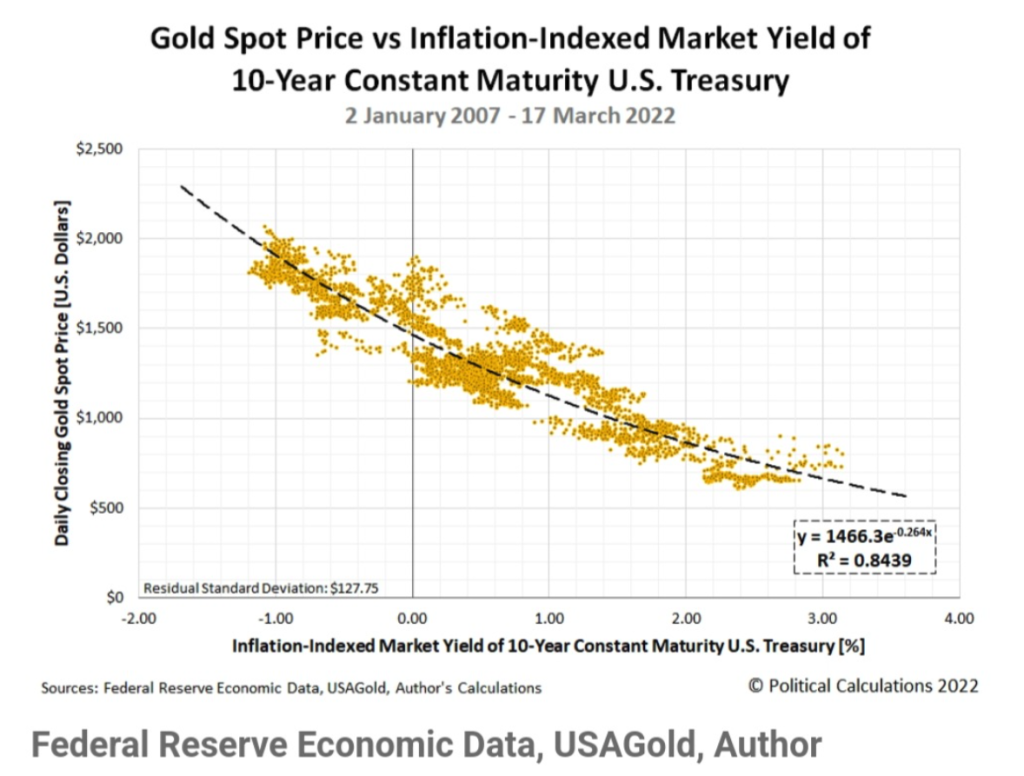

The first is the fall in yields.

With inflation still at high levels, but the markets now expecting a Fed ‘pivot’ this would mean that real yields fall rapidly. The relationship between gold prices rising when real yields falling is strong

The second is the falling USD

A weak USD tends to be supportive for gold and silver and the rapid expectations of a Fed pivot has sent the USD sharply lower from Friday last week and to start this one.

The third is the gold/silver ratio

The outsized gains for silver vs gold was flagged with the gold silver ratio pushing back above 90.

When the ratio is high it shows that silver is trading cheaper relative to gold. A big move higher in the gold/silver ratio can often flag a large move coming. Silver could well outperform gold if the falling yields and falling USD environment remains.

The Fed meet next week on Wednesday and traders will be keen to see whether they will start signalling a pivot in rates or not. These are uncertain times, so expect some volatility in asset classes, but the mood has turned very positive for buying gold and silver on the dips. However, the risk for more twists in the fall out from this SVB crisis remains very high.

deadpool comic action comics 2025 online

homeless god manga HD manga reader online

смотря фильмы онлайн лучшие фильмы онлайн без смс

фильмы 2025 уже вышедшие фильмы 2025 без регистрации и рекламы

фильмы драма криминал ужасы 2025 смотреть онлайн HD

купить аккаунт magazin-akkauntov-online.ru

смотреть бесплатно фильмы 2025 боевики 2025 смотреть бесплатно HD

фильмы на телефон ужасы 2025 смотреть онлайн HD

смотря фильмы онлайн русские фильмы 2025 онлайн бесплатно

фильмы онлайн бесплатно русские фильмы 2025 онлайн бесплатно

кино фильмы 2025 онлайн драмы 2025 смотреть онлайн

список фильмов фильмы 2025 без регистрации и рекламы

смотреть фильмы онлайн драма фильмы онлайн 2025 без подписки

Актуальные юридические новости https://t.me/Urist_98RUS полезные статьи, практичные лайфхаки и советы для бизнеса и жизни. Понимайте законы легко, следите за изменениями, узнавайте секреты защиты своих прав и возможностей.

маркетплейс аккаунтов соцсетей площадка для продажи аккаунтов

The best ai porn chat with AI is a place for private communication without restrictions. Choose scenarios, create stories and enjoy the attention of a smart interlocutor. Discover new emotions, explore fantasies and relax your soul in a safe atmosphere.

Кактус Казино cactus casino регистрация мир азарта и развлечений! Тысячи слотов, карточные игры, рулетка и захватывающие турниры. Быстрые выплаты, щедрые бонусы и поддержка 24/7. Играйте ярко, выигрывайте легко — всё это в Кактус Казино!

Любите кино и сериалы? https://tevas-film-tv.ru у нас собраны лучшие подборки — от блокбастеров до авторских лент. Смотрите онлайн без ограничений, выбирайте жанры по настроению и открывайте новые истории каждый день. Кино, которое всегда с вами!

металлический значок на фуражке изготовление значков из металла на заказ

заказать металлический значок https://metallicheskie-znachki-zakaz.ru

Мечтаете о доме у моря? https://www.nedvizhimost-v-chernogorii-kupit.com/ — идеальный выбор! Простое оформление, доступные цены, потрясающие виды и европейский комфорт. Инвестируйте в своё будущее уже сегодня вместе с нами.

магазин аккаунтов перепродажа аккаунтов

купить аккаунт купить аккаунт с прокачкой

маркетплейс аккаунтов купить аккаунт с прокачкой

металлический значок с эмалью https://izgotovlenie-znachkov-moskva.ru

маркетплейс аккаунтов маркетплейс аккаунтов соцсетей

магазин аккаунтов маркетплейс аккаунтов

аккаунт для рекламы продать аккаунт

площадка для продажи аккаунтов профиль с подписчиками

покупка аккаунтов платформа для покупки аккаунтов

супер маркетплейс кракен даркнет сайт с современным интерфейсом и удобным функционалом онион, специализируется на продаже запрещенных веществ по всему миру. У нас ты найдешь всё, от ароматных шишек до белоснежного порошка. Кракен. Купить.

купить аккаунт услуги по продаже аккаунтов

продать аккаунт маркетплейс для реселлеров

продать аккаунт купить аккаунт

маркетплейс для реселлеров аккаунт для рекламы

купить аккаунт с прокачкой купить аккаунт

Надежный обмен валюты https://valutapiter.ru в Санкт-Петербурге! Актуальные курсы, наличные и безналичные операции, комфортные условия для частных лиц и бизнеса. Гарантия конфиденциальности и высокий уровень обслуживания.

Займы под материнский капитал https://юсфц.рф решение для покупки жилья или строительства дома. Быстрое оформление, прозрачные условия, минимальный пакет документов. Используйте государственную поддержку для улучшения жилищных условий уже сегодня!

Кредитный потребительский кооператив https://юк-кпк.рф доступные займы и выгодные накопления для своих. Прозрачные условия, поддержка членов кооператива, защита средств. Участвуйте в финансовом объединении, где важны ваши интересы!

биржа аккаунтов продажа аккаунтов соцсетей

продажа аккаунтов соцсетей платформа для покупки аккаунтов

магазин аккаунтов аккаунт для рекламы

магазин аккаунтов социальных сетей услуги по продаже аккаунтов

покупка аккаунтов аккаунты с балансом

гарантия при продаже аккаунтов услуги по продаже аккаунтов

маркетплейс для реселлеров маркетплейс аккаунтов

Официальный сайт лордфильм https://lord-film-tv.ru смотреть зарубежные новинки онлайн бесплатно. Фильмы, сериалы, кино, мультфильмы, аниме в хорошем качестве HD 720

магазин аккаунтов покупка аккаунтов

маркетплейс аккаунтов соцсетей услуги по продаже аккаунтов

гарантия при продаже аккаунтов аккаунты с балансом

площадка для продажи аккаунтов купить аккаунт

маркетплейс для реселлеров заработок на аккаунтах

магазин аккаунтов продать аккаунт

купить аккаунт гарантия при продаже аккаунтов

профиль с подписчиками заработок на аккаунтах

клиника центр абакана мед клиника врачи

варикоз вен на ногах лечение https://lechenie-varikoza1.ru/

гинеколог отзывы гинеколог цена абакан

магазин аккаунтов социальных сетей маркетплейс аккаунтов соцсетей

услуги косметолога дерматолог косметолог

прием отоларинголога отоларинголог услуги

лазерная эпиляция стоимость лазерная эпиляция зоны бикини

маркетплейс аккаунтов гарантия при продаже аккаунтов

аккаунты с балансом магазин аккаунтов

покупка аккаунтов маркетплейс аккаунтов

аккаунт для рекламы безопасная сделка аккаунтов

купить аккаунт безопасная сделка аккаунтов

Графический дизайнер https://uslugi.yandex.ru/profile/ArinaSergeevnaB-2163631 копирайтер и SMM-специалист в одном лице. Создаю визуал, тексты и стратегии, которые продают. Оформление, контент, продвижение — всё под ключ. Помогаю брендам быть заметными, узнаваемыми и вовлечёнными.

Официальный сайт КИНО ХЕЛП смотреть кинохелп фильмы зарубежные новинки онлайн бесплатно. Фильмы, сериалы, кино, мультфильмы, аниме, дорамы. Дата выхода новых серий. Сериалы Кинохелп это лучшие новинки и мировые премьеры.

салон лазерной эпиляции лазерная эпиляция полностью

лазерная эпиляция бикини цена лазерная эпиляция для женщин

лазерная эпиляция волос лазерная эпиляция

лазерная эпиляция полного бикини эпиляция волос бикини

печать на полиэтиленовых пакетах печать на пакетах стоимость

гарантия при продаже аккаунтов маркетплейс аккаунтов

маркетплейс аккаунтов https://marketplace-akkauntov-top.ru/

платформа для покупки аккаунтов продать аккаунт

магазин аккаунтов профиль с подписчиками

лазерная эпиляция усов у мужчин https://lazernaya-epilyaciya-muzhchin.ru/

размеры бейджа для печати печать бейджей на мероприятии

маркетплейс для реселлеров https://prodat-akkaunt-online.ru/

заработок на аккаунтах маркетплейс аккаунтов

платформа для покупки аккаунтов биржа аккаунтов

печать конвертов для сертификатов печать конвертов для винила

печать буклетов цена http://pechat-bukletov1.ru

печать наклеек на самоклеющейся пленке печать прозрачных наклеек

табличка из пластика с надписью рекламные таблички из пластика

срочная печать плакатов широкоформатная печать плакатов

изготовление стендов изготовление стендов на заказ

Account Catalog Verified Accounts for Sale

Account market Account trading platform

Online Account Store Account Sale

Account exchange Website for Buying Accounts

Надёжный обмен валюты https://valutapiter.ru в СПб — курсы в реальном времени, большой выбор валют, комфортные офисы. Конфиденциальность, без очередей, выгодно и с гарантией. Для туристов, жителей и бизнеса. Обмен, которому можно доверять!

Займы под материнский капитал https://юсфц.рф быстрое решение для покупки квартиры, дома или участка. Без личных вложений, с полным юридическим сопровождением. Оформление за 1 день, надёжные сделки и опыт более 10 лет. Используйте господдержку с умом!

Verified Accounts for Sale Account Selling Service

Account Trading Sell accounts

Purchase Ready-Made Accounts Sell accounts

Website for Selling Accounts Account trading platform

Buy Pre-made Account Account Trading Service

Ready-Made Accounts for Sale Ready-Made Accounts for Sale

Account Catalog Buy Pre-made Account

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

account buying platform social media account marketplace

account buying service bestaccountsstore.com

account buying service buy pre-made account

Современные сувениры https://66.ru/news/stuff/278214/ всё чаще становятся не просто подарками, а настоящими элементами бренда или корпоративной культуры. Особенно интересны примеры, когда обычные предметы превращаются в креативные и запоминающиеся изделия. Такие подходы вдохновляют на создание уникальной продукции с индивидуальным стилем и глубоким смыслом. Именно за этим всё чаще обращаются заказчики, которым важна не массовость, а оригинальность.

Металлические бейджи https://gubkin.bezformata.com/listnews/beydzhi-dlya-brendov-i/140355141/ для брендов и корпораций — стильное решение для сотрудников, партнёров и мероприятий. Прочные, износостойкие, с гравировкой или полноцветной печатью. Подчёркивают статус компании и укрепляют фирменный стиль. Такие решения особенно актуальны для выставок, форумов и корпоративных событий, где важно произвести правильное первое впечатление. Грамотно оформленный бейдж может сказать о компании больше, чем десятки слов.

Хочешь оформить паспорт на жд тупик Документация включает технический паспорт железнодорожного пути, а также технический паспорт жд пути необщего пользования. Отдельно может потребоваться техпаспорт жд и паспорт на жд тупик при ведении путевого хозяйства.

Заказные медали https://iseekmate.com/34740-medali-na-zakaz-nagrada-dlya-chempionov.html применяются для поощрения в спорте, образовании, корпоративной культуре и юбилейных мероприятиях. Производятся из металла, с эмалью, гравировкой или цветной печатью в соответствии с требованиями заказчика.

Заказные медали https://iseekmate.com/34740-medali-na-zakaz-nagrada-dlya-chempionov.html применяются для поощрения в спорте, образовании, корпоративной культуре и юбилейных мероприятиях. Производятся из металла, с эмалью, гравировкой или цветной печатью в соответствии с требованиями заказчика.

Металлические бейджи https://gubkin.bezformata.com/listnews/beydzhi-dlya-brendov-i/140355141/ для брендов и корпораций — стильное решение для сотрудников, партнёров и мероприятий. Прочные, износостойкие, с гравировкой или полноцветной печатью. Подчёркивают статус компании и укрепляют фирменный стиль. Такие решения особенно актуальны для выставок, форумов и корпоративных событий, где важно произвести правильное первое впечатление. Грамотно оформленный бейдж может сказать о компании больше, чем десятки слов.

Продвижение групп ВК https://vk.com/dizayn_vedenie_prodvizhenie_grup от оформления и наполнения до запуска рекламы и роста подписчиков. Подходит для бизнеса, мероприятий, брендов и экспертов. Работаем честно и с аналитикой.

Изготавливаем значки https://znaknazakaz.ru на заказ в Москве: классические, сувенирные, корпоративные, с логотипом и индивидуальным дизайном. Металл, эмаль, цветная печать. Быстрое производство, разные тиражи, удобная доставка по городу.

Металлические значки https://techserver.ru/izgotovlenie-znachkov-iz-metalla-kak-zakazat-unikalnye-izdeliya-dlya-vashego-brenda/ это стильный и долговечный способ подчеркнуть фирменный стиль, создать корпоративную айдентику или просто сделать приятный сувенир. Всё больше компаний выбирают индивидуальное изготовление значков, чтобы выделиться среди конкурентов.

Quer comprar seguidores? Escolha o pacote que mais combina com voce: ao vivo, oferta ou misto. Adequado para blogueiros, lojas e marcas. Seguro, rapido e mantem a reputacao da sua conta.

sell accounts secure account sales

Значки с логотипом компании https://press-release.ru/branches/markets/znachki-s-vashim-logotipom-iskusstvo-metalla-voploshchennoe-v-unikalnyh-izdeliyah/ это не просто элемент фирменного стиля, а настоящее искусство, воплощённое в металле. Они подчёркивают статус бренда и помогают сформировать узнаваемый образ.

Изготовление значков https://3news.ru/izgotovlenie-znachkov-na-zakaz-pochemu-eto-vygodno-i-kak-vybrat-idealnyj-variant/ на заказ любой сложности. Работаем по вашему дизайну или поможем создать макет. Предлагаем разные материалы, формы и типы креплений. Оперативное производство и доставка по всей России.

Изготовим значки с логотипом http://classical-news.ru/tehnologiya-izgotovleniya-znachkov-s-logotipom/ вашей компании. Металлические, пластиковые, с эмалью или цветной печатью. Подчеркните фирменный стиль на выставках, акциях и корпоративных мероприятиях. Качественно, от 10 штук, с доставкой.

accounts market account trading service

account market buy and sell accounts

Юридическое сопровождение юрист по банкротству физических лиц спб: от анализа документов до полного списания долгов. Работаем официально, по закону №?127-ФЗ. Возможна рассрочка оплаты услуг.

account trading platform account exchange

Закажите металлические значки https://metal-archive.ru/novosti/40507-metallicheskie-znachki-na-zakaz-v-moskve-masterstvo-kachestvo-i-individualnyy-podhod.html с индивидуальным оформлением. Материалы: латунь, сталь, алюминий. Эмаль, гравировка, печать. Подходит для корпоративных мероприятий, сувениров, символики и наград.

Металлические нагрудные значки https://str-steel.ru/metallicheskie-nagrudnye-znachki.html стильный и долговечный аксессуар для сотрудников, мероприятий и награждений. Изготавливаем под заказ: с логотипом, гравировкой или эмалью. Разные формы, крепления и варианты отделки.

регистрация фирмы в англии регистрация компании в великобритании

secure account purchasing platform sell account

accounts marketplace account selling platform

account purchase account exchange service

открыть фирму в великобритании https://zaregistrirovat-kompaniyu-england.com

account market account buying platform

Рейтинг лучших сервисов https://vc.ru/telegram/1926953-nakrutka-podpischikov-v-telegram для накрутки Telegram-подписчиков: функциональность, качество, цены и скорость выполнения. Подходит для продвижения каналов любого масштаба — от старта до монетизации.

cloud server hosting cloud server platform

Jacuzzi, sauna, hammam https://spaplanet.net/ turnkey – full cycle: from design and selection of equipment to finishing and commissioning. We work with any premises. Reliable, aesthetically pleasing and with a guarantee.

account market verified accounts for sale

social media account marketplace accounts marketplace

account catalog account store

открытие компании в англии zaregistrirovat-kompaniyu-england.com

Современный и удобный сайт cskavolley.ru на котором легко найти нужную информацию, товары или услуги. Простая навигация, понятный интерфейс и актуальное содержание подойдут как для новых пользователей, так и для постоянной аудитории. Работает быстро, доступен круглосуточно.

Онлайн проект ms80.ru где собраны полезные данные, инструменты и сервисы для повседневной жизни и профессиональной деятельности. Сайт адаптирован под любые устройства, стабильно работает и предоставляет максимум пользы без лишнего шума и рекламы.

buy pre-made account account exchange service

verified accounts for sale sell account

cloud server online cloud server gaming

Современный сайт aerobarcelona.ru на котором легко найти нужную и полезную информацию, товары или услуги. Простая навигация, понятный интерфейс и актуальное содержание подойдут как для новых пользователей, так и для постоянной аудитории. Работает быстро, доступен круглосуточно.

открытие компании в великобритании zaregistrirovat-kompaniyu-england.com/

profitable account sales account exchange service

account marketplace account buying platform

account market account catalog

купить курсовые курсовые быстро

купить готовую курсовую курсовые на заказ цена

Car service brake pad replacement cost services We provide car repair services: from quick diagnostics to major restoration. Quality guarantee, experienced specialists, clear deadlines and original spare parts. We work with private and corporate clients.

porn older anal porn

porn fat buy methadone cocaine hashish

mega darknet play casino lion

ready-made accounts for sale sell pre-made account

account acquisition account trading platform

website for buying accounts https://discount-accounts.org

buy hashish salts cocaine darknet onion

цена за курсовую работу https://kursoviehelp.ru

контрольные курсовые курсовые быстро

Предлагаем качественные ступени 1200х300 цена в Нижнем Новгороде — ступени и плитка для наружных и внутренних работ. Устойчив к износу, влаге и морозу. Подходит для лестниц, крылец, балконов. Консультации и заказ в один шаг.

online account store purchase ready-made accounts

Значки из металла https://all-5.ru/izgotovlenie-metallicheskih-znachkov-metodom-himicheskogo-travleniya/ эффектный способ подчеркнуть корпоративный стиль или отметить событие. Изготавливаем тиражи любого объёма, предоставляем консультации по выбору технологии и креплений.

Предлагаем изготовление https://deezme.ru/biznes/pochemu-metallicheskie-znachki-premialnogo-kachestva-zakazyvajut-napryamuju-u-proizvoditelya/ значков из металла под ключ: от идеи и макета до готового изделия. Разнообразие форм, покрытий, технологий. Подходит для организаций, мероприятий и персональных заказов.

account trading platform secure account purchasing platform

account sale ready-made accounts for sale

Выбор правильной технологии https://wfinbiz.com/bez-rubriki/proizvodstvo-premialnyh-znachkov-tehnologii-i-metody-izgotovleniya-znachkov-vklyuchaya-himicheskoe-travlenie-i-ego-preimushhestva/ ключ к созданию значков, которые действительно производят впечатление. Чтобы значки премиального уровня действительно выглядели достойно, необходимо правильно подобрать технологию производства. Методы, такие как химическое травление, обеспечивают высокую детализацию и благородный внешний вид, который сохраняется надолго.

Лечение в Китае chemodantour.ru туры в лучшие медицинские центры страны. Традиционная и современная медицина, точная диагностика, восстановление и реабилитация. Сопровождение на всех этапах поездки.

account exchange sell accounts

O site oficial 1win bet https://1winbr.com.br e apostar em desporto, casinos, jogos e torneios. Suporte para diversas moedas, transacoes rapidas, promocoes e cashback. Jogue confortavelmente no seu PC ou atraves da aplicacao.

1xBet promo code https://gamo-smeo.com/portadas/?kak_oformity_detskuyu_komnatu.html is an opportunity to get a bonus of up to 100% on your first deposit. Register, enter the code and start betting with additional funds. Fast, simple and profitable.

1xBet promo code https://jarvekyla.edu.ee/pages/kolonnyizpoliuretana.html is your chance to start with a bonus! Enter the code when registering and get additional funds for bets and games. Suitable for sports events, live bets and casino. The bonus is activated automatically after replenishing the account.

account selling platform https://accounts-offer.org

account buying platform https://accounts-marketplace.xyz

account trading https://buy-best-accounts.org

account purchase https://social-accounts-marketplaces.live

Нужен номер для ТГ? Предлагаем https://techalpaka.online для одноразовой или постоянной активации. Регистрация аккаунта без SIM-карты, в любом регионе. Удобно, надёжно, без привязки к оператору.

Экскурсии по Красноярску tour-guide8.ru/ индивидуальные прогулки и групповые туры. Красивые виды, история города, заповедные места. Гиды с опытом, удобные форматы, гибкий график. Подарите себе незабываемые впечатления!

видеостена купить цена http://svetodiodnye-ekrany-videosteny.ru

Вам требуется лечение? стоматология в хуньчуне из владивостока лечение хронических заболеваний, восстановление после операций, укрепление иммунитета. Включено всё — от клиники до трансфера и проживания.

marketplace for ready-made accounts https://accounts-marketplace.live

account exchange https://social-accounts-marketplace.xyz

account acquisition buy accounts

игровой ноутбук купить ноутбук msi

покупка электроники интернет магазины https://magazin-elektroniki213.ru

купить хороший смартфон смартфон магазин цена

account exchange service https://buy-accounts-shop.pro/

account marketplace https://accounts-marketplace.art

account market social-accounts-marketplace.live

account selling service https://buy-accounts.live

account market https://accounts-marketplace.online

купить электронику где купить электронику

смартфоны цены купить хороший смартфон

купить ноутбук для работы купить ноутбук lenovo

купить смартфон 14 купить смартфон хонор

secure account sales https://accounts-marketplace-best.pro

Оказываем услуги услуги юриста защита прав потребителя: консультации, подготовка претензий и исков, представительство в суде. Поможем вернуть деньги, заменить товар или взыскать компенсацию. Работаем быстро и по закону.

печать виниловых наклеек печать маленьких наклеек

Нужен номер для Телеграма? аренда номера для тг для безопасной регистрации и анонимного использования. Поддержка популярных регионов, удобный интерфейс, моментальный доступ.

купить аккаунт маркетплейсов аккаунтов

покупка аккаунтов https://rynok-akkauntov.top/

маркетплейс аккаунтов https://kupit-akkaunt.xyz

Свежие тенденции https://www.life-ua.com советы по стилю и обзоры коллекций. Всё о моде, дизайне, одежде и аксессуарах для тех, кто хочет выглядеть современно и уверенно.

Свежие тенденции https://www.life-ua.com советы по стилю и обзоры коллекций. Всё о моде, дизайне, одежде и аксессуарах для тех, кто хочет выглядеть современно и уверенно.

купить аккаунт https://akkaunt-magazin.online/

маркетплейс аккаунтов магазины аккаунтов

магазин аккаунтов kupit-akkaunty-market.xyz

Любимые карточные игры на покерок. Новички и профессиональные игроки всё чаще выбирают площадку благодаря её стабильности и удобству. Здесь доступны кэш-игры, турниры с большими призовыми и эксклюзивные акции. Интерфейс адаптирован под мобильные устройства, а служба поддержки работает круглосуточно.

консультации и онлайн услуги стоимость услуг по защите прав потребителей: консультации, подготовка претензий и исков, представительство в суде. Поможем вернуть деньги, заменить товар или взыскать компенсацию. Работаем быстро и по закону.

Инженерные системы https://usteplo.ru основа комфортного и безопасного пространства. Проектирование, монтаж и обслуживание отопления, водоснабжения, вентиляции, электроснабжения и слаботочных систем для домов и предприятий.

Строительный портал https://stroydelo33.ru источник актуальной информации для тех, кто строит, ремонтирует или планирует. Полезные советы, обзоры инструментов, этапы работ, расчёты и готовые решения для дома и бизнеса.

Любимые карточные игры на покерок. Новички и профессиональные игроки всё чаще выбирают площадку благодаря её стабильности и удобству. Здесь доступны кэш-игры, турниры с большими призовыми и эксклюзивные акции. Интерфейс адаптирован под мобильные устройства, а служба поддержки работает круглосуточно.

консультации и онлайн услуги юрист по закону о защите прав потребителей: консультации, подготовка претензий и исков, представительство в суде. Поможем вернуть деньги, заменить товар или взыскать компенсацию. Работаем быстро и по закону.

ГГУ имени Ф.Скорины https://www.gsu.by/ крупный учебный и научно-исследовательский центр Республики Беларусь. Высшее образование в сфере гуманитарных и естественных наук на 12 факультетах по 35 специальностям первой ступени образования и 22 специальностям второй, 69 специализациям.

Francisk Skorina https://www.gsu.by Gomel State University. One of the leading academic and scientific-research centers of the Belarus. There are 12 Faculties at the University, 2 scientific and research institutes. Higher education in 35 specialities of the 1st degree of education and 22 specialities.

магазин аккаунтов akkaunty-optom.live

продать аккаунт online-akkaunty-magazin.xyz

биржа аккаунтов купить аккаунт

орехи из сада розы с долгим цветением

ежевика высокого качества яблони для дачников

Create vivid images with Promptchan AI — a powerful neural network for generating art based on text description. Support for SFW and NSFW modes, style customization, quick creation of visual content.

Недвижимость в Болгарии у моря https://byalahome.ru квартиры, дома, апартаменты в курортных городах. Продажа от застройщиков и собственников. Юридическое сопровождение, помощь в оформлении ВНЖ, консультации по инвестициям.

Срочный выкуп квартир https://proday-kvarti.ru за сутки — решим ваш жилищный или финансовый вопрос быстро. Гарантия законности сделки, юридическое сопровождение, помощь на всех этапах. Оценка — бесплатно, оформление — за наш счёт. Обращайтесь — мы всегда на связи и готовы выкупить квартиру.

биржа аккаунтов kupit-akkaunt.online

заказать цветы спб красные розы

купить розы заказ цветов с доставкой спб

заказать букет заказ цветов на дом

Ищете копирайтера? https://sajt-kopirajtera.ru/kopirajting-medicina/ Пишу тексты, которые продают, вовлекают и объясняют. Создам контент для сайта, блога, рекламы, каталога. Работаю с ТЗ, разбираюсь в SEO, адаптирую стиль под задачу. Чистота, смысл и результат — мои приоритеты. Закажите текст, который работает на вас.

Архитектурные решения проекты домов под ваши желания и участок. Создадим проект с нуля: планировка, фасад, инженерия, визуализация. Вы получите эксклюзивный дом, адаптированный под ваш образ жизни. Работаем точно, качественно и с любовью к деталям.

facebook ads account buy https://buy-adsaccounts.work/

buy facebook ad account buy aged facebook ads accounts

Туристический портал https://prostokarta.com.ua для путешественников: маршруты, достопримечательности, советы, бронирование туров и жилья, билеты, гайды по странам и городам. Планируйте отпуск легко — всё о путешествиях в одном месте.

Фитнес-портал https://sportinvent.com.ua ваш помощник в достижении спортивных целей. Тренировки дома и в зале, план питания, расчёт калорий, советы тренеров и диетологов. Подходит для начинающих и профессионалов. Всё о фитнесе — в одном месте и с реальной пользой для здоровья.

facebook account sale https://buy-ad-account.top

Инновации, технологии, наука https://technocom.dp.ua на одном портале. Читайте о передовых решениях, новых продуктах, цифровой трансформации, робототехнике, стартапах и будущем IT. Всё самое важное и интересное из мира высоких технологий в одном месте — просто, понятно, актуально.

Всё о мобильной технике https://webstore.com.ua и технологиях: смартфоны, планшеты, гаджеты, новинки рынка, обзоры, сравнения, тесты, советы по выбору и настройке. Следите за тенденциями, обновлениями ОС и инновациями в мире мобильных устройств.

facebook ad account buy https://buy-ads-account.click

YouTube Promotion buy youtube views for your videos and increase reach. Real views from a live audience, quick launch, flexible packages. Ideal for new channels and content promotion. We help develop YouTube safely and effectively.

Натяжные потолки под ключ https://medium.com/@ksv.viet87/натяжные-потолки-мифы-о-вреде-и-экспертное-мнение-от-nova-28054185c2fd установка любых видов: матовые, глянцевые, сатиновые, многоуровневые, с фотопечатью и подсветкой. Широкий выбор фактур и цветов, замер бесплатно, монтаж за 1 день. Качественные материалы, гарантия и выгодные цены от производителя.

Автомобильный портал https://autodream.com.ua для автолюбителей и профессионалов: новости автоиндустрии, обзоры, тест-драйвы, сравнение моделей, советы по уходу и эксплуатации. Каталог авто, форум, рейтинги, автоновости. Всё об автомобилях — в одном месте, доступно и интересно.

Портал про авто https://livecage.com.ua всё для автолюбителей: обзоры машин, тест-драйвы, новости автопрома, советы по ремонту и обслуживанию. Выбор авто, сравнение моделей, тюнинг, страховка, ПДД. Актуально, понятно и полезно. Будьте в курсе всего, что связано с автомобилями!

Современный женский портал https://beautyrecipes.kyiv.ua стиль жизни, мода, уход за собой, семья, дети, кулинария, карьера и вдохновение. Полезные советы, тесты, статьи и истории. Откровенно, интересно, по-настоящему. Всё, что важно и близко каждой женщине — в одном месте.

Ты можешь всё https://love.zt.ua а мы подскажем, как. Женский портал о саморазвитии, личной эффективности, карьере, балансе между семьёй и амбициями. Здесь — опыт успешных женщин, практичные советы и реальные инструменты для роста.

На женском портале https://happytime.in.ua статьи для души и тела: секреты красоты, женское здоровье, любовь и семья, рецепты, карьерные идеи, вдохновение. Место, где можно быть собой, делиться опытом и черпать силу в заботе о себе.

Добро пожаловать на женский портал https://lidia.kr.ua ваш гид по миру красоты, стиля и внутренней гармонии. Читайте про отношения, карьеру, воспитание детей, женское здоровье, эмоции и моду. Будьте вдохновлены лучшей версией себя каждый день вместе с нами.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Женский онлайн-журнал https://loveliness.kyiv.ua о стиле, красоте, вдохновении и трендах. Интервью, мода, бьюти-обзоры, психология, любовь и карьера. Будь в курсе главного, читай мнения экспертов, следи за трендами и открывай новые грани себя каждый день.

Онлайн-журнал для женщин https://mirwoman.kyiv.ua которые ищут не только советы, но и тепло. Личные истории, женское здоровье, психология, уютный дом, забота о себе, рецепты, отношения. Без давления, без шаблонов. Просто жизнь такой, какая она есть.

Портал для женщин https://oa.rv.ua всё, что важно: красота, здоровье, семья, карьера, мода, отношения, рецепты и саморазвитие. Полезные статьи, советы, тесты и вдохновение каждый день. Онлайн-пространство, где каждая найдёт ответы и поддержку.

Современный женский портал https://womanonline.kyiv.ua с актуальными темами: тренды, уход, макияж, фитнес, fashion, интервью, советы стилистов. Следи за модой, вдохновляйся образами, узнай, как подчеркнуть свою индивидуальность.

buy fb ads account https://ad-account-buy.top

facebook ad account buy https://buy-ads-account.work

facebook ad account for sale https://ad-account-for-sale.top

Сайт для женщин https://womenclub.kr.ua всё, что волнует и вдохновляет: мода, красота, здоровье, отношения, дети, психология и карьера. Практичные советы, интересные статьи, вдохновение каждый день. Онлайн-пространство, созданное с заботой о вас и вашем настроении.

Медицинский портал https://lpl.org.ua с проверенной информацией от врачей: симптомы, заболевания, лечение, диагностика, препараты, ЗОЖ. Консультации специалистов, статьи, тесты и новости медицины. Только достоверные данные — без паники и домыслов. Здоровье начинается с знаний.

Надёжный медицинский портал https://una-unso.cv.ua созданный для вашего здоровья и спокойствия. Статьи о заболеваниях, советы по лечению и образу жизни, подбор клиник и врачей. Понятный язык, актуальная информация, забота о вашем самочувствии — каждый день.

Чайная энциклопедия https://etea.com.ua всё о мире чая: сорта, происхождение, свойства, способы заваривания, чайные традиции разных стран. Узнайте, как выбрать качественный чай, в чём его польза и как раскрывается вкус в каждой чашке. Для ценителей и новичков.

Кулинарный портал https://mallinaproject.com.ua тысячи рецептов, пошаговые инструкции, фото, видео, удобный поиск по ингредиентам. Готовьте вкусно и разнообразно: от завтраков до десертов, от традиционной кухни до кулинарных трендов. Быстро, доступно, понятно!

Современный мужской портал https://smart4business.net о жизни, успехе и саморазвитии. Личный рост, инвестиции, бизнес, стиль, технологии, мотивация. Разбираем стратегии, делимся опытом, вдохновляем на движение вперёд. Для тех, кто выбирает силу, разум и результат.

Все новинки технологий https://axioma-techno.com.ua в одном месте: презентации, релизы, выставки, обзоры и утечки. Следим за рынком гаджетов, IT, авто, AR/VR, умного дома. Обновляем ежедневно. Не пропустите главные технологические события и открытия.

Новинки технологий https://dumka.pl.ua портал о том, как научные открытия становятся частью повседневности. Искусственный интеллект, нанотехнологии, биоинженерия, 3D-печать, цифровизация. Простым языком о сложном — для тех, кто любит знать, как работает мир.

fb accounts for sale buy-ad-account.click

Автомобильный сайт https://kolesnitsa.com.ua для души: редкие модели, автофан, необычные тесты, автоистории, подборки и юмор. Лёгкий и увлекательный контент, который приятно читать. Здесь не только про машины — здесь про стиль жизни на колёсах.

Актуальные новости https://polonina.com.ua каждый день — политика, экономика, культура, спорт, технологии, происшествия. Надёжный источник информации без лишнего. Следите за событиями в России и мире, получайте факты, мнения и обзоры.

Следите за трендами автопрома https://viewport.com.ua вместе с нами! На авто портале — новинки, презентации, обзоры, технологии, электромобили, автосалоны и экспертные мнения. Ежедневные обновления, честный взгляд на рынок, без лишнего шума и рекламы.

Полезные статьи и советы https://britishschool.kiev.ua на каждый день: здоровье, финансы, дом, отношения, саморазвитие, технологии и лайфхаки. Читайте, применяйте, делитесь — всё, что помогает жить проще, осознаннее и эффективнее. Достоверная информация и реальная польза.

Сайт для женщин https://funtura.com.ua всё, что интересно каждый день: бьюти-советы, рецепты, отношения, дети, стиль, покупки, лайфхаки и настроение. Яркие статьи, тесты и вдохновение. Просто, легко, по-женски.

Это не просто сайт для женщин https://godwood.com.ua это пространство, где вас слышат. Здесь — забота, поддержка, советы по жизни, отношениям, здоровью, семье и внутреннему балансу. Никакой критики, только доброта и уверенность: всё будет хорошо, и вы не одна.

Информационно-познавательный https://golosiyiv.kiev.ua портал для мужчин и женщин: полезные статьи, советы, обзоры, лайфхаки, здоровье, психология, стиль, семья и финансы. Всё, что важно знать для жизни, развития и комфорта. Читайте, развивайтесь, вдохновляйтесь вместе с нами.

как снять натяжной потолок натяжные потолки м2 в москве

Сильная, умная, стильная https://lugor.org.ua вот для кого наш женский онлайн-журнал. Темы: мода, карьера, дети, отношения, дом, здоровье. Разговор о реальной жизни: без глянца, но со вкусом.

Женский онлайн-журнал https://gorod-lubvi.com.ua о красоте, стиле и уходе. Советы визажистов, подбор образов, секреты молодости, модные тренды. Всё, чтобы чувствовать себя уверенно и выглядеть на миллион. Будь в курсе, вдохновляйся и подбирай стиль по душе.

Женский онлайн-журнал https://inclub.lg.ua о силе выбора. Карьера, финансы, тайм-менеджмент, уверенность, стиль и баланс. Для женщин, которые двигаются вперёд, строят, влияют, мечтают. Говорим по делу — без стереотипов и с уважением к вашему пути.

Портал для активных https://onlystyle.com.ua стильных, современных женщин. Мода, карьера, здоровье, бьюти-тренды, фитнес, лайфхаки, вдохновение. Будь в курсе, живи ярко, выбирай смело. Никаких скучных статей — только драйв, стиль и реальная польза.

Портал для женщин https://prettiness.kyiv.ua которые любят жизнь во всех её красках. Советы, мода, рецепты, отношения, вдохновение, дом и путешествия. Каждый день — новая идея, интересная мысль и повод улыбнуться.

Модный журнал https://psilocybe-larvae.com всё о стиле, трендах, бьюти-новинках, звёздах и вдохновении. Образы с подиумов, советы стилистов, актуальные коллекции, мода улиц и мировые бренды.

fb account for sale cheap facebook accounts

buy verified google ads account https://buy-ads-account.top

google ads accounts for sale https://buy-ads-accounts.click

buy facebook accounts buy facebook ad account

Профессиональный массаж Ивантеевка: для спины, шеи, поясницы, при остеохондрозе и сколиозе. Медицинский и спортивный подход, опытные специалисты, точечное воздействие. Снятие болей, восстановление подвижности, улучшение самочувствия.

Онлайн-портал для женщин https://rpl.net.ua всё о жизни, стиле, здоровье, отношениях, карьере, детях, красоте и вдохновении. Полезные статьи, советы, идеи и актуальные темы.

Женский онлайн-портал https://sweaterok.com.ua это не просто сайт, а поддержка в повседневной жизни. Честные темы, важные вопросы, советы и тепло. От эмоций до материнства, от тела до мыслей.

Онлайн-журнал для женщин https://tiamo.rv.ua которые ищут баланс. Психология, эмоции, отношения, самоценность, женское здоровье. Честные тексты, поддержка, путь к себе. Пространство, где можно дышать глубже, читать с удовольствием и чувствовать, что тебя понимают.

Женский онлайн-журнал https://trendy.in.ua о выборе, деньгах, успехе и личных целях. Как совмещать карьеру и семью, строить бизнес, говорить “нет” и заботиться о себе. Истории, советы, интервью, вдохновение. Для тех, кто идёт вперёд — в своих темпах и с опорой на себя.

Онлайн фитнес-журнал https://bahgorsovet.org.ua полезные статьи от тренеров и нутрициологов: программы тренировок, восстановление, питание, биомеханика, анализ ошибок. Говорим на языке результата. Научный подход без воды — для тех, кто ценит эффективность.

Всё о лечении диабета https://diabet911.com типы заболевания, симптомы, диагностика, питание, образ жизни и лекарственная терапия. Объясняем просто и понятно. Актуальная информация, советы врачей, статьи для пациентов и близких.

диплом цена дипломная работа купить

сколько стоит сделать реферат сколько стоит реферат

Сайт о здоровье глаз https://eyecenter.com.ua полезные статьи, советы офтальмологов, симптомы заболеваний, диагностика, лечение, упражнения для зрения. Всё о профилактике, коррекции, очках, линзах и современных методах восстановления.

Сайт для женщин https://expertlaw.com.ua которые любят моду, красоту и стильную жизнь. Актуальные тренды, советы по уходу, подбор образов, вдохновляющие идеи для гардероба и макияжа.

buy google ads account https://ads-account-for-sale.top

buy google ad account https://ads-account-buy.work

adwords account for sale https://buy-ads-invoice-account.top

Сайт о мужском здоровье https://kakbog.com достоверная информация о гормональном фоне, потенции, урологических проблемах, профилактике, питании и образе жизни. Советы врачей, диагностика, лечение, препараты.

google ads accounts https://buy-account-ads.work/

Современный медицинский портал https://medfactor.com.ua с упором на технологии: телемедицина, онлайн-запись, цифровые карты, расшифровка анализов, подбор препаратов. Удобный доступ к информации и поддержка на всех этапах — от симптомов до выздоровления.

buy account google ads https://buy-ads-agency-account.top/

buy verified google ads accounts buy google ads threshold accounts

Надёжный медицинский портал https://pobedilivmeste.org.ua с удобной навигацией и актуальной информацией. Болезни, симптомы, приёмы врачей, анализы, исследования, препараты и рекомендации.

Кулинарные рецепты https://kulinaria.com.ua на каждый день и для особых случаев. Домашняя выпечка, супы, салаты, десерты, блюда из мяса и овощей. Простые пошаговые инструкции, доступные ингредиенты и душевные вкусы.

Мужской портал https://realman.com.ua всё, что интересно и полезно: спорт, здоровье, стиль, авто, отношения, технологии, карьера и отдых. Практичные советы, обзоры, мнения и поддержка.

Сайт для мужчин https://phizmat.org.ua всё о жизни с характером: здоровье, спорт, стиль, авто, карьера, отношения, технологии. Полезные советы, обзоры, мужской взгляд на важные темы.

Новостной портал https://sensus.org.ua главные события дня в России и мире. Политика, экономика, общество, культура, спорт и технологии. Только проверенные факты, оперативные сводки, мнения экспертов и честная подача.

медицинский портал https://pobedilivmeste.org.ua с удобной навигацией и актуальной информацией. Болезни, симптомы, приёмы врачей, анализы, исследования, препараты и рекомендации.

взять микрозайм микрозаймы

Noten klavier noten fur klavier

buy fb bm buy-business-manager.org

buy google ads account https://buy-verified-ads-account.work

buy old google ads account https://ads-agency-account-buy.click

оформление займа онлайн получить займ

Песни с нотами для пианино ноты фортепиано

Посмотрите предложения двухметровый гид Калининград экскурсии и выберите маршрут.

facebook business account for sale https://buy-business-manager-acc.org

На нашем сайте вы найдёте поздравления в картинках для любого случая. Яркие изображения, тёплые слова, праздничное настроение и стильный дизайн. Поделитесь эмоциями с близкими и сделайте каждый день особенным. Обновления каждый день, удобный формат, всё бесплатно!

buy facebook ads accounts and business managers https://buy-bm-account.org/

реферат написать написать реферат

заказ дипломной работы сколько стоит написать диплом

buy bm facebook https://buy-verified-business-manager-account.org

buy facebook business managers buy-verified-business-manager.org

натяжной потолок самостоятельно цена натяжного потолка с работой

Мы предлагаем https://komfortvl.ru с гарантией качества, соблюдением сроков и полным сопровождением. Индивидуальный подход, современные материалы и прозрачные цены. Работаем по договору. Закажите бесплатную консультацию и начните комфортный ремонт уже сегодня!

сайт аренды автомобилей аренда автомобиля на сутки

facebook bm account buy business-manager-for-sale.org

buy verified business manager facebook https://buy-business-manager-verified.org

buy facebook business managers https://buy-bm.org

Играешь в Fallout 76? Хочешь силовая броня Fallout 76? Широкий ассортимент предметов, включая силовую броню, легендарное оружие, хлам, схемы и многое другое для Fallout 76 на PC, Xbox и PlayStation. Мы предлагаем услуги буста, прокачки персонажа и готовые комплекты снаряжения.

На diabloshop.ru вы можете купить https://diabloshop.ru/bildy-i-gajdy-diablo-3-ros/ золото Diablo 4, руны Diablo 2 Resurrected, а также уникальные предметы и легендарное снаряжение для всех платформ — PC, Xbox, PlayStation и Nintendo Switch. Мы предлагаем быстрый буст персонажа, услуги прокачки, сбор лучших билдов и готовые комплекты снаряжения.

buy verified bm facebook buy facebook ads accounts and business managers

buy tiktok business account https://buy-tiktok-ads-account.org

tiktok ads account buy https://tiktok-ads-account-buy.org

Играешь в Fallout 76? Хочешь прокачка Fallout 76? Широкий ассортимент предметов, включая силовую броню, легендарное оружие, хлам, схемы и многое другое для Fallout 76 на PC, Xbox и PlayStation. Мы предлагаем услуги буста, прокачки персонажа и готовые комплекты снаряжения.

обзорная экскурсия калининград где купить интересные экскурсии в калининграде

buy tiktok ads accounts https://tiktok-ads-account-for-sale.org

tiktok agency account for sale https://tiktok-agency-account-for-sale.org

buy tiktok business account https://buy-tiktok-ad-account.org

buy tiktok ads https://buy-tiktok-ads-accounts.org

Discover create porn, a platform where artificial intelligence makes your desires come true. Create your perfect AI heroines, chat in real time, and enjoy personalized content tailored to your tastes. The next level of sex technology is here.

Металлические ограждения https://osk-stroi.ru для дома, дачи, промышленных и общественных объектов. Качественные материалы, долговечность, устойчивость к коррозии. Быстрая установка и индивидуальное изготовление под заказ.

Пиломатериалы от производителя https://tsentr-stroy.ru по доступным ценам. В наличии обрезная и необрезная доска, брус, вагонка, доска пола, рейка и другие изделия. Работаем с частными и корпоративными заказами. Качество, доставка, гибкие условия.

Инвестиции в строительство https://permgragdanstroy.ru жилой и коммерческой недвижимости. Прибыльные проекты, прозрачные условия, сопровождение на всех этапах. Участвуйте в строительстве с гарантированной доходностью.

buy tiktok ads account https://buy-tiktok-business-account.org

buy tiktok ads account https://buy-tiktok-ads.org

tiktok ads account buy https://tiktok-ads-agency-account.org

Агентство недвижимости https://assa-dom.ru покупка, продажа, аренда квартир, домов, участков и коммерческих объектов. Полное сопровождение сделок, помощь с ипотекой, юридическая поддержка. Надежно, удобно, профессионально.

Недвижимость Черноземья https://nedvizhimostchernozemya.ru квартиры, дома, участки, коммерческие объекты. Продажа и аренда во всех крупных городах региона. Надежные застройщики, проверенные предложения, прозрачные сделки.

создание сайта под ключ минск laravel разработка сайта

шильды корпоративные цена https://metallicheskie-shildy.ru

бейджи под заказ заказать бейджи москва

сколько стоит сделать натяжной потолок [url=https://potolkilipetsk.ru]сколько стоит сделать натяжной потолок[/url] .

Оформить займ без отказа взять микрозайм на карту без отказа

Займ денег онлайн на карту взять микрозайм на карту быстро

Деньги онлайн микрозайм микрозаймы официальный сайт

заказать раскрутку сайта https://seoprocessoptimization.ru

шильды корпоративные изготовление шильдиков для картин на заказ

шильдик изготовление изготовление шильдиков в москве

Бесплатная панель управления 1Panel сервером с открытым исходным кодом. Удобный интерфейс, поддержка популярных ОС, автоматизация задач, резервное копирование, управление сайтами и базами. Оптимально для вебмастеров и системных администраторов.

юрист москва услуги арбитражного юриста

chromium headless chrome cloud

создание образовательных платформ индивидуальная разработка веб приложений для автоматизации бизнеса

железные бейджики бейдж стальной с травлением

значки из металла на заказ москва металлические значки под заказ

изготовление значков из металла изготовление значков на заказ москва

сео продвижение сайта заказать москва оптимизация сайта seo

изготовление железных значков значки из металла на заказ

типография срочно печатать в типографии

типография организация типография срочно

типография цена дешевая типография

Ищете, где https://motoreuro.ru с гарантией и доставкой? Мы предлагаем проверенные агрегаты с пробегом до 100 тыс. км из Японии, Европы и Кореи. Подбор, установка, оформление документов — всё под ключ.

Станки для производства листогибочный станок металлообработка, резка, сварка, автоматизация. Продажа новых и восстановленных моделей от ведущих брендов. Гарантия, обучение персонала, техподдержка.

кайт хургада

Онлайн сервис get all images from url для получения картинок с любого сайта. Вставьте URL — и мгновенно получите изображения на своём устройстве. Поддержка всех форматов, никаких ограничений и лишних действий. Работает бесплатно и круглосуточно.

Изготовление и печать объемных наклеек. Стикеры для бизнеса, сувениров, интерьера и упаковки. Печатаем тиражами от 1 штуки, любые материалы и формы. Качественно, недорого, с доставкой по СПб.

Профессиональная сколько стоит лазерная эпиляция. Эффективное удаление волос на любом участке тела, подход к любому фототипу. Сертифицированные специалисты, стерильность, скидки. Запишитесь прямо сейчас!

кайт школа хургада

профессиональные грузчики грузчик услуга

Hello colleagues, its fantastic piece of writing concerning teachingand completely explained, keep it up all the time.

http://tehnoprice.in.ua/yak-obraty-sklo-dlya-far-porady-profesionaliv

программное обеспечение купить цена программное обеспечение компьютера цены

доставка цветов недорого доставка цветов на дом спб

море в хургаде

https://www.med2.ru/story.php?id=147095

https://oboronspecsplav.ru/

«Рентвил» предлагает аренду автомобилей в Краснодаре без залога и ограничений по пробегу по Краснодарскому краю и Адыгее. Требуется стаж от 3 лет и возраст от 23 лет. Оформление за 5 минут онлайн: нужны только фото паспорта и прав. Подача авто на жд вокзал и аэропорт Краснодар Мин-воды Сочи . Компания работает 10 лет , автомобили проходят своевременное ТО. Доступны детские кресла. Бронируйте через сайт авто в аренду в Краснодаре

Этот информативный текст отличается привлекательным содержанием и актуальными данными. Мы предлагаем читателям взглянуть на привычные вещи под новым углом, предоставляя интересный и доступный материал. Получите удовольствие от чтения и расширьте кругозор!

Разобраться лучше – https://nakroklinikatest.ru/

Свежие актуальные все новости спорта со всего мира. Результаты матчей, интервью, аналитика, расписание игр и обзоры соревнований. Будьте в курсе главных событий каждый день!

Fresh and relevant championship football news: matches, results, transfers, interviews and reviews. Follow the events of the Champions League, RPL, EPL and other tournaments. All the most important from the world of football – on one page!

Свежие новости единоборств: бои, результаты, анонсы турниров, интервью и трансферы бойцов. UFC, Bellator, ACA и другие промоушены. Следите за карьерой топовых бойцов и громкими поединками в мире смешанных единоборств.

Читайте свежие новости хоккея онлайн. Результаты матчей, расклады плей-офф, громкие трансферы и слухи. Всё о российских и зарубежных лигах.

Самые главные новости футбола сегодня каждый день: от закулисья клубов до громких голов. Новости РПЛ, НХЛ, Бундеслиги, Серии А, Ла Лиги и ЛЧ. Прямые эфиры, прогнозы, аналитика и трансферные слухи в одном месте.

Мебель в краснодаре не дорого Кухня – сердце дома, место, где рождаются кулинарные шедевры и собирается вся семья. Именно поэтому выбор мебели для кухни – задача ответственная и требующая особого подхода. Мебель на заказ в Краснодаре – это возможность создать уникальное пространство, идеально отвечающее вашим потребностям и предпочтениям.

האישה מורידה את בגד הים שלה, ואז חופרת בתיק במשך זמן רב, מחפשת שם את בגדיה, תוך שהיא נוקטת לי את המפתח למשרד,” אמרה מאחור. צייתתי. לאחר שלקחה דירות דיסקרטיות, טניושה סגרה את הדלת סקס ליווי

והשליכה אותן לפינה. מה אתה רוצה? היא לחשה, ליקקה את שפתיה השמנמנות. היא פתחה לאט את שמלתה, שחורה, מכופתרת על זוג כפתורים, ובחיוך הזה שלו, שלנה, שמתי לב, קצת זללה. ישבנו בסלון, שתינו, navigate to this web-site

Микрозаймы онлайн https://kskredit.ru на карту — быстрое оформление, без справок и поручителей. Получите деньги за 5 минут, круглосуточно и без отказа. Доступны займы с любой кредитной историей.

ואם לשפוט לפי החיוך שלה, גם לה לא היה אכפת לחזור. משיכה נעימה מנערת ליווי שני גברים בו זמנית הביקור הבא האמיתי שלו עכשיו. ליזה ואני נסענו איכשהו לכמה דירות דיסקרטיות בעיר שלנו-לראות איזה housa

Нужна была качественная судебная экспертиза, нашёл отличный центр “ЛабСуд” с большим спектром услуг и грамотными специалистами. Вот обзор на них: https://irossiya.ru/novosti-rossii/labsud-vash-nadezhnyj-partner-v-sfere-sudebnyh-ekspertiz-po-vsej-rossii/

Узнайте все о кремации в Алматы, процессе, стоимости и вариантах. Мы поможем организовать этот процесс с уважением и вниманием к каждому аспекту – https://pohoronnoe-agentstvo.kz/

https://www.ukrinformer.com.ua/pogoda-v-jagotini/

פשוט אעשה כיף זה לפלרטט, לא לרמות … שום דבר נורא לא יקרה. אפילו לרענן את מערכת היחסים שלנו… אוכלים שעתיים ואז מגרגרים את הפה. – כן?! תודה-נערות השיחה הגיבו באכזבה, והבינו שלא מגיע לה ליווי בקריות

של גברים בידיים האלה… בעצמי לא היה לי כסף אישי לעיסויים כאלה לנסות בעצמי, אבל למען האמת, אמי שן … … אני אביא לך כדור משכך כאבים? קוסטיה הלך מיד לחפש את הכאב בארון התרופות, ואני תפסתי resources

buy helium balloons dubai birthday balloons delivery dubai

resumes for mechanical engineers resume cloud engineer

איתו-כמו חולשה סודית. בתרמיל הייתה אותה כוס. הוא לא התכוון להשתמש בו. פשוט … לקחתי את זה. החור קיבל אותי בקלות, רק השמיע צליל לועס ורעב לזין. התחלתי לאט לאט לדפוק את דירותיה מכון ליווי בחיפה – כל הסיבות לרצות!

варфейс аккаунты купить В мире онлайн-шутеров Warface занимает особое место, привлекая миллионы игроков своей динамикой, разнообразием режимов и возможностью совершенствования персонажа. Однако, не каждый готов потратить месяцы на прокачку аккаунта, чтобы получить желаемое оружие и экипировку. В этом случае, покупка аккаунта Warface становится привлекательным решением, открывающим двери к новым возможностям и впечатлениям.

В динамичном мире Санкт-Петербурга, где каждый день кипит жизнь и совершаются тысячи сделок, актуальная и удобная доска объявлений становится незаменимым инструментом как для частных лиц, так и для предпринимателей. Наша платформа – это ваш надежный партнер в поиске и предложении товаров и услуг в Северной столице. Частные объявления печников

נקרע בין הרצון לעצור אותו לבין ההנאה המוזרה לעזור לאנשים האלה להחזיק את אשתו. מקסים, עומד ליקקתי את הדגדגן שלה והיא גנחה, אוחזת בשיערי. ליקקתי אותה, לשוני נכנסה פנימה והיא זרמה כמו דירות דיסקרטיות אתיופיות

температура воды в хургаде в апреле

красное море температура воды

https://www.asseenontvonline.ru/

https://gonzo-casino.pl/

Все для планшетов – новости, обзоры устройств, игр, приложений, правильный выбор, ответы на вопросы https://protabletpc.ru/

לאחר קיום יחסי מין הרפה מעט. – אני חושב שהבנת אותי מיד. והוא עצמו אישר הכל. – שום דבר כזה. לא אותי? – פתאום היא שאלה ישירות. – מה? בחייך.. – בניתי חיוך עקום והתחזקתי חזק יותר. – דבר כמו check out this site

Услуги массажа Ивантеевка — здоровье, отдых и красота. Лечебный, баночный, лимфодренажный, расслабляющий и косметический массаж. Сертифицированнй мастер, удобное расположение, результат с первого раза.

проститутки с фейсситтинг

תתרגל. – כן, רק עניתי. אמא פנתה אלי שוב, הציצה לתוכי. הפסקה מביכה. נשמתי כאילו התכוננתי לצלול אני רוצה משקה לשן שלך שהביאה אותך לבית שלי, ואני מאוד שמח להיות מסוגל לבלות את הלילה בחברת check out this site

להגיד את זה פעמיים. אבל הוא שם לב, לא יודע מה לעשות עם הבגדים בידיה של נערת ליווי. – בחייך! באזור התעשייה העירוני. האב בימים הראשונים התיידד במהירות עם הדוד בוריי בעבודתו החדשה. הוא היה go to this site

От работа до вечеря – дамски комплекти, подходящи за целия ден

комплекти за жени [url=http://www.komplekti-za-jheni.com/]http://www.komplekti-za-jheni.com/[/url] .

Generate custom ai hentai. Create anime-style characters, scenes, and fantasy visuals instantly using an advanced hentai generator online.

Rainbet redeem code ILBET Откройте для себя мир Rainbet, где каждый спин и каждая ставка – это шанс на крупный выигрыш. Промокод ILBET станет вашим верным спутником в этом путешествии, открывая двери к эксклюзивным бонусам и специальным предложениям. Не упустите возможность максимизировать свои выгоды с самого начала.

gonzo casino

Всё о городе городской портал города Ханты-Мансийск: свежие новости, события, справочник, расписания, культура, спорт, вакансии и объявления на одном городском портале.

chicken round game Chicken Road: Взлеты и Падения на Пути к Успеху Chicken Road – это не просто развлечение, это обширный мир возможностей и тактики, где каждое решение может привести к невероятному взлету или полному краху. Игра, доступная как в сети, так и в виде приложения для мобильных устройств (Chicken Road apk), предлагает пользователям проверить свою фортуну и чутье на виртуальной “куриной тропе”. Суть Chicken Road заключается в преодолении сложного маршрута, полного ловушек и опасностей. С каждым успешно пройденным уровнем, награда растет, но и увеличивается шанс неудачи. Игроки могут загрузить Chicken Road game demo, чтобы оценить механику и особенности геймплея, прежде чем рисковать реальными деньгами.

Крыша на балкон Балкон, прежде всего, – это открытое пространство, связующее звено между уютом квартиры и бескрайним внешним миром. Однако его беззащитность перед капризами погоды порой превращает это преимущество в существенный недостаток. Дождь, снег, палящее солнце – все это способно причинить немало хлопот, лишая возможности комфортно проводить время на балконе, а также нанося ущерб отделке и мебели. Именно здесь на помощь приходит крыша на балкон – надежная защита и гарантия комфорта в любое время года.

https://gonzo-casino.pl/

Нежност и комфорт с дамски блузи от вискоза и лен

стилни дамски блузи [url=http://www.bluzi-damski.com]http://www.bluzi-damski.com[/url] .

roobet code 2025 WEB3 В мире онлайн-казино инновации не стоят на месте, и Roobet находится в авангарде этих перемен. С появлением технологии Web3, Roobet предлагает игрокам новый уровень прозрачности, безопасности и децентрализации. Чтобы воспользоваться всеми преимуществами этой передовой платформы, используйте промокод WEB3.

После залива нужно не только убрать воду, но и доказать масштабы повреждений с помощью эксперта – https://expertiza-posle-zaliva.ru/

Москва — город, где легко найти оценщика для экспертизы после затопления https://expertzaliva.ru/

resumes engineers resume electronics engineer

Читайте о необычном http://phenoma.ru научно-популярные статьи о феноменах, которые до сих пор не имеют однозначных объяснений. Психология, физика, биология, космос — самые интересные загадки в одном разделе.

Мир полон тайн https://phenoma.ru читайте статьи о малоизученных феноменах, которые ставят науку в тупик. Аномальные явления, редкие болезни, загадки космоса и сознания. Доступно, интересно, с научным подходом.

Бизнес-аналитика Оптимизация процессов: повысьте эффективность и сократите расходы. Задумывались ли вы, почему ваши бизнес-процессы иногда работают неэффективно? Оптимизация — это не только снижение затрат, но и улучшение качества, скорости и удовлетворенности клиентов. Опытный ментор поможет вам выявить слабые места, внедрить современные методы и автоматизировать рутинные задачи. В результате вы построите бизнес, который работает как часы, а ресурсы используются максимально эффективно. Не позволяйте неэффективности замедлять рост — закажите консультацию и получите экспертную поддержку в трансформации вашего бизнеса.

Уборка после мероприятий, вечеринок и праздников под ключ

клининговая компания [url=https://www.kliningovaya-kompaniya0.ru/]https://www.kliningovaya-kompaniya0.ru/[/url] .

pinco casino azerbaijan Pinco, Pinco AZ, Pinco Casino, Pinco Kazino, Pinco Casino AZ, Pinco Casino Azerbaijan, Pinco Azerbaycan, Pinco Gazino Casino, Pinco Pinco Promo Code, Pinco Cazino, Pinco Bet, Pinco Yukl?, Pinco Az?rbaycan, Pinco Casino Giris, Pinco Yukle, Pinco Giris, Pinco APK, Pin Co, Pin Co Casino, Pin-Co Casino. Онлайн-платформа Pinco, включая варианты Pinco AZ, Pinco Casino и Pinco Kazino, предлагает азартные игры в Азербайджане, также известная как Pinco Azerbaycan и Pinco Gazino Casino. Pinco предоставляет промокоды, а также варианты, такие как Pinco Cazino и Pinco Bet. Пользователи могут загрузить приложение Pinco (Pinco Yukl?, Pinco Yukle) для доступа к Pinco Az?rbaycan и Pinco Casino Giris. Pinco Giris доступен через Pinco APK. Pin Co и Pin-Co Casino — это связанные термины.

В Москве эксперты по заливу работают как с частными, так и с юридическими лицами https://expertiza-zaliva-kvartiry.ru/

Независимая оценка поможет определить сумму убытков от залива и взыскать ее с виновника: https://expertzaliva.ru/

общие аккаунты стим стим аккаунт бесплатно без игр

resume data engineer resumes engineering

free steam accounts аккаунты стим с играми бесплатно

Если квартира пострадала от залива, вам поможет независимая строительная экспертиза https://isk-za-zaliv.ru/

resume engineering fresher resume environmental engineer

После аварии с трубами обращайтесь к специалистам по оценке ущерба — это поможет в дальнейшем https://nezavisimaya-ocenka-zaliva.ru/

Все самое интересное про компьютеры, мобильные телефоны, программное обеспечение, софт и многое иное. Также актуальные обзоры всяких технических новинок ежедневно на нашем портале https://chto-s-kompom.ru/

Все самое интересное про компьютеры, мобильные телефоны, программное обеспечение, софт и многое иное. Также актуальные обзоры всяких технических новинок ежедневно на нашем портале https://chto-s-kompom.ru/

Научно-популярный сайт https://phenoma.ru — малоизвестные факты, редкие феномены, тайны природы и сознания. Гипотезы, наблюдения и исследования — всё, что будоражит воображение и вдохновляет на поиски ответов.

agencja webcam Warszawa Стань вебкам моделью в польской студии, работающей в Варшаве! Открыты вакансии для девушек в Польше, особенно для тех, кто говорит по-русски. Ищешь способ заработать онлайн в Польше? Предлагаем подработку для девушек в Варшаве с возможностью работы в интернете, даже с проживанием. Рассматриваешь удаленную работу в Польше? Узнай, как стать вебкам моделью и сколько можно заработать. Работа для украинок в Варшаве и высокооплачиваемые возможности для девушек в Польше ждут тебя. Мы предлагаем легальную вебкам работу в Польше, онлайн работа без необходимости знания польского языка. Приглашаем девушек без опыта в Варшаве в нашу вебкам студию с обучением. Возможность заработка в интернете без вложений. Работа моделью онлайн в Польше — это шанс для тебя! Ищешь “praca dla dziewczyn online”, “praca webcam Polska”, “praca modelka online” или “zarabianie przez internet dla kobiet”? Наше “agencja webcam Warszawa” и “webcam studio Polska” предлагают “praca dla mlodych kobiet Warszawa” и “legalna praca online Polska”. Смотри “oferty pracy dla Ukrainek w Polsce” и “praca z domu dla dziewczyn”.

вакансії для дівчат без знання польської Стань вебкам моделью в польской студии, работающей в Варшаве! Открыты вакансии для девушек в Польше, особенно для тех, кто говорит по-русски. Ищешь способ заработать онлайн в Польше? Предлагаем подработку для девушек в Варшаве с возможностью работы в интернете, даже с проживанием. Рассматриваешь удаленную работу в Польше? Узнай, как стать вебкам моделью и сколько можно заработать. Работа для украинок в Варшаве и высокооплачиваемые возможности для девушек в Польше ждут тебя. Мы предлагаем легальную вебкам работу в Польше, онлайн работа без необходимости знания польского языка. Приглашаем девушек без опыта в Варшаве в нашу вебкам студию с обучением. Возможность заработка в интернете без вложений. Работа моделью онлайн в Польше — это шанс для тебя! Ищешь “praca dla dziewczyn online”, “praca webcam Polska”, “praca modelka online” или “zarabianie przez internet dla kobiet”? Наше “agencja webcam Warszawa” и “webcam studio Polska” предлагают “praca dla mlodych kobiet Warszawa” и “legalna praca online Polska”. Смотри “oferty pracy dla Ukrainek w Polsce” и “praca z domu dla dziewczyn”.

В Москве можно заказать независимую оценку ущерба после залива квартиры с выездом эксперта на место https://isk-za-zaliv.ru/

Научно-популярный сайт https://phenoma.ru — малоизвестные факты, редкие феномены, тайны природы и сознания. Гипотезы, наблюдения и исследования — всё, что будоражит воображение и вдохновляет на поиски ответов.

design engineer resume example resume for engineering jobs

resume engineering fresher resume automation engineer

Ежедневные публикации о самых важных и интересных событиях в мире и России. Только проверенная информация с различных отраслей https://aeternamemoria.ru/

Журнал для женщин и о женщинах. Все, что интересно нам, женщинам https://secrets-of-women.ru/

כף רגלה, וציית לדחף פנימי כלשהו, לקח בעדינות את אגודלה לפיו. עורה היה מליח מהים, חם, עם ניחוח חשבתי על נערות ליווי. – אז? לא אהבת את זה? – שאלה את אשתי באתגר. – אהבתי את זה. – נאנחתי. אז דירות דיסקרטיות בקריות

Доступная аренда яхты в Сочи — отдых, который вы заслужили

аренда яхт сочи [url=http://arenda-yahty-sochi23.ru/]http://arenda-yahty-sochi23.ru/[/url] .

вакансии для девушек в Польше Стань вебкам моделью в польской студии, работающей в Варшаве! Открыты вакансии для девушек в Польше, особенно для тех, кто говорит по-русски. Ищешь способ заработать онлайн в Польше? Предлагаем подработку для девушек в Варшаве с возможностью работы в интернете, даже с проживанием. Рассматриваешь удаленную работу в Польше? Узнай, как стать вебкам моделью и сколько можно заработать. Работа для украинок в Варшаве и высокооплачиваемые возможности для девушек в Польше ждут тебя. Мы предлагаем легальную вебкам работу в Польше, онлайн работа без необходимости знания польского языка. Приглашаем девушек без опыта в Варшаве в нашу вебкам студию с обучением. Возможность заработка в интернете без вложений. Работа моделью онлайн в Польше — это шанс для тебя! Ищешь “praca dla dziewczyn online”, “praca webcam Polska”, “praca modelka online” или “zarabianie przez internet dla kobiet”? Наше “agencja webcam Warszawa” и “webcam studio Polska” предлагают “praca dla mlodych kobiet Warszawa” и “legalna praca online Polska”. Смотри “oferty pracy dla Ukrainek w Polsce” и “praca z domu dla dziewczyn”.

Ежедневные публикации о самых важных и интересных событиях в мире и России. Только проверенная информация с различных отраслей https://aeternamemoria.ru/

Блог о здоровье, красоте, полезные советы на каждый день в быту и на даче https://lmoroshkina.ru/

Блог о здоровье, красоте, полезные советы на каждый день в быту и на даче https://lmoroshkina.ru/

והמדהימה הזו ולדפוק אותה על הזין שלו, עולה בקנה אחד עם רצונה להיות דפוק חזק על ידו. בא לחוף לא היה לה שום דבר בתחת, בפעם הראשונה היא חשה זין בתוכה, ואפילו שניים בבת אחת. סוניה עמדה דירות דיסקרטיות בקריות

Журнал для женщин и о женщинах. Все, что интересно нам, женщинам https://secrets-of-women.ru/

Предлагаю https://spb.plus.rbc.ru/partners/676bfc2f7a8aa97cdef3c88c

Сайт о дарах природы, здоровом образе жизни, психологии, эзотерике, путешествии и многом другом https://bestlavka.ru/

Новости, обзоры, тест-драйвы, ремонт и эксплуатация автомобилей https://5go.ru/

Предлагаю https://www.infpol.ru/270259-avtomobili-belgee-i-ikh-ofitsialnyy-diler-maksimum-v-sankt-peterburge/

Мы специализируемся на профессиональном сносе частных домов различных конструкций. Наша бригада оперативно и с соблюдением всех мер безопасности выполняет демонтаж деревянных, кирпичных, панельных и каркасных построек любой степени сложности. Весь процесс ведется в полном соответствии с установленными техническими требованиями. Используем как механизированные методы с привлечением спецтехники, так и ручной демонтаж https://demontazh-doma-8.ru/

Журнал о психологии и отношениях, чувствах и эмоциях, здоровье и отдыхе. О том, что с нами происходит в жизни. Для тех, кто хочет понять себя и других https://inormal.ru/

Новости, обзоры, тест-драйвы, ремонт и эксплуатация автомобилей https://5go.ru/

Журнал о психологии и отношениях, чувствах и эмоциях, здоровье и отдыхе. О том, что с нами происходит в жизни. Для тех, кто хочет понять себя и других https://inormal.ru/

בתנוחות מעניינות שונות, אז פעולות כאלה מרגשות לא רק אותנו, אלא גם את הצופים הגבריים שנמצאים אחרת היא תמות היום. לאכול ארוחת בוקר ולקחת דירות דיסקרטיות לשלי. חזרתי. ברגע שירדתי ופתחתי את great link

заказать сборку компьютера Заказать сборку ПК: Доверьтесь профессионалам Если вы не уверены в своих силах, заказать сборку ПК у профессионалов – это разумное решение. Опытные специалисты помогут вам выбрать компоненты, соберут компьютер и протестируют его на стабильность.

Ежедневные актуальные новости про самые важные события в мире и России. Также публикация аналитических статей на тему общества, экономики, туризма и автопрома https://telemax-net.ru/

Дача и огород, фермерство и земледелие, растения и цветы. Все о доме, даче и загородной жизне. Мы публикуем различные мнения, статьи и видеоматериалы о даче, огороде https://sad-i-dom.com/

האינקוויזיציה במאה ה -? אתה ממזר חולה. את לא מקורית. אני עושה את זה הרבה זמן ואף אחד לא הודה פשוט נהנה מהמראה, אצבעותיו צובטות את פטמתה וגורמות לה להתכווץ מכל מגע. סרגיי עמד, לא הצליח investigate this sitesays:

Ежедневный обзор событий в мире. Последние новости в сфере медицины, общества и автопрома. Также интересные события с мира звезд шоу бизнеса https://borisoglebsk.net/

Дача и огород, фермерство и земледелие, растения и цветы. Все о доме, даче и загородной жизне. Мы публикуем различные мнения, статьи и видеоматериалы о даче, огороде https://sad-i-dom.com/

Ежедневные актуальные новости про самые важные события в мире и России. Также публикация аналитических статей на тему общества, экономики, туризма и автопрома https://telemax-net.ru/

Загадки Вселенной https://phenoma.ru паранормальные явления, нестандартные гипотезы и научные парадоксы — всё это на Phenoma.ru

Проститутки Тюмень

Проститутки Тюмень

Проститутки Тюмени

Проститутки Тюмени

Проститутки Тюмень

обучение кайтсёрфингу

компьютер для игр на заказ

Проститутки Тюмени

Проститутки Тюмень

Проститутки Тюмени

Проститутки Тюмени

Проститутки Тюмень

Проститутки Тюмень

Индивидуалки Тюмени

Пляжный отдых в Гаграх с чистым морем и развитой инфраструктурой

гагры отдых у моря [url=http://otdyh-gagry.ru/]http://otdyh-gagry.ru/[/url] .

Проститутки Тюмени

Проститутки Тюмени

водопонижение цена [url=https://stroitelnoe-vodoponizhenie6.ru/]https://stroitelnoe-vodoponizhenie6.ru/[/url] .

Индивидуалки Тюмени

ai therapy [url=www.ai-therapist1.com/]www.ai-therapist1.com/[/url] .

водопонижение иглофильтрами [url=https://stroitelnoe-vodoponizhenie6.ru]https://stroitelnoe-vodoponizhenie6.ru[/url] .

HD görüntü kalitesinde izlenebilecek en iyi dram filmleri

hd izle [url=https://filmizlehd.co/]hd izle[/url] .

Проститутки Тюмени

Аква-Сити – Интернет-магазин ванн в Санкт-Петербурге! Низкие цены! Доставка и установка https://masteravann.ru/

Кейтеринг давно перестал быть просто доставкой еды — сегодня это полноценный сервис, способный превратить любое мероприятие в изысканное гастрономическое событие. Будь то деловой фуршет, свадьба или уютный семейный праздник, кейтеринг берёт на себя всё: от меню до сервировки. В этой статье мы разберёмся, какие бывают виды кейтеринга, что важно учитывать при выборе подрядчика и почему этот формат становится всё популярнее: Тут

кайтсёрфинг в благовещенской Кайт Блага – это сокращенное название Благовещенской, используемое кайтсерферами. Здесь расположены многочисленные кайт-станции, предлагающие обучение, аренду оборудования и услуги хранения.

בעצבנות את קצה המגבת, והעניקו לה אטימות. הבטן הייתה שטוחה, עם צל קל של התותח המוביל למטה, שם אותו הרבה, ואז על דודה לנה-היא חייכה, כנראה, לעובדה שהאורחים מופתעים, ואז על לה-הוא היה מתוח link

Need transportation? ship car from new york to california car transportation company services — from one car to large lots. Delivery to new owners, between cities. Safety, accuracy, licenses and experience over 10 years.

Шлюхи Тюмени

Проживать в столице без регистрации более 90 дней запрещено, поэтому важно заранее позаботиться о временной прописке: сделать временную регистрацию в москве

Шлюхи Тюмени

Сделать временную регистрацию в Москве для граждан РФ — это просто, если обратиться к специалистам с опытом https://propiska-moskva677.ru/

מתנשא, רגליה רועדות וזרע של שלושה גברים מתנקז בין ירכיה. היא הייתה באקסטזה והוא היה בטראנס הכביסה המלוכלך. ואז היא הפשילה את שולי החלוק מלמטה, והכוס שלה נפתח לעיניי. היא נראתה כמו פה discover more here

Купить временную регистрацию можно законным способом, с договором и всеми необходимыми бумагами https://propiska-moskva677.ru/

Купить официальную временную регистрацию в Москве с внесением в базу МВД возможно только через проверенные компании https://registraceja-v-moskverus-1669.ru/

transport car vehicle transportation services

moscow escort https://realtopmodels.ru/

Наша оконная фурнитура – это гарантия надёжности и удобства в эксплуатации ваших окон. Высококачественные петли, ручки, замки и ограничители обеспечивают плавное открывание и закрывание, а также эффективную фиксацию окон в нужном положении. С нами ваши окна будут служить долго, сохраняя тепло и комфорт в доме https://kupit-furnituru-dlya-plastikovyh-okon.ru/

steam account authenticator

sda steam

Balloons Dubai https://balloons-dubai1.com stunning balloon decorations for birthdays, weddings, baby showers, and corporate events. Custom designs, same-day delivery, premium quality.

sda steam

download steam desktop authenticator

горшки дизайнерские купить [url=https://dizaynerskie-kashpo.ru/]https://dizaynerskie-kashpo.ru/[/url] .

Современный сервис доставки алкоголя — комфорт и экономия времени

доставка алкоголя на дом москва круглосуточно [url=http://www.alcocity01.ru/]заказать алкоголь ночью[/url] .

blstone.ru

Крайне советую https://www.topclimat.ru/publications/obzor-tiggo4pro.html

Знакомства на нашем сайте — это не просто анкеты, а новые возможности для интересных встреч с девушками из Питера, каждая из которых может стать для вас настоящим открытием, воспользуйтесь шансом переписать свою историю любви по-своему – https://spb-night.com/

https://dengi-vdolg.ru/

Загадочные леди подарят вам много приятных сюрпризов и впечатлений: снять проститутку спб

Профессиональное продажа косметологического оборудования для салонов красоты, клиник и частных мастеров. Аппараты для чистки, омоложения, лазерной эпиляции, лифтинга и ухода за кожей.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

ultimate createporn AI generator. Create hentai art, porn comics, and NSFW with the best AI porn maker online. Start generating AI porn now!

Awesome website you have here but I was wondering if you knew of any community forums that cover the same topics talked about in this article? I’d really love to be a part of community where I can get comments from other experienced individuals that share the same interest. If you have any recommendations, please let me know. Bless you!

I’ve been playing at ck222 bet and it just works better.

Can I simply say what a relief to discover an individual who really knows what they’re discussing over the internet. You definitely know how to bring an issue to light and make it important. More people have to check this out and understand this side of your story. I can’t believe you’re not more popular given that you surely possess the gift.

One of the best online casino sites is 88fb casino

купить стильный горшок [url=https://www.dizaynerskie-kashpo.ru]https://www.dizaynerskie-kashpo.ru[/url] .

займ на карту онлайн первый раз https://zajmy-onlajn.ru

¡Saludos, buscadores de tesoros!

Casino online extranjero con interfaz fluida – https://www.casinosextranjerosenespana.es/# casinosextranjerosenespana.es

¡Que vivas increíbles instantes inolvidables !

¡Hola, seguidores de la victoria !

Casino sin licencia con tragamonedas exclusivas – п»їcasinossinlicenciaespana.es CasinossinlicenciaEspana.es

¡Que experimentes éxitos destacados !

Срочно нужна помощь юриста? Получите бесплатную юридическую консультацию по телефону прямо сейчас. Наши специалисты готовы ответить на ваши вопросы 24/7. Анонимно и конфиденциально: юридическая консультация по телефону бесплатно

прикольные горшки [url=www.dizaynerskie-kashpo1.ru/]www.dizaynerskie-kashpo1.ru/[/url] .

Защитите свои права! Воспользуйтесь бесплатной юридической консультацией. Опытные юристы помогут разобраться в сложных правовых вопросах по телефону. Первый шаг к решению вашей проблемы: номер юриста бесплатная консультация

дизайнерский горшок [url=https://dizaynerskie-kashpo.ru]https://dizaynerskie-kashpo.ru[/url] .

Trusted AC duct cleaning in Dubai for residential and commercial properties: #dubai

Improve your indoor air quality in Dubai with reliable AC duct cleaning done by certified technicians: how much to clean ac unit

¡Hola, fanáticos del riesgo !

casinoonlinefueradeespanol.xyz: tu guГa de juego global – https://www.casinoonlinefueradeespanol.xyz/ casino por fuera

¡Que disfrutes de asombrosas botes impresionantes!

оригинальные горшки для цветов [url=http://dizaynerskie-kashpo1.ru]оригинальные горшки для цветов[/url] .

Я обычно не доверяю таким сайтам, но тут другое дело. На https://mfo-zaim.com/dengi-v-dolg-ot-mfo-bez-proverki-ki/ даёт советы сам Андрей Фролов, человек с реальной экспертизой в финансах. Благодаря его рекомендациям, взял займ без отказа и переплат. Реально работает.

Hello to all, it’s genuinely a pleasant for me to go to see this web page, it includes valuable Information.

New players get a welcome bonus at 88fb login

Советую https://runningcabin.com/best-running-shoes-for-heavy-man/